Kwarkot/iStock via Getty Images

STORE Capital Corporation (NYSE:STOR) is a net-lease real estate investment trust with a very attractive valuation that has fallen too far in recent months.

The trust is an excellent inflation hedge, and the dividend is about as safe as it gets.

The portfolio of STORE Capital is diverse, and the trust has the lowest pay-out ratio in its peer group. The investment opportunity for STORE Capital should not be passed up because the stock is so cheap and the dividend is so secure.

STORE Capital

In May, inflation reached 8.6%, and the consensus appears to be that we have not yet reached the peak. With inflation eroding purchasing power, investors should seek investments that offer a natural hedge against inflationary pressures. Because property values and rents tend to rise in an inflationary environment, real estate investment trusts naturally provide inflation protection.

STORE Capital thus has all of the characteristics of an investment that could provide shareholders with significant passive income as inflation continues to rise.

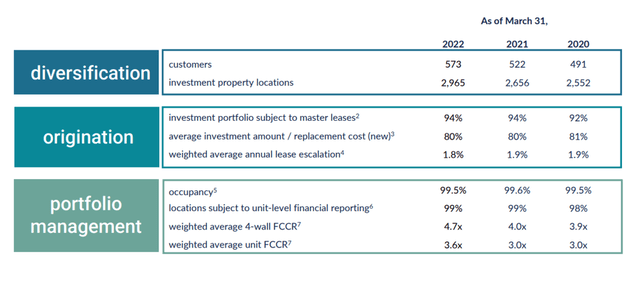

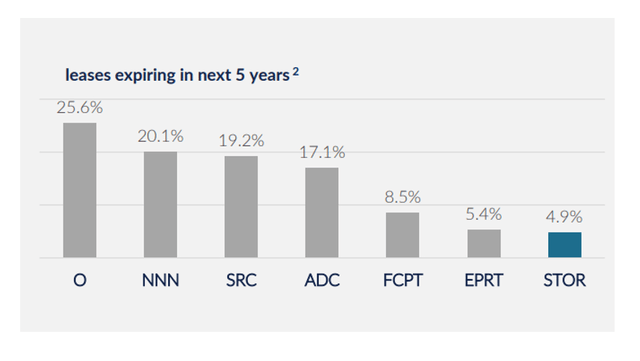

As of March 31, 2022, STORE Capital’s real estate portfolio included 2,965 investment property locations with a 99.5% occupancy rate. The trust owns real estate throughout the United States, and its rental contracts typically include annual lease escalations. This means that rental payments will automatically increase each year, which is an excellent way to protect against inflation.

Portfolio Overview (STORE Capital)

The trust’s real estate portfolio includes tenants from various industries, providing diversification. Restaurants (both full and limited service) are the most important industry category, accounting for 11.9% of rental payments. Education, auto repair shops, and health clubs are also important industries. Spring Education Group is the most important tenant for STORE Capital, accounting for 3.0% of rental payments.

Diversified Profile (STORE Capital)

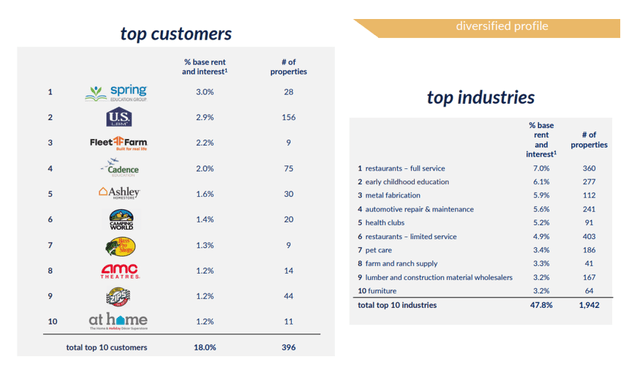

Furthermore, with 17.1 years, STORE Capital has the second-longest weighted average lease term in its competitor group. The longer the lease term, the more predictable the cash flows of the trust. Because the economy is on the verge of a recession, STORE Capital’s long lease contracts with cash flow positive tenants are a valuable asset to have.

Weighted Average Lease Term (STORE Capital)

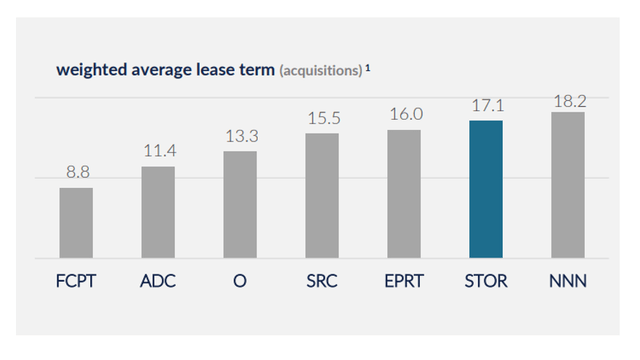

In comparison to competitors such as Realty Income, Spirit Capital, and National Retail Properties, STORE Capital has a relatively low number of near-term lease expirations. Near-term lease expirations are a problem as recessions unfold because tenants have more negotiating power in a recession, potentially limiting opportunities for funds from operations growth.

Less than 5% of STORE Capital’s leases will expire in the next five years. As a result, the long-term lease nature of STORE Capital’s portfolio is especially valuable during a downturn.

Leases Expiring In The Next 5 Years (STORE Capital)

Profitable Acquisition Model

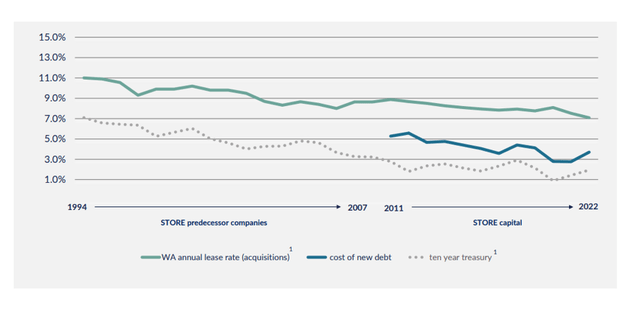

STORE Capital relies on new real estate acquisitions to expand its footprint in the United States. The trust’s rental payments are increased internally through rent increases, but acquisitions have historically played a significant role in driving STORE Capital’s funds from operations growth.

In the last three years, STORE Capital acquired an average of 77 properties per quarter, and management has consistently acquired new assets at capitalization rates that exceeded the trust’s cost of capital. This means that the transactions were immediately profitable for STORE Capital, owing to the trust’s highly disciplined approach to acquisitions and stringent screening process.

New Asset Capitalization Rates (STORE Capital)

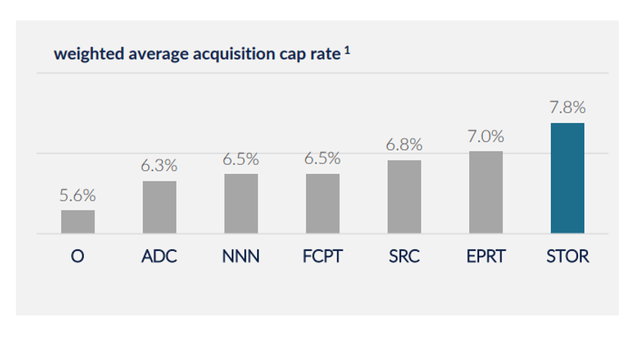

In addition, STORE Capital completed transactions at a higher average capitalization rate than its competitors. The higher the capitalization rate, the more profitable the property investment.

Weighted Average Acquisition Cap Rate (STORE Capital)

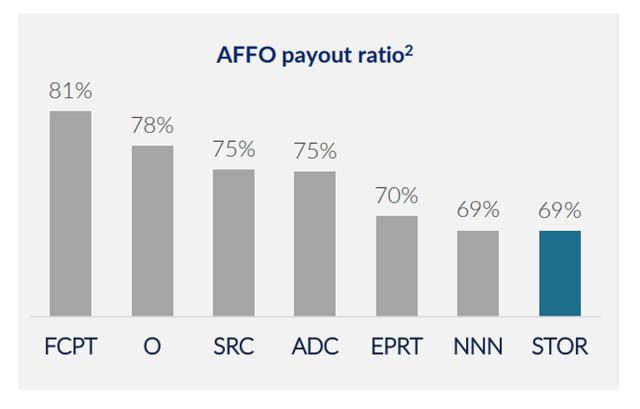

Industry Leading Pay-Out Ratio

So far, I’ve mentioned annual rent escalators, long lease terms, and high acquisition capitalization rates as reasons to buy STORE Capital stock. However, now that the stock has been chewed up and spit out, there is another reason to consider the trust:

STORE Capital has one of the safest dividends in the net-lease sector due to its industry-leading pay-out ratio of only 69%, implying that the dividend will even be safe during a recession.

AFFO Payout Ratio (STORE Capital)

Very Reasonable Valuation

STORE Capital expects adjusted funds from operations to be $2.20-2.23 per share in 2022, which means its AFFO now has an 11.6x multiple, which is lower than the competition’s. National Retail Properties anticipates adjusted funds from operations of $3.08-3.15 per share, implying a 13.3x AFFO multiple, while Realty Income anticipates $3.84-3.97 per share, implying a 16.8x AFFO multiple.

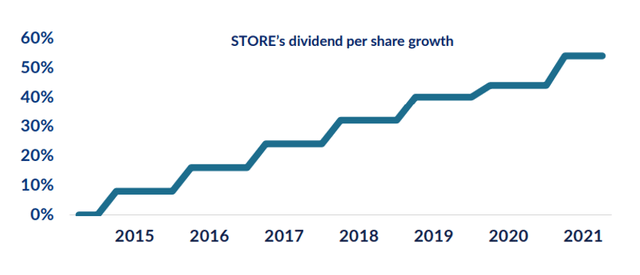

Attractive Yield

Based on a quarterly dividend payment of $0.385 per share, STORE Capital stock yields 6%. The trust has a history of increasing payouts, including during the Covid-19 pandemic.

Dividend Per Share Growth (STORE Capital)

Why STORE Capital Could See A Lower Stock Price

A recession is a risk for STORE Capital, but from a macroeconomic standpoint. As previously stated, the trust has strong portfolio and diversification metrics, as well as a very competitive pay-out ratio, which helps to protect against an unexpected decline in tenant rental payments. A recession may have the greatest impact on STORE Capital’s AFFO multiple.

My Conclusion

My advice is to purchase the drop through STORE Capital because the trust makes an irresistible offer.

Based on the trust’s AFFO 2022 forecast, the stock is quite cheap, and the portfolio (occupancy, lease terms) is very solid.

Furthermore, the trust outperforms its peers in terms of pay-out ratio and capitalization rates. The stock’s 6% yield is appealing in and of itself, and STORE Capital has a track record of increasing its payout.

Be the first to comment