PJ66431470/iStock via Getty Images

Investment Thesis

Steel Dynamics (NASDAQ:STLD) had a very challenging Q3 period, marked by several headwinds. High energy prices, low steel prices, and shipping volumes all came together. This saw Steel Dynamics’ EPS fall sequentially by 33%.

Furthermore, Steel Dynamics’ outlook for Q4 isn’t looking great. Hence, given this macro backdrop, am I still bullish on Steel Dynamics? I most certainly am!

My bullish thesis is not because of Q4, but what lies ahead into 2023 for Steel Dynamics.

Here’s why I’m bullish on this stock.

What’s Happening Right Now?

The reality at hand is that steel prices have been tumbling lower.

On the one hand, there’s the overall fear that as economies head into a global slowdown in 2023, demand for steel will also be curbed. This has been an overarching theme that has weighed down steel prices in the second half of 2022.

However, this dynamic is now set to change because of the following two drivers.

Firstly, in the US, there’s a widely held belief that the Fed has mostly completed its work of increasing rates.

As a point to consider, even if rates remain around 4.5% for a period of time, many investors believe that rates in the US will not go up much further.

This means that the US is unlikely to be forced into a deep recession in 2023. Consequently, there’s not likely to be full demand destruction in the US, as many suspected.

The other big contributor is China. More specifically, the Chinese government has moved to support real estate groups. As a reminder, China’s real estate sector is the biggest importer of steel.

And for the bulk of 2022, not only has China’s real estate market been in a slump, but with China’s Covid restrictions, it was a double whammy on the steel industry.

This does not mean that China’s real estate market is out of the woods. What it signifies is that there’s government support for the real estate market. The equivalent of a ”Fed put”, but for China. Meaning that China’s government may be more capitalist than many speculated in the past few weeks.

And this leads me to the next section, about what lies ahead for STLD.

Capital Allocation Program, Blemish?

We know that in the first half of 2022, STLD saw record earnings. Only for earnings to tumble lower in Q3. And the reason why STLD saw its earnings tumble lower, was that STLD saw metal margin contraction, meaning prices tumbled lower, plus reduced shipping volumes.

I believe that as we look ahead to the next twelve months, there’s a strong likelihood that steel prices will retrace back to the prices we saw earlier in 2022.

Could we see steel prices on the spot market return to CNY4,250 per tonne mark? In that case, it’s possible that Steel dynamics could return to printing high $20s in EPS in 2023.

Now, here’s the biggest blemish on the investment case.

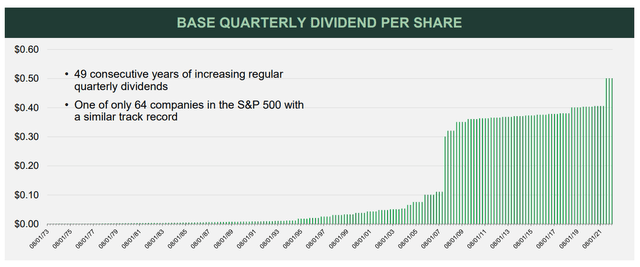

Yes, Steel Dynamics is just one year shy of becoming a dividend king, but at the same time, paying out just over 1% in dividends is hardly going to get investors excited.

Steel Dynamics also has a share repurchase program, which together with its dividend reaches approximately 40% of earnings. However, investors don’t value companies very highly that return the bulk of their capital via share repurchases.

And the reason for this is that there’s a widely held belief that this capital return program can cease at a moment’s notice.

STLD Stock Valuation – 4x 2023 EPS?

Nobody can predict what Steel Dynamics’ EPS will be in 2023. For now, analysts following the company steadfastly believe that after Steel Dynamics reports record earnings in 2022, its earnings will mean revert lower.

However, I don’t believe that’s the case. In fact, thanks to the share repurchase program, I wouldn’t be all that surprised if STLD’s 2023 figure came in higher than in 2022!

However, let’s assume that I’m wrong to be so bullish. Let’s assume that next year, Steel Dynamics EPS is level with 2022. Including everything that we’ve discussed about China’s move to support its real estate market, something that didn’t take place in 2022.

All considered, this would put Steel Dynamics’ share price at approximately 4x next year’s EPS.

Seen another way, an investor coming in today will see this investment pay for itself in four years. And anything that the company earns after year four comes as free upside. It’s a little more complex than this, but that’s a fair way to think about this investment.

The Bottom Line

I have put the bulk of my thesis on China’s demand for steel, driving steel prices higher.

I have not put my focus heavily on Steel Dynamics’ prospects, because I believe that it’s important to understand what the real underlying driving force for a company is.

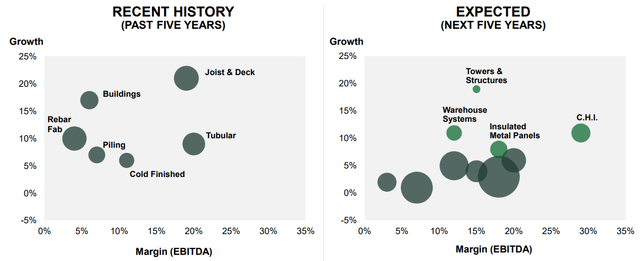

We can get caught up in believing that warehousing systems and insulated metal panels are big opportunities for Steel Dynamics. But in reality, that’s akin to being asked to focus on the trees and to miss the forest.

Be the first to comment