Young777/E+ via Getty Images

Introduction

On August 11th, 2022, I wrote this article: Stanley Black & Decker: Disastrous Q2 But Fundamentals Were Worsening Long Before

My analysis left me bearish for Stanley Black & Decker (NYSE:SWK) due to some critical points. Here are a few of them:

- Enormous declines in earnings in Q2 2022:

This was due to an unpredicted decline in net income of over 80%! Revenue rose by 16% YoY, mainly led by acquisitions. The gross margin was down 800 basis points from the prior year.

- Lack of growth, also before 2022:

In the last 20 years, SWK grew its earnings by 5.95% annually, while its sales grew by 5.9%. Free cash flow per share grew from $1.84 to $10.7 (CAGR of 10.3%) until it dropped to $0.89 last year (CAGR of -3.75%)

- Declining margins which are below the subindustry average:

Margins and return metrics, apart from ROIC, also declined in the last years… Important to say is that all these metrics are way below the average of SWK’s subindustry, and that is not just now. Most of them have been for a long time

In the last quarter, the dividend amounted to $122.3 million against a net income of $79 million and free cash flow of -$590 million

The problems that caused the decline in Q2 earnings are mainly inflation, rising rates, significantly slower demand, supply chain issues and higher commodity costs. All these problems are destined to last longer, especially the slower demand.

The valuation didn’t cover all these bad things, so I initiated a sell rating. Especially in times like 2022, when many good stocks fell, there were many better buys.

I was relatively alone with this rating. Since then, 16 articles got published on SWK, with only two of them being sell ratings. The others were three hold, eight buy, and three strong buy ratings.

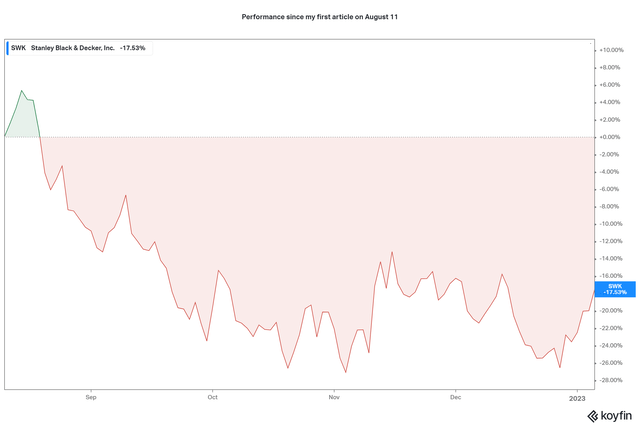

According to the share price, my sell rating wasn’t wrong:

Performance since the last article (koyfin.com)

As of today, the stock price fell by 17.5% and was down by almost 30% at its lowest point.

Today I looked at Stanley Black & Decker again to see if things have changed. Unfortunately, they haven’t. Let me show you why.

Changes since my previous article

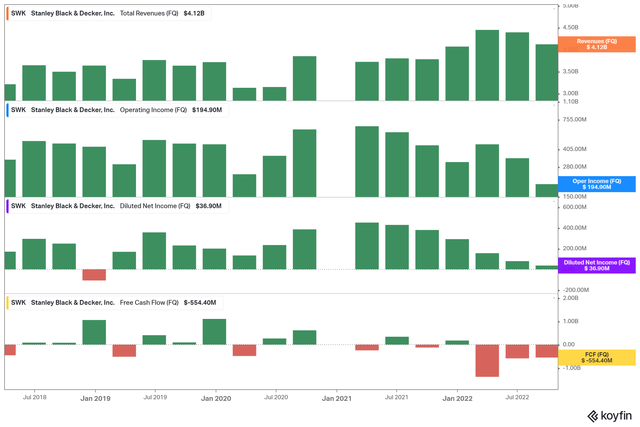

In the latest earnings report, SWK presented revenue growth of 9% YoY, led by acquisitions. In Q2, SWK could at least show 15% revenue growth YoY, so we have further negative changes here, as I expected in my previous article. The same goes for the earnings: operating income declined by 56% YoY (-42% in Q2), net income declined by 90% YoY (-82% in Q2), and free cash flow changed by -343% YoY from -$125M to -$554M in Q3 2021 and 2022 respectively (-274% in Q2).

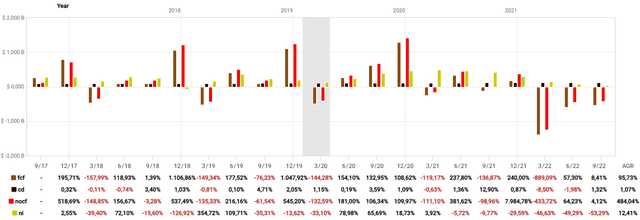

Here is a visualization of the earnings:

Sales and earnings development (koyfin.com)

Revenue is the only metric being up YoY but down QoQ. Operating and net income are down both on a yearly and quarterly basis. Free cash flow is heavily down YoY but flat QoQ. All in all, the current state of the earnings is bad and even worse than before. So the two points I mentioned in my introduction:

- Enormous declines in earnings in Q2 2022

- Lack of growth, also before 2022

have changed to the negative, as predicted.

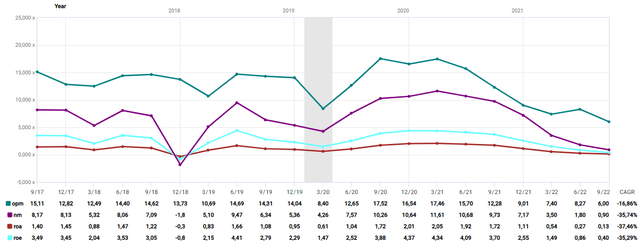

What about the margins?

Same thing. Margins have declined, too.

Operating Margin (green), Net margin (purple), ROA (red), ROE (light blue) (fastgraphs.com)

From the last quarterly earnings, the operating margin declined by 27%, the net income margin declined by 50%, the return on assets declined by 52%, and the return on equity declined by 54%. These are heavy declines QoQ, let alone YoY.

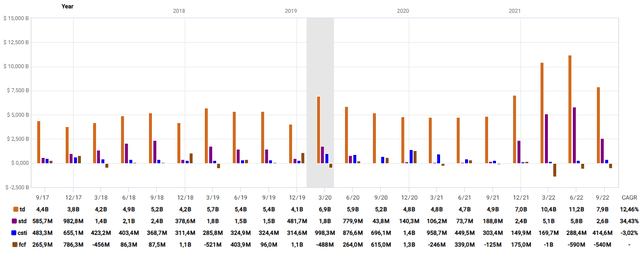

In my previous article, I also wrote about SWK’s debt. It rose substantially in the first two quarters of 2022. There is actually good news here. As you can see in the chart below, SWK managed to heavily reduce total and short-term debt while growing cash & short-term investments.

SWK’s debt, cash, and free cash flow (fastgraphs.com)

I really like to see this development, but I have to point out that debt is still above the average amount of debt before 2022 and is still not covered by free cash flow.

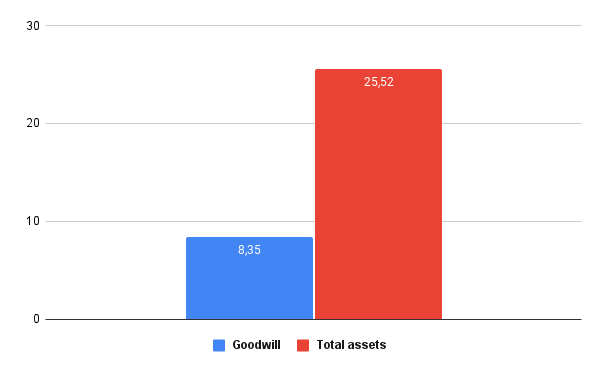

Furthermore, something I haven’t written about previously, SWK has a big amount of goodwill on its balance sheet.

SWK goodwill and total assets in billion $ (Authors chart, data from Koyfin.com)

In Q3, goodwill made up 33% of total assets. The problem with goodwill is that it could happen that a company has to write it down, which would influence the profit (at least on paper). A prominent example of this was Teladoc Health (TDOC) last year. Read more about that here.

One of the main reasons for investors to buy SWK should be the dividend. SWK is a dividend king, meaning it has paid and raised its dividend for 50+ consecutive years. SWK has a dividend yield of 3.95% and grew its dividend in Q3 2022 by 1.32%. That can barely be called growth, but considering SWK has been growing the dividend for over 50 years, I guess this is acceptable. The main problem I pointed out in my previous article hasn’t changed yet. The dividend isn’t covered. Nor with operating cash flow, free cash flow, or net income.

Dividend coverage (fastgraphs.com)

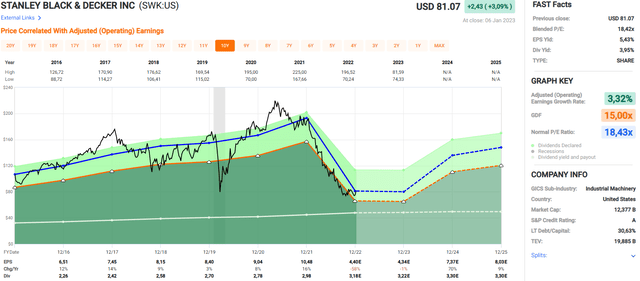

Since we saw a 17% decline in share price since my last article, I think we should look at the valuation again.

SWK historical graph (fastgraphs.com)

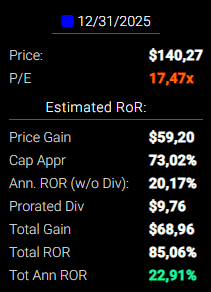

Looking at FastGraph’s historical graph, we see that SWK is exactly fairly valued according to its average earnings multiple (blue). Still, a bit above its fair value according to its growth (orange). If you measure its valuation with free cash flow, SWK is still heavily overvalued due to the negative free cash flow. Looking forward, we get a 10.24% total return annually until the end of 2025, measured by analysts’ earnings predictions. Should SWK return to its 10-year average earnings multiple, you would get a total annual return of 23%.

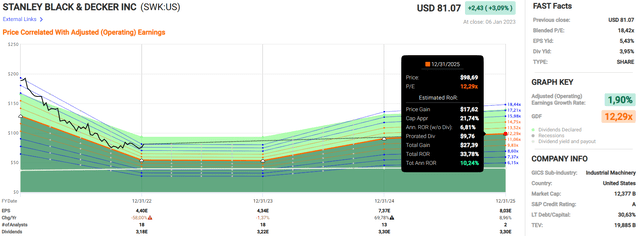

SWK forecast (fastgraphs.com)

SWK forecast (fastgraphs.com)

If you compare the FastGraphs screenshot from my previous article with the updated one, you see that analysts have heavily reduced their earnings predictions. Therefore, you should take these return forecasts with caution. I expect more reductions from analysts.

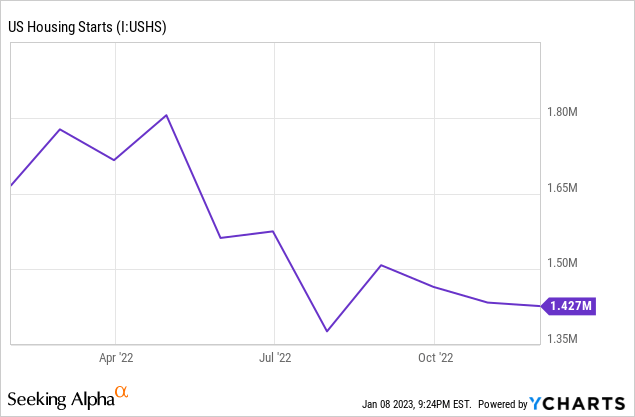

The housing market has substantially declined since my last article. Supply hasn’t changed for the better and is destined to worsen with the reopening of China.

One sign of lesser demand for SWKs products due to market conditions is the number of housing starts. It is still in a downtrend which I expect to continue.

So SWK shouldn’t see tailwinds from the housing market.

Conclusion

SWK’s earnings have further deteriorated, and the market outlook shows no improvement in the following months. Additionally, I still don’t like that SWK’s financials have been rather bad for years and are below the averages of the sub-industry. The dividend, the biggest reason to buy SWK, still needs to be covered and, therefore, is not a reason to buy this stock for me. The stock is fairly valued, with high chances of worsening forecasts. The underperformance of SWK relative to the S&P 500 in the last year will probably continue for the foreseeable future. This, and the fact that 2022 brought us a lot of good other investment possibilities, I still don’t see SWK as a buy. Many things, as laid out in this and my previous article, but especially the fact that SWK’s financials are underperforming its sub-industry, are enough for me to rate SWK as a sell. This has stayed the same as my last article.

Be the first to comment