Tanarch

The S&P 500 (SP500) may be set up for an exciting post-FOMC. Implied volatility levels for the Sept. 21 expiration are surging, which means that event risk is building. But when there’s an event risk, there’s also the potential for a relief rally. Be aware that where the market may go immediately after the rate announcement or press conference are likely to be different than where it goes in the days and weeks that follow.

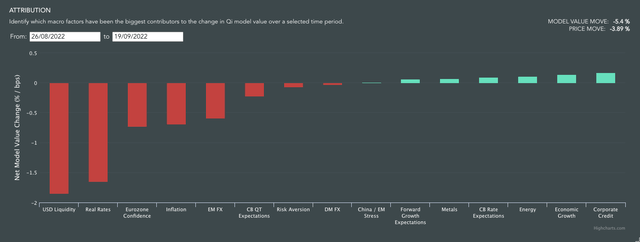

The outlook for stocks over the short-to-medium is bearish, based on rising real yields, a stronger dollar, and tightening financial conditions. Based on data from Quant Insights, those factors have had the most significant negative impact on the S&P 500 since Powell made it clear there would be no dovish pivot. Those higher rates and stronger dollar help to tighten financial conditions, which is what the Fed is trying to achieve.

One Day Wonder?

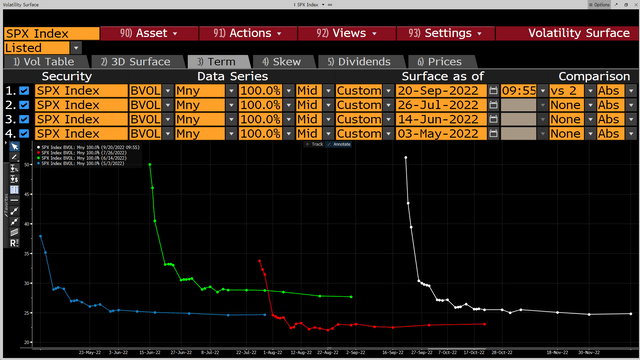

However, a post-FOMC rally may develop because implied volatility levels for an at-the-money S&P 500 option for tomorrow’s expiration date have surged to more than 50%. That’s on par with where implied volatility was heading into the June meeting.

Of course, right after the Fed meeting and all the news is out, implied volatility crashes back to lower levels, which is the mechanical aspect of what drives those post-FOMC rallies we have seen. For example, on March 16, the S&P 500 rallied by more than 1.5% after 2:30 PM. Then at the May meeting, the S&P 500 rallied by more than 2% after 2:30 PM.

Then on June 15, the S&P 500 rallied around 2% after 2:30 PM. Finally, on July 27, the S&P 500 rallied by more than 1.5% after 2:30 PM.

Given that the implied volatility profile is set up similarly to those FOMC meetings, there’s a chance we could see a similar 1.5% to 2% rally following the FOMC meeting regardless of what the Fed raises rates by or what the dot plot shows. But remember, if there’s a post-FOMC meeting rally immediately following and during the press conference, this is just short-dated volatility compressing and a mechanical aspect of the market. Essentially, all those puts that traders bought start losing value due to falling implied volatility since the event risk has passed, which results in market makers unwinding hedges by buying back S&P 500 futures.

Tough Path Going Forward

Ultimately, the market is pricing in a 75 bps rate hike, and if that’s what the market gets, this will probably be enough to kick in that mechanical bid. However, the most significant risk remains where the Fed sees rates heading. If those come in higher than how the Fed funds futures are pricing for December 2023, which is currently around 4.1%, it’s likely to strengthen the dollar further and push rates higher, which will not be bullish for stocks beyond Sept. 21.

But one should not confuse a one-day mechanical rally response from what’s likely to be a challenging path for stocks as rates rise, the dollar strengthens, and financial conditions tighten.

Don’t fight the Fed.

Be the first to comment