Alexey_Lesik

Star Bulk Carriers Corp. (NASDAQ:SBLK) is a global dry bulk company with 128 dry bulk carriers ranging from 52000 to 210000 DWT, headquartered in Greece. In my last article on Star Bulk, I valued the stock at $24. With a 2022 adjusted EBITDA of $940 million (my estimation), I update my valuation to $27.

Due to the decreased iron ore demand (because of increased interest rates in the United States and European countries to combat inflation, combined with high temperatures and heavy rains in China), the market outlook for dry bulk carriers is not as strong as before. However, due to slow fleet growth expectations and the increased coal imports into the EU, SBLK is well-positioned to benefit from the market condition. In a word, the stock is a hold.

Quarterly highlights

In its 2Q 2022 financial results, Star Bulk reported voyage revenues of $417 million, compared with 2Q 2021 voyage revenues of $311 million. Also, the company’s Voyage revenues increased by 15.5% QoQ. SBLK reported a net income of $200 million, or $1.95 per diluted share, in the second quarter of 2022, compared with a net income of $124 million, or $1.22 per diluted share in 2Q 2021, up 60%. SBLK’s adjusted net income increased by 60% YoY to $205 million. In the second quarter of 2022, the company’s EBITDA and adjusted EBITDA increased by 40% and 42% YoY to $251 million and 258 million, respectively. With 128 vessels in 2Q 2022 (compared with 126 vessels in 2Q 2021), Star Bulk’s TCE revenues increased from $255 million in 2Q 2021 to $338 million in 2Q 2022. SBKL’s TCE per day increased by 33% YoY and 11% QoQ to $30451 in 2Q 2022.

“The Board of Directors approved a dividend of $1.65/share,” the CEO commented. “With a limited supply of vessels, the upcoming environmental regulations curbing vessel ordering and speeds, our competitive operating costs and our scrubber equipped fleet, we remain optimistic on the income earning prospects of our company despite a seemingly uncertain macroeconomic environment,” he continued.

It is worth mentioning that as of the end of June 2022, Star Bulk had earned back its $250 million investment in scrubbers (exhaust gas cleaning systems) investment in a span of 2.5 years. Also, because of a refinance of $310 million, SBLK has 12 unencumbered vessels, and its interest cost will be reduced by $4 million per annum. It means the company did well in optimizing its debt since the beginning of the year.

The market outlook

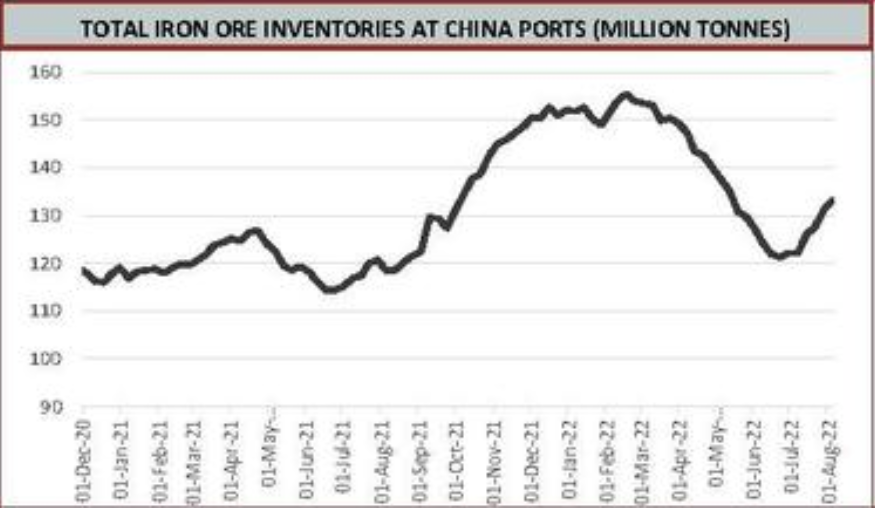

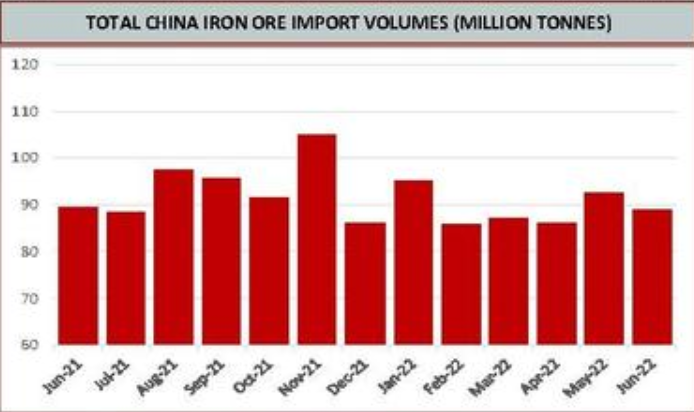

According to the MMI daily iron ore index report, published on 8 August 2022, total iron ore inventories at China ports increased from about 120 million tonnes on 1 June 2022 to around 132 million tonnes on 1 August 2022 (see Figure 1). On the other hand, total China iron ore import volumes increased from more than 90 million tonnes in May 2022 to less than 90 million in June 2022 (see Figure 2)

Figure 1 – Total iron ore inventories at Chinese ports

MMI

Figure 2 – Total China iron ore import volumes

MMI

Moreover, Chinese rebar and hot-rolled coil production decreased in the last few weeks (see Figure 3). We can see that Chinese rebar and hot-rolled coil consumption in July 2022 are below their levels in July 2019, 2020, and 2021.

Figure 3 – Chinese steel consumption and production

MMI

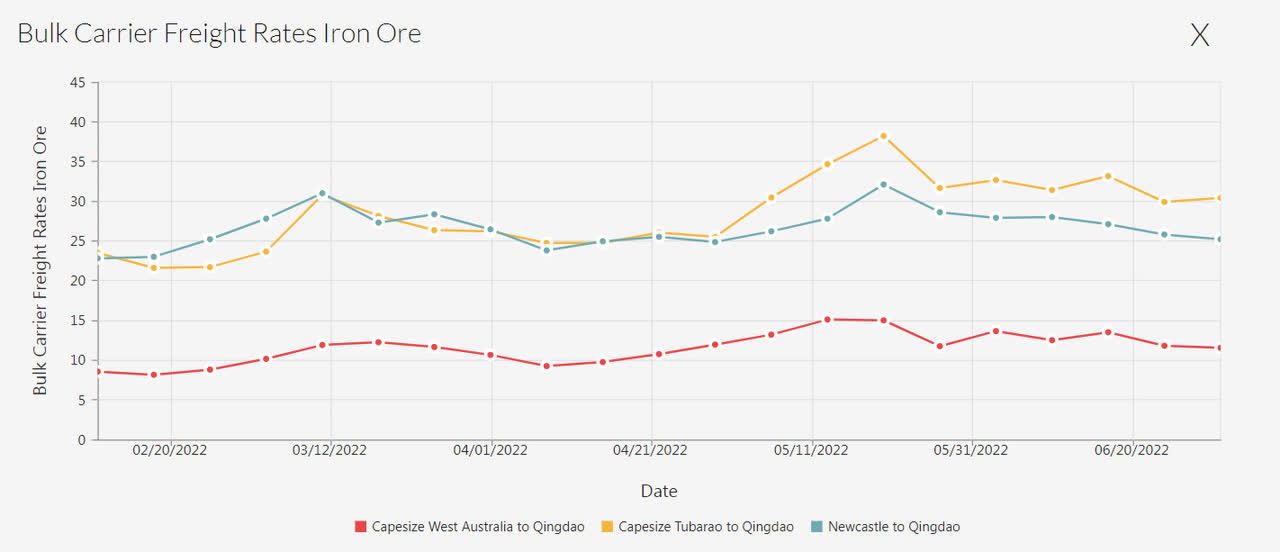

In my last article on SBLK, I explained that due to the extreme weather conditions in China, the country’s iron ore imports will not increase in the next few months. Also, I explained that increased interest rates in western countries caused their iron ore import to decrease, and with current fiscal and monetary policies to combat inflation, I do not expect the United States and European countries’ iron ore demand to increase in the following months. The result is that dry bulk charter rates cannot reach their record highs in the short term. Despite the weak outlook for iron ore demand in the following months, on average, bulk carrier freight rates in July 2022 were higher than in the first quarter of 2022. However, compared with the second quarter of 2022, bulk carrier freight rates decreased in the last few weeks (see Figure 4).

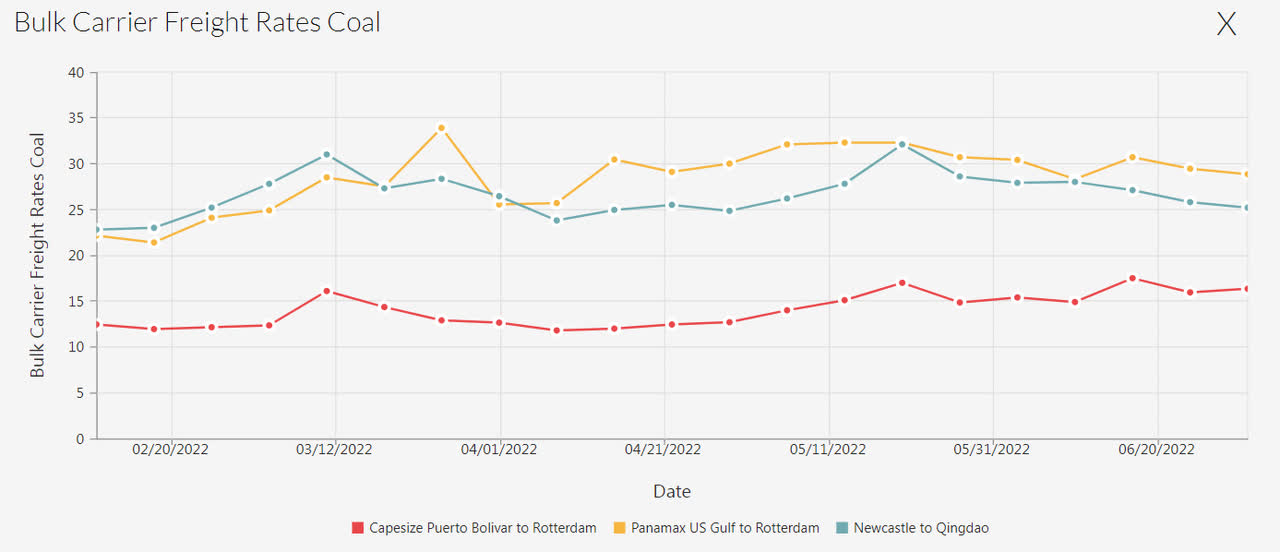

Moreover, Figure 5 shows that after a significant increase in the bulk carrier freight rates for coal in the first half of 2022 (due to European higher coal demand driven by natural gas problems), bulk carrier freight rates decreased in the past few weeks. Based on the information on the iron ore & coal market, and the data for bulk carrier freight rates, I expect the financial result for the third quarter of 2022 will not be as strong as 2Q 2022 and 3Q 2021.

Figure 4 – Bulk carrier freight rates for iron ore

www.ssyonline.com

Figure 5 – Bulk carrier freight rates for coal

www.ssyonline.com

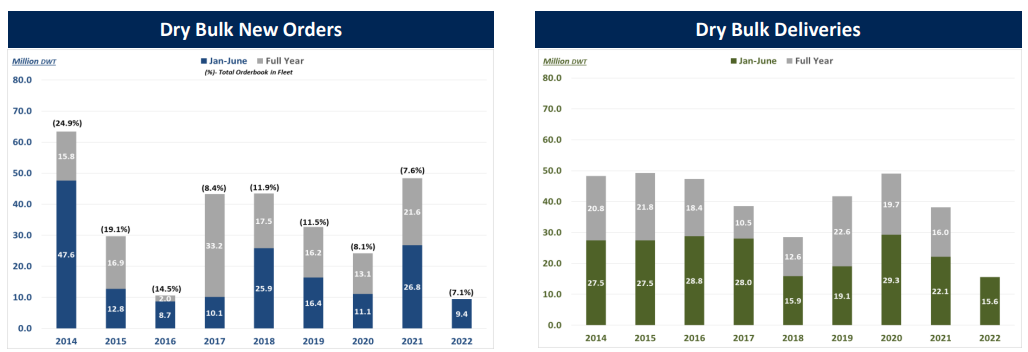

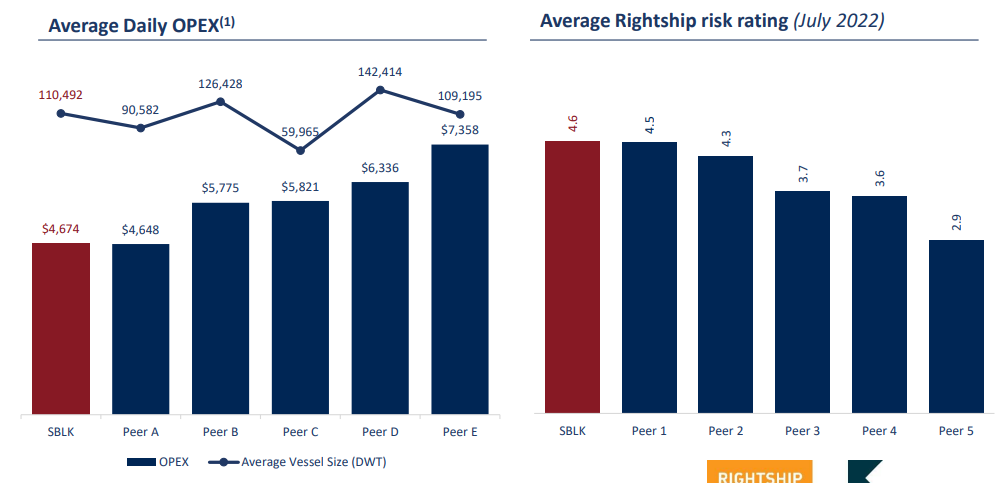

On the other hand, as a result of environmental regulations, increased shipbuilding costs, and limited shipyard capacity global fleet growth will be slow in the upcoming years (see Figure 6). SBLK expects NET fleet growth to be lower than 2% p.a. during 2022-2024. Furthermore, the company has 128 vessels with one of the lowest average daily OPEX among its peers without compromising quality (see Figure 7), which are fitted with scrubbers. Thus, Star Bulk is well-positioned to benefit from the market condition. I estimate the company’s adjusted EBITDA to be $456 million in the second half of 2022, down 6% compared with the first half of 2022. For 2022, I estimate the company’s adjusted EBITDA to be $940 million.

Figure 6 – Dry bulk new orders and deliveries

2Q 2022 presentation

Figure 7 – SBLK’s average daily OPEX and average rightship risk rating vs. peers

2Q 2022 presentation

SBLK performance outlook

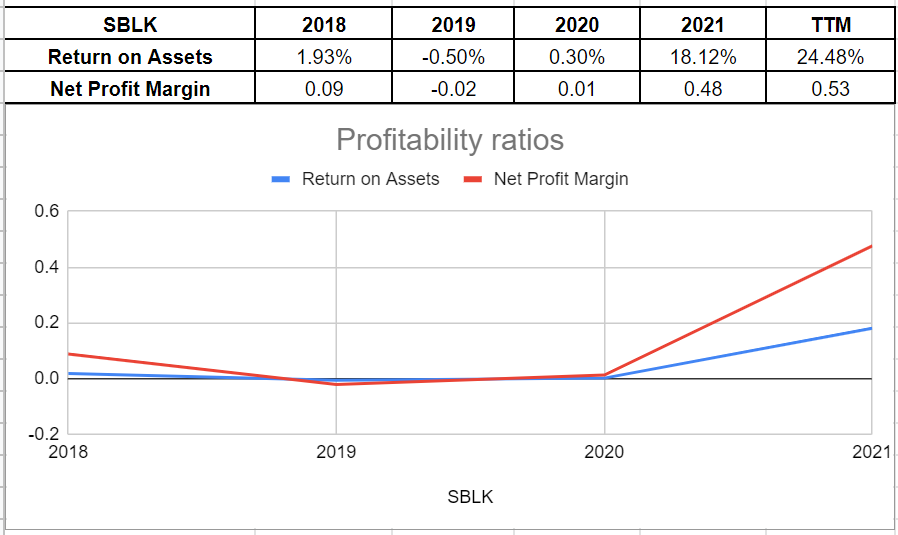

SBLK’s net profit margin provides a capture of the company’s profitability. Its amount of net profit margin surged impressively and sat on 0.48x at the end of 2021 compared with its amount of 0.01x in 2020 when the pandemic started. Moreover, across the board of return on assets, the ROA ratio in TTM shows that about 24.4% of the company’s net earnings are related to its assets. SBLK’s return on assets boosted amazingly during 2021 and sat on 18.12% versus its previous level of only 0.30% at the end of 2020. Thus, Star Bulk Career’s profitability ratios provide a good picture of its ability to generate income relative to its revenue and assets (see Figure 8).

Figure 8 – SBLK profitability ratios

Author (based on SA data)

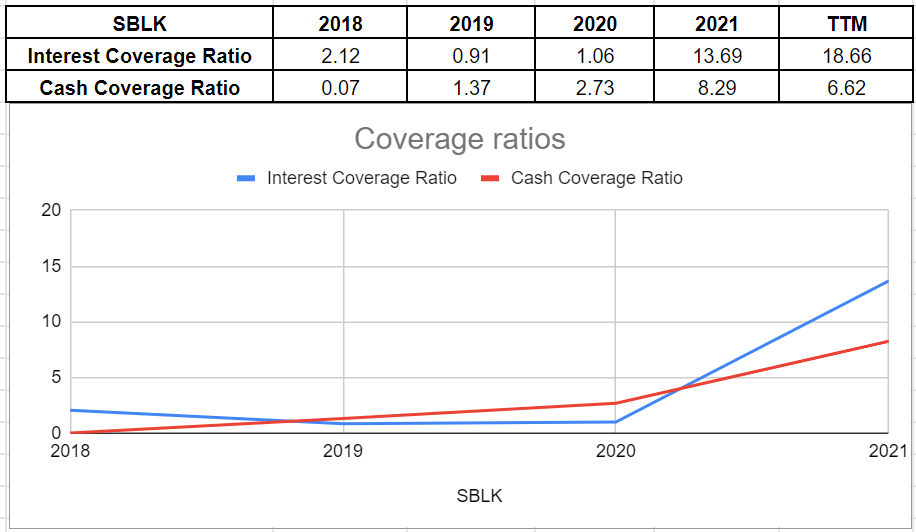

Moreover, we can analyze SBLK’s coverage ability across the board of its interest-coverage ratio and cash-coverage ratio. Currently, its ICR indicates that 18 times the company is able to pay its interest expenses on its debt with its operating income. Its interest coverage ratio in TTM has improved impressively compared to its amount of 13.69x at the end of 2021. Also, as a conservative metric to compare the company’s cash balance to its annual interest expense, Star Bulk’s TTM cash-coverage ratio has declined to 6.62x after an eye-catching surge to 8.29x at the end of 2021 versus its previous level of 2.73x at the end of 2020. In a word, the company’s coverage ratios represent that SBLK is able to pay its obligations easily (see Figure 9).

Figure 9 – SBLK coverage ratios

Author (based on SA data)

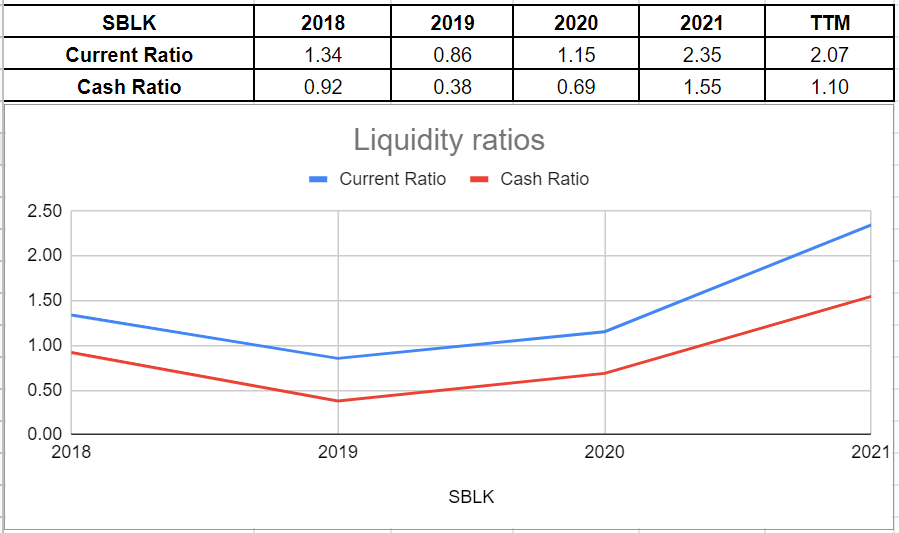

To wrap up the company’s performance outlook, I analyze Star Bulk’s liquidity by considering its cash and current ratios. With the strong cash and capital structures that I investigated in my last update, it is not surprising to see that its current ratio swelled by over 100% to 2.35x in 2021 compared to its previous level of 1.15x in 2020. Albeit slightly declining and sitting on 2.07x, its current ratio in TTM has the potential to grow by the end of 2022. Furthermore, after an amazing increase in the cash ratio to 1.55x at the end of 2021, compared with its previous level of 0.69x at the end of 2020, the company’s cash ratio in TTM declined to 1.10x. In short, Star Bulk’s healthy liquidity position is observable from its liquidity ratios (see Figure 10).

Figure 10 – SBLK liquidity ratios

Author (based on SA data)

SBLK stock valuation

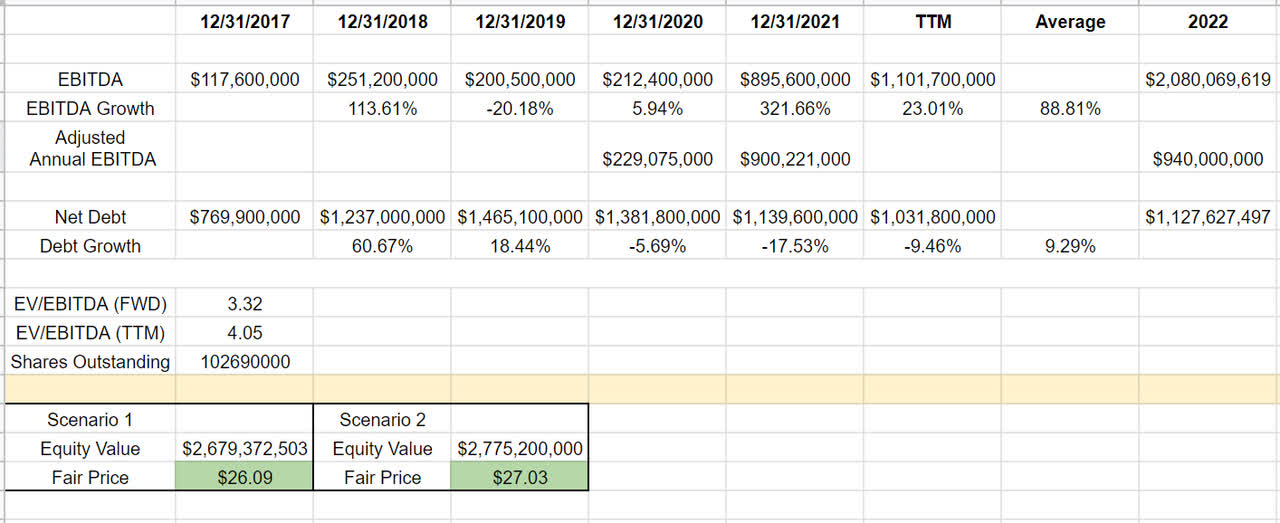

To estimate Star Bulk’s fair value, I investigated its EBITDA growth during the last five years. The company’s EBITDA grew impressively in recent years. Also, its net debt increased by over 9%, on average, during the previous years. Besides the company’s well-adjusted EBITDA at the end of 2021, its performance estimates a good amount for the end of 2022. As I explained earlier, SBLK’s adjusted EBITDA will grow to circa $940 million at the end of 2022. Moreover, I estimate that the company’s net debt amount is going to be between $1032 to $1128 million in 2022. According to the EV/EBITDA ratio in TTM and its financial data, Star Bulk’s fair value is around $27 per share (see Table 1). As it is mentioned in Table 1, Scenario 1 is based on the 9.29% average rate of increase in the net debt during the last years, and Scenario 2 is based on the TTM net debt. It is observable that in both scenarios, the stock is worth around $27 per share. All was said and done, based on my valuation, the stock is a Hold.

Table 1 – SBLK stock valuation

Author’s calculations

Summary

Despite the decreased iron ore demand, the slow fleet growth and increased imports into the European countries make Star Bulk able to benefit from the market condition. However, based on the information on the dry bulk market, I expect the financial result for the third quarter of 2022 will not be as strong as 2Q 2022 and 3Q 2021. My valuation shows that the stock is a short-term hold. SBLK is worth $27 per share.

Be the first to comment