DKart/iStock Unreleased via Getty Images

The investment thesis

While Starbucks (NASDAQ:SBUX) stock was very attractive in May and June, shares have climbed significantly since then causing valuations to rise accordingly. Macro-economic conditions, well-received earnings, and the investor day in September have contributed to the ~45% price increase since this year’s low.

The investor day was particularly important for long-term investors as management introduced the ‘Reinvention Plan’ to drive future growth. The company is putting a lot of trust in China as roughly one-third of net new stores will be opened in this Asian superpower through FY2025. Based on past performance and the future specialty coffee market outlook, I think that the growth targets could be achieved, but further increasing exposure to China is definitely a risk. Moreover, I have my doubts about the capital allocation plan from the investor day. And because stock valuations have increased significantly, I think a lot has to go right to justify the current price level.

This and more will be discussed in the following article.

Starbucks in short

Starbucks needs no long introduction. Over the past decades, it has become one of the world’s most valuable brands. Whether you like the overpriced coffee or not, many people grab a drink at Starbucks on a regular or daily basis. Every time I walk past a Starbucks store, there are long queues of people waiting for their order. It’s affordable luxury – for only a few bucks you can enjoy a premium coffee experience. Starbucks is presenting itself as the so-called ‘Third Place’, a place beyond home and office where people can work, gather, and relax. From time to time, I visit Starbucks as I like to work in different environments during the week.

The success of Starbucks has translated in exceptional growth. In twenty years, revenue has grown from $3.3 billion in FY2002 to $32.3 billion in FY2022 – that’s a 12.1% CAGR! This was driven by a combination of comparable store sales growth and store count growth (growing from 5,886 stores in 2002 to 35,711 stores in Q4 2022). Currently, 48.4% of all stores are located in North America, and 51.6% is located in the rest of the world.

Starbucks also generates revenue outside their stores with the Channels business. According to management, it has the number one share in global ready-to-drink coffee, by selling Starbucks-branded products through the Global Coffee Alliance with Nestlé (OTCPK:NSRGY).

China – The main topic at the 2022 investor day

Starbucks provided a strategy update during the recent investor day in September. Management presented the ‘Reinvention Plan’ for the coming years and highlighted some actions and investments to boost long-term growth. The financial roadmap for the next three years includes 10%-12% annual revenue growth and 15%-20% annual Non-GAAP earnings per share growth. These targets are significantly higher compared to the numbers presented at the 2020 investor day (8%-10% annual revenue growth and 10%-12% annual Non-GAAP earnings per share growth). The company aims to achieve the new improved targets by enhancing comparable store sales growth, continued margin expansion, share buybacks, and increasing store count.

For the latter, management set some impressive targets. Globally, Starbucks expects to reach 45,000 stores by 2025 and 55,000 by 2030. Based on the current store count, this requires a store count growth of roughly 7% annually through 2025 and 4% thereafter. It’s actually funny that in the annual report of FY2002, management set the target to ultimately reach 25,000 stores worldwide. Back in the days, that was indeed an optimistic target. But currently, the company plans to more than double that number.

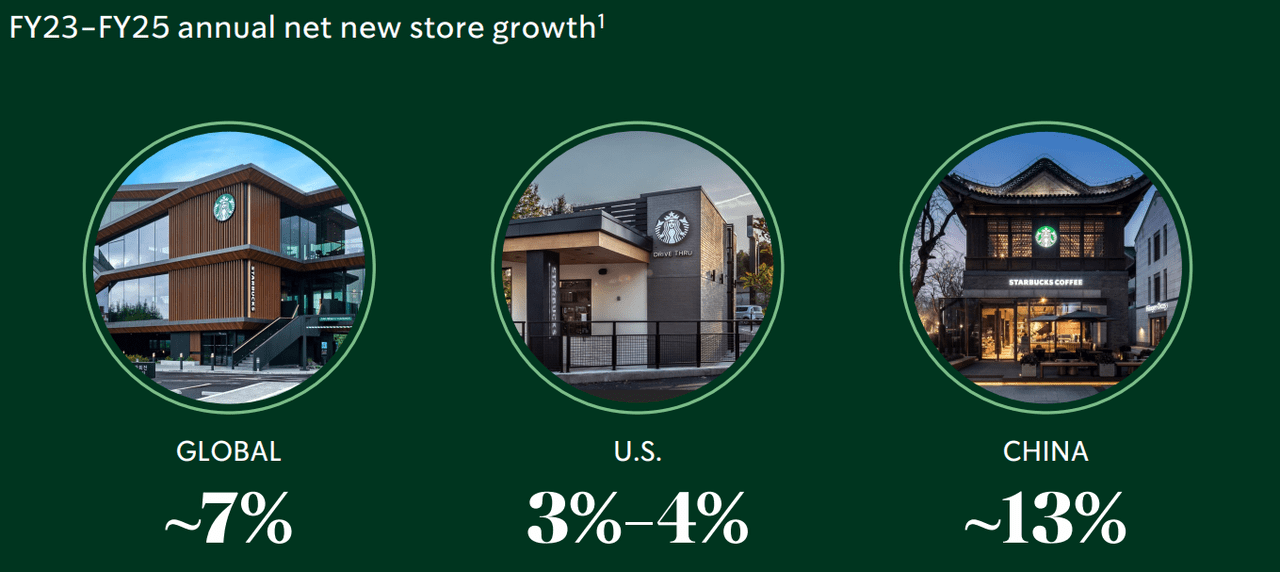

Annual growth targets for net new stores (Starbucks Investor Day 2022)

The company will heavily rely on China to reach its long-term goals. For the FY2025 store count target, China’s store count will have to grow 13% annually compared to 7% globally. Management expects to reach 9,000 stores in China by 2025. Given that China just surpassed 6,000 stores in Q4 2022, this implies a 50% jump in store count in three years. It also means that in the coming three years, roughly 33% of net new stores will be built in China. And it’s likely that China will show outsized growth beyond 2025. Reason enough to take a closer look.

A closer look at China

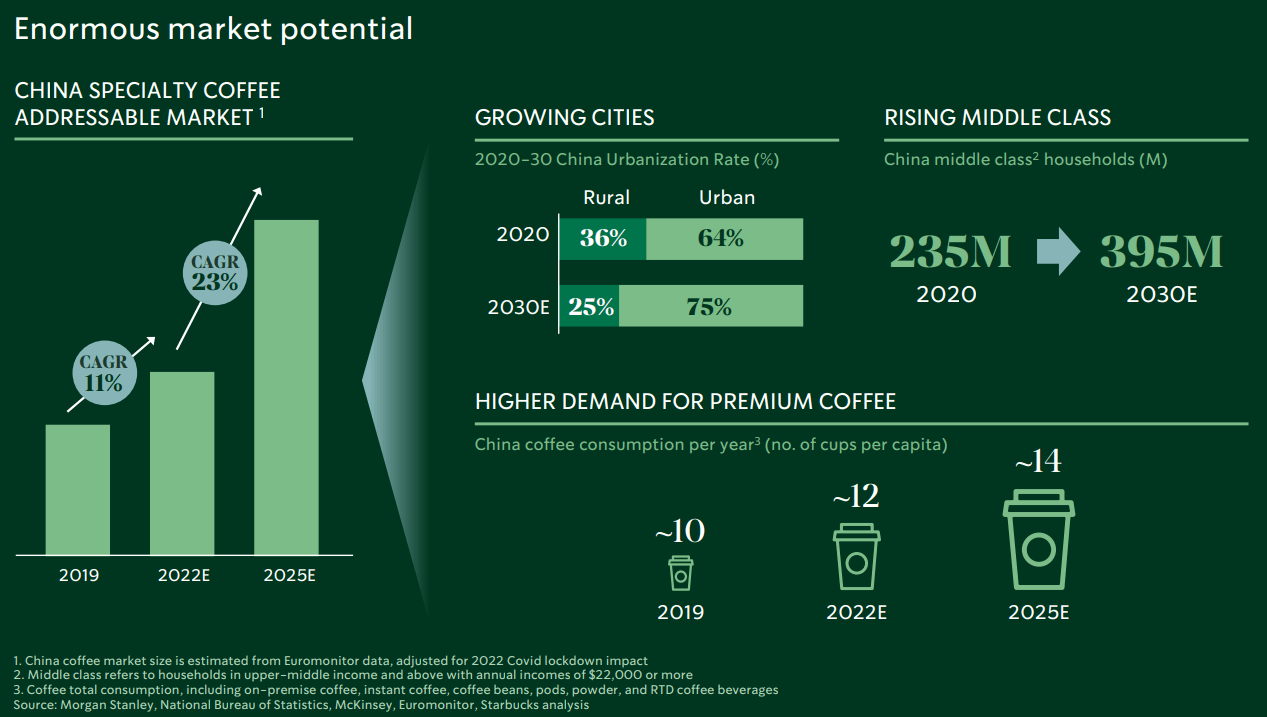

Management believes that the Chinese coffee market is still in its early stages. The Chinese specialty coffee TAM is expected to accelerate to 23% growth annually due to the growing middle class population, urbanization, and increased demand for premium coffee (see figure below). As the company continuously seeks for new growth opportunities, it seems more than logical that Starbucks wants to get a piece of the pie. Starbucks aims to further popularize the coffee culture by increasing density in top-tier cities and expanding its footprint in lower-tier cities.

Specialty coffee market outlook China (Starbucks Investor Day 2022)

Starbucks is not the only player in the market. The company experiences fierce competition with local rivals such as Luckin Coffee which operated nearly 7,200 stores halfway 2022. Other potential rivals are Manner (operating more than 300 stores across mainland China), Tim Hortons (operating more than 400 stores), and Costa Coffee (also operating more than 400 stores).

I think that despite rising competition, Starbucks will continue to gain market share in China due to their scale, customer loyalty, portfolio optimization, and innovations. Moreover, as pointed out in an article from EqualOcean, Starbucks distinguishes itself from competitors like Luckin Coffee by targeting different audiences and promoting the ‘Third Place’ concept.

Currently, China is the second largest business segment for Starbucks, but that has not always been the case. Starbucks entered the Chinese coffee market in January 1999 by opening its first store in the World Trade Building, Beijing.

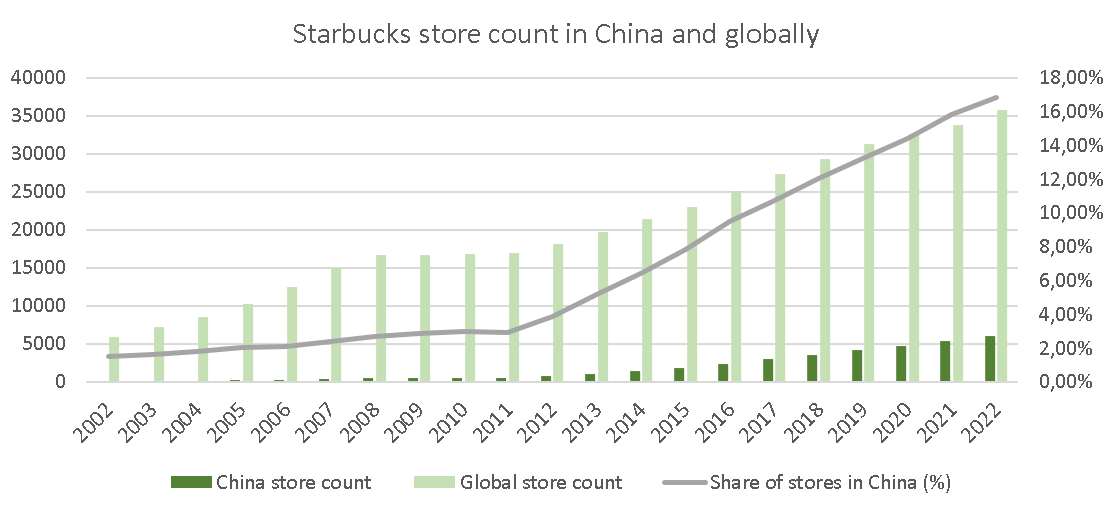

Twenty years ago, Starbucks had 88 stores in China representing only 1.5% of the total store count. But in the following years, China became more and more important for the company. The graph below shows the global and Chinese store count over the past two decades (left axis) and the share of Starbucks stores located in China (right axis). The store count numbers represent both company-operated and licensed stores. It is interesting so see that until 2011, the Chinese store count grew roughly at the same pace as the global store count. But after 2011, China really took off. After doing some research, I found a Wall Street Journal article from April 2010 in which Howard Schultz (still CEO at the time) states that Starbucks plans to open thousands of stores in China over time. And I have to say, mister Schultz has delivered. Currently, 17% of total Starbucks stores is located in China and this share will continue to grow with the company expansion strategy.

Store count in China and globally (Starbucks annual reports FY2002-FY2022)

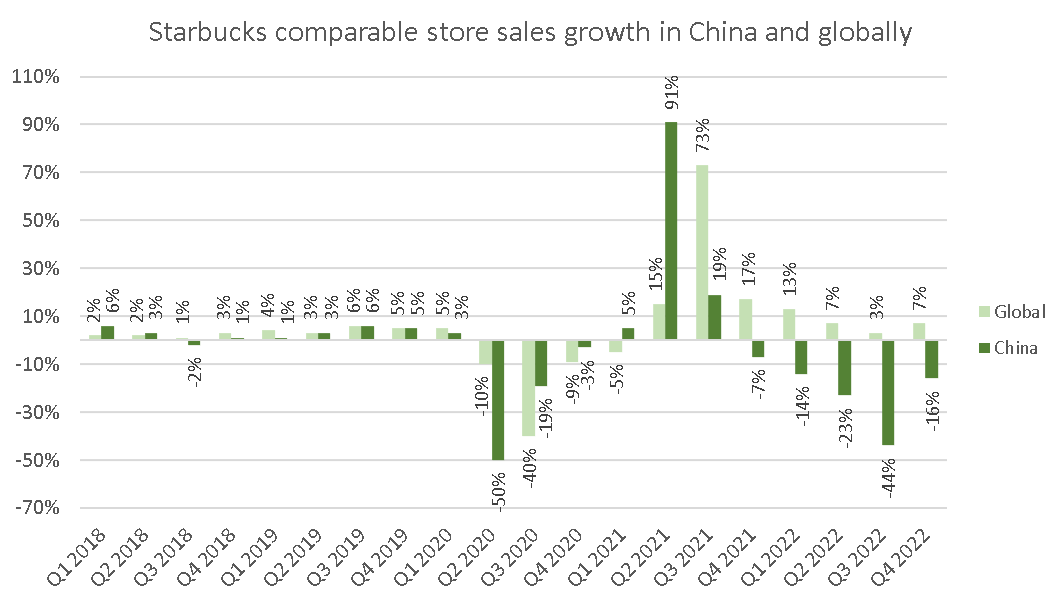

Opening stores is not enough to achieve the financial growth targets. Increasing same-store sales should help to increase revenue faster than net new store growth. While the store count has steadily grown in recent years, comparable store sales were significantly impacted by COVID-related disruptions. To show this, I plotted the year-over-year comparable sales growth both globally and in China for every quarter over the past five fiscal years (see figure below). Note that China is included in global sales, but I could not find numbers for all countries excluding China.

Pre-pandemic, global and China comparable store sales were roughly the same – sometimes China did better, sometimes the rest of the world did better. If we take a look at comparable sales growth in the most recent four quarters, comparable sales growth in China continues to underperform the rest of the world. In the most recent fiscal quarter Q4 2022, global comparable store sales growth was 7%, mainly driven by 11% growth in the North America and U.S. markets. China comparable store sales declined 16% as COVID-restrictions continued to impact transaction volume

Comparable store sales growth in China and globally (Starbucks quarterly results FY2018-FY2022)

So how will the China segment perform in the following years? During the investor day, management stated that it expects outsized comparable store sales growth for China in 2023 and 2024, to normalize in the 4%-6% range in 2025. This range was achieved for a few quarters just before the pandemic hit. I believe that Starbucks China can reach 4%-6% comparable store sales growth again in the long-term as the company benefits from the increasingly growing specialty coffee market. But the impact of COVID policies in the short to mid-term remains uncertain.

Capital allocation and balance sheet

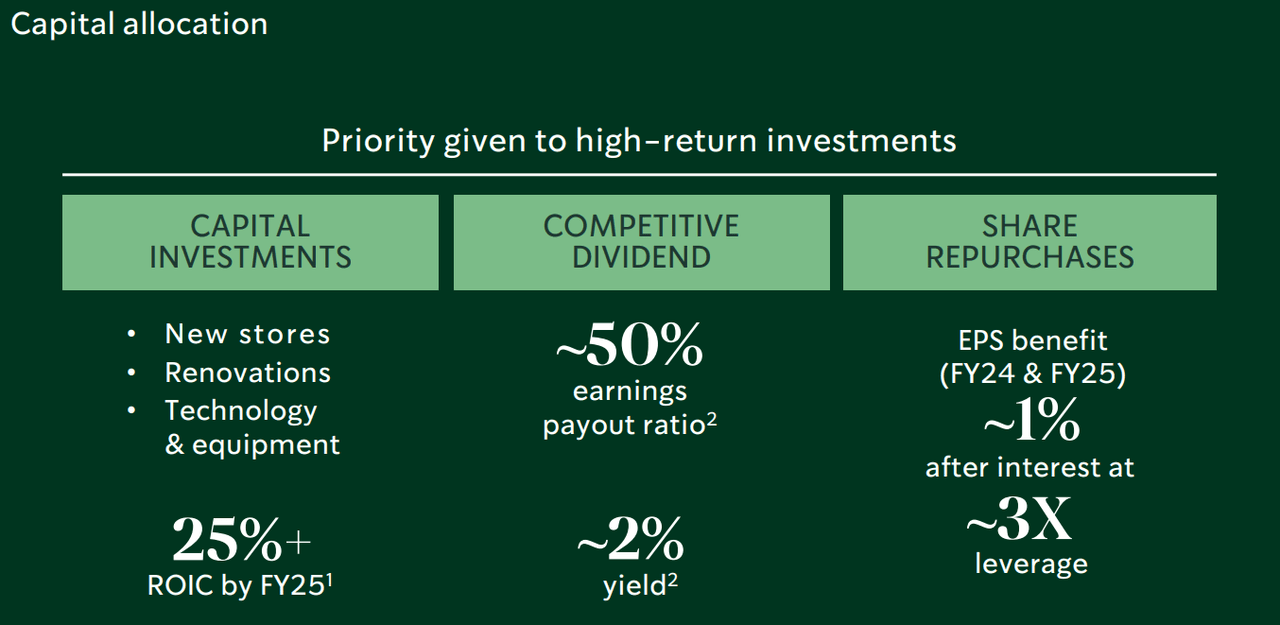

To grow the store count in China and the rest of the world at the targeted rates, Starbucks obviously requires capital. But, capital is also required for others purposes. Starbucks will invest in purpose-built store concepts and expand digital convenience. If the company can achieve a 25%+ return on invested capital as shown in the figure below, that would be great. There are not a lot of companies that are able to drive such high returns. Moreover, management expects to return approximately $20 billion to shareholders over the next three years between dividends and share repurchases.

Capital allocation plan (Starbucks Investor Day 2022)

Because Starbucks requires a lot of capital for investments and shareholders returns, I will briefly discuss the balance sheet. Net leverage has been fluctuating due to changes in net debt, and the EBITDA was heavily impacted during the pandemic (see table below).

|

Fiscal year |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Cash & Cash equivalents ($ billion) |

$8.9 |

$2.8 |

$4.6 |

$6.6 |

$3.2 |

|

Short-term & current debt ($ billion) |

$0.4 |

$0.0 |

$1.7 |

$1.0 |

$1.9 |

|

Long term debt ($ billion) |

$9.1. |

$11.1 |

$14.7 |

$13.6 |

$13.2 |

|

Net debt ($ billion) |

$0.6 |

$8.3 |

$11.8 |

$8.0 |

$11.9 |

|

EBITDA ($ billion) |

$5.1 |

$5.4 |

$3.1 |

$6.2 |

$6.0 |

|

Net leverage |

0.1x |

1.5x |

3.8x |

1.3x |

2.0x |

Source: SeekingAlpha financials page.

In general, I think that the current balance sheet is not bad but also not great. Long term debt has been decreasing since FY2020 which is a positive. Once all markets recover and the company keeps increasing the store count, EBITDA could grow at a fast pace in the coming years. What I do have difficulty with, is the $20 billion shareholder return program. According to MarketScreener, Starbucks will generate roughly $12.5 billion in free cash flow through FY2025. This is by far not enough to cover the planned share buybacks and dividends. So, net debt has to increase in the coming years which is also what analysts predict.

It is not a big issue yet as net leverage will probably stay flat with the growing EBITDA. But I would not prefer to increase debt simply to reward shareholders in the short term.

Valuation

Let’s move on to one of my favorite parts: the valuation. I often use the Discounted Cash Flow (or DCF) Analysis to calculate the intrinsic value of a business. I will project free cash flows until FY2032 – a ten-year period. It is very hard to predict the exact future growth rate, so in the following I will determine a reasonable bandwidth for the free cash flow growth rate.

I will consider the 2013-2019 period as a historical reference to exclude COVID-related disruptions. Between FY2013 and FY2019, free cash flow grew from $1.8 billion to $3.3 billion with a 10.7% CAGR. Analysts currently predict free cash flow to be $4.8 billion in FY2025, driven by growth according to the business targets from the investor day (this will imply mid-teens growth from FY2022 to FY2025). I think that growth will normalize after that and assume a 10% CAGR as a mid-point for free cash flow growth. This is slightly below the pre-pandemic growth rate and assumes growth deceleration after FY2025.

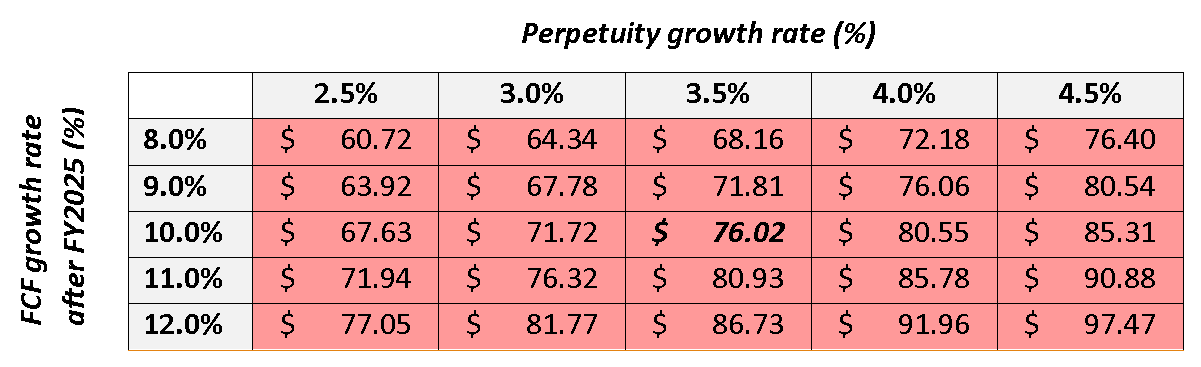

With this is mind, I will take an 8.0%-12.0% free cash flow bandwidth between FY2025 and FY2032. The perpetuity growth rate is typically between historical inflation (2-3%) and historical GDP growth rate (4-5%). Due to store count growth and pricing power, I think Starbucks will long outperform historical inflation. Therefore, I assume a 2.5%-4.5% range for the perpetuity growth rate. So, the inputs will be as follows:

|

Input |

Value |

|

First year of projections |

2023 |

|

Personal Required rate of Return |

10.0% |

|

Number of shares outstanding |

1.1478 billion |

|

Base free cash flow (fiscal year 2025) |

$4.8 |

|

Net borrowings ($ billion) |

$11.9 billion |

|

Free cash flow growth rate after FY2025 |

8.0%/ 9.0% / 10.0% / 11.0% / 12.0% |

|

Growth rate in perpetuity |

2.5% / 3.0% / 3.5% / 4.0% / 4.5% |

The intrinsic values from the DCF analysis are presented for every growth rate combination in the table below. By considering a $11.9 billion net debt position, all the intrinsic values got cut by roughly $11 per share. With my mid-point growth rate assumptions, I obtain a fair value of $76.02 per share. This means that at the current share price ($99.56) the stock is quite overvalued. Note that my growth rates are optimistic. I assumed outsized free cash flow growth through FY2025 and a 10% CAGR after that through FY2032. The company has to execute really well to achieve that.

Sensitivity analysis for Starbucks (Author)

Risks to consider

At this valuation, Starbucks has to grow with double digits over the next decade. This is definitely achievable, but it requires that the company performs according to the investor day business targets or even better. There are various factors that could prevent Starbucks from doing that. In the following I will consider the main risks that could jeopardize the attainment of the investor day objectives.

- Increasing exposure to China: According to the investor day plans, Starbucks has to increase exposure to China to achieve its long-term goals. Normally, I do not invest in China because the Chinese government is too unpredictable. According to China expert John Osburg from the University of Rochester, the following period will even be less predictable than usual. That’s due to the uncertainty around COVID policies, bad shape of the economy, and Xi beginning his third term as China’s leader. On the other hand, there are huge growth opportunities for Starbucks in the Chinese coffee market. Starbucks stock could therefore be a nice way to indirectly invest in China.

- Increasing net debt position: I have not seen many analysts covering Starbucks’ net debt position, but I think that this could become an issue in the future. Investing capital to gain a 25%+ return is great, but Starbucks also needs to add debt to finance buybacks and dividends. Especially in a higher interest rate environment, I am not a huge fan of companies taking on more debt.

- Introducing a new CEO: Starbucks recently announced that Laxman Narasimhan will become the new CEO in April 2023. He will replace the current interim CEO Howard Schultz. Previously, Laxman Narasimhan was CEO of Reckitt Benckiser Group plc (OTCPK:RBGPF), so he definitely brings some experience to the table. Starbucks did great over the past decades, especially during the periods under Howard Schultz. But with Schultz stepping down again, it remains uncertain how the company will perform under the new leadership.

Final thoughts

There is a lot to be optimistic about for Starbucks shareholders. The company strategy has translated in double-digit returns for years and the new Reinvention Plan adds some new fuel to the growth engine. Increasing exposure to China is a great way to benefit from the rising middle class and rapidly growing specialty coffee market. All capital investments combined should translate in a 25%+ ROIC, something most companies can only dream of.

However, further expanding in China also brings some serious risks to the table. Currently, there is uncertainty regarding COVID policies, the shape of the Chinese economy, and the unpredictability of the Chinese government in general. Besides, I am not a big fan of Starbucks’ new capital allocation plan as the company is likely to take on more debt. This in combination with the leadership change means that I am not willing to pay a premium for the stock.

At the current valuation, Starbucks has to realize double-digit growth again for the next decade in my view. While this is certainly possible, I do not like the risk-reward profile here. Therefore, I rate Starbucks a hold and advise investors to wait for the $70s before adding more shares.

Be the first to comment