plherrera/E+ via Getty Images

Sometimes, the smallest and simplest technologies proved to be some of the most important. Take the lock and key as an example. Since the invention of this duo, people have been able to secure their assets in a way that was never made possible before. What’s more, there’s also the fact that so long as the global population is slated to grow, the need for locks and keys will only increase. Given this fact, it stands to reason that one interesting avenue for investors to consider is ownership in a company like Strattec Security (NASDAQ:STRT). Fundamental performance achieved by the company has been, unfortunately, a bit volatile in recent years, exhibiting no real trend when it comes to either revenue or profitability. But given how cheap shares are at this time and how little leverage the company has on its books, it does seem to make for an appealing opportunity for long-term, value-oriented investors to consider.

A key to profits

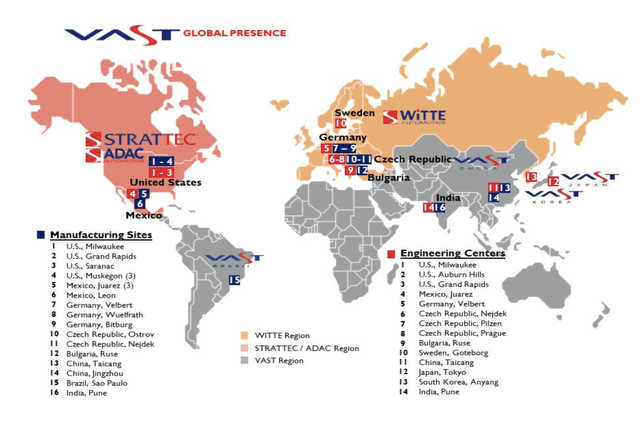

As I mentioned already, Strattec focuses on designing, developing, and producing locks and keys for its customers. Although I suppose that description is overly simplistic. More specifically, the company produces access control products including mechanical locks and keys, but also including electronically enhanced locks and keys, passive entry passive start systems, steering column and instrument panel ignition lock housings, latches, power sliding side door systems, power tailgate systems, and a variety of other offerings. It does all of this within the context of the automotive space, With a primary emphasis on the North American market. Through its partnerships with WITTE Automotive and ADAC Plastics, the company also supplies global automotive manufacturers with its offerings. This arrangement basically creates a global cross-selling network between the three parties, as demonstrated in the image below.

STRATTEC Security

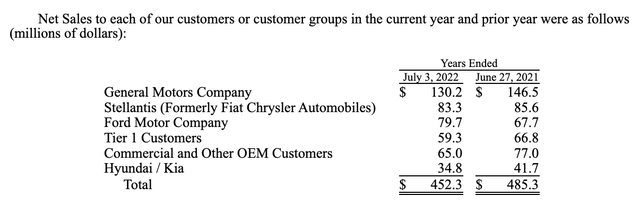

At first glance, the concept of a focus on locks and keys may seem simple. It certainly may appear to be low-tech. But as you might have guessed based on my prior description, the company does involve itself in some rather complicated technologies, such as those that are centered around sensors. A great example here would be the key fob, which allows you to wirelessly lock or unlock your vehicle. The company also produces electronic Rotary ignition modules that are used in conjunction with key fobs. Many of the other offerings the company provides were brought to it through its acquisition, in 2009, of Delphi Corporation’s Power Products Group. That purchase introduced the company to the production and sale of access devices for sliding side doors, tailgates, lift gates, and truck lids. Much of the company’s revenue comes from selling its offerings to major car companies. For instance, during its 2022 fiscal year, the company generated 28.8% of its revenue from General Motors (GM). Its second-largest exposure was to Stellantis (formerly Fiat Chrysler Automobiles), accounting for 18.4% of sales. Ford Motor Company (F) came in 3rd at 17.6% of revenue. The list goes on from there, with customers including Hyundai / Kia, and many others.

STRATTEC Security

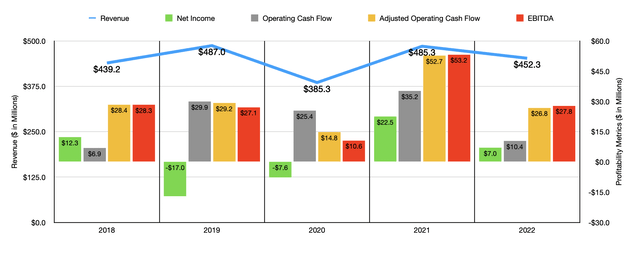

The financial picture for Strattec has been a bit lumpy over the years. After seeing revenue rise from $439.2 million in 2018 to $487 million in 2019, it dropped to $385.3 million in 2020, driven by weakness as a result of the COVID-19 pandemic. Sales rebounded to $485.3 million in 2021. But in 2022, sales suffered further, declining to $452.3 million. It is worth noting, however, that this weakness in sales was attributed not to weak demand but, instead, to the global semiconductor chip shortage. But this didn’t stop some of its customers from generating more revenue for it than they did the year before. Most notably was Ford, which accounted for $79.7 million of the company’s revenue in 2022 compared to the $67.7 million reported one year earlier. This was driven in large part by higher product content, particularly associated with new power tailgate activity for the F-150 pickup trucks.

Author – SEC EDGAR Data

On the bottom line, the picture has been even more volatile for the company in recent years. As you can see in the chart above, the company went from a net profit in 2018 to net losses in both 2019 and 2020. 2021 saw net profits of $22.5 million, a number that dropped to $7 million in 2022. As a very small firm that relies heavily on a few major customers, the pressure on it to keep costs low is likely significant. Particularly painful in 2022 compared to 2021 was a reduction in the company’s gross profit margin from 16.2% to 12.4%. This, in turn, was driven largely by increased wages and benefits paid to employees in Mexico, unfavorable foreign currency fluctuations, and lump sum bonuses paid to its Milwaukee-represented hourly workers upon the ratification of a new four-year labor contract. Selling, general, and administrative costs, also increased, climbing from 9.2% of sales to 10.4%, driven largely because of prior year customer reimbursement of engineering development costs no longer helping the firm, and by other similar factors.

If you are looking for some degree of stability from a profitability perspective, this is most certainly not the company for you. Even when it comes to cash flows, the picture has been a bit volatile. Over the past five years, operating cash flow has bounced all over the place, ranging between a low point of $6.9 million at a high point of $35.4 million. If we adjust for changes in working capital, volatility is still quite high, with a low point of $14.8 million and a high point of $52.7 million. Last year, the figure came in at $26.8 million. The same thing can be said of EBITDA, with the metric coming in between $10.6 million and $53.2 million over the past five years. Last year, it came in at $27.8 million.

Unfortunately, nobody knows what the future holds and management has not provided any real guidance for the future. What we do know is that, in the long run, semiconductor demand should only increase. However, the pandemic resulted in significant supply chain issues and, in turn, was instrumental in causing the shortage that we are experiencing today. Add onto this the fact that demand is likely to continue increasing, and we could be in for some difficulties for companies like Strattec. For instance, one report, provided by KPMG, said that supply chains are continuing to struggle to meet demand, with semiconductor sales forecasted to hit $600 billion this year compared to the $556 billion last year, resulting in a continued chip shortage that should stretch into 2023, with 56% of semiconductor firms currently expecting the shortage to continue through that time. And with the automotive industry being the second-largest driver of semiconductor growth, second only to the wireless communication industry, that does not bode well fundamentally for a company like Strattec that will ultimately have to deal with the shortage by paying higher prices and contending with lower production volume.

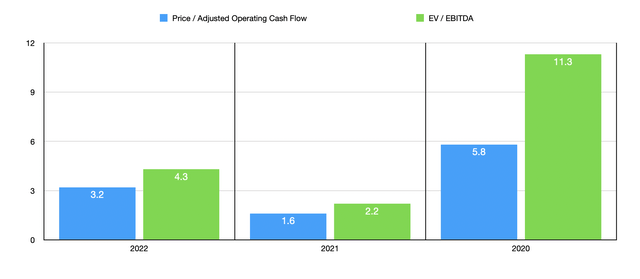

Author – SEC EDGAR Data

This makes it difficult to truly value the company. But if we rely on data from 2022, the firm is trading at very cheap levels, with a price to adjusted operating cash flow multiple of 3.2 and an EV to EBITDA multiple of 4.3. These numbers compare favorably to the 1.6 and 2.2, respectively, that we get using data from 2021. Even in the event that financial performance reverts to what it was in 2020, however, shares of the company would be considered quite affordable, with multiples of 5.8 and 11.3, respectively. I also compared the company to a couple of different firms. But given its small size and its market, there weren’t very many good companies to choose from that had positive trading multiples. The only one that had positive trading multiples was Superior Industries International (SUP), which is trading at a price to operating cash flow multiple of 1.2 and at an EV to EBITDA multiple of 3.4.

Takeaway

Fundamentally speaking, Strattec is a rather volatile company. However, the firm makes up for this and the fact that shares are cheap on an absolute basis. This picture could change based on market conditions. If the semiconductor chip shortage continues as predicted, financials could be impacted to some degree. At the same time, however, even a return to levels of profitability seen in 2020 would not make the company overvalued. In addition, there’s also the fact that the company has net debt of just $2.23 million as of this writing, making it a very low-leveraged play with little in the way of insolvency risk. Given all of these factors, I have decided to rate the business a soft ‘buy’ at this time.

Be the first to comment