imaginima/E+ via Getty Images

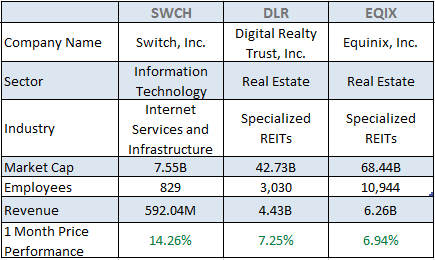

It looks like Switch (NYSE:SWCH), a smaller data center play is looking to profit from the current consolidation trend in the industry. Thus, according to an SA news update, it may be open to a takeover bid in the $7.5 billion to $10 billion range. Another indication of willingness to be acquired is the board’s earlier vote for conversion from an information technology (“IT”) company to a REIT. This would be similar to Digital Realty Trust (DLR) or Equinix (EQIX), two data center plays with much higher market caps as shown in the table below.

Comparison of key metrics (Seeking Alpha)

In view of DLR’s and Equinix’s higher revenues and market caps, they may be potential acquirers in case of an industry-level or strategic consolidation. As for Switch, its market cap has increased by around $450 million from $7.1 billion after outperforming since the news broke out on March 21.

My objective with this thesis is to estimate the value of a potential deal as well as assess the most probable consolidation route in a rapidly evolving industrial landscape, where in addition to large data center REITs, there are infrastructure companies and private equity funds looking for acquisition targets.

Benefits of data center consolidation

When considering a strategic acquisition or merger, a consolidation of two data center players creates operational efficiencies in terms of infrastructure management tools. It also provides opportunities to reduce costs by streamlining the number of staff manning the facilities, a key factor in a tight labor market.

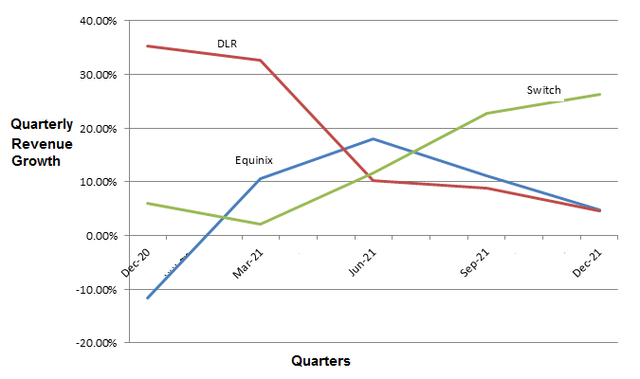

Then, there are opportunities to generate additional sales by adding customer numbers and expanding into new geographies. Talking growth, the chart below shows that the Y-o-Y quarterly revenue growth in the last quarter of 2021 for DLR (in red) and Equinix (in blue) are both less than 5%. This is the reason why acquiring Switch and adding its $592 million of annual sales to their income statements becomes an attractive proposition. Switch is also growing faster too as shown in the green chart.

Quarterly revenue progression (Seeking Alpha)

It is growing five times faster than its larger peers. Thus, its Q4-2021 revenue growth was an astounding 26% on a year-over-year basis, out of which the organic component was still an impressive 17%. For this matter, the $420 million Data Foundry acquisition in April 2021 contributed 9% to overall revenues.

Looking at the full year, the acquisition contributed 5.6% through its four data centers and also enabled Switch to expand to Texas. Switch now has 16 data centers across six locations including its home state of Las Vegas. Looking ahead, fourth-quarter revenue bookings (measured on an incremental annualized basis) were nearly $30 million, or $8 million above the monthly average of $22 million seen in 2021.

Thus, the company is not only growing faster, but booking figures point to this continuing in 2022.

The Switch differentiator

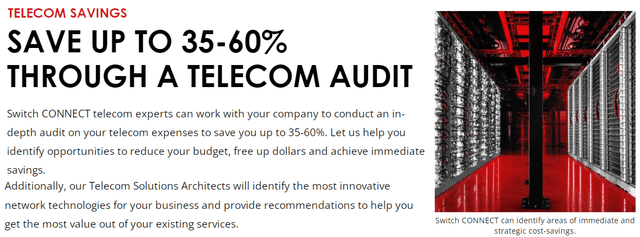

This is made possible by a strategy of differentiation through the Switch CONNECT technology, which is proving key in winning large-scale network migrations.

I specifically mention “network migrations” in contrast to server migrations. In this respect, as part of the digital transformation trend, only about 30% of organizations are migrating all of their legacy applications to the cloud. Instead, constrained by regulations, data privacy rules, and many other factors, most are creating cloud-like environments on their own premises (on-prem). Thus, with applications residing both on-prem and in the cloud, this results in more of a hybrid cloud infrastructure.

Pursuing further, contrarily to companies that migrate 100% of IT workloads to the cloud and just need connectivity to ISPs (internet service providers) like Verizon (VZ), those with hybrid clouds need more elaborate connections, linking them both to the internet and to the data lying in their private data centers. This can become costly depending on whose networks their traffic has to travel through.

It is at this point that Switch CONNECT, offering an independent cooperative-type of telecommunications provider implying lower prices comes into play.

Scanning the industry, the company has successfully positioned itself in the rapidly growing hybrid cloud market as I had explained in my thesis entitled “Switch: A Data Center Company With A Differentiated Business Model” last year. Furthermore, Switch’s sales teams have been able to devise a plan that results in a win-win scenario.

An example is a logistics customer involving the migration of over 800 network locations, making feasible a 400% growth of traffic capacity while at the same time, benefiting from a reduction in network costs by over 30%. Equally important, the deal means an additional $6 million of annualized revenue for Switch, a considerable amount just with one customer.

Consequently, Switch has attained a high level of product differentiation which explains why it is able to elevate revenues, but it is also important to verify the bottom line.

Valuations and key takeaways

With higher SG&A, exceptional legal charges of $35 million, increases in depreciation, and inflated power bills Switch reported a $10.8 million loss from operations in Q4-2021 compared to a positive income of $26.3 million in 2020. Additionally, interest expense amounted to $13.5 million, after increasing by $4.4 million over the same period last year, mostly as a result of servicing the $500 million debt contracted for the Data Foundry acquisition.

Moreover, the company has $1.72 billion of debt which is considerable given that only $48.3 million of cash is available and $660 million-$674 million of revenues are expected in 2022. Thus, with borrowing charges on the rise due to the Fed hiking rates and inflation driving labor and energy costs higher, it is more convenient for Switch to pursue its growth story as part of a bigger entity.

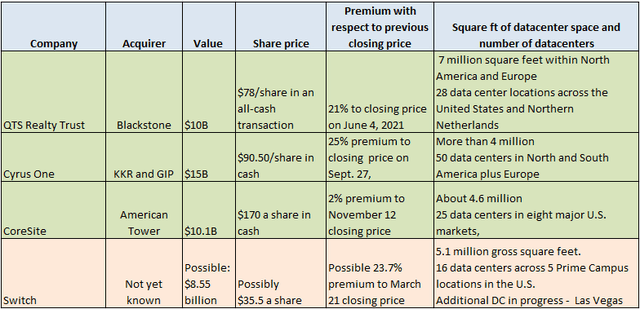

To value an eventual acquisition, I use the table below which lists past industry deals. A comparison with CoreSite which was acquired for around $10 billion by American Tower (AMT) reveals that Switch has more data center space, by about 11%, but conversely, has 56% fewer data centers.

Prepared by the author through data from Seeking Alpha

However, the company is adding space in H1-2022 as part of commissioning the Las Vegas 15 data center. Additionally, this is an industry where value dynamics also revolve around connectivity, power usage, and location. For this purpose, Switch, with its advanced connectivity services is also present in the lucrative Texas market where Californian tech companies are migrating en masse.

Taking the mid-point between Switch’s market value on March 21, or $7.1 billion, and $10 billion, or the amount QTS Realty Trust (QTS) and CoreSite were acquired for, I obtain $8.55 billion, which I consider a fair value in case there is a deal.

When dividing this figure by the number of shares outstanding, or 241.6 million, I obtain a target stock price of $35.5. As support for this target, it constitutes a 23.7% premium over March 21’s closing price of $28.64, which falls within the 21%-25% range of some of the previous deals as per the table above. Additionally, my target is within the $34-$38 per share provided by analysts at J.P. Morgan.

To further justify my bullish stance, there is also the economics of demand and supply, as, on one hand, M&A activities have taken away three U.S. data center REITs from the equation, with only a few left for sales, on the other hand, with high inflation and recession risks, there has been a surge in demand for real assets like 5G communications towers, fiber infrastructures, and data centers. Thus, current demand/supply conditions and high inflation favor Switch.

The only caveat I see coming along the way is the use of some proprietary designs, like for its HVAC (High Voltage Air Conditioning) equipment which has been designed by Switch’s founder and CEO Rob Roy himself. These are non-standardized designs, and as such have sparred the company the trouble to compete and pay a higher price in the current supply-constrained market in order to acquire them.

However, on the flip side, in the event of a strategic acquisition by either DLR or Equinix, integration may prove more difficult as a result of a lack of standardization. To further complicate matters, Switch is the only company to qualify facilities as Tier 5, whereas Uptime, the de-facto certification organization which has issued over 1,700 certifications to the vast majority of the world’s data centers including DLR and Equinix only has four tiers (Tier I to Tier IV).

These two companies are also burdened by relatively high debt levels and seem to be prioritizing an internationalization strategy since 2022, with Equinix acquiring MainOne (for $320 million) and Enel (for $705 million) to expand into West Africa and Latin America respectively. As for DLR, it acquired a majority stake in Africa’s Teraco in a $3.5 billion deal. Therefore, Switch should more likely be acquired by infrastructure companies like Blackstone (BX), KKR (KKR), or Global Infrastructure Partners.

Finally, given its potential as an acquisition target and at the current share price of $30-31, the company is a buy with a potential upside of about 15%-16%. Also, while Switch’s current trailing price to sales multiple of 6.98x is overvalued with respect to the IT sector by 100%, it is only slightly higher than the REIT sector’s median of 6.63x, by only 5%.

Be the first to comment