Yuanting/iStock via Getty Images

Investment Thesis

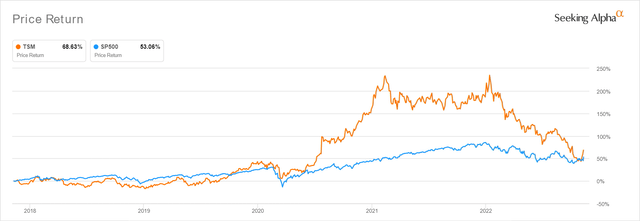

TSM 5Y Stock Price

Unfortunately, we have missed Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) at the low $60s, due to our overly aggressive price target of $50s. It is evident that its upbeat October sales have been met with much optimism from market analysts, triggering an impressive 18.81% recovery for TSM from the recent bottom. However, investors need not fret, since the stock is still exposed to much geo-political risks, significantly worsened by the uncertain US mid-term elections. Through 2023, we may see more volatility as the Chip war between China and the US develops, which could cause the current optimism to be digested moderately.

On the other hand, though one-day price movements do not reflect the market’s eventual turnaround, things are definitely looking more promising now. The October CPI report has finally indicated that the Feds’ four consecutive 75 basis points hikes are working. The S&P 500 Index recorded a remarkably bullish one-day recovery, as with TSM on 10 November 2022. Therefore, boosting Mr. Market’s confidence that the Feds will pivot soon, with 85.4% of analysts predicting a 50 basis points hike by December, similar to the Bank of Canada’s recent moderation.

Assuming so, we are indeed seeing the last of the market’s bottom and may start welcoming a long-term recovery ahead. Only time will tell, since TSM continues to boast exemplary 10Y returns of 444.5% despite the tragic correction thus far. We are also hearing some quiet whispers of the potential easing of China’s Zero Covid Policy. With consumer demand possibly rebounding in China and the US inflation gradually easing, we may see TSM sustainably recover in the short term.

Consumer Demand Remains Intact No Matter The Temporal Recession

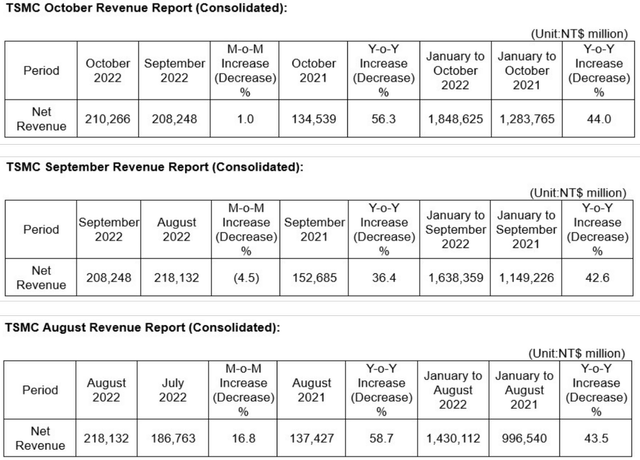

TSM October/ September/ August 2022 Sales

TSM continues to prove that there is no destruction of demand, given the sustained growth in its sales thus far. The company reported an excellent YoY increase of 44% for YTD sales, while the October report showed robust demand with revenues of NT$210.26B, representing a 1% QoQ growth and 56.3% YoY growth. Though these numbers may indicate a notable deceleration from FQ3’22 levels of 47.9% YoY growth, it is still a massive improvement from FQ3’21 levels of 16.3%, FQ3’20 levels of 21.6%, and FQ3’19 levels of 12.6%.

It is natural for the TSM stock to be normalized from hyper-pandemic levels, due to its slowing FY2022 capital expenditure from the original projection of $44B to $36B. However, we must still highlight the tremendous expansion from FY2021 levels of $30.25B and FY2020 levels of $18.04B, on top of its already sizeable net PPE assets of $80.19B in FQ3’22 against $39.13B in FQ3’19. Furthermore, part of the Capex slowdown is attributed to its pivot towards the 3-nm technology through 2024 and supplier challenges.

The latter is no wonder, since ASML (ASML) reported massive backlogs of €38B by FQ3’22, growing tremendously by 200% YoY. It is important to note that 85% of the backlog is attributed to advanced nodes and wafer capacity expansions. Furthermore, deliveries have to be staged through 2024 due to the robust demand eclipsing its existing build/ shipment capacity, pointing to the sustained growth in Capex through the uncertain macroeconomics. Though the semi-supercycle and stocks had clearly crashed in November 2021, this pain is only temporal, since it only gives interested investors with highly discounted entry points, significantly aided by the worsening geopolitical issues.

No matter what the bears say about the speculative Taiwan invasion, TSM has been making major efforts in its geographical expansion as well, with the potential addition of 3-nm technology in its second US plant by 2025. The eventual global shutdown in major world economies worse than the COVID-19 pandemic would also make an outright war very unlikely, since the Chinese economy would suffer tremendously as a result. If an invasion were truly to happen, the majority of the stock market would crash anyway, so debunking the bears’ biggest concern about the loss in TSM’s stock value.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Brutal Market For Taiwan Semiconductor – Another 10% Downside

- Taiwan Semiconductor: Peak Fear, Uncertainty, And Doubt Is Here

So, Is TSM Stock A Buy, Sell, or Hold?

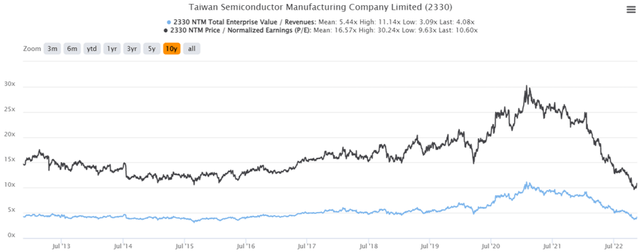

TSM 10Y EV/Revenue and P/E Valuations

TSM is trading at an EV/NTM Revenue of 4.08x and NTM P/E of 10.60x, lower than its 10Y mean of 5.44x and 16.57x, respectively. The stock is also trading at $70.84, down -51.14% from its 52 weeks high of $145.00 though at a premium of 19.19% from its 52 weeks low of $59.43. Nonetheless, consensus estimates are still bullish about TSM’s prospects, given their price target of $84.50 and a 19.28% upside from current prices.

We also expect TSM to moderately rise from the ashes, since the Chinese government is showing promise in an unexpected Zero Covid Policy pivot, as seen through its slashed quarantine periods and the reversal of secondary contact tracing. Assuming that these easings hold through the difficult winter, there is a good chance that most Chinese ADRs will rebound, as seen with Alibaba’s (BABA) optimistic recovery by 7.6% on 10 November 2022, JD.com (JD) by 8.41%, Baidu (BIDU) by 8.34%, XPeng (XPEV) by 5.55%, and NIO (NIO) by 11.78% at the same time.

Furthermore, the Chinese economy accounted for the majority of the global chips demand, totaling 40% of global consumption worth $350B in 2020 with a 14.6% YoY increase. Despite the ongoing US trade war and domestic COVID lockdowns, the country continued to import 417.1B units of chips for the first nine months of 2021, with $79.4B worth from Taiwan alone in H1’22. Therefore, we expect to see a great recovery in chips demand, once the Chinese economy rebounds and consumer demand returns.

In addition, TSM remains highly relevant through the next decade with its 54.9% leading global foundry share, so investors with higher risk tolerances and longer-term horizons may still nibble at current levels. Near all-time low P/E valuations of 9.63x, the stock is really dirt cheap for portfolio growth and investment over the next decade. Naturally, only suitable for those who are able to turn a blind eye to the worsening geopolitical issues and resulting short-term volatility.

Be the first to comment