Cindy Shebley/iStock via Getty Images

Residential home solar provider Spruce Power (NYSE:SPRU) is now a publicly listed company after a hard pivot by XL Fleet, an entity previously concerned with converting class 2-6 internal combustion engine vehicles into either hybrid or plug-in hybrid electric systems. Consecutive quarters of high cash burn, a short seller report, and dwindling cash and equivalents position tipped management towards reinventing the business in the most dramatic fashion. The original retrofitting business now has the legacy moniker attached with the company announcing last month that it will cease all retrofitting operations, including all relevant hybrid and drivetrain-related product development and commercial activities.

Spruce Power has now sold certain battery inventory and its legacy hybrid technology to Bangkok, Thailand-based RMA Group. XL Fleet is now dead, with Spruce Power set to drive the next phase of returns after a near-constant decline of the commons since the legacy business went public via a combination with a blank check firm in 2020. The home solar business was acquired for $58 million and the assumption of around $542 million of debt. It’s been described as the largest privately held owner and operator of home rooftop solar systems in the US with 52,000 household subscribers and $83 million in revenue for the 12 months through June 30, 2022. Houston, Texas-based Spruce Power is also profitable, generating a net profit of $15 million on the back of an adjusted EBITDA of $51 million.

Why The Legacy Business Had To Go

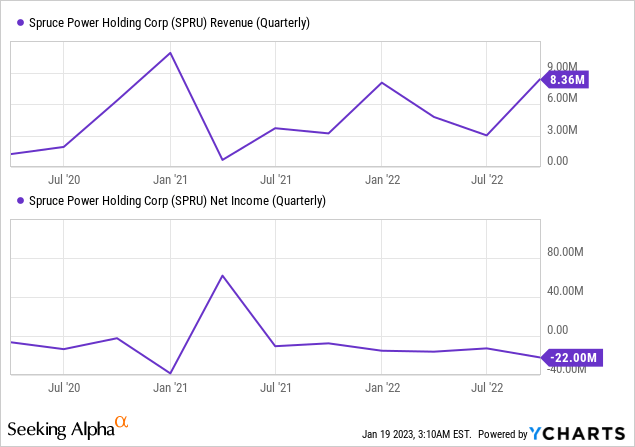

Trailing 12-month cash burn from operations for the legacy business stood at $60.7 million. The underlying economics were not healthy, with gross margins frequently negative, an overall revenue trendline that was flat with net losses that were increasing sequentially and year-over-year.

The fundamental dynamic of retrofitting was also skewed to the downside. Not only is retrofitting gas and diesel-powered vehicles with electric components a relatively mature industry with limited economic moats and plenty of players, but the solution is also only being taken on by a limited number of commercial fleet operators.

Fundamentally, the long-term growth story for the electrification of commercial vehicles was always with actual EVs being developed by traditional automakers and upstarts like REE Automotive (REE). Spruce likely gauged that fleet owners were more set to purchase these vehicles against the material level of tax credits provided for their purchase by the Inflation Reduction Act. The total addressable market for the legacy business was probably going to be forever limited, the variable cost base too high, and the overall scope of profitability constrained against a market cap that once sat at just under $4 billion.

Home Solar Set To Take The Reins

Spruce Power expects to have more than $240 million of unrestricted cash and equivalents on hand after the completion of the acquisition. The market for residential solar installs is one of the fastest-growing parts of the climate economy. The sector is set for a material ramp with the IRA providing homeowners with two separate 30% tax credits on rooftop solar systems and energy storage. Spruce Power offers a battery bundle using Tesla’s (TSLA) Powerwall and Enphase’s (ENPH) battery pack. This makes it easier for households to enhance the resiliency of their rooftop solar systems as storing energy allows demand to be better matched to supply.

This is a secular growth space with less than 2% of US homes having rooftop solar installed. Further, whilst reducing carbon emissions forms a part of the underlying driver for household demand for home solar, unit economics forms the other. Electricity bills for US households surged last year as an energy crisis led to a surge of key energy feedstock for thermal power plants from natural gas to coal. Home solar reduces this volatility for individual households. An important need as global geopolitics enters a new stage with energy becoming a tool of Russia’s energy war. Further, extreme weather events last year drove blackouts for thousands of homes across the US. This will continue to place into view the potential usefulness of solar systems as a partial hedge against any future extreme weather to homeowners.

Spruce Power is joining the ranks of other home solar companies Sunrun (RUN), SunPower (SPWR) and Pineapple Energy (PEGY) in competing for the rapidly growing US market. The company sells the power generated by its systems to homeowners through long-term agreements that require its subscribers to make recurring monthly payments. Hence, around 90% of revenues are fully contracted with payments made on a frequent basis. Spruce Power’s gross total subscriber value from long-term subscriber contracts stood at $810 million as of the end of June with an average remaining term of 13 years.

The company differs from its competition by not selling directly to homeowners. It does not have a sales team or installation technicians but has more than doubled its revenues from 2019 through the acquisition of 10 rooftop solar portfolios. Spruce Power intends to maintain this strategy post-acquisition. Overall, whilst the pivot was required and the new business looks healthier from a profitability perspective, Spruce Power is still entering an intensely competitive space. Enthusiasm should be tempered. An acquisition-led growth strategy opens up the company to execution risks and would likely get increasingly expensive from a revenue multiple-paid perspective. I remain neutral on the stock.

Be the first to comment