jetcityimage

Dear readers/followers,

Previously, I took a very neutral “HOLD” stance on SpartanNash (NASDAQ:SPTN). As of today, I still don’t own a single share in the company (sadly enough), but I’m willing to consider it if the price is right. Following the company’s failed takeover where a scenario of $50/share was shot down, I ended my article with a conservative SPTN price target of $28/share, given the current market direction, trends, and flow.

This was obviously too bearish a target. Following revisions, the company bounced up and growth has now been added to the business forecasts. However, I still believe, now more than ever, that caution regarding the company is warranted.

Let’s update on SpartanNash.

SpartanNash – Updating on the thesis

Anyone should be able to, on a high level, understand the fundamental appeal of SpartanNash. The company is a success story in food solutions and services, delivering vital ingredients and services for its consumers.

Among some of its specialized segments are included military supplying through brokers and manufacturers to military commissaries and exchanges, a fairly unique sort of segment, with a massive sort of resilience no matter the environment we’re currently in. However, the company’s largest operational segments are in grocery products, namely over 65,000 different ones, to various consumers (retail stores).

SPTN is one of the largest wholesale distributors for groceries in all of the US and reaches the Top 5 on a yearly basis if looking only at annual revenues. It also owns retail stores – around 140 of them – as well as 36 fuel centers in 9 states in the Midwest, operating under the brands of Family Fare, Martin’s Super Markets, D&W Fresh Market, VG’s Grocery, and Dan’s Supermarket, ranging from 14,000 sqft up to 90,000 sqft on a per-store basis.

It’s neither seasonal nor especially volatile overall in its natural state – it all depends on the company making scaling work. We’ve seen some inflation, wage, and fuel risks since we last wrote about the company, and these impacts have been clear here. Despite ongoing inflation and cost increases, SPTN like other businesses has been able to clear hurdles and increase both top and bottom-line results, which considering the macro we’re in, is very good.

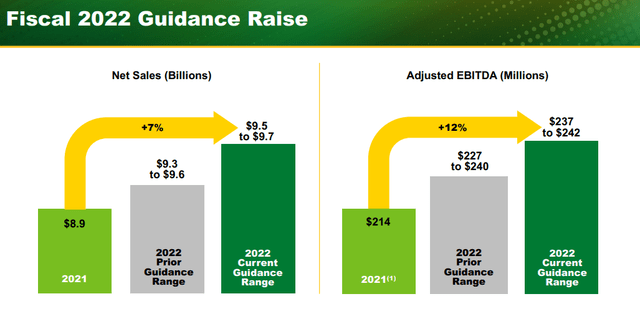

Guidance for 3Q22 – and guidance is all we have at the moment – expects the company to perform better than consensus, aside from raising the bar for the full year. This goes hand in hand with the grocery sector as a whole, that’s seen some impressive resilience towards cost increases.

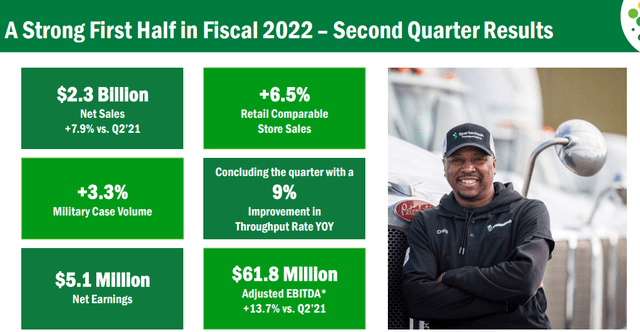

SPTN IR

To remind you, the company also raised guidance in 2Q22, so this would be the second raising of the full-year guidance in 2 quarters, which already expected bottom-line adjusted EBITDA of $240M on the high end. Increasing this could bring us to closer to $250M, and potentially double-digit in billions of sales revenue (previously below $9.6B).

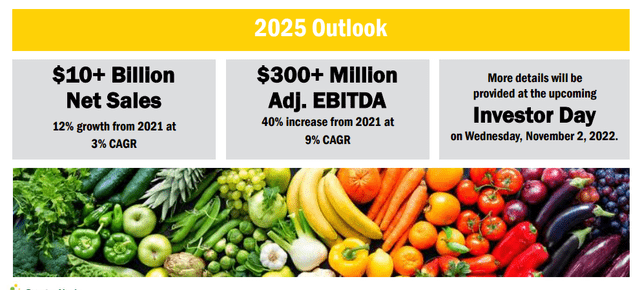

This would put the company closer in range to its 2025E targets.

SPTN IR

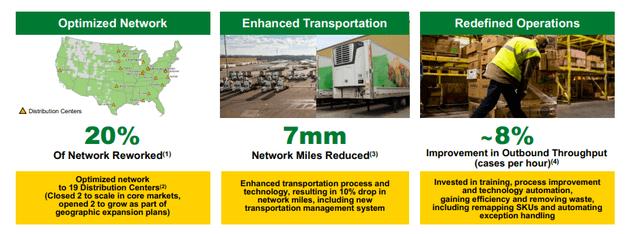

These improvements are a consequence of the company’s successive focus, which is described by management as an inflection point, now realizing the company’s transformational and growth-oriented initiatives and strategic plans. These are expected to result in more sales growth, better earnings, and lower overall costs while being able to deliver return rates to shareholders through not only buybacks but increased dividends.

The 2025 targets imply a 70% improvement in EBITDA over the 2019 fiscal and a 40% increase over the last fiscal – a massive improvement. But based on the lack of company-influenced headwinds, meaning all headwinds are either macro or something the company does not control, I don’t see many obstacles on a high level for the company – especially not with improvements as they are looking at this particular time.

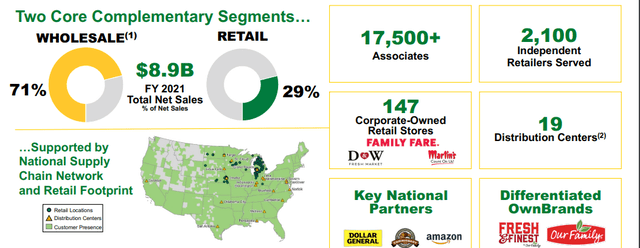

The company also went through some operational-level changes, combining the military segment with food distribution, called Wholesale. So we know that the company does have military sales under its wings, but we need to know they’re part of wholesale despite previously being their own segment.

The company also has new management, which it proudly presents on its latest report.

SPTN IR

Taking a fresh look following the failed takeover is warranted, given the company’s significant exposure and mix. around 71% of the company’s sales are attractive wholesale, with around 29% retail. With 2,100 independent retailers served, the company covers large parts of the US, when looking at a high-level map of operations that stretch from coast-to-coast.

SPTN IR

The wholesale market is a $100B+ market, and the company is addressing its positive KPIs, such as high on-time deliveries, improvement in safeties, increases in applicants for the company, and the like. SPTN is improving the supply chain for its processes, and these improvements are starting to be visible along the chain.

SPTN IR

As I mentioned in my initial article – the question I got was if this is a good investment. And based on its operations and where it works, I would say that the company can be a good investment. It’s been able to deliver good EPS growth for the past 10 years, and earnings continue to go up.

The company has clear shortfalls and risks. It still doesn’t have a credit rating. Its yield is relatively low on a sector comparison, and it does have debt above 40% of capital. This makes the case for the company difficult because, to be frank, there are plenty of opportunities out there that are much better than SpartanNash – and this picture remains especially today as the company has appreciated.

There is growth potential in SpartanNash, but there’s also a downside potential to the company that needs to be considered.

SPTN IR

The guidance change is good – but let’s view it in the context of the valuation.

SpartanNash Valuation

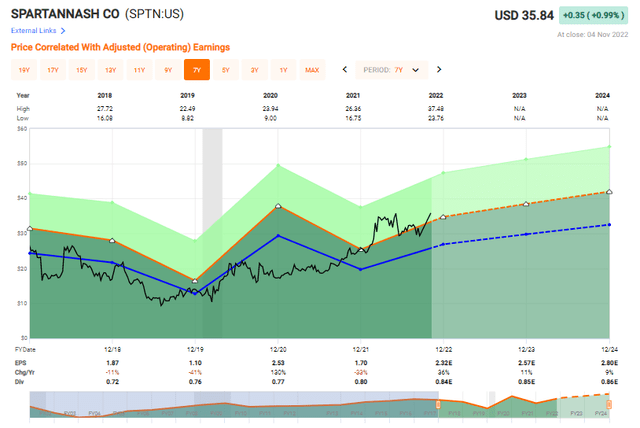

The company’s valuation has grown problematic when viewed in context to where it’s usually seen, with an average discount of around 11-12x P/E. The current P/E is around 16.12x.

My view is that this is the hallmark of exuberance following perhaps a too-strong optimism following a failed takeover and riding on the company’s positive guidance. While undoubtedly positive, this multiple puts a dent in the RoR we can expect.

SPTN is still unrated by S&P Global and its dividend is no more than 2.3%, putting it in the lower overall ranges and begging the question if it’s good enough to even consider here. My answer to the question is still “No”.

This is where we find SPTN today.

SPTN Valuation (F.A.S.T Graphs)

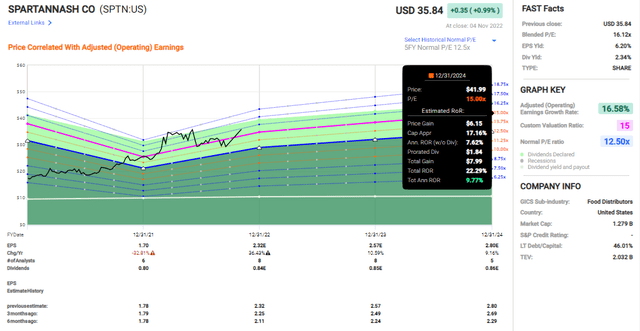

My targets are based on conservative estimates. Current forecasts using a 5-year average of 12.5x call for an upside of 1.27% annually, or no more than 2.76% to that 12.5x, which still assumes a 16.58% EPS CAGR.

Even when assuming a 15x P/E on a forward basis, the upside isn’t even double digits on an annual basis.

SPTN Upside (F.A.S.T graphs)

And remember that analysts generally fail around 45% of the time to accurately forecast SpartanNash earnings, even with a 20% margin of error on a 2-year basis. While I understand the increased positivity on the company here, and I do believe that there is some cause for some excitement, it’s my stance that the market is overreacting perhaps a little bit here.

In my previous articles, I clarified that some investors consider SPTN worth $50/share in a takeover scenario based on breaking up what the company actually does.

I thought this excessive, and so did S&P Global, at least in terms of analyst price targets – and this has proved to be right. Based on 4 analysts, the average company share price target isn’t higher than $34/share, with the highest price target of $36, making the current $35.9/share above any average given by analysts here. That is never a good position to go into an investment.

Only one of those analysts has a “BUY” rating on the stock, and the overvaluation considered the average is around 5% here.

In the long term, I am still unwilling to pay any more than 12.5X normalized P/E here – and that’s exactly the issue I have with SPTN. The current share price is well above the normalized P/E and continues to rise despite this. While I agree that operational improvements provide some value in context here, I don’t think they provide enough for me to change my stance on the company at this time.

I do not often change my price targets. The reason is that those price targets are set with what I would actually pay for the company, not a target where I “might maybe reconsider looking at the business.” When I set a “BUY” target, that PT is where I would buy the company at.

So – long story short – “HOLD” and unchanged, but with a slight PT bump of up to $30/share to reflect the improved EPS guidance and operational improvements here.

Thesis

SpartanNash is, despite some of the appeal, a company with the following thesis:

- The company lacks the sort of upside that justifies investing at the current price of $35-36/share. The takeover offer isn’t in any way concrete or confirmed, meaning there’s a very real downside potential if it does not happen, or if the price does not meet market expectations.

- The company is fundamentally appealing – but I believe at current valuation levels, there are superior investments with better upside.

- I value SPTN to a $30/share PT, with a “HOLD” rating at the current valuation.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment