DNY59

By Rob Isbitts.

Summary

ProShares Short 20+ Year Treasury ETF (NYSEARCA:TBF) is an ideal way to capitalize if you believe the price of long-term Treasury Bonds is going down. This is the same thing as saying long-term interest rates are going up, which they have been all year. TBF is a straightforward “inverse” investment in the price of 20-30 year Treasury Bonds. Long-term rates have surged higher this year, but are still below T-bill rates. The “easy money” has already been made here, and there will likely be another time to pounce on this in the future. But for now, we rate TBF a Sell.

Strategy

TBF aims to deliver the mirror-image performance of the ICE U.S. Treasury 20+ Year Bond Index. In other words, it does the opposite of what 20-30 Year Treasury Bonds do.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Inverse

-

Sub-Segment: Inverse Long Bond

-

Correlation vs. S&P 500 (SP500): Low

-

Expected Volatility (vs. S&P 500): Moderate.

Holding Analysis

As with many inverse exchange-traded funds (“ETFs”), TBF takes a 2-part approach within its portfolio. It enters into swap contracts with major brokerages, and backs those swap investments with U.S. Treasury Bills. The swap counterparties are currently Citibank (the largest right now), Societe Generale, and Goldman Sachs International. There is also a modest allocation to Treasury Bond futures contracts. This is all designed to allow the ETF’s manager to track the inverse of its index as closely as possible.

Strengths

When it comes to shorting the long-end of the U.S. Treasury curve through an ETF without using leverage, this ETF is in a class by itself. It has been around since 2009, and has performed as intended. This has offered those with an interest in profiting from falling bond prices a great outlet. It is a fund we have used in our managed account and model-signal investing businesses for several years. It allows an investor to essentially get the return stream of being “short” without buying put options, shorting futures, or doing other complex maneuvers. As with any ETF, you just buy it on the stock exchange, like a stock. And, as opposed to many inverse long bond ETFs, it does not use leverage. So, you don’t have to watch it every minute of every day, in case some sudden up move in bond prices threatens to bust your position in a heartbeat.

Weaknesses

This ETF is not for novice investors. It is essentially shorting a major market index, one that can be as volatile as stocks, as 2022 has shown us. This is the part of the bond market that is used by many investors to speculate on the broader trend in interest rates. It also invites a lot of short-term investing, which we can see by the fact that about 20% of its asset base turns over in a day, on average.

Opportunities

In a period of rising rates such as the one we have been in during 2022, TBF is a bond bear’s best friend. It has shown that in an environment where stocks have caused headaches for many investors, shorting the bond market can produce rallies of 35% or more. That provides another weapon in the arsenal for many investors, particular tactical types (like us).

Threats

TBF has had a strong run. In other words, 20-30 Year Treasuries have rallied hard this year. There is increasing technical evidence that this run is ending. So, investors have to be cautious in using TBF, as it can give back a good chunk of what it just made. That’s bond investing in an era of Fed-induced chaos and inflation expectations, which we currently have.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

TBF is an ideal security to use for a very specific purpose: profiting from rising long-term Treasury rates. Whether rates rise due to inflation or any other factor, TBF is built to profit from that.

ETF Investment Opinion

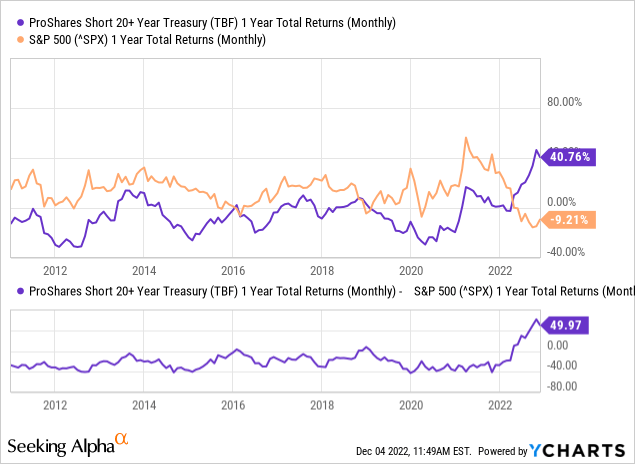

TBF has enjoyed an epic run in 2022. From the start of the year through October 24, it rose 54%. During this time, the S&P 500 fell 19%. TBF recently hit its highest 1-year outperformance versus the S&P 500 in its history, a whopping 60% advantage! However, less than 2 years ago, it trailed the S&P 500 by a like amount over a 12-month time frame.

Bottom-line: TBF is a strong potential diversifier. But our technical and quantitative analysis signals that the risk of holding it at this immediate stage of the interest rate cycle outweighs the reward, for the first time in at least a year. So, while we will always view TBF as a great tactical tool, for now, the odds favor looking elsewhere as both an anti-equity position and as a way to profit in a market starving for sustainable opportunities. For now, TBF gets a Sell rating from us. But hey, thanks for the recent memories, TBF!

Be the first to comment