AsiaVision

Thesis

Synchrony Financial (NYSE:SYF) is a company that has performed well in recent years and has shown a strong commitment to shareholder value. While we like the stock, we remain wary of the implications of an economic downturn for the company’s short-term prospects. Due to various headline risks and the fact that a high interest rate environment is unfavorable for financing companies like Synchrony Financial, we recommend a “HOLD” on this stock until the next earnings announcement and we will assess the company’s outlook once Q3 earnings are announced.

Company Overview

Synchrony Financial is a consumer financial services company that provides a full line of financing solutions for consumers and businesses. The company provides lending and financing products and solutions to clients in retail, healthcare, travel, and more. Synchrony Financial has a market capitalization of $13.97 billion and the company has a trailing dividend yield of 3.17% as of the time of this writing.

Shareholder Friendly Policies

Synchrony Financial has had a history of friendly shareholder programs. The company has paid out quarterly dividends since 2016, and the company started out with a $0.13 per quarter in dividends. Now, as of July of this year, the company pays out $0.23 per quarter in dividends at an annualized yield of 3.17% (~$0.92 per year). That represents a quarterly dividend CAGR of ~10.0% in 6 years, which far outpaces the rate of inflation. In addition to solid dividend growth, the company has previously undertaken numerous buyback programs with large sizes compared to the company’s market capitalization. In 2019, the company announced a large $4 billion buyback program, and most recently in early 2022, the company initiated an incremental $2.8 billion buyback program which is nearly ~20% of the company’s current market capitalization. We believe that the recent dividend hikes and the generous buyback program is indicative of management’s confidence in the company’s business prospects and demonstrates the company’s commitment to shareholder value.

Modest Growth In Key Areas

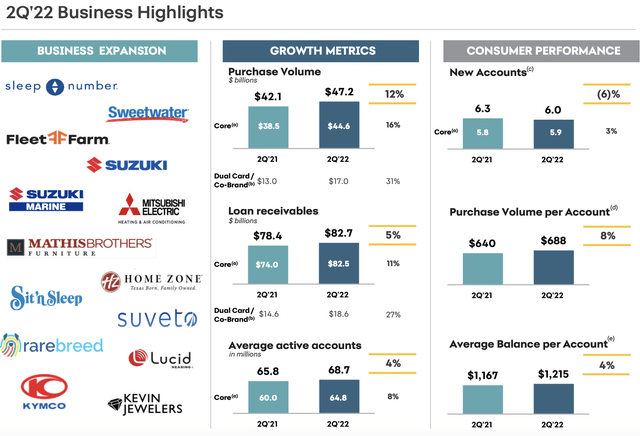

In the company’s most recent earnings report for Q2, the company has shown some solid growth metrics on key metrics that affect the business. The business model relies on higher consumption and higher credit use, and Synchrony has seen meaningful increase, as the purchase volume has increased 12% YoY along with an 8% YoY increase in the purchase volume per account. Such growth metrics demonstrate the continued growth in consumption and credit use by users of Synchrony Financial and also is an indication that the company has partnered with businesses that sell products and services that consumers want. Subsequently, the loan receivables have increased 5% YoY, which should indicate a moderating loan growth. Nevertheless, growth has all around been solid in key metrics, and we believe that such growth is a net positive for the company.

Robust Underwriting

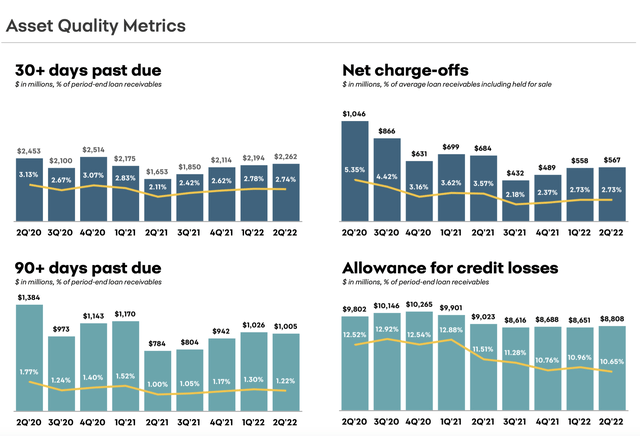

Along with growth metrics, management reported solid performance in the company’s balance sheet. Despite a slight deterioration in most asset quality metrics since the 2H of 2021, the metrics remain stable over the past few quarters. For example, delinquency rates as measured by 30+ days past due and 90+ days past due have remained low and have remained within the range in the past few quarters. Net charge-offs have also remained stable over the past few quarters, and is still more than half from the medium-term pandemic peak in the second quarter of 2020. Overall, the past performance indicates that the company has shown to do a good job in protecting its assets, and the $8.8 billion in allowance for credit losses (~10% of the loan receivables) allow for solid downside protection in the event of higher credit losses.

Recession Risk

Risk of a major recession or economic turmoil should not be understated in the context of analyzing a financial services company like Synchrony Financial. The Federal Reserve continues to raise rates at a rapid pace and the overall monetary conditions have tightened, as can be seen in the high yields in the short-term treasury market. The combination of a higher interest rate environment and a slowing down of the economy can pose a major risk to Synchrony Financial as the company is exposed to both higher credit losses from customers from higher interest rates as well as reduced purchase activity from a slowdown in consumption. It remains unclear how deep the next downturn will be and how the current monetary policy will impact consumption and household credit. Nevertheless, the company is well-capitalized and has $10.6 billion of cash on the balance sheet in addition to $8.8 billion for allowance for credit losses. Still, we remain wary of the current macroeconomic environment, and we believe that investors should wait until the Q3 earnings in October to see any signs of how interest rate hikes may have affected the company’s short term prospects.

Conclusion

We remain positive on Synchrony Financial’s recent financial performance. The company has grown well in key metrics that demonstrate the health and success of the business model, and the company has attractive shareholder policies in place. Nevertheless, the recent economic fears are warranted and an economic downturn would directly impact Synchrony Financial. We believe that investors should wait until the next earnings in Q3 to assess the impact of the economic conditions on Synchrony and then make any determination on the stock.

Be the first to comment