Andronius/iStock via Getty Images

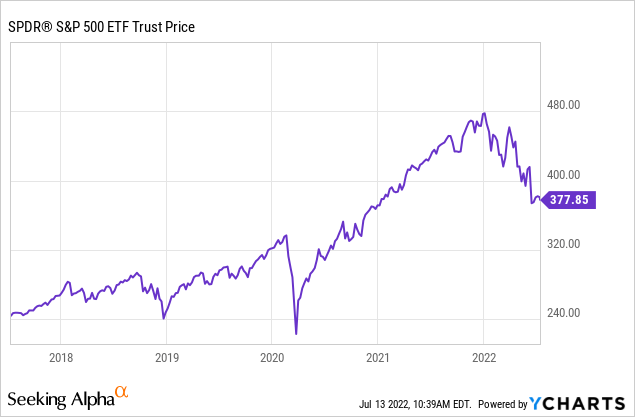

June CPI came out this morning, showing overall prices rose 1.3% for the month, while core prices rose 0.7%. The initial market reaction was to dump both stocks and bonds. As of my writing this, the S&P 500 (NYSEARCA:SPY) is down roughly 21% for the year.

The CPI numbers were really bad all around. Everyone knows that gasoline prices have skyrocketed, but the real problem for the Fed is in core areas like rent, services, and used cars. Bulls are likely to point out that gas prices have started falling since mid June. What matters far more for understanding the economy is how sticky prices like rents and other services are, and how pervasive supply chain issues have been. Now we have a crippling railroad strike potentially coming down the pike in the US, while Russia angles to shut down the Caspian Pipeline to further squeeze Europe. The possible rail strike especially is a big deal. Transportation strikes have brought down governments time and time again and in the most extreme case could knock out the electric grid in major metropolitan areas in the US during a historic heatwave. The strike will start Monday unless the White House intervenes. Meanwhile, Biden is heading to Saudi Arabia to see what the US can do to get them to pump more oil. These are big problems with no easy solutions. Inflation is not magically going away on its own. With core prices surging, the Fed now has little choice but to continue to hike rates into a stagnating economy to curb demand.

Could rapidly hiking interest rates pull the rug on years of fraud, waste, and speculation that has built up in the financial system in a market crash? I wouldn’t rule it out. Michael Burry is among the high-profile voices seeming to think so.

Where’s The Market Headed Next?

Falling prices for stocks, bonds, and housing are all likely to continue, with a market crash predicted by the likes of Burry and “Dr. Doom” Nouriel Roubini if earnings come in poor while prices stay high. I don’t think things will get bad enough to trigger a full-on crash, but I reiterate that stocks are likely to fall at least 10% to fair value–and possibly 20% or more. Ex-Treasury Secretary Larry Summers believes unemployment is likely to rise to 6% or so in the US.

Big banks mostly report their Q2 earnings this week or next week, and I think they’ll be decent. The Fed hiking rates more than expected could actually benefit some financial companies if credit losses don’t come in terribly bad. This said–guidance will be much more important than current results. Tech and consumer discretionary heavyweights report earnings toward the end of the month. Historically speaking, the S&P 500 is heavily concentrated in a few mega-cap names, and if they see a slowdown in a few key areas, it will disproportionately affect the index. If Apple (AAPL) iPhone sales are weak because of dropping consumer confidence, or ad spending drops at Meta (META) or Google (GOOG) (GOOGL), then they’ll drag down the index. Ditto for enterprise spending at companies like Microsoft (MSFT) and Amazon (AMZN).

Stock prices are a function of multiples and earnings. Earnings will impact stocks. Fed hikes should drive down the multiple that investors are willing to pay for profitable companies and to work to push junk companies out of business. The ball is now in the Fed’s court for their meeting on July 26-27. They’re likely forced to announce another 75 basis points in their next meeting and might announce more QT as well.

Bond yields popped on the CPI news, but the 10-year has since fallen back under 3% as of my writing this. These types of moves can always be from short covering, but I have some more thoughts on this. The US actually collected a ton of money in April due to people cashing in on various asset bubbles in 2021 and owing taxes. The federal government collected 19.6% of GDP in 2021, a figure only topped by the year 2000 and a couple of years during World War II. This means the government doesn’t need to sell as many bonds this quarter, which pulls yields lower for the time being. 10-year yields probably still need to go to 3.5% and stay there to balance the market. To this point, there have been some super interesting studies done on asset bubbles. The key takeaway is that bubbles redistribute huge amounts of wealth to the top 1% of households and the government at the expense of the middle class. A superior understanding of finance and economics is generally cited for why this is rather than conspiracy or fraud.

Even after today’s awful inflation numbers, the 10-year inflation breakevens are low and falling. 2.3% annually is the inflation breakeven for the next 10 years in the US. If you think this is too low, you can buy TIPS (TIP) or commodities (VCMDX). Buffett is buying loads of Occidental (OXY) along a similar line of thinking. This is puzzling. The market, on the other hand, seems to firmly believe that we will have a recession and that having one will squelch inflation. The euro is trading near parity with the dollar as markets price a deep recession for the EU economy as the Russia-Ukraine war drags on. Recession fears are also reflected in the deepening inversion of the 2-year Treasury/10-year Treasury spread, a classic recession indicator.

Key Takeaways

- June CPI came in much worse than expected. Inflation – the economic venereal disease – is not going to go away on its own after the party is over. And there are some potential supply-side minefields ahead with strikes and shutdowns of energy production. The Fed is likely to need to hike rates more than expected as a result.

- Most Q2 earnings for stocks come in between now and the end of the month. I don’t think earnings will be particularly good. Companies that can’t meet analyst estimates for earnings are likely to sell off, with the worst sell-offs concentrated in hyped-up growth companies that disappoint.

- Without massive government borrowing and stimulus supporting it like in 2021, the S&P 500 likely has another 10% downside to fair value and possibly 20% or more in a recession. With limited exceptions, investors are likely better off waiting to buy or dollar-cost-averaging than buying everything now.

- The bond market seems to be pricing an economic recession and a collapse in inflation. But the continued relevance of yield curves in the age of QE and a boom in government revenues from previous asset bubbles is an open question. Bonds are buyable here, but I don’t love the risk-reward.

What do you think about today’s inflation report? Share your thoughts below!

Be the first to comment