skynesher

Introduction

Sun Life Financial (NYSE:SLF) is an insurance and financial services company of Canadian origin. The company provides insurance and financial services to retail and institutional clients. Currently, high interest rates favor Sun Life in terms of investment income. Higher interest rates are favorable for Sun Life because newly issued bonds generate more income. Although the valuation of current bonds in the portfolio falls when interest rates are higher, this should not be a problem if the bonds are held to maturity.

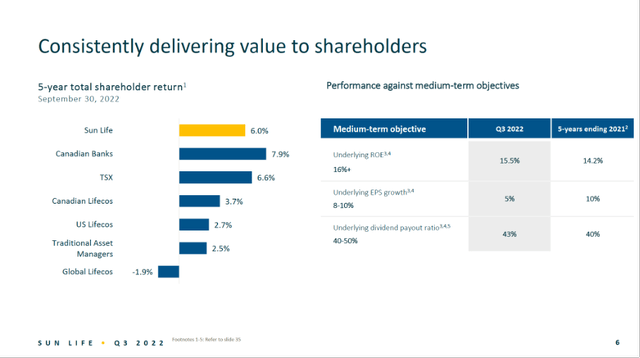

Delivering value to shareholders (Sun Life 3Q22 Investor Presentation)

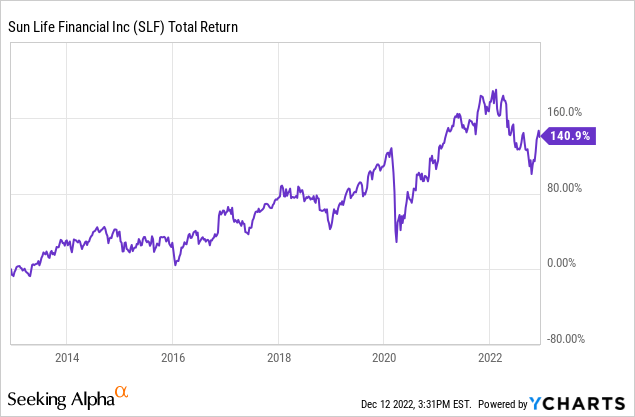

The share price has risen 9.6% annually over the past decade. The inexpensive valuation, positive earnings estimates and high dividend yield make the stock worth buying.

Company Overview

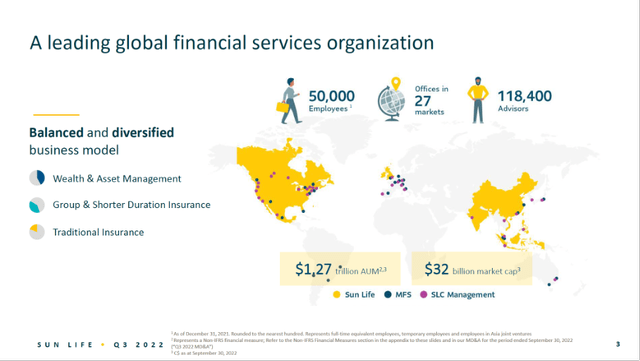

A leading global financial services organization (Sun Life 3Q22 investor presentation)

Sun Life Financial is a Canadian financial services company providing insurance, wealth and asset management solutions for individuals and businesses worldwide. The insurance segment includes life insurance, as well as personal health, dental, critical illness, long-term care and disability products. The company also offers reinsurance, as well as investment advisory and wealth management, and other banking services.

Sun Life Delivered Strong Third Quarter Results

Sun Life posted strong results in the third quarter, even in a challenging environment with high inflation. Results from the United States showed strong revenue and earnings growth due to the addition of DentaQuest. Net income for the quarter was $466 million. Underlying income of $949 million and underlying earnings per share of $1.62 were 5% higher than last year.

Sun Life also did well in Asia, where insurance and profits began to emerge from covid restrictions. The Canada segment also did well by posting strong results with higher insurance sales. SLC Management showed strong growth in alternative assets. MFS saw asset under management and earnings decline along with outflows of AUM as equity markets fell. Outflows of $5.2 billion for individuals resulted from slower sales activity due to the uncertain macroeconomic environment. Falling equity markets affected fee income and earnings as central banks continue to fight inflation by raising interest rates.

The underlying return on equity of 15.5% reflected the strong performance in the quarter and approached the ROE target of 16%+.

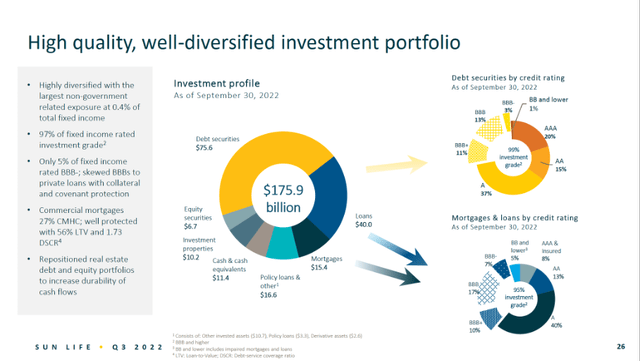

Investment portfolio (Sun Life 3Q22 investor presentation)

The company’s investment portfolio consists mainly of debt securities (43%), followed by loans (23%) and mortgages (9%). The value of debt securities falls when interest rates rise. With inflation above the Fed target of 2%, interest rates are expected to rise to 5% and stabilize at that level.

Inflation data came in favorably at 7.1% in November, excluding volatile food and energy prices, CPI was 6% higher than last year. High inflation figures suggest that the Fed will continue to raise interest rates, which is favorable for income investors who buy newly issued bonds at higher coupon rates.

Higher interest rates are not always favorable. High rates mean the risk of a severe recession is imminent. Yield spreads are currently deep in the red and pose a major risk to the US economy. Sun Life could benefit from higher interest rates if bonds are held until maturity, but higher rates could mean bond defaults. There is no need for panic as the company is still doing well, and analysts expect earnings per share to rise gradually over the next few years.

High Dividend Yield of 4.6%, Increasing Annually

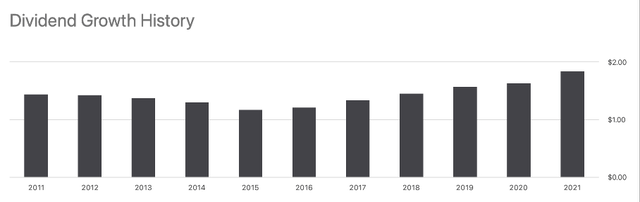

The high dividend yield of 4.6% is well covered by its earnings and free cash flow. Sun Life’s management is shareholder-friendly by increasing dividends year after year. The dividend per share has increased an average of 7.8% over the past 6 years. 8 analysts expect a 7.2% increase in dividends per share by 2023. Further growth is expected as earnings per share are expected to rise sequentially.

Dividend growth history (Sun Life 3Q22 Investor Presentation)

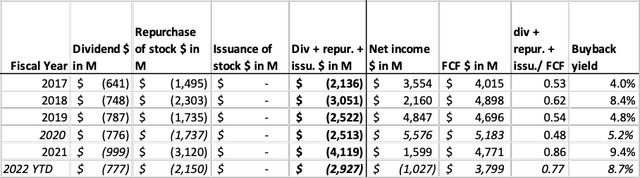

Net income rose until 2020. The growth in dividends per share was mainly due to share repurchases, as the company bought back many shares. The repurchase yield has been high in recent years. The current repurchase yield is 8.7%, and 2021 was also high at 9.4%. Share repurchases benefit both income investors and equity investors because the dividend per share increases after the company repurchases shares. With reduced supply and increased demand, the stock price should rise when the company repurchases shares in the open market.

Free cash flow highlights (SEC and author’s own calculation)

Dividends and share repurchases are well covered by free cash flow. Year to date, the company has returned 77% to investors, and 86% by 2021. This indicates that the management is shareholder-friendly.

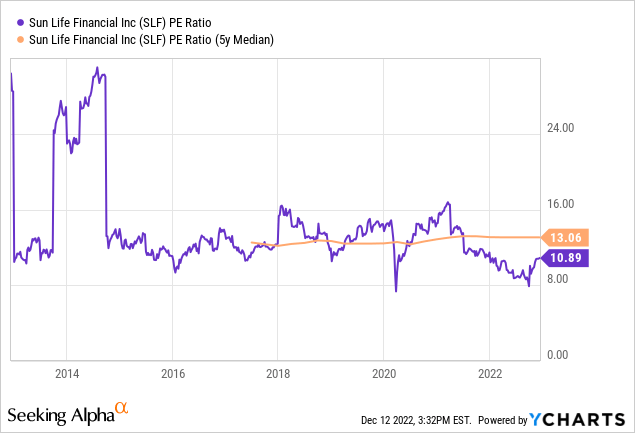

Valuation Looks Favorable

To get an idea of the valuation of insurance and financial services companies, I first look at the current PE ratio and compare it to the average PE ratio. The current PE ratio is 10.9, indicating that the stock is cheaply valued compared to the S&P500. The S&P500 has a PE ratio of 20.9. The company’s average PE ratio of 13.1 is higher than its current PE ratio; the stock is trading at a 17% discount based on this.

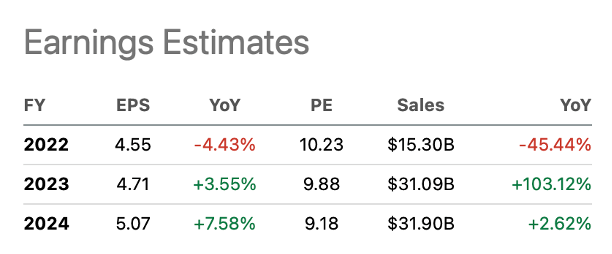

Looking at future earnings per share, the company should be doing well, as 11 analysts have revised earnings per share upward. Earnings per share for fiscal year 2024 is expected at $5.07, and if we multiply this number by the average PE ratio of 13 we arrive at a share price of $66.42. The expected price corresponds to a share price increase of 42%, 12.2% per year and 16.8% per year including dividends.

Earnings Estimates (Sun Life Seeking Alpha ticker page)

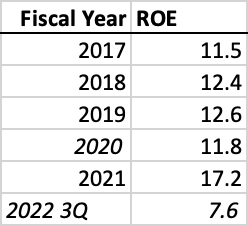

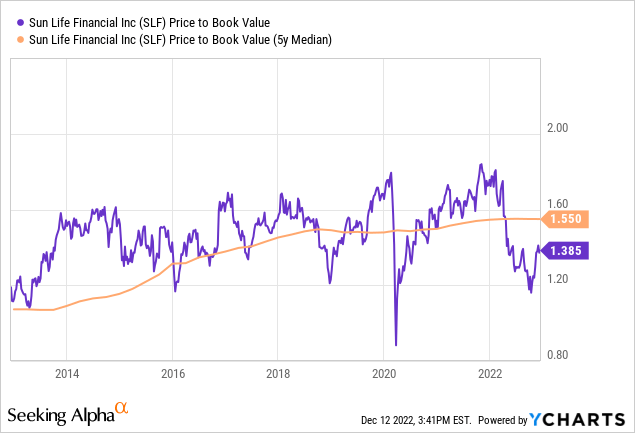

Another metric to look at for financial companies is the P/B ratio. Sun Life Financial has a favorable P/B ratio of 1.39, indicating a favorable valuation because its ratio is lower than its average P/B ratio of 1.55. Sun Life’s return on equity is 7.6% in the third quarter, a high figure but lagging behind its ROE of previous years.

Return on equity (SEC and authors own visualization)

The company continues to perform strongly in a high inflation environment and its valuation looks favorable. As the company rewards shareholders well, I expect the share price to increase in value in the coming years.

Key Takeaway

- Sun Life Financial is a Canadian financial services company providing insurance, wealth and asset management solutions for individuals and businesses worldwide.

- Higher interest rates are favorable for Sun Life because newly issued bonds generate more income. Although the valuation of current bonds in the portfolio falls when interest rates are higher, this should not be a problem if the bonds are held to maturity.

- Higher interest rates are not always favorable. High rates mean the risk of a severe recession is imminent. Yield spreads are currently deep in the red and pose a major risk to the US economy.

- Net income for the quarter was $466 million. Underlying income of $949 million and underlying earnings per share of $1.62 were 5% higher than last year.

- The underlying return on equity of 15.5% reflected the strong performance in the quarter and approached the ROE target of 16%+.

- The high dividend yield of 4.6% is well covered by its earnings and free cash flow. Sun Life’s management is shareholder-friendly by increasing dividends year after year.

- The stock price is trading at a 42% discount for fiscal 2024.

Be the first to comment