Scott Olson

Sweetgreen (NYSE:SG) is a nascent healthy eating fast casual restaurant chain. It has strong unit economics of $2.9 million AUV and decent 18% restaurant margins. Unfortunately, corporate expenses are far too high. With a guidance cut in Q2, corporate momentum has decelerated. I would recommend investors stay on the sidelines and track the upcoming quarters to see if Sweetgreen can show a path to profitability before investing.

Sweetgreen Background

Sweetgreen, Inc. is a fast casual restaurant chain focused on delivering fast, healthy food. Its corporate mission is to “build healthier communities by connecting people with real food“.

From the start, Sweetgreen wanted to create a sustainable and green restaurant chain, to cater to the environmentally conscious millenial/Gen-Z customers. Sweetgreen sources from farmers and producers that minimizes their carbon footprint and participates in regenerative practices. The menu is crafted with carbon footprint minimization in mind, and the company strives to develop its restaurants with green building materials and furniture to embody its corporate values (Figure 1).

Figure 1 – Sweetgreen corporate values (Sweetgreen website)

Well Liked By Millenials

Millenials and the younger generations appear to value Sweetgreen’s corporate mission, with the company garnering 320k Instagram followers despite having only 166 stores across 13 states (Figure 2). Chipotle Mexican Grill, Inc. (CMG), a much larger fast casual chain with over 2,600 restaurants, only has 1.1 million Instagram followers. Five Guys, with 1,700 restaurants, only has 360k.

Figure 2 – SG is well liked by millenials (Sweetgreen Instagram)

Sweet IPO

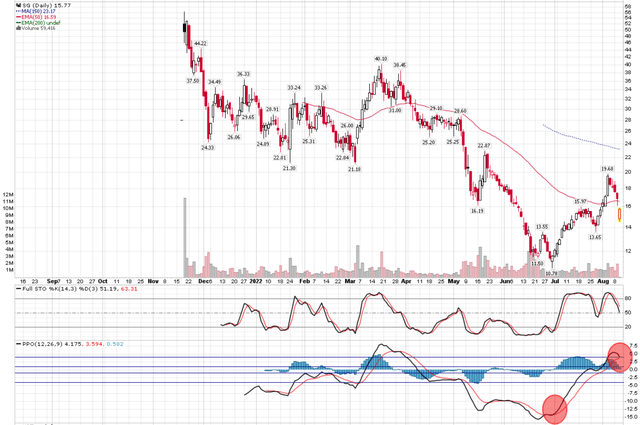

Sweetgreen’s on-trend message and lofty growth ambitions led to a massive $3 billion IPO in late 2021. With hype from having Naomi Osaka as an investor and spokesperson and offering 1% of the IPO to Robinhood (HOOD) investors at the IPO price of $28, Sweetgreen was able to double its market cap in the first day of trading to $56 per share (Figure 4). Unfortunately, the first day marked the peak, and the stock price subsequently dipped as low as $10.79 in late June.

Figure 3 – SG stock price (Author created with price chart from stockcharts.com)

Does It Have A Sweet Business?

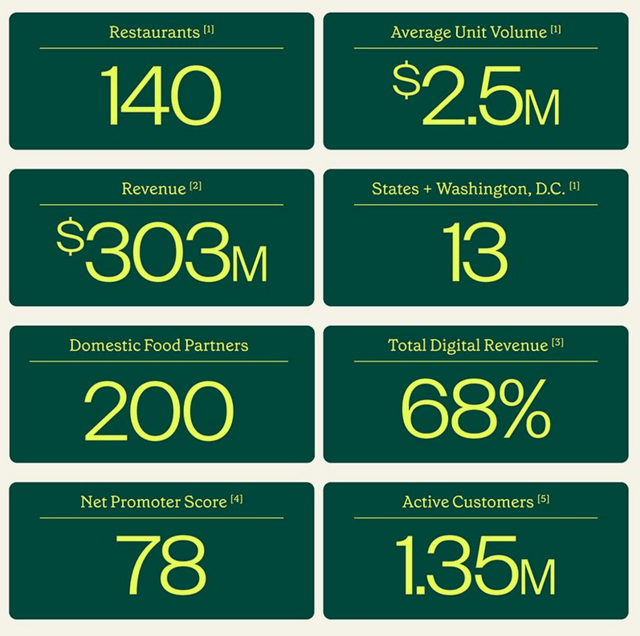

With such a hot stock, what was the underlying business like? From the IPO prospectus, we are able to glean some insights into the underlying business.

First, the company boasted average unit volume (“AUV”) of $2.5 million. That was a pretty good figure, as Chipotle, the category leader, only has an AUV of $2.6 million.

Figure 4 – SG business metrics (Sweetgreen S1)

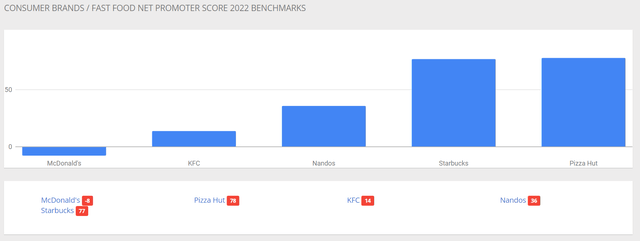

Sweetgreen’s Net Promoter Score (“NPS”) of 78 is also fairly high. NPS measures customer loyalty and how likely they will ‘promote’ the brand. According to customer.guru, Starbucks (SBUX) has a NPS of 77 while McDonald’s (MCD) is -8 (Figure 5). (Note SG didn’t specify who measured their NPS and whether this is comparable to the NPS from customer.guru).

Figure 5 – Comparative NPS scores (customer.guru)

Finally, SG promoted that 68% of their revenues were digital. Digital revenues is an increasingly important metric, as consumers are shifting to digital orders. SG’s 68% digital revenue is high, relative to fast casual peers. For context, 39% of Chipotle’s revenues were digital.

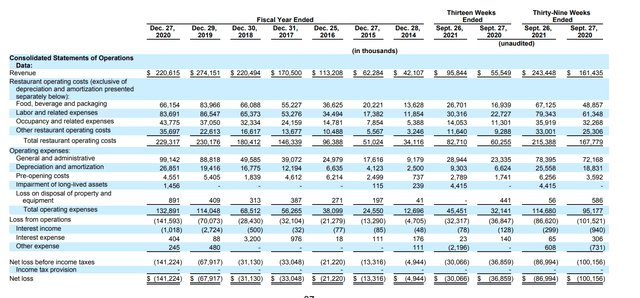

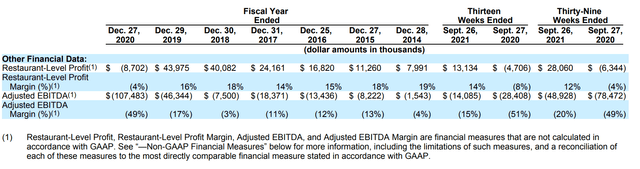

Figure 6 and 7 summarizes SG’s financials in the years leading to the IPO. Revenues grew rapidly, although 2020 was a down year due to covid costs. Restaurant margins were strong between 14% to 19%, but not spectacular. Again for reference, Chipotle, considered one of the best fast casual chains, has restaurant margins of ~25%. According to restaurant365.com (a restaurant solutions provider), restaurants have average margins of 3-6%, while fast casual restaurants have margins of 6-9%.

Figure 6 – SG summary financials (Sweetgreen S1) Figure 7 – SG summary margins (Sweetgreen S1)

Furthermore, despite decent restaurant level economics, SG has not been profitable on an operating level. General and admin expenses have increased from $9 million in 2014 to $78 million in the 9 months to September 2021. So even though restaurant profits have gone from $8 million in 2014 to $28 million (9MYTD2021), operating losses have deepened from $5 million to $87 million (9MYTD2021). G&A, as a percent of revenue, rose from 21.8% in 2014 to 32.2%. Most businesses find economies of scale as they grow; so far, that has not been the case at SG.

Latest Quarter Was A Disappointment

Heading into the latest quarter (Q2/2022), there was a bit of excitement in the stock, as it had bottomed in late June and was up over 80%. Analysts were expecting the company to report $130 million in revenue, and -0.15 in EPS.

Unfortunately, the company disappointed, reporting a $0.36 per share loss and revenues of only $125 million. Importantly, management highlighted “We began to see softness in revenue around Memorial Day“, and lowered its 2022 guidance to $480 to $500 million in revenues for the full year, down from the $515 to $535 million previously expected. Same store sales growth was also lowered to 13-19%, down from 20-26%. The company is also cutting 5% of headcount in the corporate support center, part of the G&A bloat I highlighted above.

The stock reaction was swift, with the stock trading down 30% at one point in after-market hours, although so far in the day post earnings, it is only down ~5%.

Digging Into The Details

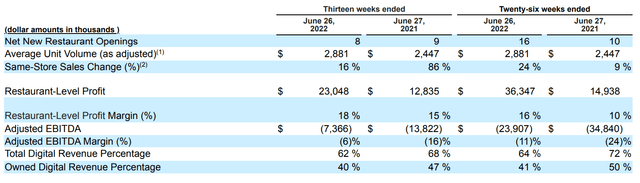

Digging into the details of the quarter, it wasn’t all bad. The company saw AUV increase to $2.9 million, which actually surpassed Chipotle’s $2.6 million AUV. Restaurant margin also improved YoY to 18%.

Figure 8 – SG Q2/2022 KPI (Sweetgreen Q2/2022 10Q)

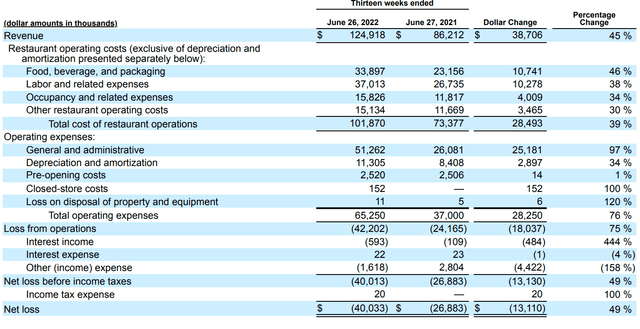

Unfortunately, SG&A was way too high, coming in at $51.3 million for the quarter or 41% of revenues (G&A was 30% of revenues in Q2/2021)! So while restaurant margins grew 80% YoY to $23 million, operating loss actually expanded 75% YoY to $42.2 million. Note the SG&A figure in Q2 included $21.3 million in stock-based compensation (“SBC”), something many companies like Sweetgreen seem to like to exclude. Adjusting for SBC, G&A was 24% of revenues, an improvement from 30% in Q2/2021.

Figure 9 – SG Q2/2022 summary financials (Sweetgreen Q2/2022 10Q)

Once again, we come back to Chipotle, the gold standard for a well run fast casual chain (ignoring the sky high valuation); Chipotle reported Q2/2022 G&A of 6.4% of revenue, which was actually down YoY from 7.7%. Shake Shack Inc. (SHAK), another fast growing fast casual chain struggling with profitability, has G&A expenses of 12.6% of revenues. Simply put, Sweetgreen is struggling to show a path to profitability at the moment.

Valuation Is Challenging

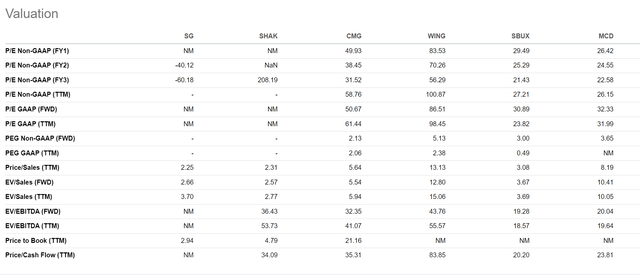

The challenge with valuing a company like Sweetgreen is what methodology or metric to use? Using comparables, the only metric that can be used is EV/Sales (Figure 10). On this metric, SG is trading at similar multiples to SHAK, but below that of CMG and other restaurant chains. (Note, with the exception of SHAK, the other comparables are profitable and rightly deserve a higher multiple)

Figure 10 – SG comparables (Seeking Alpha)

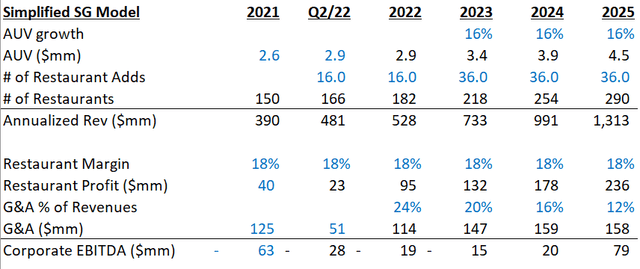

From management’s guidance, if the company can deliver $490 million in revenues for 2022, and if restaurant margins are stable at 18%, Sweetgreen should deliver restaurant profits of $88 million. Assuming same store sales growth of 16% are maintained and SG adds 36 stores a year, if we take the leap of faith that SG will focus on expenses and reduce G&A expenses as a % of revenues from an adjusted 24% in Q2/2022 by 4% per annum, how long will it take for SG to reach corporate profitability?

With these generous assumptions, I model Sweetgreen to turn EBITDA positive on a corporate level in 2024 (Figure 11). Of course, this is simply a model, but it does give me something to measure the company against.

Figure 11 – Simplified SG model (Author created)

Luckily, the company has over $400 million in cash as of Q2/2022, so it should be able to sustain corporate losses for the next few years as it grows it restaurant-base.

Risks To Sweetgreen

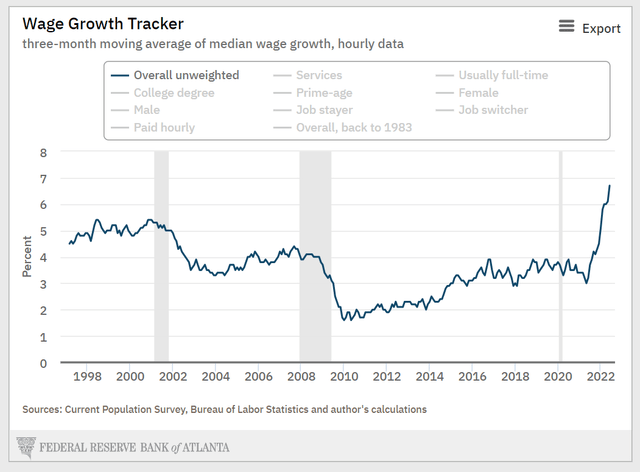

One of the risks to all restaurant chains at the moment is soaring inflation, particularly in wages. According to the Atlanta Fed, wage inflation is tracking at a 6.7% rate (Figure 12), in addition to rising food input costs.

Figure 12 – wage inflation (Atlanta Fed)

Furthermore, although Sweetgreen has exhibited fast growth so far, it is unclear how well the concept will perform in other areas of the country and potentially overseas. Although there is a trend towards healthier eating, will consumers continue to pay $15 for a bowl of salad when inflation is running at over 8% Yoy?

Conclusion

In conclusion, Sweetgreen is a nascent healthy eating fast casual concept. It has strong unit economics of $2.9 million AUV and 18% restaurant margins. Unfortunately, corporate expenses are far too high at the moment. With a guidance cut in Q2, momentum has clearly decelerated. I would recommend investors stay on the sidelines and track the upcoming quarters to see if Sweetgreen can show a path to profitability.

Be the first to comment