U. J. Alexander/iStock via Getty Images

Sunnova Energy’s (NYSE:NOVA) 32% pullback over the last 12 months has failed to reflect what looks like solid momentum in the underlying business of the home solar company. The market for this is growing, homeowners want greater energy independence, to reduce their carbon footprint and benefit from lower electricity rates. Hence, in a year when electricity prices reached new records and the Inflation Reduction Act was passed, home solar companies would experience a broad demand boom that looks set to continue into 2023 and beyond.

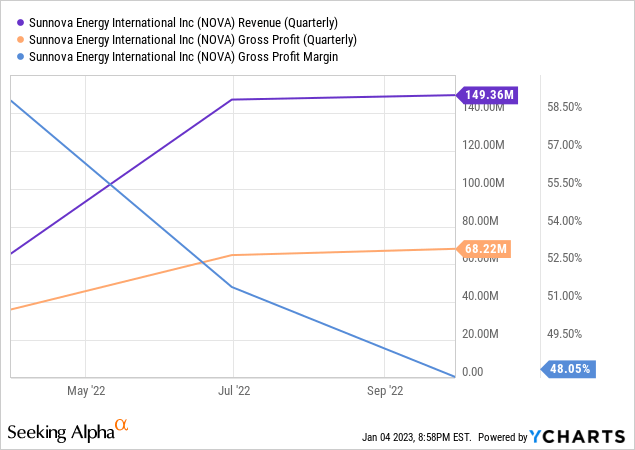

Houston, Texas-based Sunnova last reported earnings saw revenue come in at $149.36 million, an increase of 116.8% from its year-ago comp as the company’s energy as a service model rode positive demand momentum to reach new customers. Sunnova offers home solar, battery storage, EV chargers, and system protection services to customers across the US and its territories. The model is straightforward. Households can get a solar PV system installed with $0 down and either pay back the total cost of the system over a certain time period or just for the power it produces.

Revenue Is Booming But Profits Are Still Elusive

Sunnova last reported earnings for its fiscal 2022 third quarter. This saw revenue grow materially year-over-year to reach a new quarterly record of $149.36 million, up sequentially from $147 million in the second quarter and a beat of $16.43 million on consensus estimates. The company added 21,800 new customers during the quarter to bring its total to 246,600, a 41% increase from the year-ago figure. These had a weighted average contract life of 22.3 years remaining and came with $459 million in cash inflow expected over the next 12 months.

Gross profit was $68.22 million, maintaining a trendline that’s seen gross profit margins decline from over 58.5% a year ago. The company’s underlying profitability will continue to be squeezed by higher borrowing costs, which continue to be pushed higher by an unrelenting hawkish Fed as interest rates are expected to be hiked by at least another 75 basis points this year. The home solar company held $4.8 billion in long-term debt on its balance sheet as of the end of its last reported quarter, up from $2.9 billion as of the end of the year-ago comp.

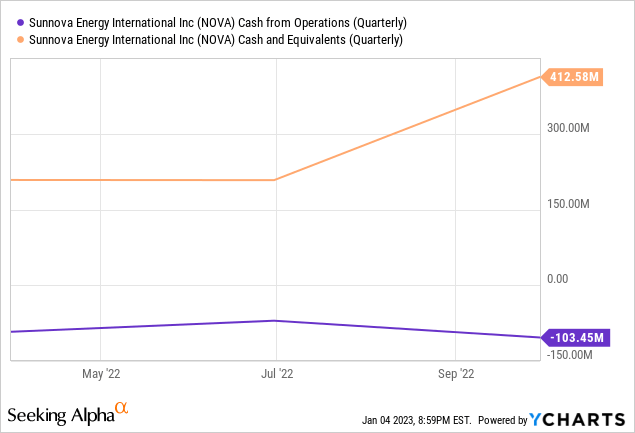

Sunnova essentially leans on corporate debt to fund the solar systems provided to households who then pay back the cost of the systems plus interest over the term of their contract. This works when interest rates are low, but the net interest margin comes under pressure when borrowing costs rise.

For some context, the company currently trades on a market capitalization of $2.09 billion, placing its long-term debt balance at more than 2x its market cap. This is set against cash burn from operations that stood at $103.45 million as of the end of its last reported quarter, up from $36.2 million in the year-ago period. Cash burn as a percent of revenue for its last reported quarter was 69%, up from 52.5% in the year-ago comp. Hence, the increase in cash and equivalents to $412.58 million was built on the back of increased corporate borrowings and provides a runway of around four quarters.

A Fast-Growing Part Of The Climate Economy

The current macroeconomic environment has formed a material headwind for Sunnova’s underlying profitability. 2023 is likely set to mirror the same risk-off sentiment that characterized much of last year. So whilst it would be easy for bulls to wax lyrical about the company’s revenue boom, Sunnova remains unprofitable and looks far too leveraged. The revenue boom against heavy competition from Sunrun (RUN), SunPower (SPWR), Pineapple Energy (PEGY), and Tesla (TSLA) underlies just has fast-expanding home solar’s TAM is and lends credence to Sunnova’s execution.

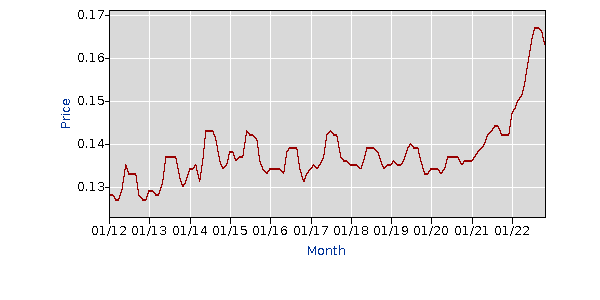

U.S. Bureau of Labor Statistics

Hence, whilst the average cost of electricity per KWH in US cities remains at elevated levels to form a huge backstop for demand, continued unprofitability will form a barrier to positive momentum for its common shares.

I’m bullish on the potential for solar to help achieve decarbonization targets and home solar will play a part in this, but I fail to see the appeal of Sunnova here. The pathway to positive sustained cash flows first starts with scale, where overall operational losses as a per cent of revenue start to decline. This is going the wrong way. Whilst price increases were brought in during the third quarter and the company is expanding into the commercial market through Sunnova Adaptive Business, its ultimate ability to create significant value will be built on profitable execution which has been elusive since its founding in 2012. I’m broadly neutral on the stock but the bears are right to raise the high leverage and rising unprofitability as a reason to avoid entering a position for now.

Be the first to comment