JohnFScott

Starbucks (NASDAQ:SBUX) reported reports from their first fiscal quarter, ending December, which we will summarize below, along with the highlights of the conference call. Following that, very important to long-term investors, is the current valuation of SBUX, relative to the historical and, especially, the future growth rate of earnings and cash flow.

The December Quarter – reported after the close last Thursday.

The headline numbers showed revenues up 8% to a record, $8.7 billion. Same store sales were up 10% in the US, up 5% globally, up by double digits excluding China, which was down 29%. Active Reward Membership was 30.4M, up 15%, and 6% sequentially, in the US. The GAAP EPS of $0.74 and a penny more non-GAAP, missed analyst estimates by $.02-.03/share, impacted by the COVID-driven results in China in the amount $0.06 per share. While the company maintained previous guidance, to be discussed later, since the top line and the EPS missed analyst estimates, this begins a “show me” situation relative to the March-September period of ’23 and beyond, SBUX sold off by several percent in the aftermarket on Thursday and did not recover (in a weak general market) on Friday. We should point out that this type of price action has been fairly common for SBUX just after earnings come out, and the stock has normally recovered as the reactive dust settles.

The GAAP operating margin of 14.4%, down from 14.6% YTY and 14.7% estimated by analysts was affected by labor costs, inflationary pressures and deleverage in China, “partially offset by strategic pricing in North America and sales leverage across markets outside of China.” The operating margin was 18.5% in the US, down from 18.9% YTY. The international segment had an operating margin of 14.3%, down from 16.0%, primarily because of China. The 10% comp in the US was driven by a 9% increase in average ticket, with a 1% increase in comparable transactions. Traffic, therefore, with all the good stuff happening in the US, was essentially flat. International comps were down 13%, with a 12% decline in transactions and a 1% decline in average ticket.

Founder, Howard Schultz began the conference call, highlight the “stunning 10% comp growth in the US and North America, 5% comp growth globally, except for China very strong sales and comp growth in every international market we are in.” China comps (same store sales) were down 29%, “4x worse than we expected.” Schultz, went on to talk about a raft of initiatives, around the world with 36,000 locations in 84 markets (over 6,000 in China, to be 9,000 by the end of 2025). Schultz pointed to record results in the US in the December quarter and lots of other promising indications. Suffice to say that Schultz continues to have great enthusiasm for the long-term continued growth of this worldwide brand.

Readers, with sufficient time and interest, can read the release, the 10Q and the conference call transcript for themselves, but our summary is: Management maintains its long-term optimism relative to China, which is by far their most important growth opportunity. However, management expects “negative comps” in China to continue through the second quarter, followed by improvement in the balance of the year.” Currency translation will continue to cost 2-3 percentage points, but, with the weaker dollar lately, that will be an improvement of about one percentage point from previous guidance. “Operating margin is expected to decline sequentially in Q2, near prior level driven primarily by COVID in China, improving sequentially in Q3 and Q4 as sales leverage, pricing, productivity gains from reinvention in China as well as recovery in China…contribute. We continue to expect quarterly EPS shape to roughly mirror the operating margin with a sequential decline in Q2 and a meaningful step up in the second half…our repurchase program resumed in Q1… our dividend growth (over 51 quarters) has averaged greater than 20%… an exceptional complement to our long term EPS growth target as high as 15%-20%.”

Takeaway from the Quarter

Management is sticking to their guns in terms of intermediate and long-term targets, and analysts are supporting that expectation. Estimates have not been changed from about $3.40-$3.50 per share in the YE 9/30/23 and $4.00 – $4.10 for 9/30/24. Beyond fiscal ’24, everyone is hopeful that EPS can reaccelerate to well north of 10%, which, including a 2% dividend which has been steadily increased, and stock buybacks, can raise the total shareholder return to the mid-teens.

This is a great worldwide brand, but it has been said that “you are what your record says you are.” Ten to twenty years ago, the record and the future growth prospects for Starbucks were far different than today. Which brings us to the subject of “the valuation of growth stocks.”

Valuation Basis of Growth Stocks

It need not be debated that the faster a company is growing, the more the stock will be worth in the long run. Higher growth means higher Price/Earnings (P/E) multiples. This ties in to the fact that stock ownership is a small piece of equity in that business and the more revenues, followed by cash flow and earnings and dividends, the more the business, and therefore the stock will be worth. The question then becomes one of “attractive vs. “reasonable” vs. “unreasonable.”

The PEG Ratio

According to Wikipedia:

“The PEG ratio was originally developed by Mario Farina, in his 1969 book called ‘A Beginner’s Guide to Successful Investing in the Stock Market’. Better known to many of us has been Peter Lynch, who wrote in 1969 ‘One Up on Wall Street’ saying that ‘The P/E ratio of any company that is fairly priced will equal its growth rate’, a fairly valued company will have a PEG equal to 1’.”

Our experience dealing with institutional growth stock investors is that a PEG ratio of 1 is continued a bargain, 2 is fairly valued for a financially healthy, well situated, and steadily growing company. A PEG above 2 is normally considered a “reach”, with less opportunity for upside revaluation and more downside risk, especially in a general market downdraft.

Further quoting Wikipedia:

“PEG is a widely employed indicator of a stock’s possible true value. Similar to PE ratios, a lower PEG means that the stock is undervalued more. It is favored by many over the price/earnings ratio because it also accounts for growth. The PEG ratio of 1 is sometimes said to represent a fair trade-off between the values of cost and the values of growth, indicating that a stock is reasonably valued given the expected growth. A crude analysis suggests that companies with PEG values between 0 and 1 may provide higher returns.

“PEG Ratio = Price/Earnings divided by Annual EPS Growth*

*Yahoo Finance uses 5 year expected growth rate and a P/E based on the EPS estimate for the current fiscal year. The Nasdaq website uses the forecast growth rate (based on the consensus of professional analysts) and forecast earnings over the next 12 months.”

Operating Income

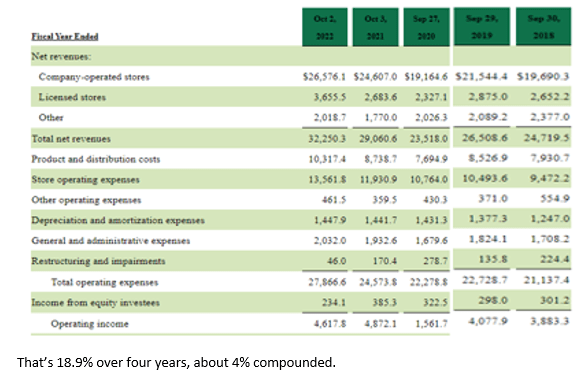

From fiscal 2018 (9/30) through fiscal 2022

Operating Earnings – last five years (10K)

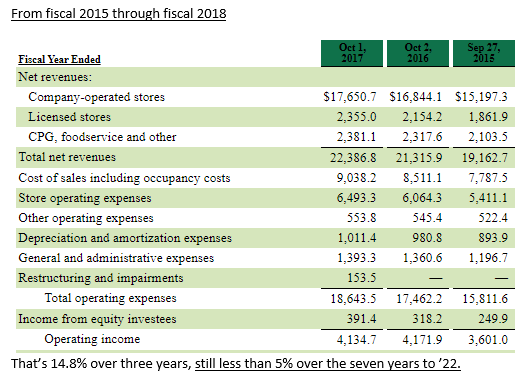

Operating Earnings – Previous 3 years (10K)

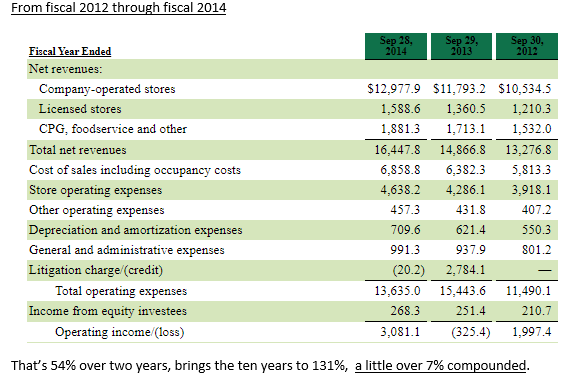

Operating Earnings – going back10 yrs (10K)

The Result

Starbucks is a very successful, very secure, still growing worldwide brand with a great operating culture. While 20 and 30 years ago Starbucks was growing rapidly, over the last four years operating earnings have grown just over 4% and still under 5% in the seven years ending 9/30/22. If we add in years nine and ten, 2012 and 2013, which grow at about 24%, the ten year growth rate moves up to 7%.

SBUX at 109, and consensus earnings for ’24 (more than 12 months out) around $4.00/share, the P/E of 27x provides a very rich PEG relative to the 4-5% growth rate (a PEG of about 6) over seven years and even the 7% growth rate (a PEG of about 4) over the last 10 years.

The Possible Saving Grace

The saving grace of this valuation exercise is the possibility that the growth rate in the future could accelerate to a rate that could justify a P/E multiple of 27x ’24 EPS. The stock today at $109, on a PEG basis, would be a bargain if the future growth rate could be 27%, would be fairly valued with a future growth rate of 13.5%, and overvalued to whatever extent future growth is less than 13.5%. Judge for yourselves these possibilities. As a stockholder or potential stockholder, I want to explore what fundamental developments could introduce a growth rate substantially higher than it has been over the last 10 years.

Current Questions – looking for an inflection point.

As discussed above, the December quarter for Starbucks, in spite of a great number of positive developments, and continued huge opportunity in China, constituted a short-term miss. The second half of ’23, ending September, is expected to look better, far improved beyond that. We have followed Starbucks as a public company for decades and can’t remember when management, Howard Shultz being the best leader (and cheerleader) of all, was not very optimistic. In the context of continued great opportunity, obvious current concerns are store level margins to be expected, wage expectations, commodity price expectations, and the pace of recovery in China. The most important “levers,” both ways, in this situation is the pace and form of recovery in China.

Conclusion

We started this piece by saying that this is a great company to be admired for all kinds of reasons. It’s also a very big ship to turn around, or to re-accelerate growth in this case. No other company we are aware of has sustained an operational culture to this scale as well as Starbucks. However, even Starbucks is vulnerable to the law of large numbers and we suspect that future growth won’t be a lot faster in the future than it has been in the last seven to ten years. We call SBUX fully valued, no better than a hold for very long-term investors.

Be the first to comment