HT Ganzo

The events of the past two years have shown the world the importance of supply chain security. For any country, while diversifying its supply chain of critical materials and energy from multiple partners looks like a viable strategy, even superior option would be domestic supply. The US economy, being amongst the leaders of EV production, is expected to experience a significant uptick in nickel demand. Talon Metals (OTCPK:TLOFF) could play a key role in establishing domestic production of nickel in the US, through the Tamarack project. The company has done a PEA of the property and is currently in an intense drilling campaign, which recently led to significant increase in the resource estimates of the project. The company has partnership with the mining major Rio Tinto (RIO) and the leading EV manufacturer Tesla (TSLA). Although there are a lot of milestones to be hit and challenges to be resolved before Talon puts its project into production, I think that the company is a good speculative buying opportunity.

The nickel market outlook

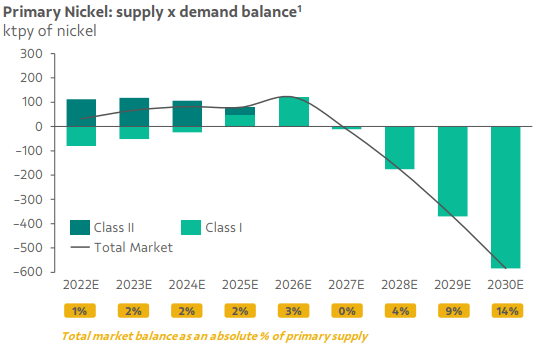

Nickel is expected to be one of the cornerstones of the energy transition process. The metal allows for improved energy density and higher storage capacity of batteries, which makes it a suitable ingredient in EVs. With the rapid adoption of the latter, demand for nickel is projected to increase around 50% by the end of this decade. However, supply is expected to not be able to meet the increase in demand, creating a market deficit by 2026, according to Vale’s (VALE) presentation at the XXII Analyst & Investor Tour in Sept ’22.

Nickel market outlook (Vale)

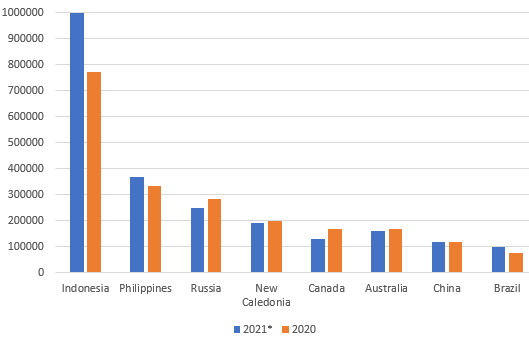

Looking more closely at supply from a geographical perspective, it turns out that Indonesia’s dominance in the nickel production is quite comparable with Kazakhstan’s dominance in the uranium space, or South Africa’s superiority in the PGMs. In 2021, the South Asian country produced 1MMT, while the second largest nickel producer – Philippines only 370kMT. It’s worth mentioning that Australia, although not in a leading spot in terms of current output, has large Ni reserves, comparable to those of Indonesia of 21MMT.

Top nickel producers (Kitco.com)

In the other hand, the US in nowhere to be found on the nickel “map” in terms of production with meager 18kMT of output in 2021. However, having ambitious energy transition goals and establishing itself as a leading EVs producers, the US economy needs lots of nickel. While the country relies on recycling to meet its Ni needs, that’s still not nearly enough, as roughly half of the demand is met through imports. For that reason, as well as the importance of supply chain security and the expected rapid increase of demand, nickel was put on the country’s critical minerals list. Although production of nickel in the US is currently minuscule, the country has estimated reserved of 340kMT. Bringing them to production and expanding the resource base may be a key towards strengthening the supply chain of this critical metal and here’s like Talon Metals comes into the picture.

Company overview

Registered in Canada, Talon Metals’ main property is the Tamarack nickel project, located in Minnesota, USA. The company has 51% majority interest with the remaining 49% are owned by Rio Tinto. However, there’s an agreement that the controlling stake could be increased to 60% if Talon completes a feasibility study and pays additional US$9M to the Australian mining major. In 2022, the company added to its portfolio a second project, located in Michigan.

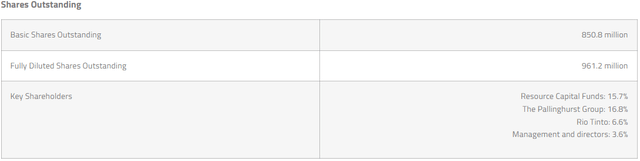

Talon’s shareholder structure (Talon Metals)

As of November 2022, the company has 850.8M shares outstanding, which could go to 961.2M if all outstanding options and warrants are exercised. The latest available information on those instruments as of the end of Q3’22 indicate around 40M warrants with average exercise price of CAD$0.70, while outstanding options are reported to be around 110.5M with average exercise price of CAD$0.36. Judging by the difference from the possible dilution and the reported outstanding financial instruments, my guess is that in the meantime around 40M of options were exercised in order for the numbers to make sense.

Talon’s team (Talon Metals)

The two biggest shareholders are institutional investment firms with focus on natural resources, while the presence of Rio Tinto with 6.6% stake also catches the eye. Management and directors have 3.6% ownership interest, which is also a positive sign, implying some skin in the game. On the topic of the key personnel in Talon, it’s important to note, that some of the team members have decades of experience with the development and operations of nickel projects, gained in the likes of Rio Tinto.

The Tamarack nickel project

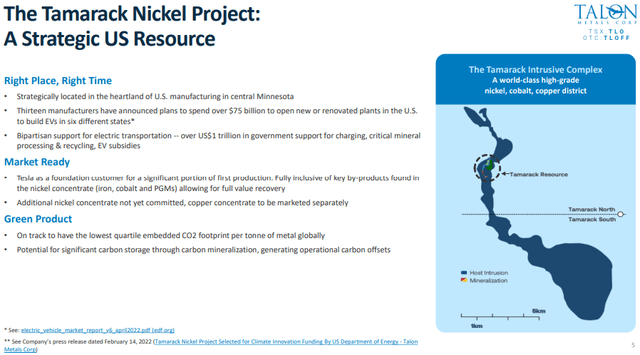

Located in Minnesota, the Tamarack nickel project could be a cornerstone in securing much needed domestic sources of nickel in the USA. Talon is the majority owner of the property, while Rio Tinto has a 49% minority stake, which could be further reduced to 40%. During the last few years, a lot of work has been done to de-risk the project and move it towards a feasibility study. In a Preliminary Economic Assessment (PEA), Talon highlighted three possible paths to production.

The Tamarack nickel project (Talon Metals)

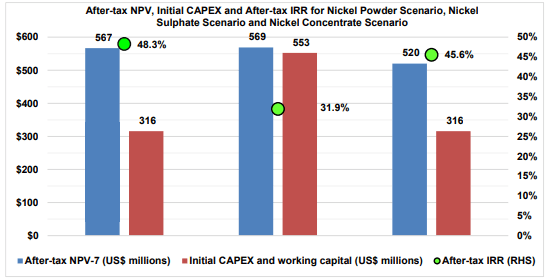

In the beginning of 2022, Talon entered into a supply agreement with Tesla, under which the company is supposed to begin commercial production before 2026 and deliver to the EV manufacturer 75kMT of nickel concentrate annually. The deadline could be extended by 12 months to 2027 if both parties agree and the purchase price is going to be linked to the LME spot price, although the exact formula was not disclosed. Based on that deal, Talon would go with the Nickel powder scenario, since it’s designed for the needs of the EV market. This would imply after tax NPV of US$567M (100% basis), using a 7% discount rate and initial investment of US$316M.

Tamarack’s economics (Talon Metals)

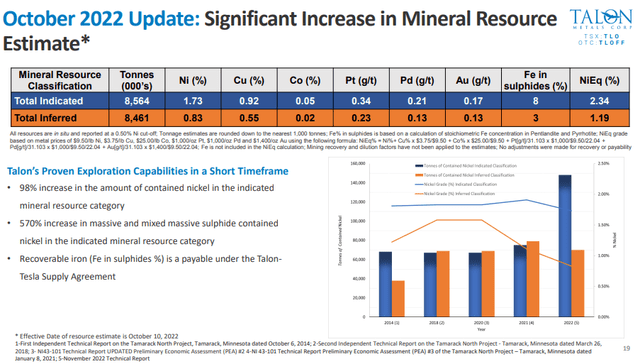

While the initial CAPEX calculations will most likely suffer significant inflation, it’s important to note, that the base case is based upon assumptions of nickel price of US$8.00/lbs, while current market prices are around US$11.50/lbs. In addition, further drilling allowed Talon to significantly upgrade its inferred resources at the property, compared to the numbers used in the PEA.

Tamarack’s upgraded resources (Talon Metals)

Talon claims that the PEA is based upon only a minor part of the whole property and has identified new areas with high-grade copper-nickel mineralization for further exploration. Due to the intense drilling plans, the company has decided not to hire a third party for those services and instead has bought 6 own rigs.

In order to de-risk the permitting process from an environmental standpoint, Talon decided to separate the mine and the processing facility, which is planned for construction in North Dakota. The company plans to use existing railway infrastructure to transport the ore as it’s located approximately 2km away from the mine site. It’s unclear what the effects of such move will be on the costs, but it will likely elevate them.

Liquidity needs and financing

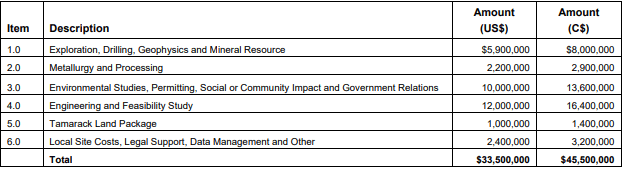

As of the end of Q2’22, Talon had CAD$7.5M of cash and equivalents as well as US$14.4M of T-bills and term deposits, while maintaining a debt free profile. In addition, in November, Talon raised CAD$36.9M through a bought deal public offering by issuing 75.2M shares at CAD$0.49 each. This puts the available liquidity at around CAD$58.8M, which seems sufficient to complete the pre-construction activities planned by the company in the latest Technical report on Tamarack, released in November 2022.

Budget for recommended work (Talon Metals)

When it comes to construction funding, the company got selected by the US Department of Energy to receive US$114M (27% of total costs of the Tamarack project) grant for the construction of the North Dakota processing facility. Rio Tinto, as a JV partner should also put 40% (in case Talon increases its ownership in the JV to 60%) of the money. This, in addition to the supply agreement with Tesla and nickel being considered a critical mineral in the US could theoretically mean that the rest of the CAPEX may be financed through bank loans, limiting further dilution.

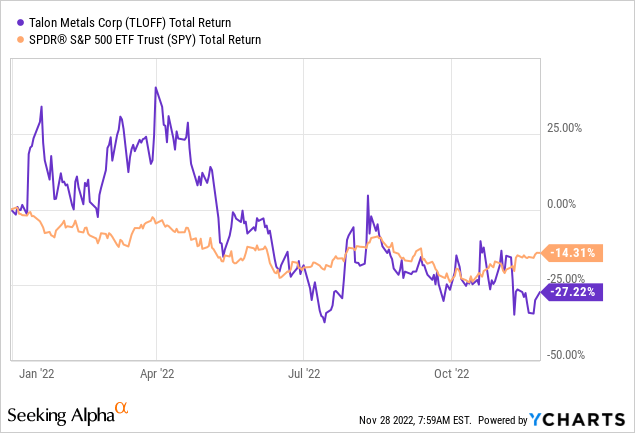

Share price and valuation

YtD, the shares of Talon Metals have tumbled 27.2%, roughly double the decline of the broad market. However, during the year the company has made good progress with the advancement of the project. Looking at the Economics of the PEA for a pointer towards valuation, the estimated NPV of the Ni powder scenario is US$567M at a 100% basis, which puts the prospective 60% share of Talon at US$340M. At the same time, the current EV of the company is around US$250M. At first glance, this discount seems not large enough, given that the company still has a lot of milestones to be hit before production. On a second thought, taking into account the projected deficit on the Nickel market as well as the made in America label, I could see a considerable potential in Talon. Also, the presence of Rio Tinto in the JV could indicate future takeover attempt, if the advancement of the project continues smoothly as the Australian mining major has a track record of trying to takeover promising projects where it already has a stake like for example TRQ. For these reasons, I’ll consider the stock a speculative “Buy”.

Risks

Permitting risk

While the US is one of the places with strongest property rights, putting a mine into production is a difficult and lengthy process, because of red tape. In that regard, Talon may not receive the necessary permits at all or in time to fulfill its part of the agreement with Tesla. On that risk, I think that the bipartisan consensus in the US about the importance of supply chain security of critical minerals could help regarding receiving the necessary documents in time.

Cost inflation risk

There’s little doubt that the initial investment, projected in the PEA will be inflated significantly. Unfortunately, there’s very little that the company could do in order to mitigate this, besides counting on higher nickel prices to offset that effect on the project’s economic profile.

Exploration risk

Talon is still away from its feasibility study, so the estimated inferred and indicated resources may not transfer themselves into proven and probable at a desirable rate, which could impact negatively the economics of the project.

Conclusion

Nickel is shaping itself as one of the cornerstones of the energy transition, by playing a key role in the EVs market. On the other hand, the USA, while trying to establish itself as a leading EVs producer, has to import half of its Ni needs. Talon Metals could be part of the solution to bridge that gap by domestic supply through its Tamarack project. The company has attributable estimated NPV of US340M, according to its 2021 PEA, while having EV of US$250M. Higher nickel prices in the future could further improve the economics of the project significantly. Also, the presence of Rio Tinto could indicate a possible takeover attempt in the future. Of course, as an exploration company, Talon brings a lot of risk, but I consider it a speculative way for investors to play the projected nickel supply deficit.

Be the first to comment