halbergman

The U.S. economy is heading towards a recession, interest rates are sharply on the rise and expected to hit above 4.5% by the end of the year, inflation is in the 9% area and the 2-year Treasury is yielding in excess of 4%.

All this creates a toxic cocktail for REITs and BDCs and while some stocks of that sector like W. P. Carey (WPC) have been able to withstand a large selloff this year, other stocks have really suffered and today’s market-wide selloff in the REIT and BDC sector creates attractive long-term buying opportunities.

Investors are selling former high-yielding stocks in the REIT and BDC sector and instead turn towards seemingly risk-free Treasuries and thus it is important to focus on high-quality stocks with strong balance sheets, healthy leverage and manageable debt maturity ladders.

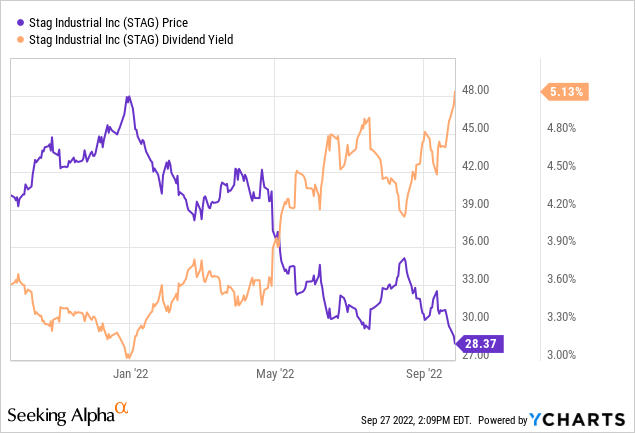

STAG Industrial (NYSE:STAG) fits all these criteria and yet the stock is down a massive 38% with its dividend yield now back at 5%.

I am buying REITs and BDCs via weekly and monthly savings plans and consider the current selloff in STAG presents an attractive opportunity.

What is going on at STAG Industrial?

STAG Industrial’s recent Q2/2022 earnings have been more than just solid featuring a comfortable FFO beat with FFO of $0.56 and revenue growth of 16.7% Y/Y to $1615M even though it marginally missed expectations by a whisker of $1.1M.

On a Y/Y basis, FFO is up a healthy $0.04 or 8% which represents very strong performance especially as we are just leaving the pandemic behind us and sequentially FFO is up a full $0.03.

Similarly impressive is same-store cash NOI growth of 4.0% which shows STAG is well-equipped for inflation. It has reaffirmed the highest level of guidance in terms of same-store cash NOI growth of 4% to 4.5% driven mostly by rental escalators and almost tripling the average same-store cash NOI growth of 1.6% over the last seven years!

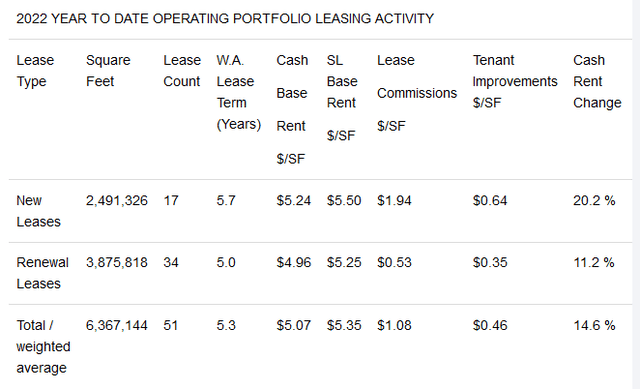

Over the course of Q2/2022, STAG Industrial signed new leases of 3.2M square feet with an average cash rent rate that is 14.1% above the previous rate which is very similar to its Q1 performance. Overall, STAG acquired nine new buildings with 1.5M square feet for $165.4M. Although STAG’s pipeline shrank by 23 buildings to 151 buildings this leaves enough room for investment activity with an estimated value of $3.0B.

Leasing Activity 2022 YTD (Seeking Alpha)

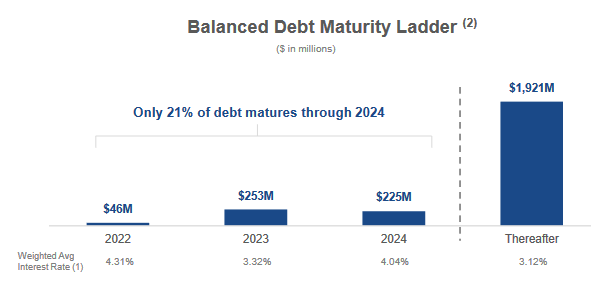

In my view, the most crucial thing right now is to take a good look at the debt profile of REITs and BDCs in order to assess their relative strength in this high-interest environment which we haven’t been confronted with for decades. And it is not only the expected peak interest level of around 5% in 2023 which is concerning but also the immense pace at which the Federal Reserve is hiking rates. The Fed caused that situation all by itself as it deemed inflation transitory for many months and was significantly too slow to react to the outbreak of the war and soaring energy prices.

STAG Industrial sports a conservative balance sheet with manageable debt maturity ladder consisting of 95.3% fixed rate debt. Its leverage ratio in terms of net debt to adjusted EBITDA is at 5.1x. Recent capital markets activity in Q2/2022 was very limited and only included a $400M private placement offering carrying an interest rate of 4.1% with a 2032 maturity. The REIT was raising further capital subsequent to quarter end by upsizing its revolving credit facility to $1B. In total, as of September 6, this leaves STAG with $20.4M of cash on balance sheet and a further $900M of undrawn revolver balance. Given deteriorating macro conditions, most notably inflation, consumption and interest rates, I would expect STAG to be very prudent and selective with that liquidity and like also trim down acquisition activity by focusing on the really good deals only.

In the short-term STAG does not really need to worry about debt repayment as only 21% of its debt matures until 2025 and as mentioned above the overwhelming majority of that is fixed with an aggregate interest rate of 3.72%.

STAG Industrial Debt Maturity Ladder (Investor Relations)

I’m very impressed by STAG’s Q2/2022 operating portfolio leasing activity as it features outstanding cash rent change and straight-line rent change with a weighted average lease term of around 9.1 years and a straight-line capitalization rate of 5.7%. That is around 2.5 years longer and 1% less than in Q1 but given that I don’t expect inflation to remain at these levels for almost a decade those cap rates are attractive and provide a great deal of planning certainty as these leases will reliably and sustainably add to STAG’s funds from operations and help continue its growth story.

STAG, which is a pure-play industrial REIT, now owns 110.5M square feet of industrial real estate spread over 559 properties across 40 states with an estimated enterprise value of above $10B which by the way is almost double STAG’s currently depressed market cap of just above $5B.

How STAG Industrial creates value (Investor Relations)

STAG is creating value for its customers and ultimately its shareholders through leasing and redevelopment. Anybody with a big purse can buy real estate but the key ingredients to a successful investment are to maximize the return by leveraging location and the asset itself. For instance in May 2021 STAG acquired a property in Greenwood, IN and lease the building within 4 months after acquisition for seven years to an investment grade tenant.

STAG is more than just an owner of industrial real estate but also an operator and sometimes even a developer with the ultimate goal to maximize the value of the asset for both the tenant and for STAG itself. That is the case with STAG’s ground-up development work at a Burlington facility where STAG build a new building on a large area of excess land it acquired.

When you invest in real estate it is easy to generate a lot of cluster risk as assets are large and expensive and it takes a big portfolio to properly diversify across all relevant dimensions such as geography, tenancy, industry and lease maturity. Since its IPO in 2011 STAG’s portfolio more than quintupled from 93 properties to over 550 today. STAG expanded from 26 states to 40 states and has turned into one of the largest owners and operators of U.S. industrial real estate.

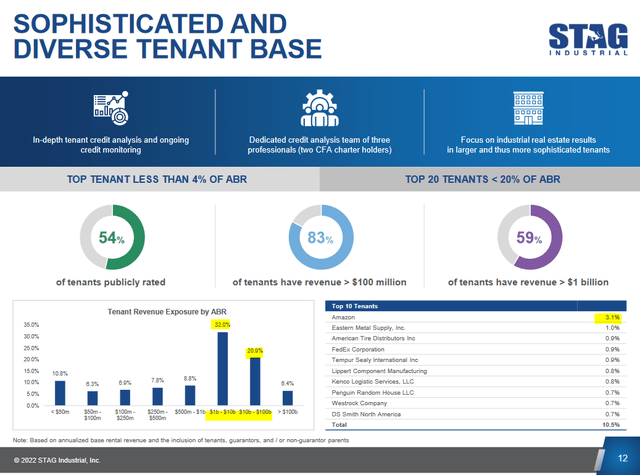

Tenant Diversification (STAG Industrial Investor Relations)

STAG’s tenant base is diverse and sophisticated with strong credit ratings and not overly reliant on a single tenant. In fact, STAG’s largest tenant is Amazon but it only makes up for 3.1% of annualized base rent and STAG’s second-largest tenant-only contributes 1.0%. In total the Top 10 tenants only account for 10.5% of total annualized base rent which essentially means that no single tenant or even a group of the biggest tenants represents a significant cluster risk to STAG’s business.

On a long-term basis, STAG is operating in a very attractive market which has received a huge boost from the pandemic with domestic warehouse space demand as high as ever. It is estimated that e-commerce penetration rate will essentially double over the next 9 years and with 40% of STAG’s portfolio tied to e-commerce activity this presents a strong and long-term secular growth driver. The best thing is that as of today, STAG’s portfolio is less than 1% of the total addressable industrial market which is estimated at $1T which leaves a long-term runway for growth.

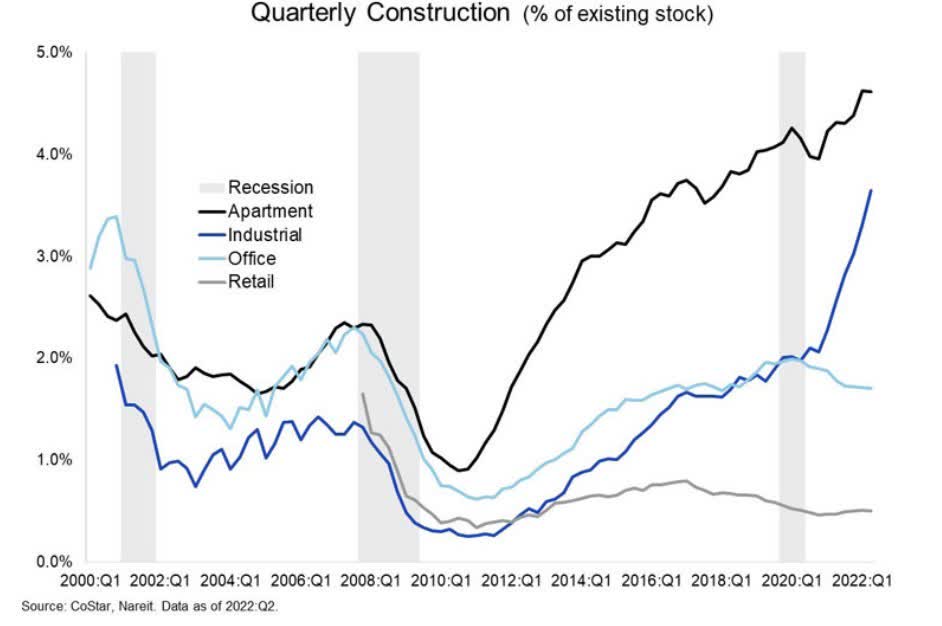

With the U.S. economy in recession which is likely worsen over the next quarters, it is very likely that e-commerce activity will decline and while that will slow down the expansion of warehouses STAG’s financially strong tenants should have enough strength to weather that storm. In fact, commercial real estate has been seeing strong demand in Q2 with especially industrial construction which is STAG’s main focus performing strongly as construction as a percent of existing stock hit a new all-time high of 3.6% despite a slowing economy.

Commercial Real Estate Activity (Seeking Alpha)

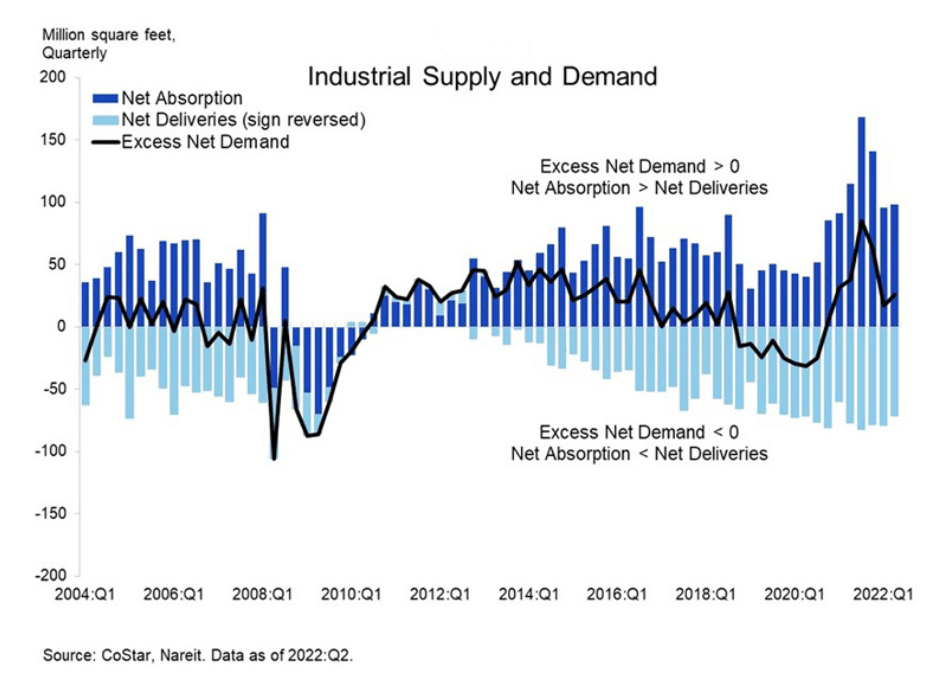

What’s more, according to a report by the National Association of Real Estate Investment Trusts (Nareit), Q2 industrial demand exceeded industrial supply which shows that despite dramatic headlines like Amazon scaling back on its warehouse operations the broad market continues to grow and continues to offer attractive opportunities for REITs at least those operating in the industrial sector.

Industrial Supply and Demand (Nareit)

Naturally, STAG is not the only company operating in that space and there are players far bigger than STAG, but from a valuation point of view, STAG remains the most attractive opportunity for me. STAG is currently trading at a 13.0x FFO multiple whereas peers like Duke Realty Corporation (DRE) with an FFO multiple of 25.6x, EastGroup Properties (EGP) with an FFO multiple of 21x, First Industrial Realty Trust (FR) with an FFO multiple of 20.9x and Prologis (PLD) with an FFO multiple of 20.1x boast significantly higher multiples.

There is always consolidation in the commercial real estate sector and recent deals by Prologis acquiring DRE for $24B or STORE Capital (STOR) going private in a $14B all-cash acquisition deal with GIC and Oak Street demonstrate the attractiveness of that sector. In hindsight the acquirers would certainly have preferred to wait a bit more given the selloff in the REIT and BDC sector which has accelerated sharply since the last week but what this means for STAG with it massively discounted price is that it has certainly become an attractive acquisition target. I wouldn’t be in favor of that as STAG is the only industrial REIT which pays monthly dividends with decades of growth ahead but that only reinforces my commitment to purchase as many shares as possible before such a potential buyout may eventually take place.

What’s in it for Dividend Investors?

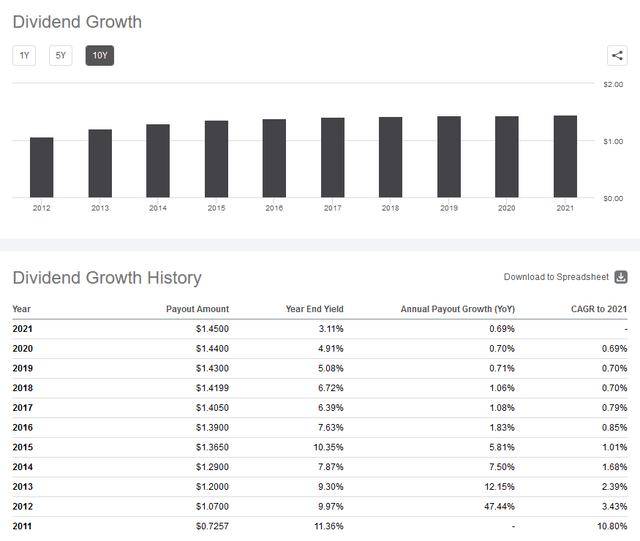

STAG Industrial has a strong history of income generation and has become one of the very few stocks that pay monthly dividends. STAG changed its dividend payout calendar from quarterly to monthly in mid-2015 and has slowly grown its dividend ever since with the latest hikes being an anemic 0.7% in 2020, another 0.7% in early 2021 and yet another 0.7% hike in January 2022. None of that is really exciting but the reason for that paltry growth is to bring down STAG’s FFO payout ratio.

STAG Dividend Growth (SeekingAlpha)

I think that mission has been accomplished now given that STAG’s FFO payout ratio for the latest quarter now stands at a very healthy 65%. Although that would theoretically allow for faster dividend growth I would expect management to remain cautious as the economic climate is rapidly deteriorating with inflation remaining hot and cost of capital soaring and thus 2024 would be a likely target for moderate dividend growth to resume.

Investor Takeaway

So far STAG Industrial is not a dividend growth machine, but it rewards dividend-hungry investors with regular and reliable monthly payments. Combined with STAG’s stock price appreciation investors can easily generate 10%+ total returns. It trades at an FFO multiple of around 13x and its dividend yield currently sits above 5% again. The current yield is certainly significantly below inflation and with this year’s dividend growth of 0.7% the dividend alone also does not protect investors from inflation, at least not today. Looking into the future though I fully expect STAG to significantly boost its dividend growth rate and with the stock price being extremely cheap today this presents very attractive income and total return prospects.

Be the first to comment