AlbertPego/iStock via Getty Images

Sometimes, investing requires a great deal of patience in order to pay off. In other cases, you can start seeing the benefits in a short period of time. A great example of the latter case can be seen by looking at SP Plus (NASDAQ:SP). Best described as a facilities services provider, SP Plus offers its customers a wide array of services such as valet services, on-street parking meter collection, training and hiring for security officers and patrol personnel, and more. Thanks to generally positive financial performance, a low share price, and a recent increase in guidance by management, shares of the company have outperformed the broader market. Having said that, the overall upside scene recently has been modest compared to what we probably should be seeing. In all, I do believe that the company still warrants a ‘buy’ rating at this time.

Outperformance continues

Back in July of this year, I wrote my most recent article about SP Plus. In that article, I talked about how the company had performed over the prior few months, including from both a revenue and cash flow perspective and a share price perspective. I found myself impressed by the value that management continued to generate for the business. And at the end of the day, I ended up reiterating my ‘buy’ rating on the firm. So far, this assessment of the company has proven to be fairly accurate. While the S&P 500 is down by 8.7%, shares have generated upside for investors of 1.9%. If this is not impressive, consider that from my first article on the company in April, shares are up 17.6% compared to the 15.7% drop the S&P 500 experienced.

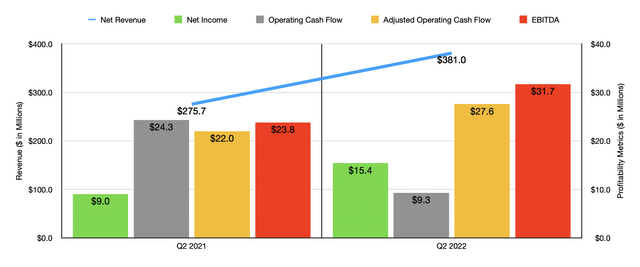

To best understand why the company continues to increase relative to the broader market, we should discuss its most recent financial performance. This would involve data from the second quarter of the company’s 2022 fiscal year, the only quarter for which data is now available that was not available when I last wrote about it. During that quarter, revenue came in strong at $381 million. That’s 38.2% higher than the $275.7 million generated in the second quarter of 2021. Some of the greatest increases the company saw involved its services activities. Revenue here jumped by 39.2% from $141.2 million to $196.5 million. This was driven largely by an increase in transient and monthly parking revenue thanks to improving business conditions as the economy reopened. Higher volume related to its baggage delivery operations and volume-based management type contracts as a result of improving business conditions were also instrumental in pushing sales here up. The company also saw strength elsewhere. For instance, services revenue grew by 27.8%, driven largely by more lease-type contracts.

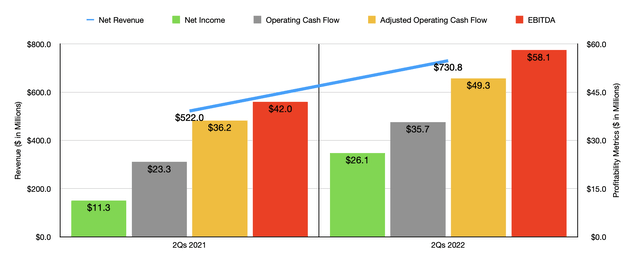

With this rise in revenue also came improved profits. Net income in the latest quarter totaled $15.4 million. That’s almost double the $9 million reported the same quarter last year. Admittedly, not every metric improved year over year. Operating cash flow, for instance, dropped from $24.3 million down to $9.3 million. But if we were to adjust for changes in working capital, it would have risen from $22 million to $27.6 million, while EBITDA jumped from $23.8 million to $31.7 million. This strong performance occurred in more than only one quarter. For the first half of the 2022 fiscal year as a whole, the picture was great. Revenue rose from $522.4 million in the first half of 2021 to $730.8 million the same time this year. Profits more than doubled from $11.3 million to $26.1 million. And as you can see in the chart above, the company’s cash flow figures all improved year over year.

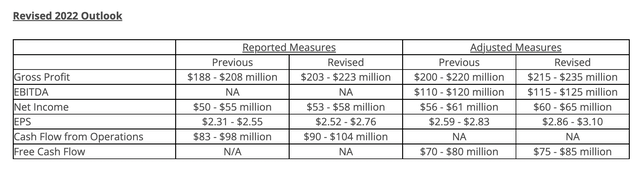

Thanks to the strong performance, management has even gone so far as to increase guidance for the 2022 fiscal year. For earnings per share, they now anticipate a reading of between $2.52 and $2.76. This compares to the prior expected guidance of between $2.31 and $2.55. At the midpoint, current guidance implies a net income of $56.4 million. The company also now expects operating cash flow of between $90 million and $104 million. Previously, the firm expected this to be between $83 million and $98 million. Unfortunately, no guidance was given when it came to EBITDA. But based on my estimates, that number should come in at around $110.4 million.

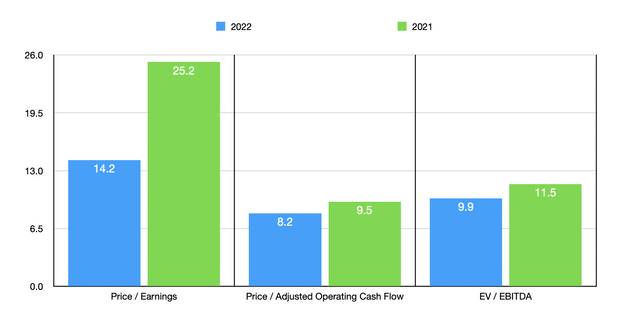

Using these figures, I calculated that the company is trading at a forward price-to-earnings multiple of 14.2. The price to adjusted operating cash flow multiple is substantially lower at 8.2. And the EV to EBITDA multiple should come in at 9.9. Even if we assume that financial performance falls back to what it was in 2021, these multiples would still look fairly attractive, with the price to adjusted operating cash flow multiple at 9.5 and the EV to EBITDA multiple at 11.5. Meanwhile, the price-to-earnings multiple does look a bit lofty in this case, coming in at 25.2.

Truth be told, I don’t really like comparing SP Plus to other companies. After all, the nature of its operations is quite a bit different than most other firms. So finding a good comparable is not exactly easy. Instead, I decided to compare the company to four facilities services operators. Doing so, I found that these four companies are trading at a price-to-earnings multiple of between 12.4 and 207.7. I also found that they are trading at a price to operating cash flow multiple of between 8.3 and 18.5. In both cases, only one of the four companies was cheaper than SP Plus. Using the EV to EBITDA approach, the range was between 6.7 and 14.5, with two of the four firms being cheaper than our prospect while another one was tied with it.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| SP Plus | 25.2 | 9.5 | 11.5 |

| Heritage-Crystal Clean (HCCI) | 12.4 | 8.3 | 6.7 |

| CECO Environmental Corp. (CECE) | 93.7 | 18.5 | 10.6 |

| BrightView Holdings (BV) | 207.7 | 16.7 | 14.5 |

| Li-Cycle Holdings (LICY) | 32.7 | 12.4 | 11.5 |

Takeaway

What data we have today tells me that SP Plus continues to generate some rather impressive results, both on its topline and its bottom line. From an earnings perspective, the stock is not quite as cheap as I would like, especially if financial performance reverts back to what it was in 2021. But given how cheap shares are from a cash flow perspective, I do believe that further upside potential exists from here. As such, I have no problem retaining my ‘buy’ rating on the company for now.

Be the first to comment