Candle Photo/iStock via Getty Images

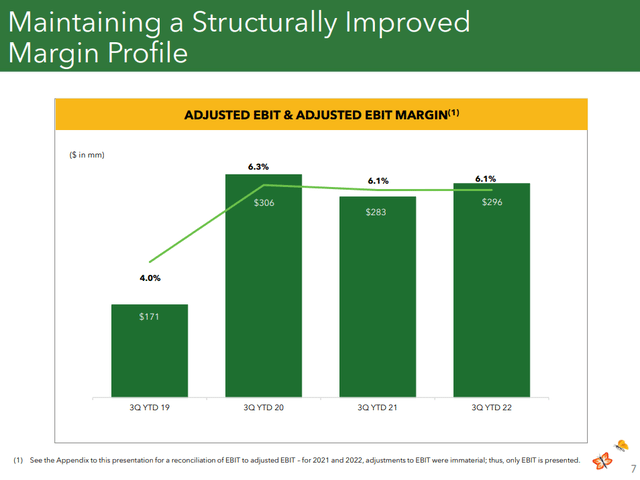

The number one takeaway we have from Sprouts Farmers Market (NASDAQ:SFM) third quarter results is that it continues to maintain its structurally improved margin profile despite a number of headwinds that include higher inflation, a weakening economy, and intense competition.

The company delivered strong third-quarter earnings, with comparable sales up 2.4% and a roughly flat EBITDA margin (7.6%) despite a rising cost environment. Online sales rose ~19%, representing around 11% of overall sales. An interesting announcement was that the company is partnering with DoorDash (DASH), which should complement the existing Instacart (ICART) partnership, and should further increase e-commerce growth.

Sprouts Farmers Market has been less promotional this year than last year, when they were testing a variety of promotional and pricing tactics. This has resulted in improved gross margins for the company and provided a nice profitability tailwind.

An interesting comment made during the earnings call was that the company is not really experiencing trade downs despite the challenging economy. In fact, many of its higher-priced categories are experiencing the most significant growth. This might be partially explained by the fact that the company is over-indexed to more affluent consumers that can continue to increase spending during tough economic periods.

Another particularly interesting comment made during the earnings call was in response to an analyst that compared shares to a coiled spring. CEO Jack Sinclair replied that he agreed that the stock is cheap. The company certainly seems to agree that shares are a good investment, given that during the quarter the company repurchased 1.6 million shares for an investment of $44 million.

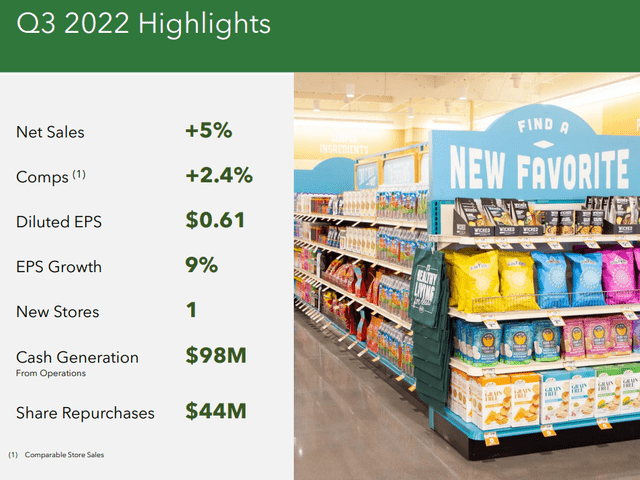

Q3 2022 Results

For the third quarter, total sales were $1.6 billion, up $81 million or 5% from the same period in 2021, driven by new stores and comparable store sales growth of 2.4%.

Q3 gross margin was 36.7%, an increase of approximately 90 basis points compared to last year’s third quarter. For the third quarter, diluted weighted average shares outstanding were down 6% from last year. Earnings per share grew ~9% to a diluted EPS of $0.61.

Sprouts Farmers Market Investor Presentation

Financials

We were particularly reassured that the company has been able to maintain its improved profit margin profile despite numerous headwinds. For Q3 2022, the adjusted EBIT margin remained at 6.1%. This is much better than where the company was in 2019, and it appears that management is doing a good job turning around the company and improving its profitability. Management believes they can maintain this improved margin.

Sprouts Farmers Market Investor Presentation

During the call, an analyst asked this very question, to which CFO Chip Molloy replied the following:

Scott, yes, I think we can maintain it. And obviously, with a 10% square footage growth, we’re going to need to comp in a place that’s probably north of two to be able to keep that stable, and we do have some costs that we have to manage through. But net-net, we think that we’re in a place where we’re certainly not going to see — we don’t believe that we’re going to see gross margins deteriorate.

We’re fundamentally — we’ve shifted the business, we’ve changed the business, it’s a different mix in the business today, and we don’t see gross margins declining at this point. So it’s really a matter of keeping that EBIT margin flat while we’re investing in new stores and managing our costs accordingly to be able to ensure that our EBIT margin stays relatively flat.

Growth

The company shared that they have done an analysis and now believe that the brand can support 1,350 total stores in the continental US. That would represent an incremental 970 stores from where the company is at today. For next year the company is planning to open at least 30 stores, CEO Jack Sinclair expressed confidence in this target:

We’re feeling pretty solid about the 30 stores. And we’ve got — as we’ve said in the last few calls, we’ve got a solid pipeline of stores well beyond the number that we need for this year. So 30 is a number that we’re feeling comfortable with. And I know this year, we got — we only got to 16.

But we’re feeling — the context of that, we understand much better as we go into 2023 and 2024 than we did in going into 2022 with all the volatility that was going on in supply chain. So all other things being equal, we’re feeling good about that number of 30 stores.

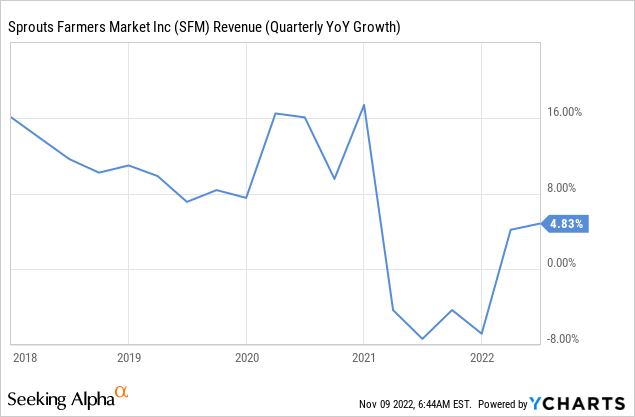

While the third quarter’s +5% sales growth is an improvement from the negative numbers the company posted in 2021, it is still far from the much higher rates the company delivered in the past. With 30 store openings expected next year, we are looking forward to higher revenue growth in the future.

Balance Sheet

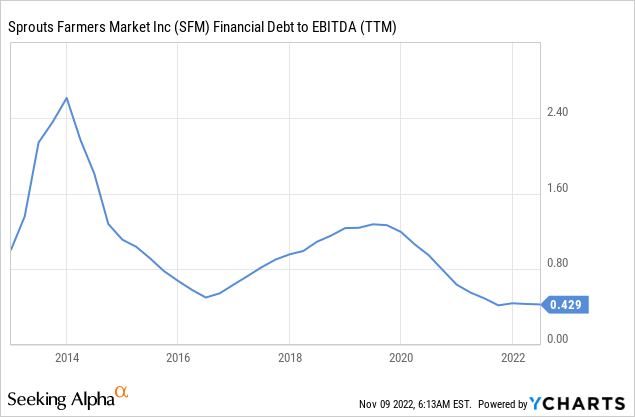

Sprouts Farmers Market ended the quarter with $316 million in cash and cash equivalents. This is higher than the $250 million it has outstanding on its $700 million revolver and $25 million of outstanding letters of credit. The company reported that its outstanding debt remains fixed with interest rate swaps through the end of this year. Given that the company has more cash and short-term investments than long-term debt, we are not concerned about the health of its balance sheet, especially given its low financial debt to EBITDA ratio.

Guidance

The company updated full-year guidance, now calling for 4.5% to 5.0% net sales growth (previously 4% to 5%) and $2.32 to $2.36 in adjusted diluted EPS (previously $2.18 to $2.26). For the fourth quarter, comparable sales growth is expected to be approximately 2% and EPS $0.35 to $0.39.

The company was not yet ready to give guidance for 2023 given the current uncertainty in the marketplace, only guiding to the opening of at least 30 new stores next year.

Valuation

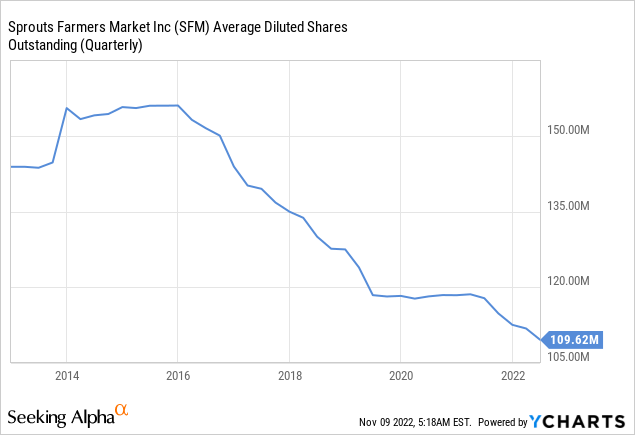

We think management is right that shares are currently cheap. The company is backing up this claim by buying back significant amounts of shares. From 2015 through Q3 2022 the company has repurchased 56 million shares and reduced shares outstanding by ~36%.

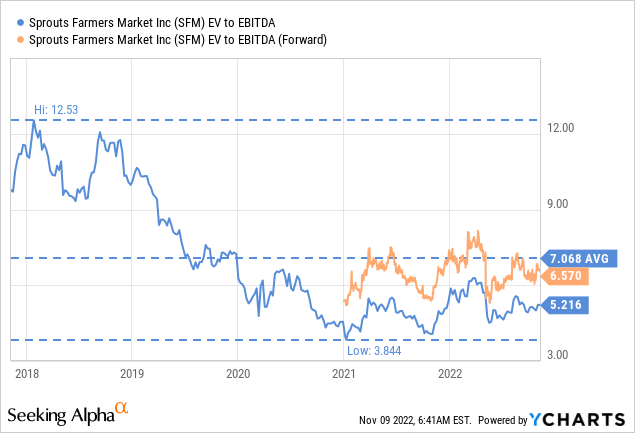

The trailing twelve months EV/EBITDA is only ~5.2x and the forward multiple is ~6.5x. Given the strength of the balance sheet and the progress with the company’s turn-around, we consider these multiples quite low and believe shares are undervalued.

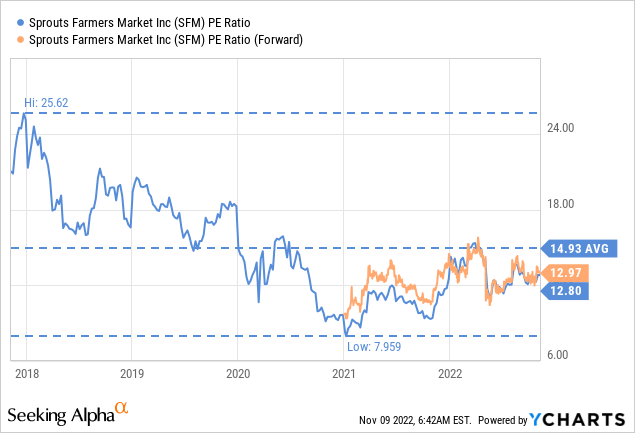

The price/earnings ratio is relatively low too, at a little under 13x for both the trailing twelve months and the forward multiple.

Risks

We consider intensifying competition the biggest potential risk for Sprouts Farmers Market, as it competes with much larger rivals that have vastly greater resources. As we pointed out in our previous article on the company, so far Sprouts has shown that it can compete with giants. It directly competes with companies like Kroger (KR), Publix, Whole Foods Market (AMZN), Albertsons (ACI), and to a lesser degree even with Walmart (WMT) and Costco (COST).

Conclusion

Sprouts Farmers Market delivered a strong third quarter, showing that its turnaround is on track. Importantly, it showed that despite numerous headwinds, it was able to maintain a high-profit margin. The company plans to increase the roll-out of new stores next year, which should help re-accelerate sales growth. While there are certainly risks, including intense competition in its sector, shares look undervalued at current prices.

Be the first to comment