Justin Sullivan/Getty Images News

Since JetBlue (NASDAQ:JBLU) and Spirit Airlines (NYSE:SAVE) announced that they would be combining their operations with a $33.50 per share offer plus a ticking fee, Spirit Airlines lost some of the hype for investors and that is not odd. The quick buck on the name has already been earned and right now the upside towards the price of $33.50 is mostly tied to progress and prospects of the combination with JetBlue. Nevertheless, it is interesting to see how Spirit Airlines is performing.

Spirit Airlines Underestimates Fuel Costs… Again

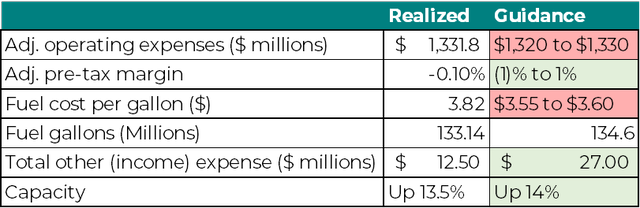

Taking a broad view on some key metrics, we see that operational expenses were marginally higher than what Spirit Airlines had guided for. Strictly speaking, adjusted operating expenses were higher than what was guided for but is only $1.80 million higher and we see that total other expenses were lower than expected absorbing the higher adjusted operating expenses. On the cost side, what we see is a returning issue with Spirit Airlines and that is that they are unable to have proper insight into fuel prices. For the third quarter they underestimated fuel costs per gallon by $0.27 to $0.22 per gallon. Capacity was guided for to be up around 14% and actual numbers were up 13.50% which I consider to be close enough to what was guided for. The small 0.5% difference partially explains the 1.2% higher difference that was accounted for which likely is linked to the capacity increase compared to 2019 that was guided for could likely range from 13.5% to 14.5%.

Overall revenues were in line with what analysts expected missing by only $10 million, while core earnings per share were 3 cents above expectations.

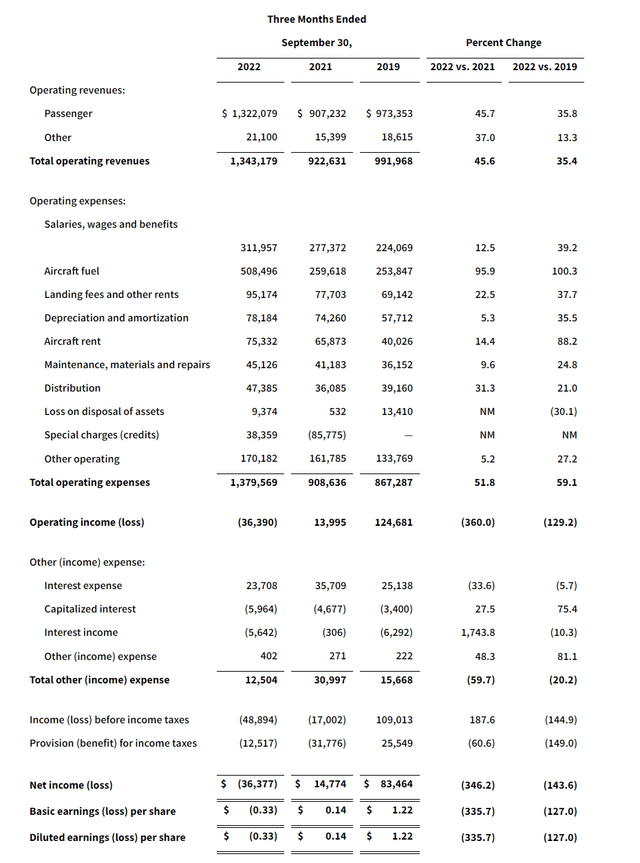

Revenues are up 35.4% compared to pre-pandemic levels on 13.5% higher capacity. So, as we see with other airlines (regional ones operating under capacity agreements excluded), we see strong unit revenue driving top line growth. Revenue per passenger rose 22% to $134 and non-ticket revenues increased 21%. So, ancillary revenues increased in line with revenue per passenger. Performance is strong but somewhat pressured by infrastructure constraints in Florida. Normally Florida to continental US operations are about 50% of the network but due to air traffic control shortages that share is lower and where possible Spirit Airlines can direct that available capacity elsewhere instead of Florida operations where they see most strength for their business.

On cost level, the operating margin was -2.7% and the margin of earnings before taxes was -3.6% compared to 1.5% and -1.8% last year. We can adjust this for special items which brings the operating margin to 0.1% for Q3 2022 and -7.7% for Q3 2021. So, we do significant improvement in operating margin and adjusted for special charges the EBIT margin was -0.8% for Q3 2022 and -11.1% for Q3 2021. Also important to note is that there was a $5 million pressure on earnings due to Hurricane Ian. Absent of this pressure, the operating margin would have been 0.5% and EBIT margin would have been -0.4%. We calculate adjusted basis numbers differently than Spirit Airlines does, but it is important to realize that there was some impact from special items.

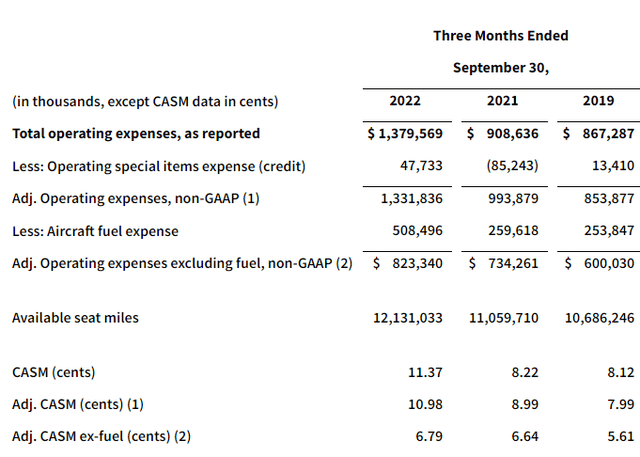

Going back to changes versus 2019, we see that revenues grew 35% but costs grew 59.1%. This is driven by higher labor rates and of course a 100% increase on the fuel bill driven by higher oil prices. However, Spirit Airline is also a bigger airline than it was three years ago. The airline has 184 aircraft in its fleet now versus 136 aircraft three years ago. This 35% fleet growth can also be seen back in some cost elements. So, it is more interesting to look at unit costs.

What we see is that unit costs are 40% higher than in 2019. That obviously reflects higher fuel prices. If we look at the adjusted unit costs excluding fuel, we see an increase of 21%. Interesting to note is that the share of salaries remained more or less stable at 38% compared to 40% a year ago. So, there is minor scale advantage realized there, which is driven by seat-mile production being pressured by the situation in Florida and continued staffing challenges. This results in aircraft utilization being down to 10.6 hours per day from 12.5 hours in 2019. If Spirit Airlines were able to better utilize its fleet on constant cost, the adjusted CASM excluding fuel would be up only 3%.

Spirit Airlines Guides For Capacity Expansion

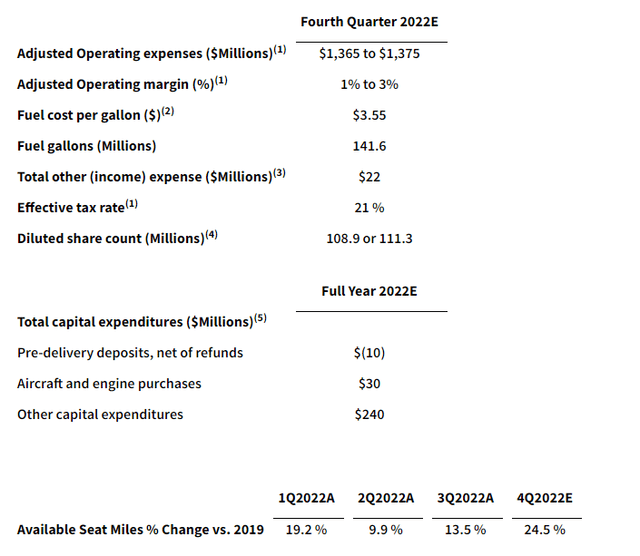

So Spirit Airlines is facing three challenges and one event. Starting with the event, Hurricane Ian will have a $5 million impact on operating income in Q4 2022 and there is a $3 million to $5 million pressure on revenue levels due to bookings softening somewhat following the hurricane. The challenges faced are mostly ATC shortages that don’t allow Spirit Airlines to deploy capacity where it wants, namely to and from Florida. Furthermore there are challenges with aircraft deliveries and pilot training which further pressure seat-mile production.

Nevertheless, for the fourth quarter capacity is expected to be up 24.5% as 13 Airbus A320neo deliveries are expected and utilization improves. Up until the end of November, Spirit Airlines has received 6 out of the 13 aircraft it expected. Airbus is pushing some deliveries into 2023, so it remains to be seen whether Spirit Airlines will actually get those 13 aircraft in. For each missed delivery they have to push 5 aircraft to higher utilization which is challenging given all the pressures faced, so it will be interesting to see whether they will get those 13 aircraft in. Either way, we see that lower expected fuel prices are providing some relief to operating expenses and capacity expansion should bring down unit costs further aiding the airline to return to profitability on adjusted basis.

For 2023, the capacity guidance came down somewhat to 60 billion to 62 billion seat miles or up 23% to 27% compared to 2022. This is due to better utilization as utilization is expected to be back to pre-pandemic levels by mid-2023, but it is 3 billion seat miles lower due to some deliveries from Airbus slipping resulting in CASM excluding fuel to be in the low to mid six cents instead of the low sixes that was aimed for. So, capacity and unit costs remain somewhat of an issue.

Conclusion: Spirit Airlines Stock Is A Hold

I believe that shares of Spirit Airlines are a hold. Investors get a $0.10 ticking fee starting in January related to the combination with JetBlue and in the meantime results should improve. However, one thing to keep in mind is that most of the improvement in margins is related to capacity expansion. We see some capacity pressure driven by supply of new aircraft to Spirit Airlines and while I do believe that at least for the coming 6 months demand for air travel remains high, it seems the only lever that Spirit Airlines currently uses to bring cost down is by significant capacity expansion. If demand softens, they will see topline pressure but the cost that the company has built to execute its schedules remain. So, that is most definitely a watch item because what we have seen so far shows that while capacity grew significantly from the levels seen in 2019, it has not shown lower unit costs. Said differently, the company is producing at a higher cost basis with higher capacity compared to 2019 only putting a damper on CASM costs and not a reduction. If demand falls through, we expect that oil prices will also soften which will be a benefit but it could also mean that Spirit Airlines has grown to a size too big for the demand profile without reducing the CASM ex. Fuel costs. All of this is the result of the currently significantly constrained market that airlines are operating in.

Be the first to comment