AlbertPego

Thesis

TCW Strategic Income Fund (NYSE:TSI) is a multi-asset class closed-end fund managed by TCW Investment Management Company. The CEF has been in the market since 1987 and currently employs no leverage. Furthermore the vehicle’s distribution policy aims to pay investors just what it makes in underlying assets cash-flows, hence ROC is avoided. We believe this is an honest, straight forward way of doing business, especially when no leverage is employed.

The fund is currently overweight mortgage back securities, in both Non-Agency (27.3%) and Agency (12%) formats. This exposes the fund to the currently slowing housing market, which has quite a bit further to go as per our analysis in the “State of the Housing Market” below. The transmission mechanism to the fund is via lower refinancings, which result in lower CPRs for the bonds which in turn increase duration and lower prices/fund NAV. Expect a bit more of this theme for the rest of the year. The fund runs investment grade corporates as its second largest risk at 26% of the portfolio. We are yet to see a peak in rates so expect more weakness here as well.

This is where the bad news ends. The fund has a robust long term performance, with annualized 5- and 10-year returns sitting at 3.79% and 5.26% respectively. The 5-year metrics are obtained with a Sharpe of 0.38 and a low standard deviation of 5.14. A retail investor is not getting an oversized return here due to the lack of leverage but at the same time the risk is on the lower side, combined with lower volatility.

TSI Holdings

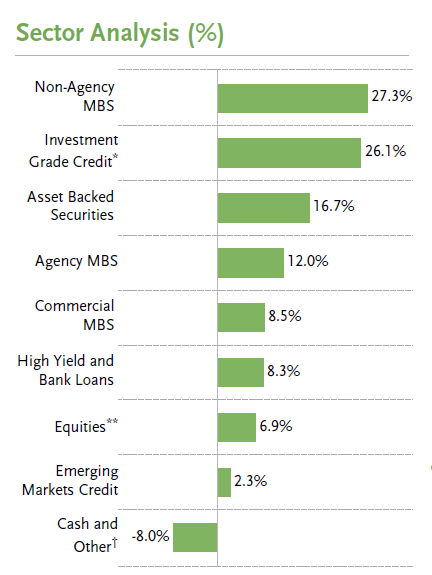

The fund holds a mix of fixed income securities but it is geared towards mortgages:

Sectors (Fund Fact Sheet)

Mortgage backed securities account for over 39% of the fund when looking at Agency and Non-Agency MBSs. Housing thus plays a very large role in this fund’s returns. The CEF also has a large holding in investment grade bonds, which account for over 26% of the fund holdings.

While the Agency MBS bucket is AAA and some of the Non-Agency MBSs and Asset Backed Securities are AAA as well, the fund contains a larger non-investment grade bucket:

Ratings (Fund Fact Sheet)

We can see a bar-belled approach here for the fund, which usually works in environments outside of 2022. What do we mean by that? A large AAA allocation usually compensates risky assets in a normalized yield environment – where the market sells off treasuries rally hence the embedded hedge in such a bar-belled portfolio approach. This has not worked in 2022 due to the market sell-off on the back of higher rates.

State of the Housing Market

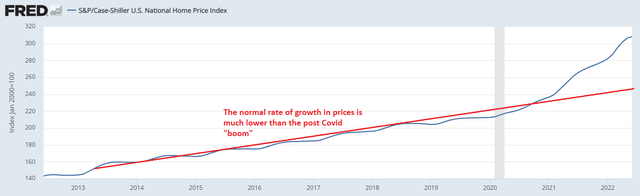

Due to the zero rates environment the housing market has seen ever increasing prices:

As we can see from the above graph the post-Covid Fed policy resulted in a massive acceleration in house prices, significantly outside the normal growth rate witnessed in prior years. Prices will come down towards the normalized growth rate. Nothing goes up parabolically.

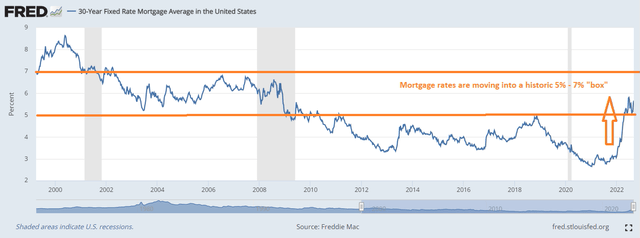

Mortgage rates have risen significantly and we anticipate them to stay elevated:

We can see from the above chart that post the Great Financial Crisis, mortgage rates moved below the 5% threshold and stayed there. In the new higher inflation for longer macro environment, and with an overbought housing market, we expect mortgage rates to re-establish a 5% to 7% range for the next few years. This results in tighter financial conditions and fewer people re-financing.

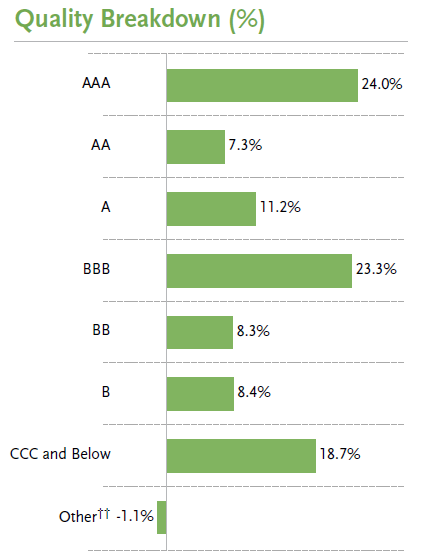

We are already starting to see the tighter financial conditions feedback in the housing market:

Supply of new homes (Compound Capital)

Higher mortgage rates have resulted in fewer people buying houses, which in turn have started to create a glut of unsold homes. This will translate into lower prices next.

TSI Performance

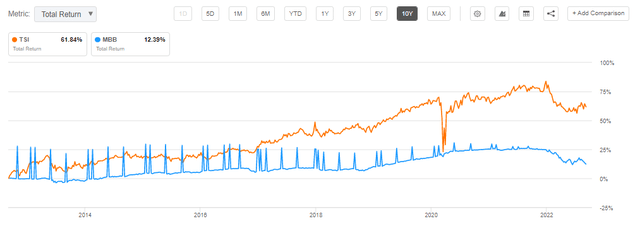

The fund is down only -10% year to date due to its lack of leverage:

YTD Performance (Seeking Alpha)

On a 3-year basis the fund is now flat:

3Y Total Return (Seeking Alpha)

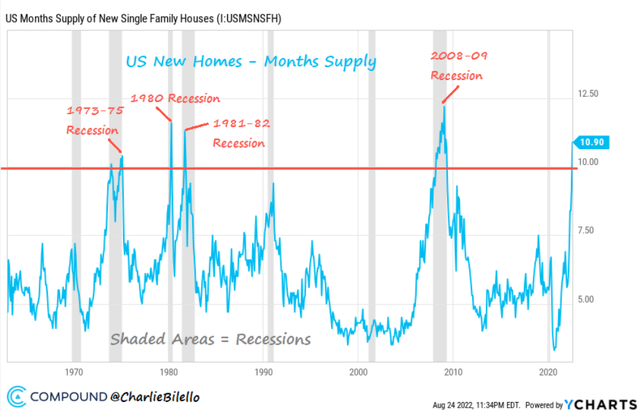

Despite its cyclicality the fund has a nice upwards sloping total return graph on a long term basis:

10Y Total Return (Seeking Alpha)

Premium / Discount to NAV

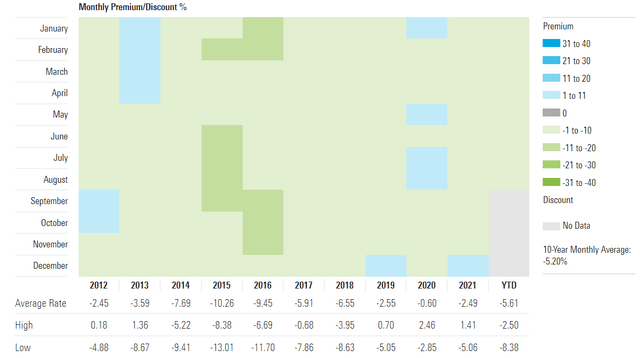

TSI has generally traded at discounts to net asset value in the past decade:

Premium/Discount to NAV (Morningstar)

The fund usually has an average -5% discount to NAV with the occasional burst that bids it up over the net assets value. Given the very long track record with TSI expect the average discount for TSI to persist in the future.

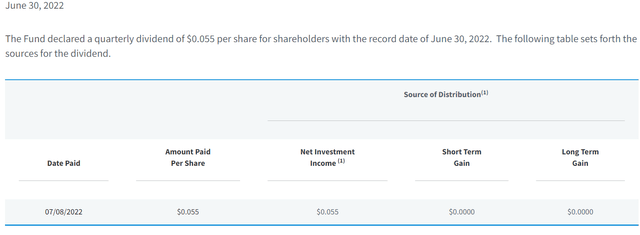

Section 19a

The fund does not use return of capital “ROC” in its distributions:

The vehicle changed their managed distribution plan in 2014. Prior to that date dividends for the upcoming year were estimated at the beginning of the year and dividends were held constant throughout the given calendar year. The Fund approached over-distribution via ROC in 2013 due to volatility in income and its Non-Agency MBS bonds holdings at the time. This resulted in switching to a “pass-through” distribution policy in 2014, essentially distributing all income to shareholders.

The goal of the current fund distribution policy is to maintain a stable payout without having to return capital to investors. The CEF also strives to maintain a modest reserve balance such that an income surplus remains at the end of the year as opposed to a shortfall.

Conclusion

TSI is a fixed income CEF that has been in the market since 1987. The fund currently has no leverage and exposes a “pass-through” structure where no ROC is utilized for its dividends. That makes its yield low, but also ensures a low volatility vehicle. The fund is overweight Agency and Non-Agency MBS bonds and will continue to be under pressure as the housing market pulls back and CPRs collapse. The CEF will become an attractive play once the Fed tightening is done.

Be the first to comment