Zerbor/iStock via Getty Images

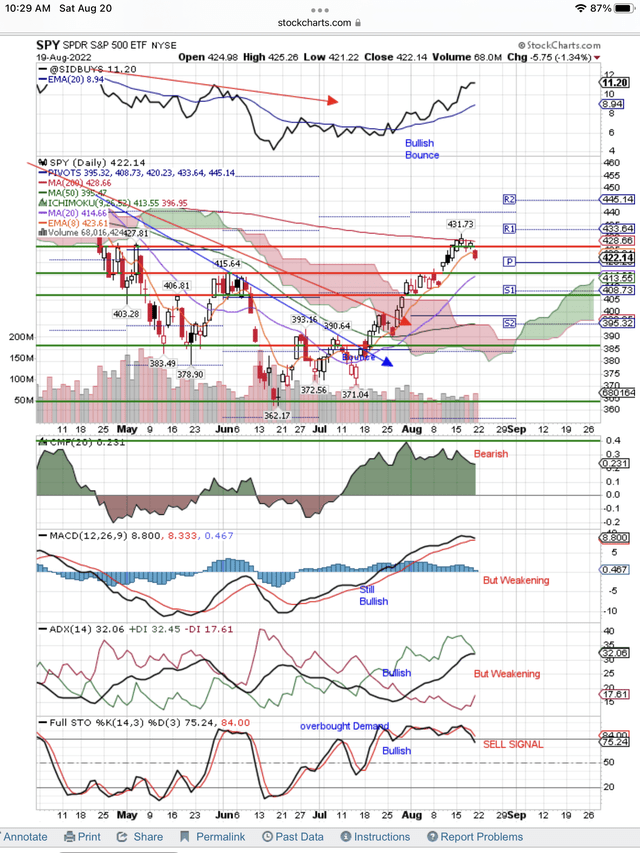

The market (NYSEARCA:SPY) chart has flashed its first sell signal and that tells us the summer rally is coming to an end. You can see this Sell Signal at the bottom of the daily chart below. Options expiration pushed the SPY down and almost triggered our preset Sell Alert at $420, which will signal to us the end of this summer rally.

Why Expect A Bounce To $428?

As we saw on the way up, there was a little price pullback after each of our Buy Alerts was triggered. We expect to see this pattern in reverse on the way down. We expect to see bounces each time one of our preset Sell Alerts is triggered. Therefore, we are now looking for one of those bounces targeting a retest of $428. The last bounce almost made it to $432.

Obviously you can see on the chart below that all the signals are weakening, as Demand is exhausted and Supply takes price down. It won’t go straight down as it did on Friday. We are going to get bounces on the way down. We expect the next bounce to target a retest of resistance at $428. This is the long term, bear market trend identified by the 200-day moving average. The first attempt to stay above this downtrend just failed.

Why Is The SPY Dropping?

The narrative changed from lower inflation and a Fed increase of only 50 basis points, back to a strong economy requiring a 75 basis point increase by the Fed on September 18th. That is only one narrative and there are many other narratives playing out in the market about the war, the dollar, the recession in Europe, the nuclear plant in the Ukraine, the winter energy crisis Russia has created for Europe and all the others we don’t know about. The SPY takes them all and puts them into price movements. We just had our first Sell Signal on the chart below. Bingo! We know what the SPY is concluding. The summer rally is coming to an end.

Another piece of technical trivia, is the break below the exponential, 8-day moving average, which is a day-traders and bots sell signal. It is of passing interest to us because it is short term, but probably indicates that our $420 Sell Alert will be triggered this week.

What Are The Other Bearish Signals For This Rally?

The S&P VIX Index (VIX) did pop on Friday and that supports our bearish thesis and maybe one last pop in the SPY to test resistance at $428. Traders love buying the VIX for a big jump as the market tanks. The day-traders also love to buy the ProShares UltraShort S&P 500 (SDS) as the market drops and switch back to the ProShares Ultra S&P 500 (SSO) for the predictable bounces from oversold, like the one we expect back to $428. They love making money in a bear market! Even if you don’t trade, you have to follow the VIX, SDS and SSO to understand what is happening in the SPY.

Conclusion

We are not in the guessing game about what the market is going to do. We let the signals on the chart tell us what the market is doing and then we act to make money trading or in our Model Portfolio. We update what we are doing every day and tell our subscribers. Or tune in next week for our weekly update. We expect our $420 Sell Alert to be triggered and we expect a bounce. We will go to cash in our Model Portfolio as the SPY reaches for $428 on what we think is the last bounce of this summer rally or “The End.” Stay tuned as the signals tell us what to do.

Be the first to comment