sarkophoto/iStock via Getty Images

It was another rough week for the stock market, with the S&P 500 (SP500) finishing lower by 1.55%. The big data came on Thursday with that hotter-than-expected CPI report. Unfortunately, many investors were very confused by what happened on Thursday, and that hurt them on Friday.

After dropping 2.5% at the open on Thursday, stocks saw a post-CPI rally, which was mechanical and not genuine, suggesting the decline on Friday may not be over due to a massive bond repricing.

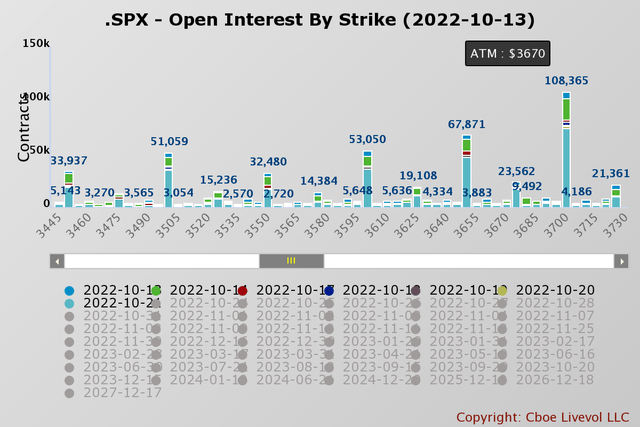

As I expected, the CPI report came in hotter than expected. That also resulted in an expected drop in the S&P 500. However, the decline was so rapid and severe that it immediately took the S&P 500 to the level with the greatest concentration of open puts, at 3,500.

Squeezing Higher

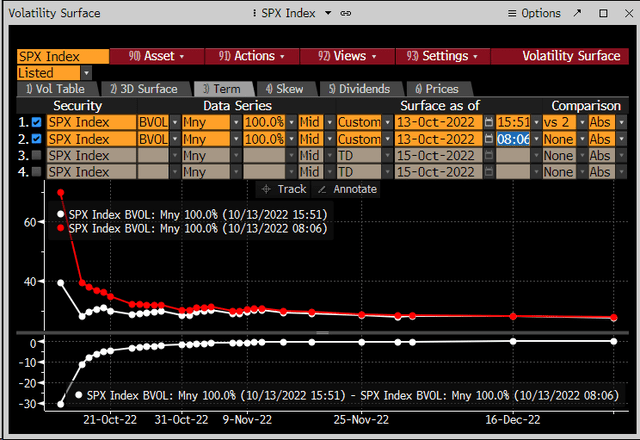

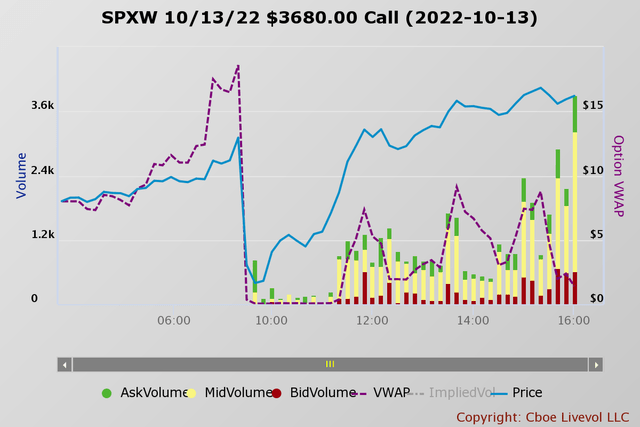

On top of this, the implied volatility levels were very high going into the CPI report, rising to around 70% minutes before the print came out at 8:30 AM. By day’s end, implied volatility for an at-the-money option dropped to approximately 40%.

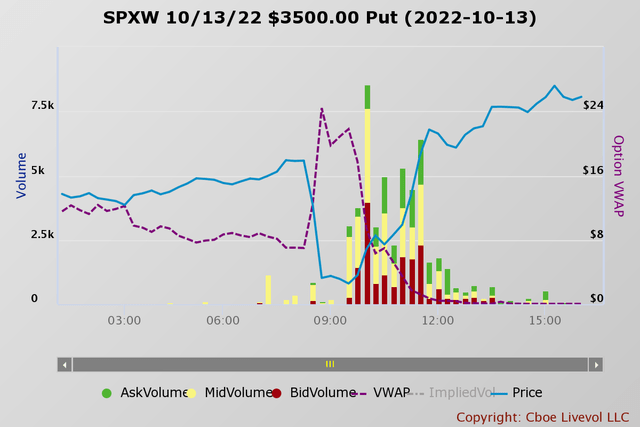

The sharp opening drop in the market and the high implied volatility led to options traders quickly starting to sell their puts, with the average weighted price jumping from around $7 per contract to more than $20 by the time the market opened for an October 13, 3,500 put.

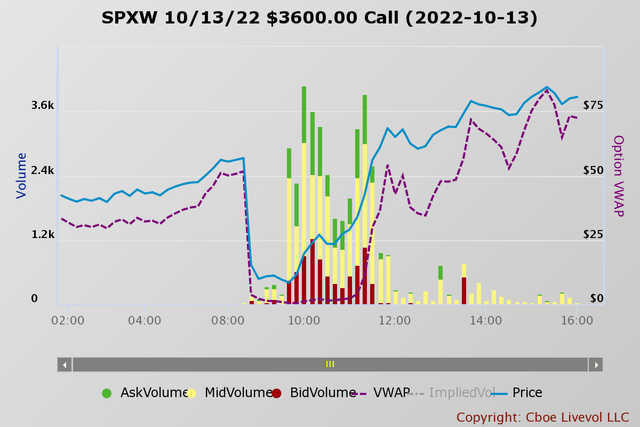

As options traders sold these puts, market makers were forced to unwind hedges and buy the S&P 500 futures, helping fuel the rally in the equity market. As the market stabilized and bounced off the 3,500, options for the October 13 trade date at the 3,600 strike price began to trade more heavily, which in effect, helped to fuel the rally further. As options traders began to buy these calls betting on the index bouncing, market makers had to hedge their positions again, buying S&P 500 futures.

As the day progressed, the call activity shifted higher as the S&P 500 pushed higher. The 3,680 and 3,700 call options were among the most active trade contracts on the day.

The combination of put selling and call buying resulted in implied volatility crashing and the S&P 500 rising. But by Friday, implied volatility had reset, resulting in the mechanical bid vanishing, allowing the sellers to reclaim market control.

Bonds Knew The Whole Time

Despite the mechanical rally on Thursday, the bond market understood the CPI data very clearly. Core CPI reached a new cycle high at 6.6% and up from 6.3% in August, while headline CPI showed minimal signs of cooling, coming in at 8.2% vs. 8.3% last month.

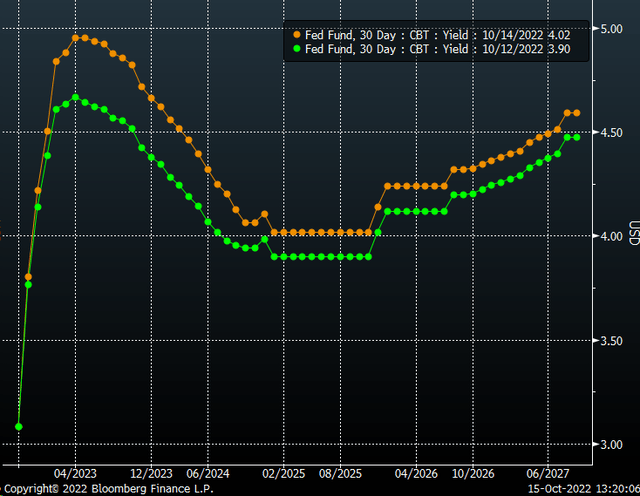

It resulted in Fed Fund futures dramatically repricing, with the peak terminal rate in April 2023 rising to 4.95% on October 14 from 4.67% on October 12. This dramatic shift helped push the US 2-Yr Treasury rate up to 4.5% from 4.29%. This move higher in rates was eye-popping, as the market began to price more Fed rate hikes instantly.

Additionally, the market priced in the more frontloading of rates, with the odds for a 75 bps rate hike in November climbing 97%, as the odds of a 75 bps rate hike in December rose to around 70%. It is a meaningful shift in market rate hike expectations. This move higher in rates was not only dramatic but should have instantly raised eyebrows around the equity markets moving higher. It served as a non-confirmation of the equity market rally and an indication that the rally made zero sense and would not last.

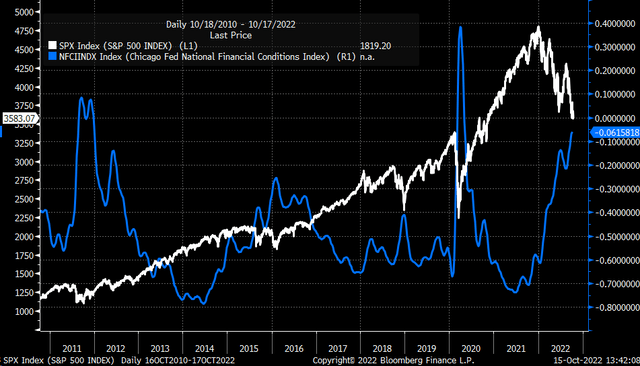

Because at the end of the day, it returns to rates driving equity market valuations. The bond market signaled that the Fed would have to do more and suggested that financial conditions would need to tighten more. Tightening financial conditions have never been good for stocks, and tighter conditions suggest that stocks should be falling.

Should financial conditions ease, it is likely only to make the Fed’s job harder, which is another reason why the rally on Thursday made zero sense. We talked about this in my interview with Charles Payne on the FOX Business channel on Thursday. You can watch the video below.

By Friday, all of those equity market gains reversed. The dollar began to rise, and yields not only held on to their gains from Thursday but continued to increase on Friday.

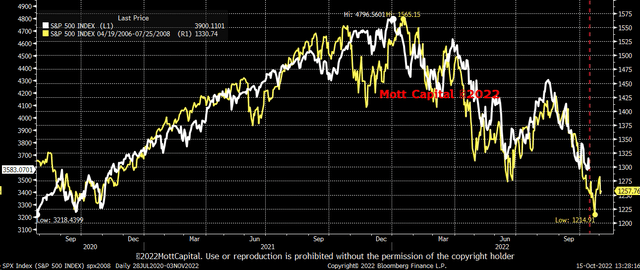

Past Bear Markets

This move down on Friday kept the S&P 500 very much on the path of the bear market cycle of years past, such as 1937, 2000, and 2008. But for now, the S&P 500 appears to continue following the 2008 analog the most closely, and one could almost argue that the rise on Thursday and the decline on Friday should have been expected based on that 2008 analog. The 2008 chart also suggests that there may be a further fall before this most recent decline is over.

There shouldn’t be any confusion; the rally on Thursday was not in celebration of the CPI report, nor was it a capitulator event. It was a big short-covering event that turned into an option-fueled squeeze. Once again, the bond market is the most critical part of the market to follow. If the bond market says one thing and the stock market says another, be sure to listen to what the bond market says.

Be the first to comment