Shutter2U

Investment Thesis: I take a bullish view on Target Hospitality as a result of strong revenue growth across the Government segment, as well as a decrease in long-term debt to total assets.

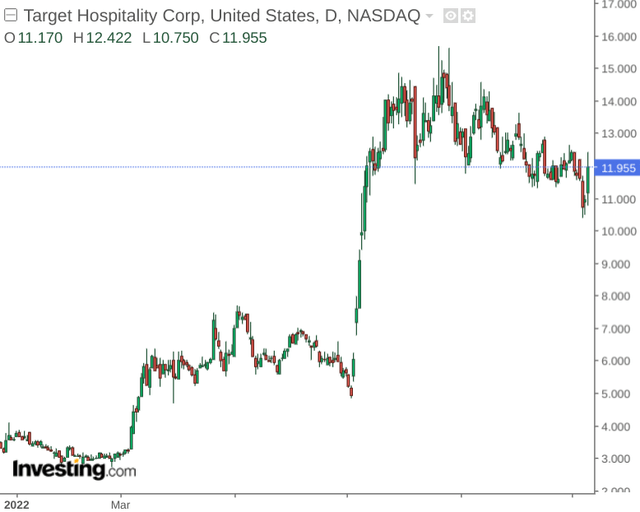

In a previous article back in September, I made the argument that Target Hospitality (NASDAQ:TH) had seen significant growth up until that point. However, investors will increasingly expect to see further growth to justify upside at current price levels – and inflationary pressures in the short to medium-term could mean that growth is modest.

Since September, price has taken a steady decline following the surge that we saw over the summer months. However, the stock has seen an uptick with the recent release of Q3 2022 financial results.

The purpose of this article is to determine if the stock could see upside from here in light of recent results.

Performance

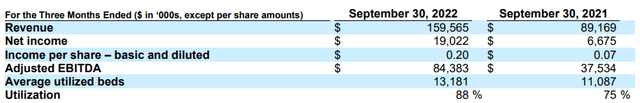

When looking at third quarter 2022 results, we can see that Target Hospitality has continued to significantly grow income per share from that of the same period last year, along with a near doubling of revenue and a higher utilization rate.

Target Hospitality Third Quarter 2022 Results

When comparing the breakdown of revenue for September 2021 and September 2022, we can see that the Government segment accounts for over 77% of the company’s total revenue in the most recent quarter, while it accounted for just over 52% a year previously:

| Sep 2021 | % of total revenue | Sep 2022 | % of total revenue | |

| Government | 46428 | 52.07% | 123308 | 77.28% |

| Hospitality & Facilities Services – South | 31066 | 34.84% | 33632 | 21.08% |

| Hospitality & Facilities Services – Midwest | 1266 | 1.42% | 1860 | 1.17% |

| TCPL Keystone | 9880 | 11.08% | 0 | 0.00% |

| All Other | 529 | 0.59% | 765 | 0.48% |

| Total revenue | 89169 | 159565 |

Source: Figures sourced from Q3 2022 Target Hospitality Financial Results. Revenue figures provided in $ in thousands. Percentage of total revenue figures calculated by author.

Additionally, with no further revenue being recognised from the company’s prior contract with TC Energy (TRP) dating back to 2013, the termination of the Keystone XL Pipeline Project has also increased the company’s dependence on revenue derived from the Government segment.

According to the latest financial results, the Expanded Humanitarian Community has largely driven the sharp increase in revenue that we have been seeing across the Government segment. The company also outlines that there exists potential for variable services revenue associated with the project to be $50 to $185 million of additional revenue on top of the minimum expected revenue.

Moreover, with Target Hospitality having secured an exclusive 11-year partnership with a non-profit partner to continue providing joint services for the Expanded Humanitarian Community – I take the view that we can expect revenue growth across this segment to be quite stable going forward.

From a balance sheet standpoint, we can see that Target Hospitality has significantly reduced its long-term debt to total assets ratio, down from 0.64 in December 2021 to 0.46 in September 2022.

| Dec 2021 | Sep 2022 | |

| Long-term debt, net | 330212 | 333275 |

| Total assets | 513392 | 729698 |

| Long-term debt to total assets ratio | 0.64 | 0.46 |

Source: Figures sourced from Target Hospitality Q3 2022 financial results. Figures provided in $ in thousands, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

Should we continue to see the benefits of the increase in revenue across the Government segment and the long-term debt to total assets ratio continue to decrease as a result, then I take the view that this could be a significant catalyst for upside.

Looking Forward

Going forward, while Target Hospitality has had to deal with the loss of revenue resulting from the ending of the TCPL Keystone – the growth in revenue across the Government segment has more than compensated for this and the Expanded Humanitarian Community project looks set to continue serving as a long-term revenue stream.

Going forward – while inflation is a broad macroeconomic risk for businesses in the hospitality sector – the main risk for Target Hospitality is that rising costs significantly lower the impact of revenue growth on gross profit.

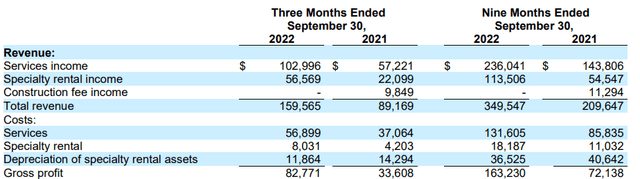

For instance, on a nine-month basis, we can see that growth in costs across Services were up by over 50%, even though gross profit had also doubled:

Target Hospitality Third Quarter 2022 Results

While rising costs remain a risk, I take the view that if revenue growth continues to outpace the same and the long-term debt to total assets ratio continues to decrease, then the stock could continue seeing upside going forward.

Conclusion

To conclude, Target Hospitality has seen strong performance in the most recent quarter. While I previously expressed reservations that inflationary pressures could place pressure on the company – this does not appear to have been the case. I take a bullish view on Target Hospitality.

Be the first to comment