Khanchit Khirisutchalual/iStock via Getty Images

When I wrote this article about Splunk (NASDAQ:SPLK) I cautioned investors about the long turnaround for cloud adoption and the short-term challenges for the business. It has been a bumpy ride since then, but Splunk has been putting in solid revenue growth, and the recent selloff brought about by recession risks has reset the stock price quite nicely. Today we will look at what improvements Splunk has made to the cloud business and discuss our updated bullish thesis on the stock.

Earnings Download

Splunk recently reported strong third-quarter results. The company saw a 40% growth in total revenue, reaching $930 million, and a 54% growth in cloud revenue, reaching $374 million. This success was driven by strong term license demand from existing customers, who continue to see value in Splunk’s mission-critical security and observability solutions powered by their unique data platform.

Despite this growth, the company called out that customers are still cautious about the timing of their cloud migrations and expansions due to ongoing macro concerns. This makes sense because even though the future is obviously in the cloud, legacy siloed operations are unlikely to break so there is minimal incentive to migrate on the cusp of a global slowdown as they will likely cause a significant increase in cost over the short term.

The major point for the investors was that the company restated its full-year targets despite noting the significant headwinds. Leadership seems confident in their ability to deliver to expectations despite being given every excuse to walk expectations back due to the weak global economic outlook in 2023.

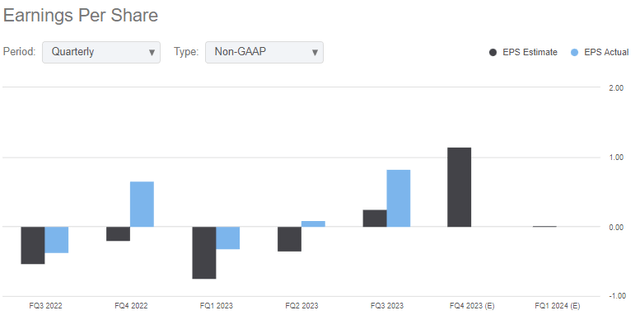

Investors have every reason to believe them. The management team has beaten handily in each of the past five quarters, and there has been significant EPS improvement.

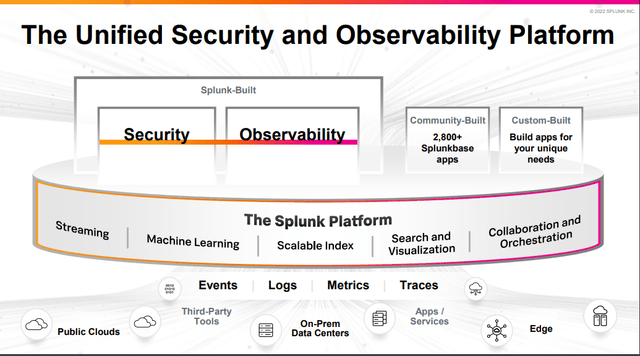

The Product

Much of the firm’s success is attributable to the product. The SaaS space is rife with competition these days, and often times the company with a comprehensive differentiated suite of products wins. Splunk offers a variety of solutions for different use cases, including data indexing, ERP options, and cyber security. Their data visualization and big data options stand out as a better alternative to traditional ERP solutions like SAP, but they offer much more than just an ERP platform. They also offer a cloud-based option, which provides more value to shareholders as the company is not capped to a fixed revenue determined by competitors, but instead, the customer pays more as Splunk’s dashboard adds more value to their business.

The challenge with cloud adoption is that many companies don’t fully understand it. Profitable relationships with Splunk usually start with a small use case, and then there is customer satisfaction-driven growth across the client’s company. That is, customers try the cloud for one aspect of their business and quickly incorporate it into different use cases across the business for synergy benefits.

The ‘old school’ option is the on-premise option which is offered with the traditional term contract. The cloud, however, is billed by client usage, which unlocks a lot of value for shareholders as the company isn’t capped to a fixed revenue determined largely by competitors, but instead, they win a contract, and the customer pays more as Splunk’s dashboard adds more value to their business.

Even in the current economic environment, there is still robust demand for digital transformation. Splunk’s technology provides unparalleled capabilities at scale and the partnership that organizations need to keep their systems secure, reliable, and performing.

Splunk’s differentiated technology has been recognized by industry experts, with Gartner naming the company a leader for the ninth consecutive year in its Magic Quadrant. The company’s security solutions have been praised by CISOs for their breadth and depth, and Splunk’s observability solutions have been recognized as leading the market in AI Ops and cloud observability by various research firms. Splunk was also rated first in IDC’s market share ratings for the IT operations analytics software market and was the market share leader by revenue in Gartner’s 2021 market share report for all software markets worldwide. Moving forward, Splunk plans to roll out an enhanced unified security console and enhance its observability cloud with new features to help customers identify and address potential issues before they become more significant problems.

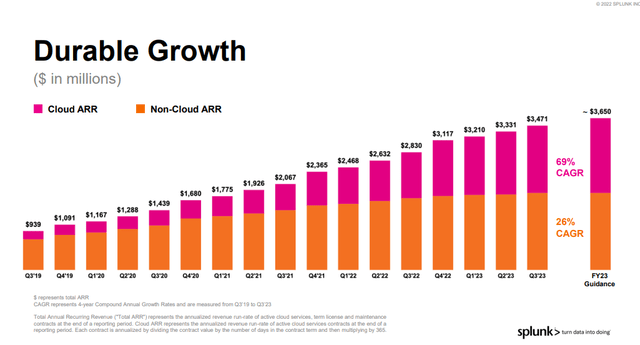

Splunk’s performance showed the value customers place in the company and its team, particularly in the uncertain macro environment. While the company saw a slower pace of cloud migrations and expansions as customers remained cautious with their budgets and reprioritized their investments, demand for Splunk remained strong. RPO bookings were $1.1 billion in the quarter, up 37% year-over-year, and total ARR was $3.47 billion, up 23%. Cloud ARR was also up 46% to $1.62 billion.

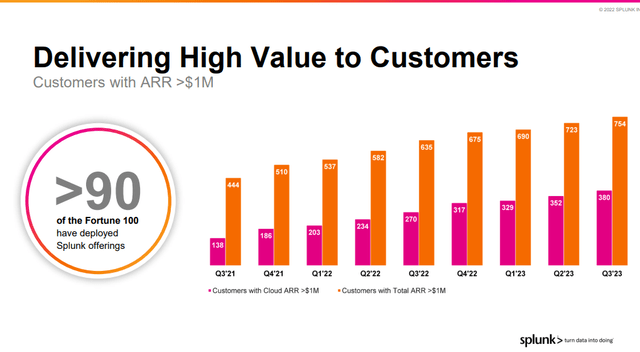

Interestingly that ARR is coming from an increasingly diverse consumer base, with both cloud and overall ARR heading in the right direction.

Splunk partners with many of the world’s largest and most innovative organizations, including over 90 of the Fortune 100. The company’s customers are passionate about the mission-critical role Splunk plays in driving their overall business resilience. During the quarter, Splunk earned six distinct Best Of awards from TrustRadius, determined entirely by customer reviews. The company also had several notable customer wins, including a significant banking and securities firm renewing its on-prem Splunk platform agreement and signing a new 3-year agreement with both Splunk Cloud and Splunk Observability Cloud.

Looking Forward

Despite the challenging macro environment, Splunk is confident in its execution plan and is reaffirming its full-year total ARR target of $3.65 billion. However, the company remains cautious on the pace of cloud migrations and expansions and is moving to a range for Cloud ARR of between $1.775 billion and $1.8 billion, primarily due to continued uncertainty of the cloud mix.

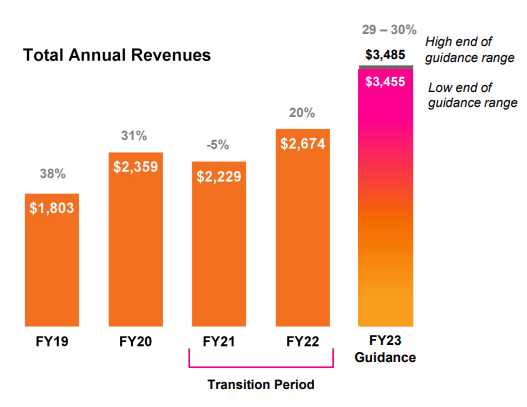

For the fourth quarter, Splunk expects total revenues of between $1.055 billion and $1.085 billion, with a non-GAAP operating margin of between 23% and 26%, reflecting expense reduction efforts and continued profitability improvement. For the full year, the company is increasing its outlook for total revenues to between $3.45 billion and $3.485 billion, reflecting its Q3 outperformance.

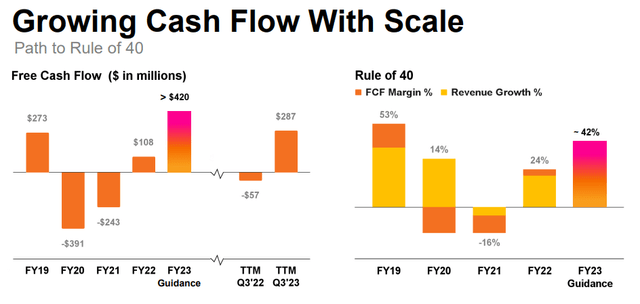

Additionally, the company is upping its total op margin expectation from 8% to between 12% and 13% and expects a higher free cash flow of $420 million from expense savings in the back half of this year.

Management is bullish about meeting its FY23 guidance despite the headwinds though the revenue mix may be less cloud-heavy.

Splunk

Valuation and Forward-Looking Commentary

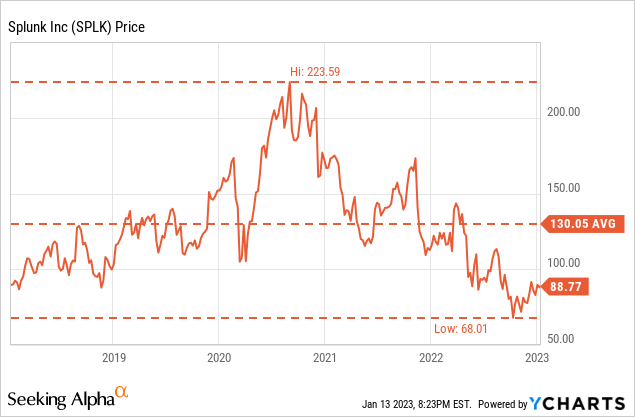

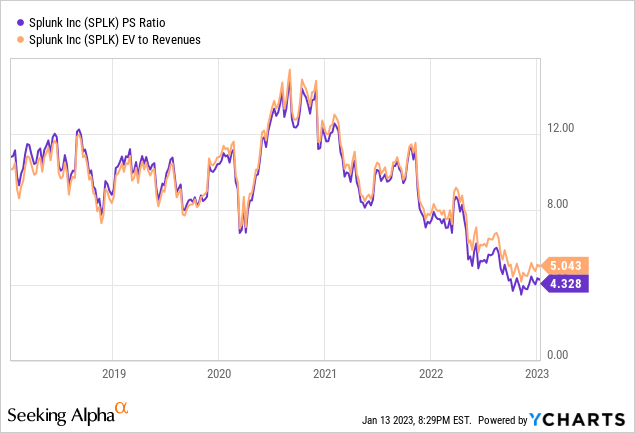

So let’s talk valuation. Looking at the chart we can see that Splunk is trading near 5 year lows and is down more than 50% from the $223 2021 highs.

Many will point out that the price of the stock was artificially inflated by the Pandemic rally that pushed any company that had anything to do with the impersonal economy or cloud computing to extended levels. We can see that even if we ignore that move, the stock is still trading well below normal levels despite consistent revenue growth over the years and building out its cloud business.

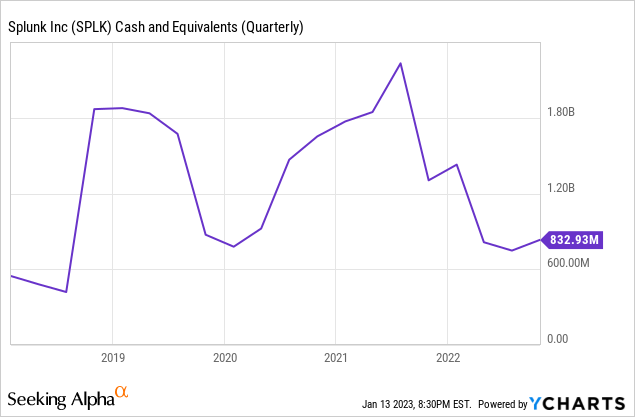

This is causing the stock to trade at multi-year lows relative to each dollar of the company’s earnings. This is atypical for a well-known tech stock with lots of cash and steady revenue growth.

In fact, the more you look into Splunk, the more there is to like. Its customer retention, revenue growth, revenue mix, and customer diversity are all encouraging, but the big missing piece is profits. The transition has been tough as one would expect, but it seriously dented profitability. But the firm looks like it is turning a corner now, and that should get investors excited.

Downside Risks

The company is not without some significant risks that investors should take note of. Until now, we have seen strong retention trends for the company, and the stock still hasn’t exactly been on fire. Cloud adoption is often not mission-critical, but it is sticky once implemented. Companies tend to get rid of their on-prem offerings to achieve synergy savings and productivity wins. This aspect of the business is quite secure, but I worry about the impact a slowdown could have on cloud adoption from a growth perspective, particularly with the depth and length of a possible weakening. There is also a tendency to consolidate or acquire SaaS companies in downturns which can be a double-edged sword. Put another way, if a big name were to acquire one of Splunk’s competitors or build out similar capabilities, they could be in trouble, but they could also be acquired. The most prominent challenge, however, is the effect high rates continue to have on growth names. The company will likely be able to weather this just fine, but it could result in some serious near-term losses for investors.

The Verdict

Here we have a sexy company in a sexy industry that has taken its knocks and is now turning things around. I have been a long-time investor in the company, and I would change course now. We may see lower prices in the short term, but for long-term-oriented investors, the current levels represent a great starting point. I rate Splunk as a buy.

Be the first to comment