Bill Pugliano/Getty Images News

Introduction

This article will further develop the research I already shared in a previous article (Stellantis is swimming in cash), where I outlined Stellantis’ (NYSE:STLA) solid balance sheet, with a net cash position of almost $20 billion.

I pointed out that it is the only stock among automakers that gives every shareholder a cash per share higher than the share price. Stellantis’ balance sheet is in EUR and although the USD has appreciated against it and the stock has recently rebounded in July, the difference is still true, with the current share price at $14.38 while cash per share at $15.05 before the last earnings report. As we will see, this number has changed once again.

In the meantime, I was also pointing out that Stellantis was going to put into action meaningful synergies that would have reduced capex and R&D while increasing free cash flow. The most interesting aspect for me was that Stellantis was increasing its margins above 10%, outpacing the industry and its main peers. Moreover, Stellantis owns 15 brands and still needs to leverage its iconic premium and luxury ones like Alfa Romeo, Lancia, DS and Maserati. As these brands are brought back to profitability, the whole group’s results will be even more hauled up. In addition, I warned not to overlook Stellantis’ electric strategy as the group was laser focused on deploying a convincing portfolio of electrified cars that would have gained many customers. Lastly, I think that Stellantis asset-light exposure to China is strategically a hedge that can protect shareholders from geopolitical conflicts.

H1 2022 Results

In the first half of the year, Stellantis delivered outstanding results in its last earnings report.

Let’s take a look at some major numbers:

- Net revenues: €88.0 billion, up 17% YoY

- Adjusted operating income of €12.4 billion, up 44% YoY

- Operating margin 14.1% with all five regions with double-digit margins

- Net profit of €8.0 billion, up 34% YoY

- Industrial free cash flows of €5.3 billion, up €6.5 billion YoY (6% of revenue)

- Industrial available liquidity at almost €60 billion

- Stellantis ranked second in BEV sales and LEV sales in Europe and ranked third in the U.S. market for LEV sales.

- Global BEV sales up nearly 50% YoY to 136k units

In the meantime, shipments declined by 7% due to semiconductor shortages and supply chain constraints that are indeed easing up, but that still affected the company, especially in the first quarter.

The electrification strategy is delivering strong results. The growth rate of Stellantis’ BEV sales is nearly 50% YoY. The highlight was that, in Europe, Stellantis is now breathing down the neck of the market leader Tesla (TSLA), with just a few thousands delivered vehicles that separate the two.

Stellantis keeps on being the leader in the commercial vehicle market. The European market share is 33%, and in Latin America it is 30.7%. But if we look at electrified commercial vehicles, then the market share is 50%.

All five regions where Stellantis operates have reached double digit margins. In North America, the company achieved record profitability of 18.1%. As we will see later, this is an outstanding result that leaves behind its main peers. The result was possible thanks to a very high level of efficiency and effectiveness, combined with a market share increase. The average transaction price in the region was up, too, and reached 52k.

In Europe, Stellantis’ market share in the LEV market is now 19.2%, very close to the company’s total market share of 21.2%. Profitability in this sector reached 10.4%, up from the 9.2% of last year. The Fiat 500 E is the number 1 BEV selling car in Italy and Germany and the group has 5 vehicles among the top 10 selling BEV in the market.

Middle East and Africa saw a strong improvement on profitability at 15.5% percent of AOI margin, and the company holds a leading position in Algeria, in Egypt, and in Turkey.

In South America, we see some outstanding results. The group is the market leader in Brazil and the margin on operating income was 13.9%. On the first 6 months Stellantis has delivered more profit than in the full year of 2021, which is truly amazing.

In Asia, China and in the Asia Pacific, profitability was 13.4%. We need to spend a little on this regions. It was once seen as the future. However, with recent geopolitical conflicts, we see that it is not so safe for a Western company to rely big on revenues from China. Stellantis’ revenues in the region are only €2.15 billion in H1, accounting for approximately 2.5% of total. Nowadays, this is something that can’t be seen as a weakness, but as a protection. The company is well aware of this and it is focused on executing an asset-light strategy, exiting from previous joint ventures. Carlos Tavares addressed this issue, giving, in my opinion, a wise understanding of how he plans on leading the company in these times of tensions:

when we presented Dare Forward plan for China, the title was Asset-Light Strategy. And this is a meaningful title. Why do I think we should be asset light? Because with geopolitical tensions, each time you have the risk of cross sanctions, you have to choose. You have to choose between 1 of the 2 contenders. And of course, in our case, we are a Western company leading Latin America, [with a] strong presence in North America, number 2 in Europe, we are a Western company. So if we were in a cross sanctioned environment, which I believe we will, at one point in time, we would be very exposed if we had an asset-heavy strategy in China. Hence, the fact that having an asset-light strategy in China is the right strategy for the next few years in terms of protecting us against geopolitical cross sanctions.

We also know that Stellantis and Dongfeng agreed on a share repurchase framework that should enable the former to buyback 3.16% of its shares. In case the agreement goes through, Stellantis declared during its last earnings call that it will cancel the repurchased shares, making the operation a real buyback that will increase shareholders’ equity in the company.

Room for improvement in two segments

Now, Stellantis still has room to improve, especially in the premium and luxury segments. Here the group can leverage more of its brands and unlock a lot of potential. Stellantis managed last year to turn around Alfa Romeo’s business model, making it highly profitable. Maserati owns an iconic brand, but its operating income margin, though growing, is still at 6.6%, which is quite low for the segment. Stellantis aims at pushing it up somewhere between 15% and 20%. This will have an impact on the company’s results.

During the earnings call, Richard Palmer, Stellantis’ CFO, summed up all these results, outlining how the general trend in shipments is improving and how the strong performance enabled the company to increase its liquidity despite repaying a facility and paying in April a very hefty dividend of €1.04 per share.

very strong operating performance with 14.1% margins, and that was despite the fact that our consolidated shipments were down 7% for the half. That is split between 12% down in Q1 and 3% down in Q2, so we’re seeing some improvement in the trend. The result of that is that our net revenues for the half despite the minus 7% of shipments was a plus 17% improvement, the EUR88 billion. very strong performance on industrial free cash flows, as mentioned, to plus EUR5.3 billion, and that took our industrial available liquidity to just short of EUR60 billion despite the fact that we repaid a EUR6.3 billion facility for Intesa in January and paid our dividend.

Peer comparison

Investors should be aware that Stellantis is not only following a general trend of the market nor should they think that all automakers are enjoying such a situation.

For example, Volkswagen (OTCPK:VWAGY) H1 2022 report didn’t report similar numbers:

- sales were down 14%

- revenue was up only 2% YoY to €132.3 billion

- operating margin is only 10% at €13.2 billion,

- free cash flow went down from €10.2 billion to €2.3 billion (-77% YoY).

Ford (F), in its last earnings report, let the markets know these numbers:

- sales were up 3%

- revenue was up 21.3%

- operating margin was, however, only 9.3%

- free cash flow was $3.6 billion (4.28% on revenue)

- operating margin in North America is at 11.3%

- operating margin in Europe is at a worrisome 0.2% in Europe.

Stellantis is executing better

If two major peers, though benefiting from some general conditions of the market that strengthen the automaker’s pricing power, struggle to reach a double digit margin, it is clear that Stellantis is doing something better than just following the market cycle. Furthermore, Stellantis is able to push up profitability in all its regions and it is able to turn the margin into free cash flow. We have to spend some time discussing free cash flow. Stellantis has been able to deliver such a good result as it is putting into action synergies between the former PSA and FCA that, just this year, generated a positive result of €3.1 billion, €2 of which relate to lower capex and R&D. It is clear that synergies come from good management that sees how to extract value and profits from a wide portfolio of brands. As Carlos Tavares, the Portuguese CEO of the group, said during the last earnings call:

On the CapEx, what you see is that we are confirming every day what we told you in the Dare Forward presentation plan, which is we believe we have a 30% efficiency and effectiveness edge against our peers in the way we spend our money. This is something that we check once we have all the results, and every time again, we consider and we conclude that we have a 30% efficiency edge, effectiveness edge against our competitors. So it’s normal that on a recurring basis, you see CapEx numbers, which may be much lower than some of our competitors. So we confirm that we have a 30% hedge, positive hedge against our competitors.

Some more key information Stellantis gave to investors should help us understand how safe the company is in case of a major downturn. It was again Carlos Tavares who explained that:

with the H1 numbers, the breakeven point of Stellantis is 40%, which means we have a very sound situation. We have a very low breakeven point at 40%. We’ll keep it below 50%, and that is going to give us a significant sustainability to face any unflictable crisis that we would be facing in the near future.

This means that Stellantis just needs to sell 40% of its full capacity in order not to lose money.

Takeaways

After the report, I see these major points to be aware of:

- Stellantis is highly profitable due to its good execution

- Stellantis has a hedge against downturns that comes from implementing cost saving synergies, from having a low break-even point, and from being exposed mainly to the Western block, thus avoiding geopolitical conflicts.

- Stellantis is already a major player in the BEV industry, that, in my opinion, is being overlooked

Valuation

Let’s get to the point: share price. I think it is clear that Stellantis is a well managed company that will play a role for years to come. But how much does it cost to be a shareholder? At the beginning of the article I already showed that the current share price is less than the cash per share. During the earnings report, we came to know that Stellantis currently holds €60 billion in cash. If we divide it by the current number of outstanding shares of 3.14 billion gives a cash per share of $19.08. Now, if we subtract the debt per share of $9.4 we have a net cash per share of almost $10. Given the share price of $14.62, we are currently paying $4.62 a share, which is less than this year expected EPS of $5.50. It means that in less than a year, a shareholder will be the owner of a total value which likely exceeds the current share price. Rarely a stock trades at a price that is covered in such a brief time.

If we look at Stellantis’ forward P/E we see a 2.86. To me, this is a true mispricing. It means that investors are currently saying that the company offers no guarantee to be around in about three years and that it is not safe to invest in the company with a longer timeframe. Is this true in reality? Is Stellantis really only offering this, when it could actually be the European market leader of BEV?

Ford currently trades at a forward P/E of 7 and Volkswagen at a 4, but they didn’t deliver results as good as Stellantis.

An explanation could be that investors are pricing in a major downfall of the auto market in two years. However, Stellantis will face the difficulties starting from a much stronger and safer place than its peers, having higher margins, a net cash position and a leadership in many markets. Furthermore, investors are not discounting Volkswagen’s exposure to China, which could be troublesome in the future. I don’t see this higher level of protection yet priced in the stock.

Carlos Tavares was asked about the current stock price and this is what he answer:

There is a significant opportunity for investors to consider the fact that currently Stellantis is very cheap, and that is absolutely correct. Given what we have in our plan, given our execution capability, given our focus, given the support that we have from our employees to this merger, which is a very strong bottom-up support, it is fair to say that our market — market cap is very cheap and that our stock is very cheap. So for investors that would be willing to invest in an all-weather company that has demonstrated the strong resilience, that is now demonstrating its strong competitiveness on the electrification path, there is indeed a big opportunity. We used to make the difference in the execution. That’s where we make the difference. The fact that in a very volatile environment on pricing, on raw materials, on semiconductors, on energy, you name it. We are extracting from the market possibly one of the best values that we can imagine. With north of €1 billion of positive free cash flow and north of 14% of AOI margin, this is a quite unique combination in the automotive industry right now. […] But I would say on reasonably normal operations with, I would say, reasonable crisis, if that has any sense to you, we can commit on double digits. So we do not consider that it is a credible scenario to think that we would be below double digits in 2024. We don’t consider that as a credible scenario. We think it’s unlikely, and with a breakeven point at 40%, there is enough room, enough protection to the sustainability of the company to keep it above 10%. That’s where we are.

Given the situation, the company could execute buybacks to prove it really believes it is undervalued. However, Tavares said they need to be careful about this because of social conditions that are not favorable to buybacks at the moment. I think it is worthy to read his whole reply to the question because it states how he wants to make every stakeholder rewarded, taking care both of employees and shareholders.

In the buyback, just one point I would like to highlight to answer your question, and it is something that we should be mindful of. We need to make sure that we keep, I would say, a calm and peaceful social environment. As you know well right now in the Western world, there is a risk of social unrest, as you know well, as a consequence of inflation and the way we are mitigating the inflation, interest rates hike and what that may bring to the cost of living of people. It is important that we keep that in mind because for this big and highly sustainable company to be continuously operating in a proper way for the big benefit of our stakeholders, starting with the investors, we need to protect this stable environment. And of course, buyback shares is something that has a sensitivity in terms of social perception that is not new. And we will have also to take that into consideration to protect your interest as an investor and keep our company as smooth, as focused as possible. […] And our employees and our union partners, they started from a position a few years ago where they only wanted base salary because they didn’t trust that the recurrent profits would happen, so they only wanted base salary increases. Now, they understand that through the level of demand and the way we are managing the company, they are recurring profits, and they start trusting that performance bonus are as good money as a pure base salary increases. And of course, we have to take into consideration what is going on in the inflation right now, and there will be there some wage increase most probably. But the most efficient way, the safest way to keep the balance, keep social stability in the company is to make sure that the performance bonus policy is bringing to the employees a fair share of our success as much as it should bring to our investors the right return that you are expecting from us. So I trust that we will be able to keep this balance.

I really liked to know that a few years ago employees refused to be paid performance bonuses since they didn’t believe the former companies able to deliver good results, but that they know accept these bonuses because they see how the company is operating. As a shareholder, I want employees to be paid well and be happy to work in this company in order to make it more profitable for me, too.

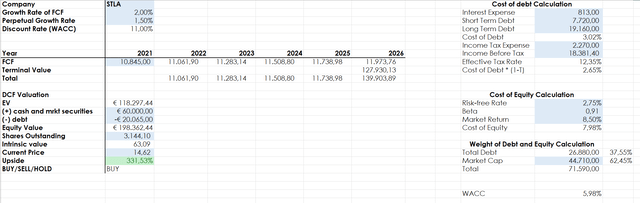

I ran my discounted cash flow model to reach a target price. No matter how conservative I make it, I reach an amazing chance of upside. Here is my base scenario, with an expected growth rate of FCF of 2% in the next 5 years and a perpetual growth rate of 1.5% with a discount rate of 11%.

Author, with data from Seeking Alpha

The target price I reach is $63, a 3x from today’s price.

If I push up my discount rate to 15% and plug in a FCF growth rate of 0.5% and a perpetual growth rate of 0.5% I still have as a target price $49, more than 2x the current price.

I really can’t find a way to justify today’s depressed valuation and this is why I am quite confident that in a few years I will be very pleased about my position in Stellantis. In the meantime, I will collect its 8% dividend and keep on increasing my position.

Conclusion

I owe the reasoning behind this investment to Peter Lynch. In fact, I started building my position after I read One Up On Wall Street and found out that Stellantis resembles in more than one metric the investment Lynch made in Ford back in the 80s. As a conclusion, I would like to share with my readers the two paragraphs that inspired me:

When a company is sitting on billions in cash, it’s definitely something you want to know about. Here’s why: Ford’s stock had moved from $4 a share in 1982 to $38 a share in early 1988 (adjusted for splits). Along the way I’d bought my 5 million shares. At $38 a share I’d already made a huge profit in Ford, and the Wall Street chorus had been sounding off for almost two years about Ford’s being overvalued. Numerous advisors said that this cyclical auto company had had its last hurrah and the next move was down. I almost cashed in the stock on several occasions. But by glancing at the annual report I’d noticed that Ford had accumulated the $16.30 a share in cash beyond debt—as mentioned in the previous chapter. For every share of Ford I owned, there was this $16.30 bonus sitting there on paper like some delightful hidden rebate. The $16.30 bonus changed everything. It meant that I was buying the auto company not for $38 a share, the stock price at the time, but for $21.70 a share ($38 minus the $16.30 in cash). Analysts were expecting Ford to earn $7 a share from its auto operations, which at the $38 price gave it a p/e of 5.4, but at the $21.70 price it had a p/e of 3.1. A p/e of 3.1 is a tantalizing number, cycles or no cycles. Maybe I wouldn’t have been impressed if Ford were a lousy company or if people were turned off by its latest cars. But Ford is a great company, and people loved the latest Ford cars and trucks. The cash factor helped convince me to hold on to Ford, and it rose more than 40% after I made this decision not to sell.

I think today Stellantis resembles this situation, and I do expect the stock to unleash its potential as investors come to realize the opportunity.

Be the first to comment