wacomka

And those who were seen dancing were thought to be insane by those who could not hear the music.”― Friedrich Nietzsche.

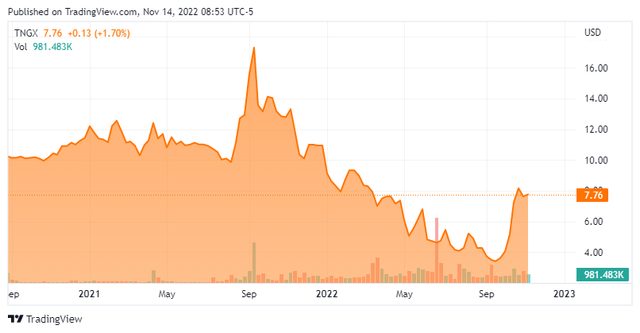

Note: This original research and ‘watch item’ buy recommendation went out exclusively to Biotech Forum members one month ago. The stock in this piece up some 60% since then. I have updated the original article and recommendation to account for recent news and third quarter results.

Today, we take a deeper look at a small biotech concern that has a potentially lucrative partnership with Gilead Sciences, Inc. (GILD). The stock formed a floor over the summer and has shot skyward over the past month. The company has a rock-solid balance sheet and has picked up some buying from beneficial owners recently as well. An analysis follows below.

Company Overview:

Tango Therapeutics, Inc. (NASDAQ:TNGX) is a Boston-based early clinical-stage biotechnology concern focused on the development of therapies that target tumor suppressor gene loss in defined populations with high unmet medical need. The company has one clinical asset undergoing Phase 1/2 evaluation and three that should enter the clinic in 2023. Tango was formed in 2017 and listed on the NASDAQ in August 2021 when it merged into special purpose acquisition company (SPAC) BCTG Acquisition Corp. As part of its public debut, the company received net proceeds of $326.3 million at $10 a share. The shares briefly went over the $16 mark in September of last year. The stock currently trades at just over $7.50 a share, translating to a market cap of approximately $685 million.

Tango’s Approach

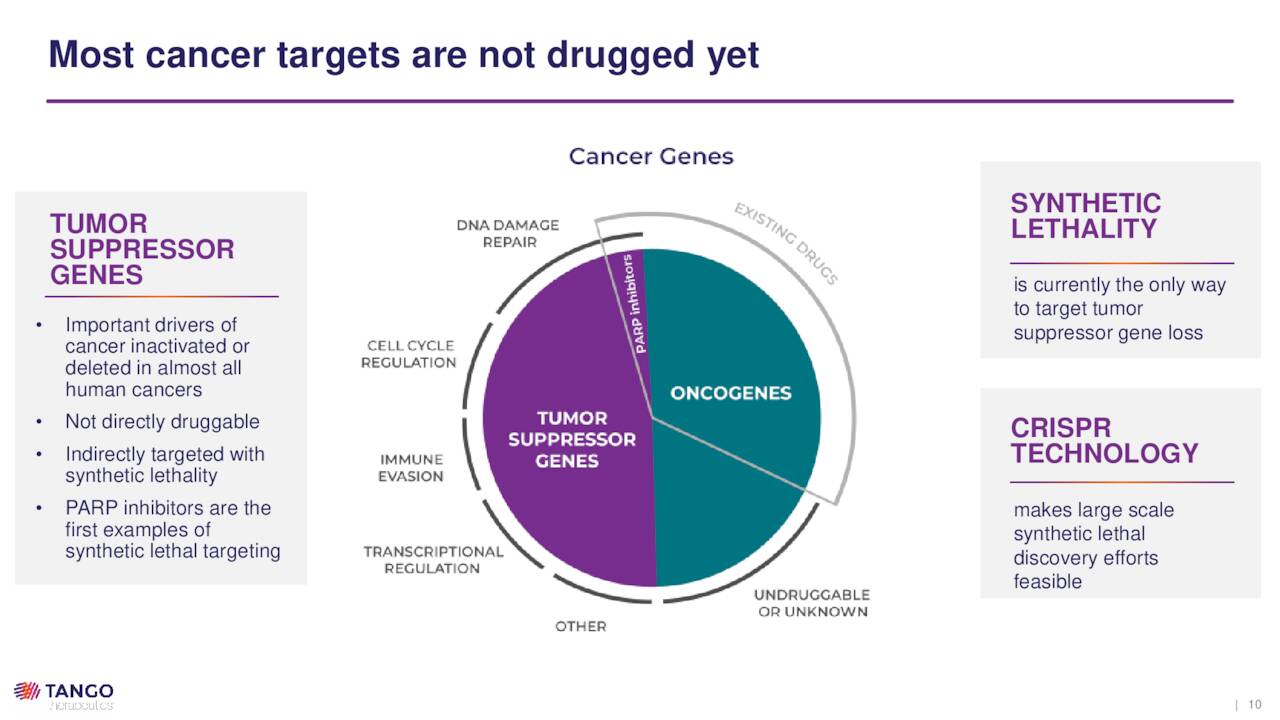

Leveraging the genome as a method of treating cancer is now a well established and delineated approach. However, there are two genetic drivers of cancer that have not received much attention due either to their molecular structure – known as undruggable oncogenes – or functional loss. Targeting tumor suppressor gene loss directly is not possible as the genes in question have been deleted or inactivated; however, this relatively unexplored area comprises a significant portion of the genetic alterations that power cancer.

August Company Presentation

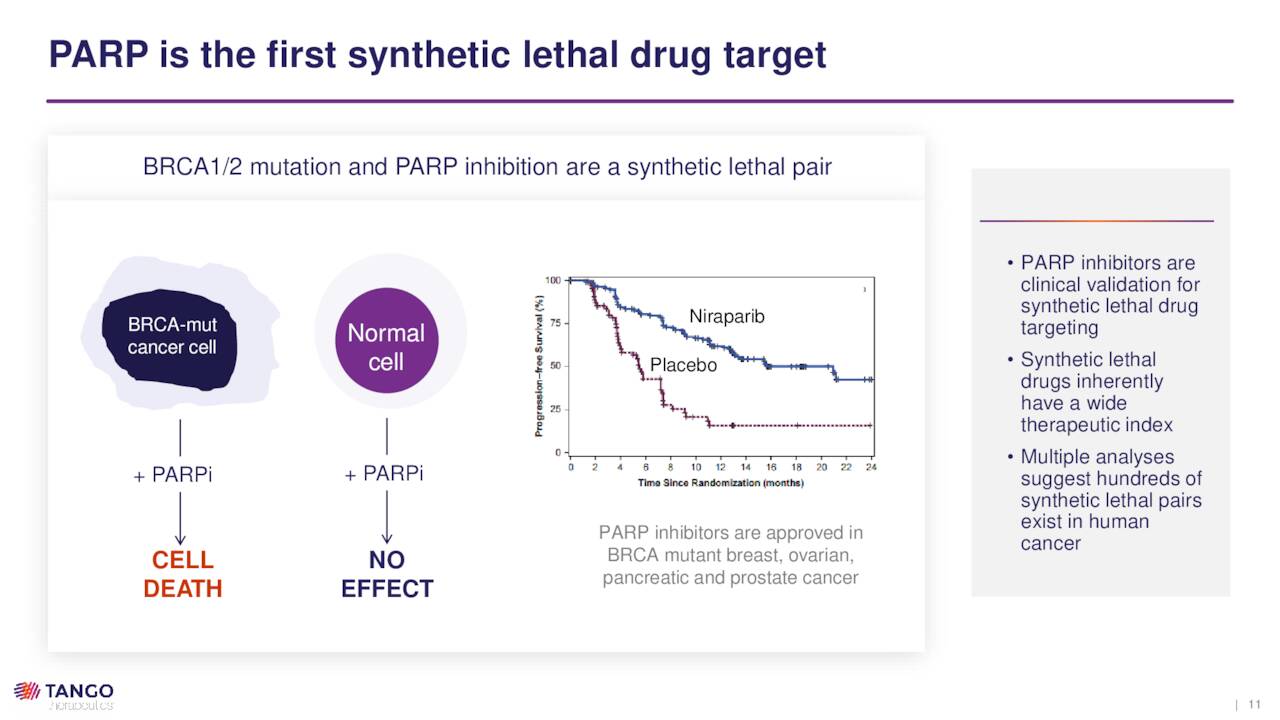

To attack this un-targetable target, Tango is employing a concept known as synthetic lethality, which is the interaction between two genes that causes cell death when both are inactivated. In cancer cells, one of these genes is inactivated by mutation, while the other can be inactivated by a targeted therapy. Although genetic mutations give rise to cancer, they also provide a vulnerability that Tango seeks to exploit: namely, they are unable to respond to a particular signal, such as DNA damage or cell cycle (duplication) arrest. Because normal cells can respond to these signals, they are largely unaffected by synthetic lethality, while the mutant cancer cells are selectively killed. Put another way, since the tumor suppressor gene is lost, synthetic lethality becomes a de facto suppressor gene, targeting a specific oncogene.

Although a “relatively unexplored” approach, the FDA has approved several PARP inhibitors for BRCA-mutant ovarian cancer – Merck (MRK) and AstraZeneca’s (AZN) Lynparza, GlaxoSmithKline’s (GSK) Zejula, and Clovis Oncology’s (CLVS) Rubraca – as well as therapies for mutant breast and prostate cancer.

August Company Presentation

Pipeline

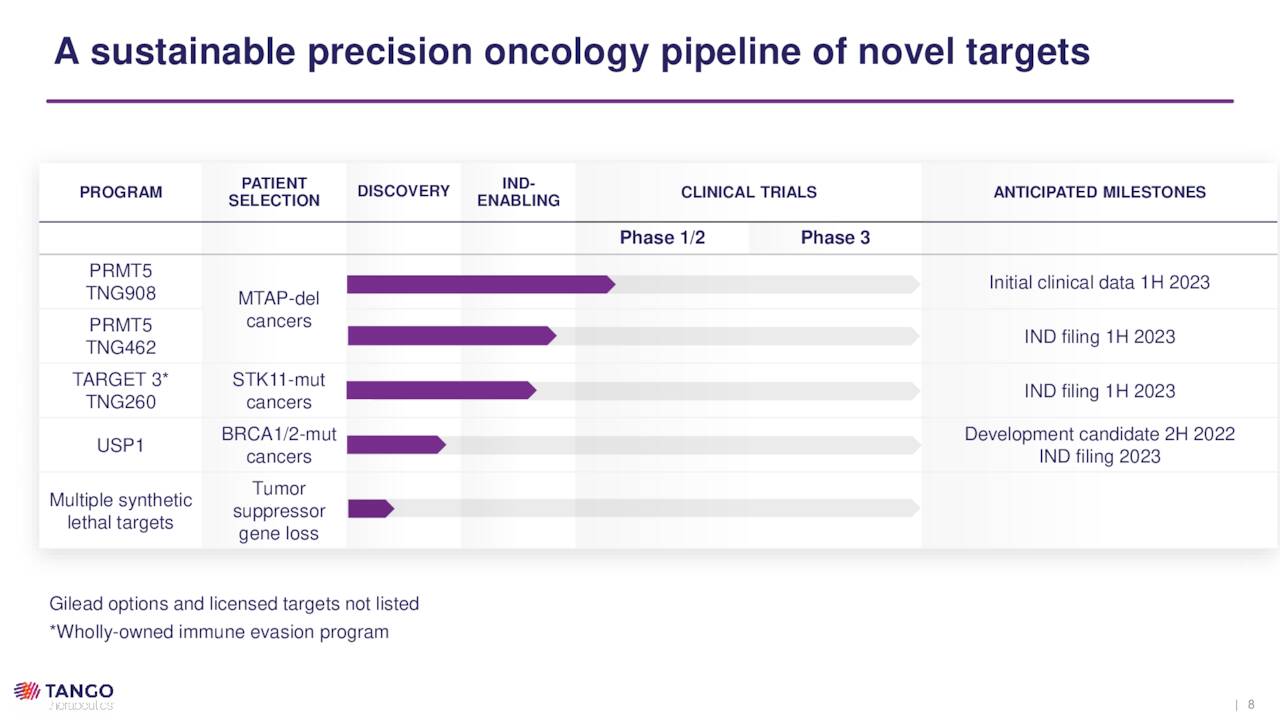

Employing tumor suppression gene loss as a selection marker for patient enrollment, Tango can increase its chances of success in the clinic. To date, it has entered one candidate into human trials, with three more expected to follow in FY23.

August Company Presentation

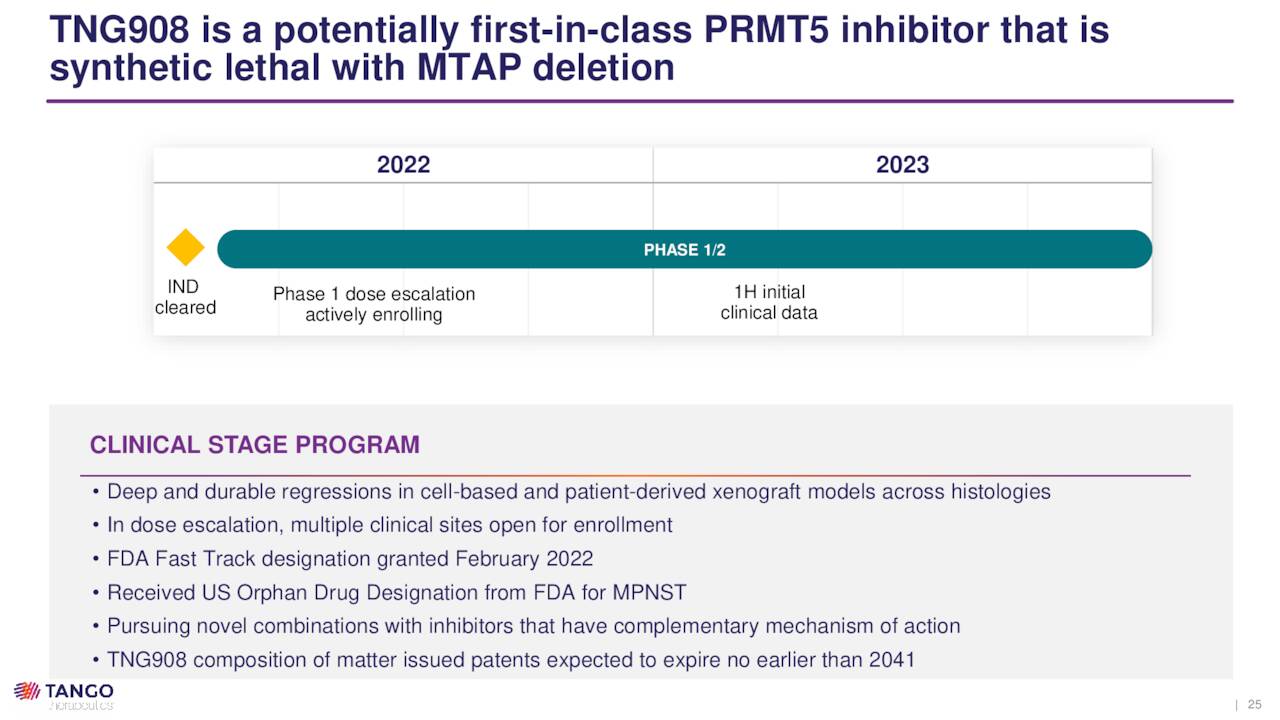

TNG908. Tango’s lead program is TNG908, an oral small molecule inhibitor of protein arginine methyltransferase 5 (PRMT5), which is an enzyme that is central to cell survival. TNG908 is designed to target cancer cells where the MTAP gene is deleted, as it is the synthetic lethal partner to PRMT5. This targeting is accomplished by binding cooperatively with PRMT5 inhibitory co-factor MTA, whose levels are already high – essentially the undetected signal – in cells that have lost MTAP (MTAP-null). Since normal cells possess MTAP, they are (in theory) spared any of the toxic effects of this interaction.

August Company Presentation

TNG908 is designed to treat patients with solid tumors with MTAP deletion, which represents 10%-15% of all tumors, including mesothelioma, pancreatic cancer, cholangiocarcinoma, non-small cell lung cancer (NSCLC), and glioblastoma multiforme, amongst others. After demonstrating 15 times more potency in MTAP-null cells versus normal cells and penetration of the blood-brain barrier in non-human primates, the compound is currently undergoing evaluation in a 60-patient dose escalation Phase 1/2 trial. The study will enroll three 20-patient cohorts covering multiple cancers with each cohort having MTAP and MTAP-null patients. Initial clinical data are expected in 1H23.

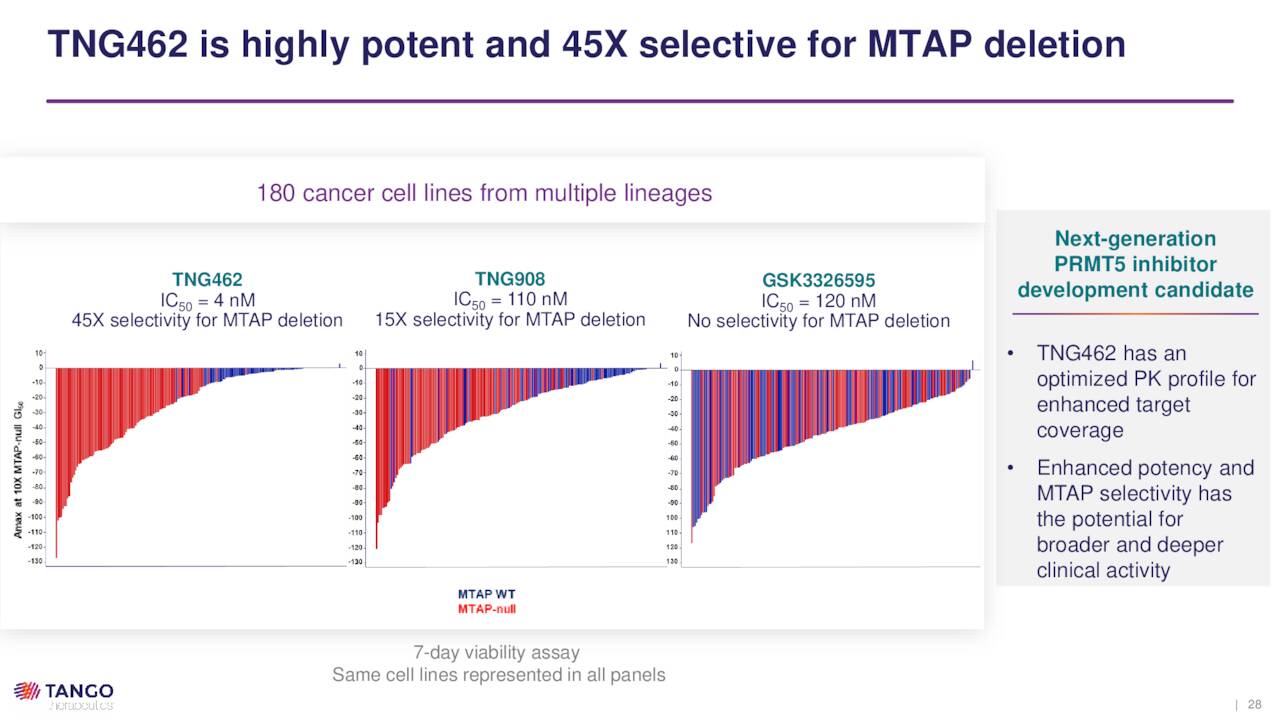

Pre-IND Compounds. Although TNG908 just entered the clinic in 2Q22, Tango is already developing another PRMT5 inhibitor (TNG462) that is approximately three times more potent and selective than the former, although it does not cross the blood-brain barrier. TNG462 is being assessed in IND-enabling studies with an IND anticipated to be filed in 1H23.

August Company Presentation

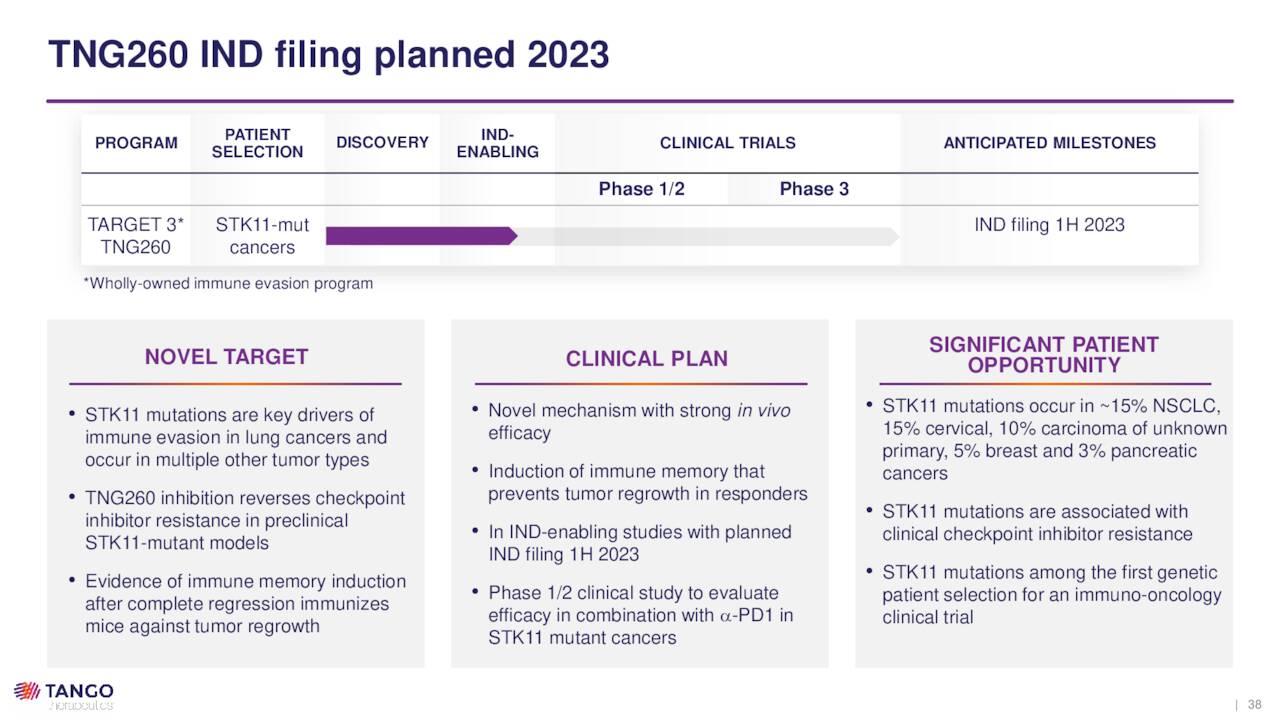

The company is also developing TNG260, which is designed to reverse immune invasion caused by STK-11 loss-of-function mutations. After demonstrating promise in murine models with functioning T cells (i.e., immuno-competent mice), Tango expects to file an IND in 1H23 with likely targets of NSCLC and cervical cancer, where STK-11 mutations occur in ~15% of the cases.

August Company Presentation

An IND filing for TNG348, a novel USP1 inhibitor that is being developed for treatment of BRCA1 and BRCA2-mutant cancers, is also on track for some time in 2023.

Gilead Collaboration

Although the company was only formed in 2017, its approach to treating specific cancers attracted the attention and capital of Gilead Sciences, who initially inked a deal for five immuno-oncology targets in 2018. That agreement, which included $50 million upfront, has since expanded to 15 targets, additional cash of $125 million, a $20 million investment, and $35.1 million of licensing and option-extension fees to date – all accruing to Tango. Gilead has the option to obtain the exclusive rights to develop and commercialize those 15 compounds, which includes all of the therapies discussed above. In return, Tango is eligible to receive up to an additional $410 million in license, research extension, and clinical, regulatory, and commercial milestone payments on each compound, for a potential total of $6.15 billion before royalties.

August Company Presentation

Balance Sheet & Analyst Commentary:

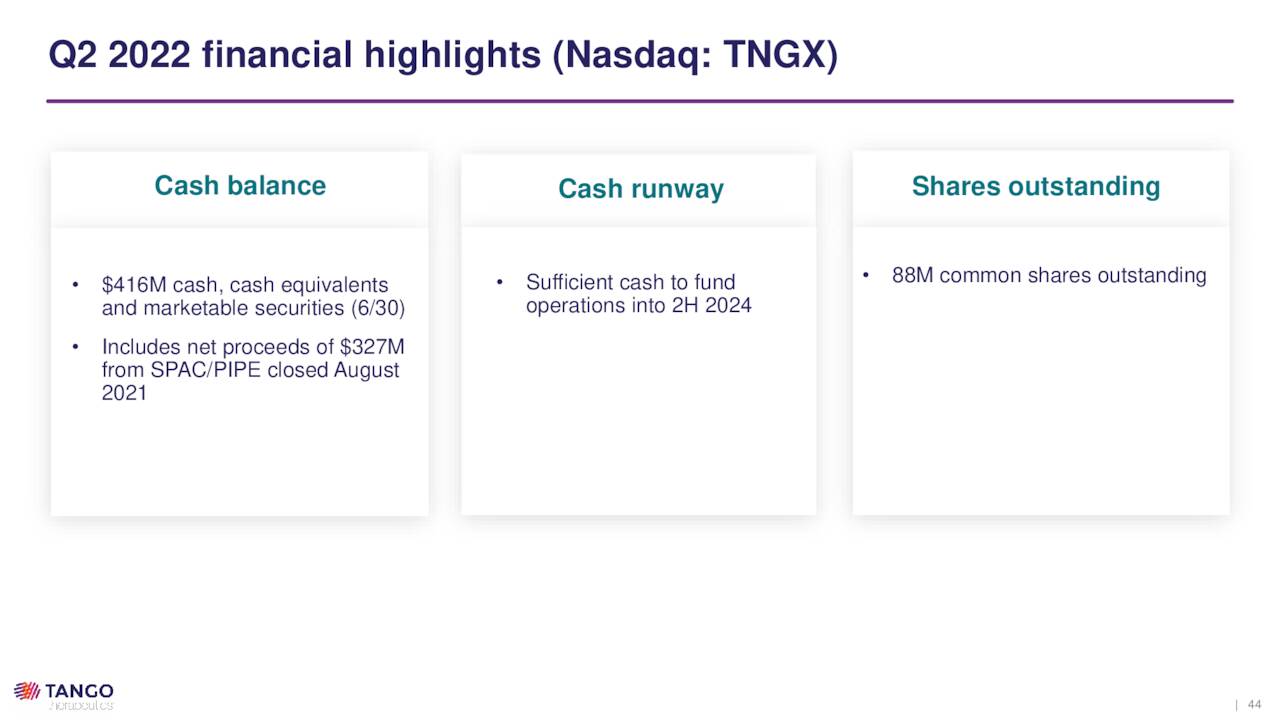

Owing to funds received from its SPAC merger and Gilead, Tango held cash and marketable securities of $393.3 million and no debt as of June 30, 2022, providing it a runway into 2025.

August Company Presentation

Shortly after Tango went public, four Street analysts initiated coverage with two buy and two outperform ratings. They had not commented since – not that there is much to say about an early-clinical stage concern with no data due to arrive until 1H23. However, last week after the company posted third quarter results: both SVB Securities ($16 price target) and Wedbush ($21 price target) reissue Buy ratings. H.C. Wainwright assumed coverage with a Buy rating and $10 price target on October 20th.

Beneficial owner Boxer Capital, a biopharmaceutical investment firm and the SPAC’s sponsor, has used the recent price levels, which were discounted ~60% since the merger, as a cost-averaging opportunity, purchasing 182,000 shares at an average price of $3.92 from October 4th-6th. Another beneficial owner entity added just over $1 million to their holdings between October 11th and October 13th.

Verdict:

The 60% evaporation in Tango’s market cap since going public before the recent rise in the shares had little to do with any setback regarding its research or its approach. In fact, its approach is (in theory) histology-agnostic, as patients can be treated based on specific gene mutations, irrespective of cancer type – or in the case of Tango, the particular tumor suppressor gene loss. Its share price performance was a function of a catalyst vacuum combined with bad timing and a doleful market backdrop.

The equity has bounced sharply over the past month as sentiment has improved. That said, there isn’t much to elevate the company’s share price out of the doldrums until more actionable data arrive in 1H23. The one exception would be the announcement of another Gilead-like licensing deal.

August Company Presentation

When this original analysis came out it was a pretty straight forward decision to recommend a small watch item holding in this name. The stock was selling at a slight discount to cash with a Gilead licensing deal that could bring it billions backed by a synthetic lethality approach that has already generated a handful of FDA approvals.

That said, TNGX still seems to merit a small holding in a well-diversified biotech portfolio. Given the recent rally in Tango Therapeutics, Inc. shares, however, I would probably accumulate that position slowly during dips in the overall market.

Almost nobody dances sober, unless they happen to be insane.”― Howard Phillips Lovecraft

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment