zhaojiankang

Introduction

After starting the year with a disappointingly flat outlook for 2022, SunCoke Energy (NYSE:SXC) surprised shareholders with a big dividend when releasing their previous results for the second quarter and as my previous article highlighted, there was more to come. Whilst their recently released results for the third quarter were even stronger and saw management raise their full-year guidance, it seems prudent that investors do not get too excited, as discussed within this follow-up analysis.

Coverage Summary & Ratings

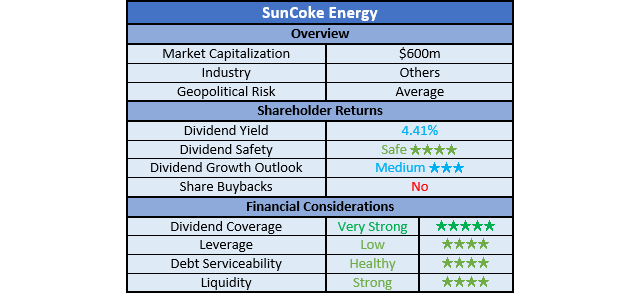

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

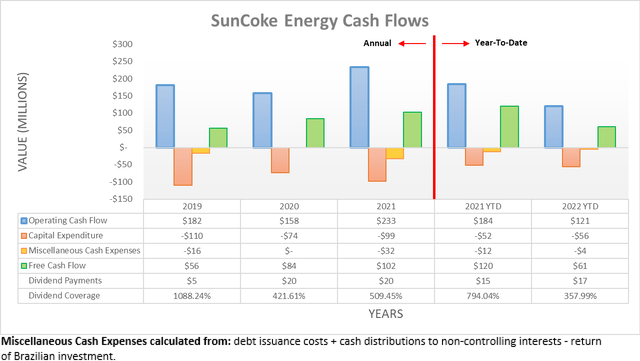

When first reviewing their cash flow performance following the third quarter of 2022, on the surface their operating cash flow appears quite disappointing with its result of $121m during the first nine months down around one-third lower versus its previous result of $184m during the first nine months of 2021. Whilst initially appearing alarming, once again similar to the first and second quarters of 2022, their reported results were weighed down by working capital movements.

If zooming into their underlying operating cash flow that excludes working capital movements, their result of $75m during the third quarter of 2022 was stronger than any previous quarter during 2022 or 2021, primarily driven by the booming steel market earlier in the year. This further builds upon the strength of their previous results during the first half of 2022 and sees a combined $85m of working capital build across the first nine months, which means they have a large sum of pent-up cash heading to their coffers when it reverses into a draw, hopefully during the fourth quarter.

Following this stronger financial performance, management also raised their guidance for full-year 2022 with their adjusted EBITDA now forecast to exceed the upper end of their previous guidance of $285m. In theory, this points favorably for their operating cash flow given its positive correlation but at the same time, it seems prudent that investors do not get too excited because when looking ahead past this short-term windfall, their outlook already appears to be softening, as per the commentary from management included below.

“Looking forward, we’re experiencing softening in export coke markets, particularly in pricing driven by global economic uncertainties.“

-SunCoke Energy Q3 2022 Conference Call.

Due to the global energy shortage, many steel producers are idling their furnaces as costs surge and demand faces headwinds, especially in Europe that already saw upwards of twelve furnaces idled by early October. Even though management only mentioned the export market, the outlook for their domestic market is not looking too positive with the United States steel industry also suffering with United States Steel (X) recently idling two furnaces, one in Pennsylvania and one in Indiana. It appears difficult to make a strong case for the steel industry anywhere in the world given the widely expected impending recession, not to mention the outlook for materially higher costs due to the global energy shortage. Admittedly, no one can see the future but as a basic rule of thumb, if your customers are suffering, you are also likely to suffer in the not-too-distant future, especially as less steel production means less demand for their coke.

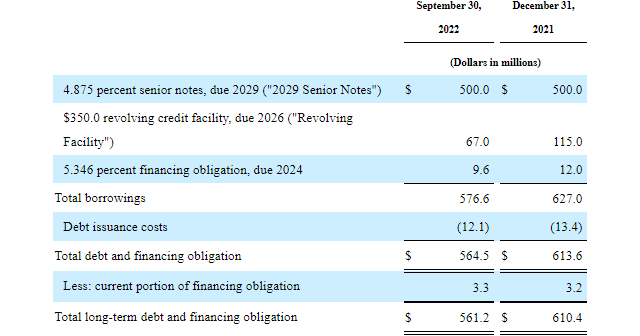

This outlook sounds rather grim and whilst yes, in the short-term investors are likely in for a bumpy ride, in the medium to long-term, their shares still offer desirable value. On current cost, even their middle-of-the-road results from 2021 whereby they generated $102m of free cash flow could still provide a very high free cash flow yield of nearly 17% given their current market capitalization of approximately $600m.

Furthermore, their recently increased quarterly dividends of $0.08 per share only cost $26.7m per annum given their latest outstanding share count of 83,402,313 and thus is dwarfed by their free cash flow, which was still $84m even during the downturn of 2020. Thanks to this very strong dividend coverage of 300%+, regardless of any possible downturn, their dividends still appear safe. Whilst this also leaves the door wide open for more dividend growth to come in the medium to long-term, as was the focus of my previous analysis, in the short-term, their capital allocation strategy is prioritizing deleveraging, as per the commentary from management included below.

“We also continue to reward shareholders with substantial dividends, which were increased by 33% last quarter. Finally, on the debt side, we continue to make good progress, reducing our revolver balance and expect our deleveraging initiatives to continue for the balance of the year.”

-SunCoke Energy Q3 2022 Conference Call (previously linked).

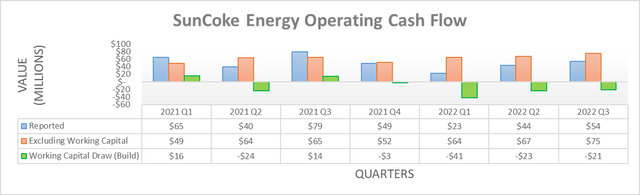

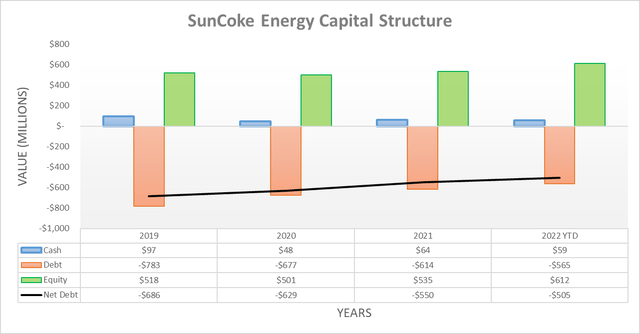

Similar to almost every quarter during the past three years, their net debt once again dropped lower during the third quarter of 2022 to $505m, thereby representing a modest decrease of $29m against where it ended the second quarter at $534m. Whilst already positive, if not for their pent-up working capital build during the first nine months, this would have been another $85m lower and thus if this reverses during the fourth quarter, it would instantly wipe out nearly 17% of their net debt, even before counting any free cash flow generated.

When looking ahead as they face this possible downturn, their net debt will likely slow its downward trend but thankfully, they are now better positioned than any other time in recent history. Even if forgetting the possible upcoming boost from working capital movements, their net debt is still now around 26% lower than its previous level of $686m at the end of 2019, when they were last staring down the barrel of an impending downturn.

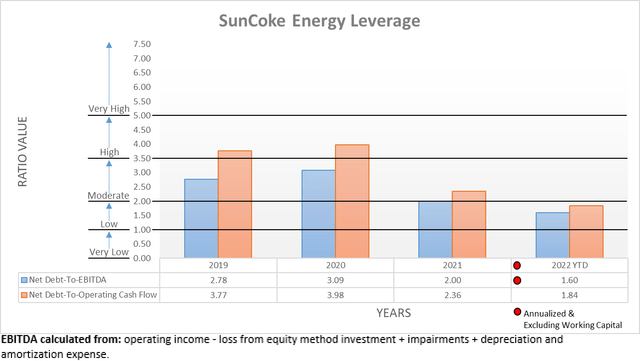

Thanks to their net debt continuing its downward trend during the third quarter of 2022, it allowed their stronger financial performance to push their leverage lower, albeit only to a small extent. As a result, their respective net debt-to-EBITDA and net debt-to-operating cash flow are now at 1.60 and 1.84, versus their previous respective results of 1.73 and 2.04 following the second quarter and thus now sees both results within the low territory of between 1.01 and 2.00, as was expected when conducting the previous analysis.

Despite being positive, when looking ahead their deleveraging stands to slow or even temporarily reverse as the likely downturn hinders their financial performance. Whilst their leverage was never too problematic during the downturn of 2020, even a repeat of this severe downturn would now see less impact as their net debt is materially lower. If comparing their latest net debt of $505m against their cash flow performance during 2020, it sees their net debt-to-operating cash flow at 3.20, which would remain within the moderate territory of between 2.01 to 3.50, unlike their previous results for 2020 that saw a result of 3.98 sitting within the high territory.

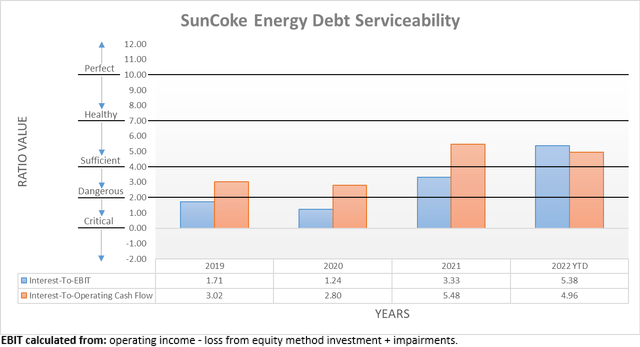

Quite unsurprisingly following their leverage, the same driving forces also kept their debt serviceability healthy following the third quarter of 2022, which is becoming increasingly important to consider as interest rates climb rapidly. To this point, their interest coverage is healthy regardless of whether taking an accrual or cash-based approach with results of 5.38 and 4.96 compared against their EBIT and operating cash flow, respectively. Whilst this would weaken if they face a downturn, the impact should not be too severe because as subsequently discussed, they have the potential to repay the remainder of their credit facility, which is their only debt carrying a variable interest rate.

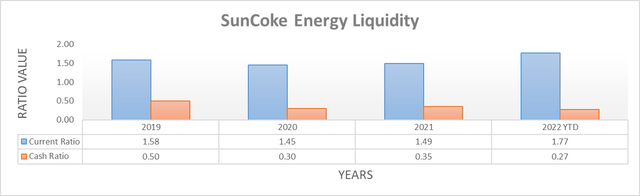

The third quarter of 2022 also saw their strong liquidity effectively unchanged with their latest respective current and cash ratios at 1.77 and 0.27, versus their previous respective results of 1.72 and 0.29 following the second quarter. Furthermore, if their $85m working capital build during the first nine months reverses during the fourth quarter, it could easily repay the entire $67m balance of their credit facility, which as previously mentioned, remains a priority of management. Whether this opens the door for higher dividends during 2023 most likely depends upon the extent operating conditions soften going forwards. Regardless, the remainder of their debt does not mature until June 2029 and only carries a moderate interest rate of 4.875% and thus even if they face a severe downturn, they are well positioned to endure the turbulence and reward shareholders as soon as operating conditions recover.

SunCoke Energy Q3 2022 10-Q

Conclusion

The extent that operating conditions soften going forwards remains to be seen, although the outlook is concerning. Apart from the global energy shortage making a recession quite likely as central banks rapidly tighten monetary policy, it is also making it more costly for their customers to continue steel production and thus when looking ahead, their outlook is skewed to the downside, despite their otherwise stronger financial performance during the third quarter of 2022. Whilst this would normally warrant a rating downgrade, I nevertheless continue to believe that my buy rating is appropriate because as a medium to long-term investor, their very high nearly 17% free cash flow yield remains desirable given its middle-of-the-road basis.

Notes: Unless specified otherwise, all figures in this article were taken from SunCoke Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment