Michael Gonzalez

T-Mobile US (NASDAQ:TMUS) is leading the 5G race in the United States and has reported strong results for the third quarter of 2022. The company’s focus on delivering value and its network leadership position has resulted in industry-leading customer growth, EBITDA, and cash flow. Total net customer additions in Q3 2022 amounted to 1.7 million customers, and the high-speed internet segment is continuing to accelerate, adding 578 thousand net customers in Q3, reaching a total of 2.1 million. Growth in this segment has only just begun. Free Cash Flow is up 32.5% YoY, ending at $2.065 billion, up a whopping 17.5% QoQ. On its strong results, T-Mobile has also raised its 2022 guidance for the third consecutive quarter. The company’s strategy is focused on expanding its brand strength for value leadership and building a reputation for having the best network in the country. Its 5G leadership translates into overall network leadership, and the company is winning recognition from third-party sources. T-Mobile is also driving innovation through its Magenta MAX plan and has launched initiatives to make it simple for customers to switch to T-Mobile.

Market

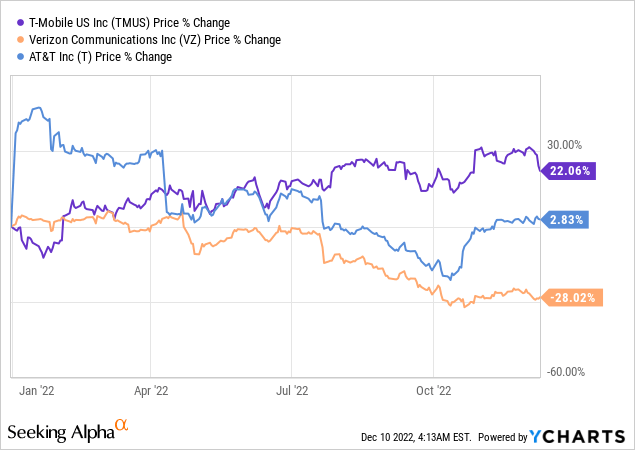

The wireless network market is a highly competitive and dynamic industry dominated by a few prominent players, such as AT&T (T), Verizon (VZ), and T-Mobile, which control most of the market and offer a wide range of wireless network services, including voice, data, and internet access. The demand for these services is expected to grow as more people use smartphones and other mobile devices to access the internet. In response to this growth, companies in the industry have been investing in new technologies, such as 5G, to offer faster and more reliable services. Additionally, the market is also home to many smaller players who are working to gain a foothold in the market. Overall, the wireless network market will likely remain competitive and dynamic, with many opportunities for growth and innovation.

T-Mobile Competition (T-Mobile Investor Relations)

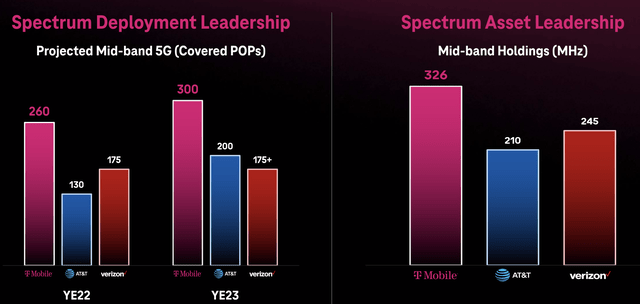

5G Domination

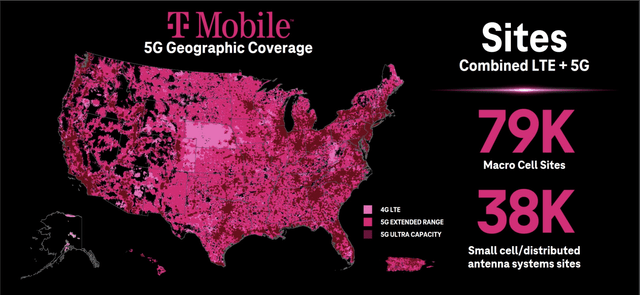

T-Mobile is the leading provider of 5G services in the United States. The company has been aggressively rolling out its 5G network, focusing on providing broad coverage and high speeds. As of December 2022, T-Mobile’s 5G network covers over 200 million people across the country and is available in over 7,500 cities. Regarding speed, T-Mobile has consistently ranked at or near the top of various studies and reports measuring 5G performance. Additionally, T-Mobile has been developing new technologies, such as 5G-powered home internet, to offer customers even more options for accessing high-speed wireless data. Compared to its competitors, T-Mobile is widely considered at the forefront of the 5G race in the United States.

T-Mobile Factbook

Financials

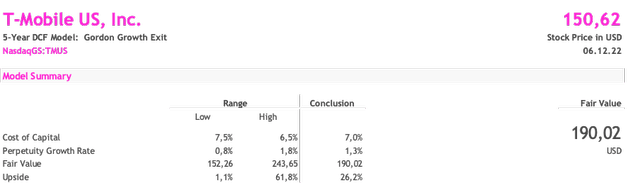

According to my forecasts, T-Mobile’s fair valuation, according to my projections, is at $190.08, representing an upside to today’s price of 26.2%. T-Mobile has seen continuous customer growth in recent quarters, driven by the stark rise in demand for 5G-related services. Hence, as the company continues to add customers while raising its ARPU slowly but steadily, T-Mobile’s revenue should grow approximately ~5% p.a. over the next five years. Further, the Capex-heavy investments in building up the 5G infrastructure have reached their peak, which for the following years will mean higher free cash flow due to higher revenues and lower investments. As a result, I expect FCF to grow almost 11% p.a. over the next five years to ~$21 million by 2026. However, it must also be mentioned that the company, on the back of its substantial progress, has been valued relatively high, trading at an EBITDA/LTM multiple of 11.1x, while its closest rivals, AT&T and Verizon, trade at multiples of 5.7x and 7.7x respectively. The growth prospects and the first-mover advantage, with advanced Capex cost for T-Mobile, justify this relative valuation gap, as most of this gap will evaporate once investment volume normalizes.

T-Mobile – 5 Year DCF (Personal Source)

Risks

There are several potential risks associated with investing in T-Mobile US. First, the telecommunications industry is highly competitive, with many large and well-established companies vying for market share. This intense competition can lead to lower profit margins and make it difficult for T-Mobile to differentiate itself from its rivals.

Second, the rapid pace of technological change in the telecommunications industry can also be a risk for T-Mobile. The company must constantly invest in new technologies and infrastructure to keep up with its competitors and meet the changing needs of its customers. This can be a significant financial burden, and if T-Mobile cannot effectively navigate these technological changes, it could negatively impact the company’s economic performance.

Third, T-Mobile’s business heavily depends on consumer spending, which can be affected by economic downturns and other external factors. If consumers cut back on their spending, T-Mobile’s revenues and profits could be negatively impacted.

While T-Mobile has demonstrated strong financial performance in recent years, there are potential risks associated with investing in the company that investors should carefully consider before making an investment decision.

Final remarks

T-Mobile US is a leading provider of wireless network services in the United States. The company is well-positioned to capitalize on the growing demand for high-speed wireless data services, with a nationwide network of high-speed data centers and a growing customer base. T-Mobile’s recent merger with Sprint has given it even more scale and resources to compete with larger rivals like AT&T and Verizon. Additionally, the company is investing heavily in 5G technology to offer customers even faster and more reliable wireless data. Overall, T-Mobile’s strong position in the market, focus on 5G, and partnerships make it an attractive investment opportunity.

Be the first to comment