MicroStockHub

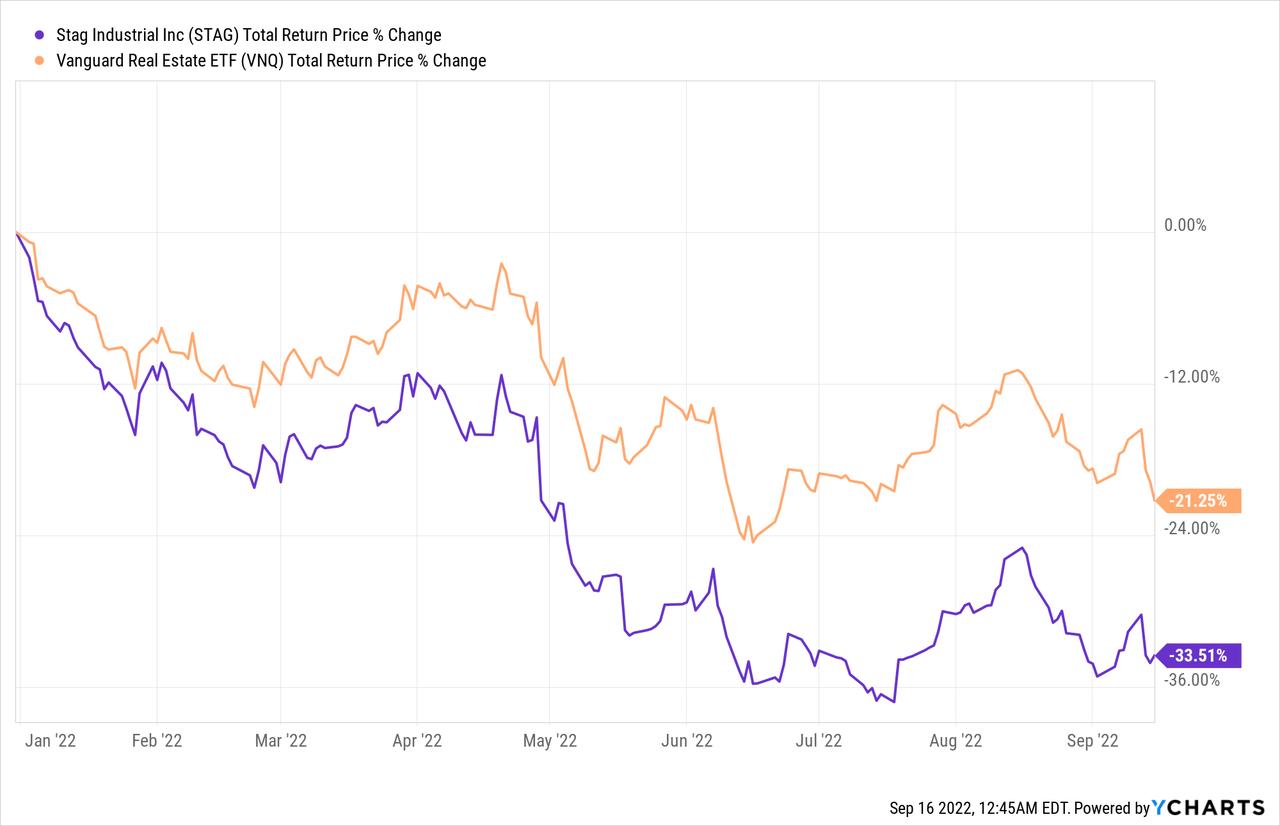

STAG Industrial (NYSE:STAG) stock has turned in an abysmal 2022 so far, significantly underperforming already poor performance from the major indexes, including the broader REIT sector (VNQ):

The reasons for this pullback range from rising interest rates weighing on the broader stock market and REITs in particular, rising recession risks which may have an outsized impact on STAG’s lower grade industrial assets, and a resetting lower of ecommerce growth expectations largely due to Amazon (AMZN) acknowledging that it had overbuilt and over hired for its warehouse operations.

That said, we believe that the sell-off in STAG stock has been overblown and therefore believe it presents investors with a compelling buying opportunity at the current share price. In this article, we will share two major reasons why.

#1. Industry And Company Fundamentals Remain Strong

While it is true that ecommerce growth estimates have declined somewhat this year as the robust COVID-19 fueled growth has retraced some, with ~40% of STAG’s portfolio handles e-commerce activity as a percentage of total retail sales declining from over 16% in 2020 to 14.3% today, the long-term rapid growth trajectory remains intact, with ecommerce share of retail exploding from 6.2% in 2014 to 14.3% today.

On top of that, the retail inventory to sales ratio – a key metric for measuring the value of industrial storage space – is expected to balloon from 1.2x to 1.5x in the coming months as supply chain headwinds continue to ease.

Last, but not least, STAG’s fundamentals remain very impressive with the company providing its highest level of same store growth guidance in its history, with 4.5% at the midpoint for 2022, up by 100 basis points from its initial guidance for the year. This strong performance is largely due to a combination of shorter downtime between leases, solid 2.5% weighted average rental escalators, and a very impressive mid-teens cash leasing spread.

With total liquidity of $920.4 million on hand compared to a market cap of ~$5.5 billion, STAG has plenty of firepower to continue investing aggressively for growth.

#2. Deeply Discounted Stock Price

In addition to robust sector and company fundamentals, STAG stock is deeply discounted at the moment. Its current P/FFO and P/AFFO ratios are clearly discounted relative to the REIT’s history, standing at 13.95x and 15.58x, respectively. Meanwhile, its five-year average P/FFO ratio is 16.22x and its five-year average P/AFFO ratio is 17.41x. On top of that, its EV/EBITDA is only 15.95x compared to its five-year average EV/EBITDA of 17.41x and its forward dividend yield is 4.81% compared to its five-year average of 4.75%. Perhaps the clearest indicator of its discount, however, is revealed in its P/NAV ratio of 0.78x, while it has historically traded in line with its NAV.

Moving forward, STAG is expected to continue generating solid AFFO per share growth, with 8.9% AFFO per share growth expected in 2022, 6.1% AFFO per share growth forecasted for 2023, and 4.5% growth anticipated in 2024. However, if private market cap rates expand in the coming months to accommodate rising interest rates, STAG will likely grow at an even faster rate.

Between its attractive current dividend yield, strong growth prospects, and deep discount to NAV which implies considerable multiple expansion potential, STAG’s total return proposition is very attractive at the moment with double-digit returns highly likely.

Investor Takeaway

After the brutal sell-off in the stock price this year, STAG is looking more attractively priced than it has in quite some time. Meanwhile, its diversified pool of real estate makes it a stable cash flow generator that should be able to weather a recession fairly well. On top of that, demand for its properties remains very high, as evidenced by its strong lease spreads. When combining its mid to high single-digit expected annualized AFFO per share growth rate with its attractive dividend yield, relatively low risk profile, deep discount relative to historical valuation multiples and current estimated private market valuation, and strong sectoral fundamentals, STAG is a Strong Buy right now.

That said, investors should keep an eye on macro developments, as a particularly severe and prolonged recession could potentially hurt STAG. Furthermore, if Amazon is forced to continue cutting back on warehouse space due to disappointing growth in its ecommerce business, it could hurt demand for some of STAG’s assets.

Overall, however, STAG is simply too cheap to ignore at these levels, and we believe that longs enjoy disproportionately attractive risk-reward here.

Be the first to comment