gorodenkoff/iStock via Getty Images

Introduction

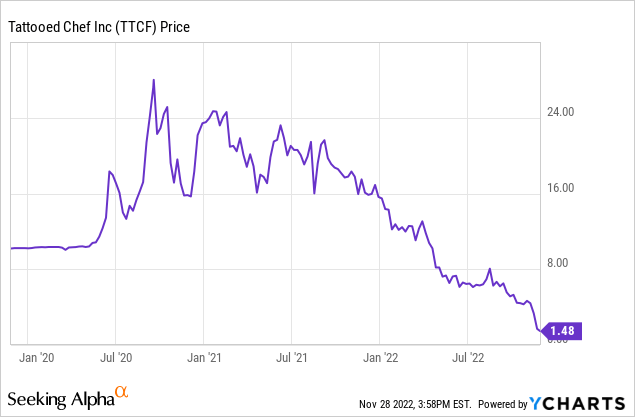

Tattooed Chef (NASDAQ:TTCF) is a plant-based frozen packaged food company. The company manufactures its own products both under its own brand name sold in retailers and through white-labeled products for retailers. I previously wrote about the company when it was around $6 per share, calling for 40% downside with virtually no upside. The stock has essentially gone straight down since, now trading below $1.60, down around 94% from the highs.

Reason #1: Third Quarter Disaster

Tattooed Chef issued a press release on November 10, 2022, announcing an updated 2022 financial outlook. The company issued another press release announcing third-quarter earnings on November 15, however, the 10-Q wasn’t filed until November 17, several days after the NASDAQ required filing date. The company was notified by NASDAQ that they were not in compliance before getting the 10-Q out and regaining compliance. While the company likely won’t see any consequences for this, it does speak to management’s competence as public company operators to get reports out on time.

The results were poor. The company reported $54.1 million in revenue, down 6.7% year over year. Even worse was the gross profit/loss line, where the company reported a gross loss of $3.9 million vs a gross profit in the same quarter last year of $5 million. This means the company had negative gross margins.

Net loss for the quarter came in at $38.5 million vs just $8.2 million in Q3 2021.

The company had $17.2 million of negative operating cash flow in the quarter, officially putting the company into a net debt position with just $14 million of cash remaining on the balance sheet while drawing $20 million on its credit line.

Tattooed Chef lowered guidance to $235-240 million of revenue for 2022, down from prior guidance of $280-285 million. They also dropped gross margin guidance to 0-3% from 8-10%.

The company also announced cost cuts (in the Nov 10 PR linked above) to the tune of $30 million for 2023. This is, in my opinion, unlikely to be enough as the company has posted a net loss of $86.8 million through the first 9 months of 2022 and is on pace to exceed $100 million of losses in 2022. The cost cuts will hit Tattooed Chef’s marketing and operating budget leading me to believe they are unlikely to achieve revenue growth again in 2023, meaning losses will still be well into the mid-high 8 figures without severe further cost cuts or massive improvements in gross margins.

Reason #2 Now In A Net Debt Position And In Breach Of Debt Covenants

Just seven quarters ago, Tattooed Chef had $185 million of cash on the balance sheet (more than its current market cap) and zero debt. It was perhaps unthinkable that a company with around $200 million of annual revenue could burn through that much cash in less than two years. And yet, that is exactly what Tattooed Chef has done.

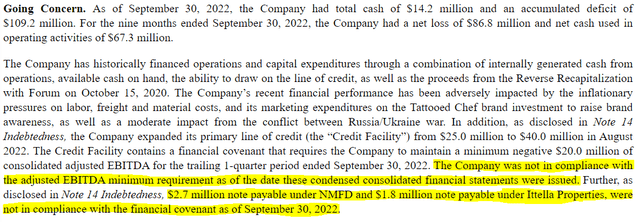

Not only has Tattooed Chef entered a net debt position, but they are also in breach of the covenants for their credit facility as per the Q3 2022 10-Q.

TTCF Q3 2022 From 10-Q (SEC Filing)

While the terms of these covenants are not disclosed, it is possible that the lender could call on Tattooed Chef to pay back the full amount immediately. This would trigger a liquidity crisis for the company as they would not have the cash to fulfill this order. That said, I think it is unlikely the lender would do this and force Tattooed Chef into bankruptcy as the lender would likely prefer to work with Tattooed Chef to find a solution. It is, however, very unlikely that this credit line would be further increased by the lender while in Tattooed Chef is in breach of these covenants.

Reason #3 Highly dilutive equity raise is now necessary.

This all brings me to my final point. Tattooed Chef’s cost cuts are not enough, and their credit line will soon be fully used up, along with their remaining cash balance at their current cash burn rate (or even a reduced burn rate after cost cuts). Perhaps they can liquidate some inventory or manage some working capital to bring in a little more cash short term, but it ultimately looks unlikely that the company will achieve positive operating cash flow by the time they need more cash, and their only remaining option will be a highly dilutive equity raise.

Given that the stock is now low, shareholders may see substantial dilution in an equity raise as the lower the stock price is, the more shares the company has to issue to raise the same amount of cash. When one considers the company’s market cap of $135 million along with its current cash burn rate exceeding $25 million per quarter, they may have to dilute up to 50% simply to get through another 6-9 months.

Can TTCF Ultimately Survive? & Final Takeaways

Buying Tattooed Chef ahead of what is likely to be a dilutive equity raise is in my opinion a bad idea. The company’s cost cut measures are unlikely to be enough, and the company now has a going concern warning and is in breach of its debt covenants for its line of credit. Their only option left is to raise money by issuing new equity, thus diluting existing shareholders. This would likely see the stock price fall further. Even then though, the company appears structurally unprofitable. In my opinion, there is a substantial risk of the company going out of business for good.

Nonetheless, the risks to a bearish thesis here still exist. First, the company may issue some positive PR shortly before an equity raise to try to get the stock as high as possible. If this were to trigger a short squeeze, shares could rip higher. Second, if this company were to see gross margins improve, which have been impacted by things that are likely temporary such as high shipping rates, then, when combined with cost cuts, they may be able to reduce cash burn enough that they can prolong the existence of the business and the necessity for an equity raise for some time, or alternatively require less of a raise resulting in less dilution.

I recently had a short position but I have since covered in the mid $1s. I would re-short on a bounce in the stock price. In the interest of full disclosure, I will update readers in the comments should I initiate another short position.

Be the first to comment