Kevin Dietsch

An Intro To Southwest Airlines

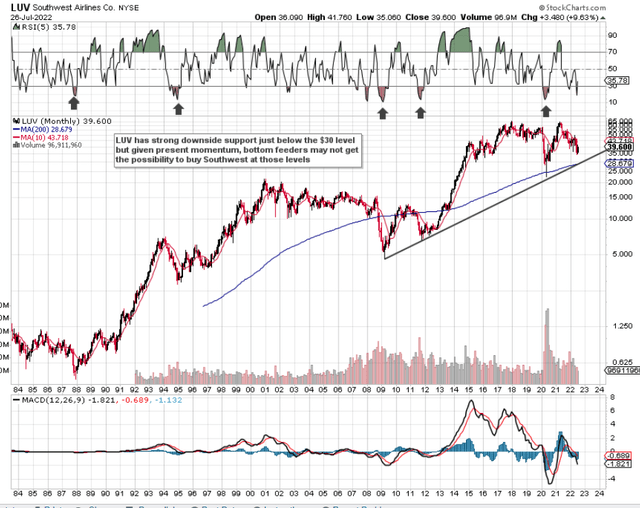

If we look at a long-term chart of Southwest Airlines Co. (NYSE:LUV), we can see that shares have once more dropped into steep oversold conditions. Long-term support can be found at just under $30 a share where the upward multi-year trend-line depicted below coincides with the stock’s 200-month moving average. It will be interesting to see if shares indeed test this support area in upcoming weeks but present trends indicate that they will not.

We state this because forward-looking earnings projections in Southwest have increased significantly in recent months as demand for the airline’s services has really come to the fore. Southwest’s GAAP earnings estimate now comes in at $1.22 per share (where March of this year was really the first month where demand began to spike) for its fiscal second quarter which will be announced on the 28th of July next. Suffice it to say, if the airline reports a significant earnings beat but more importantly delivers strong vibes for future growth, shares could spike above $40 a share and not look back.

LUV Long-Term Technical Chart (Stockcharts.com)

Momentum

This is where the “momentum” argument in airline stocks comes into play, which is an argument that many long-term investors do not concur on. First on the momentum side. To really get earnings moving in the right direction, Southwest’s labor issues (including salaries, wages, etc.) have to dissipate and its proven track record of reliability and efficiency needs to return in spades. With net profit margins hovering only around 3%, the airline needs to turn over its capital quickly in order to grow profits significantly once more. Revenues are expected to grow by more than $2 billion, for example, in the second quarter.

Tailwinds

Suffice it to say, Southwest has some clear tailwinds in play at present, such as demand outstripping supply (which should continue to lift prices) buoyed by high levels of consumer savings (strong affordability). The company’s strong balance sheet, growing profitability, and hedged fuel program should enable the airline to continue investing in its people, fleet, and operations. Compared to its peers, Southwest has a strong investment grade rating where leverage at present comes in at a conservative 56%. All of these trends, in theory, should enable the airline to report enough sales to then produce positive earnings and cash flow, which essentially is the fuel to drive the airline forward through sustained investment. The more investment dollars available to Southwest over upcoming quarters, the faster the airline can put capital to work in areas that are needed.

Long-Term Risks Remain For LUV

From a long-term perspective, however, Southwest’s valuation, for example, as well as shareholder compensation, are areas that are far more closely studied. Although Southwest’s forward GAAP earnings multiple of roughly 17 and forward cash-flow multiple of 7.60 look very appealing on the surface, investors must remember that the airline’s dividend has still not been reinstated and share buybacks have literally come to a standstill. However, the biggest concern that long-term investors should continue to have at Southwest’s present valuation is the economy for the following reason.

On the recent Q1 earnings call, the principal themes revolved around getting the network restored and increasing staff numbers significantly. Now as these investments take place over the forthcoming weeks and months, you imagine the economy takes a turn for the worse be it much higher interest rates that curtail spending or fresh Covid-related restrictions which curtail the movement of people. For Southwest to grow though, it knows it needs to put capital to work, period. However, the high fixed cost nature of this business means that rates of return can come under sustained pressure in difficult times due to the constant requirement for capital. Suffice it to say, lower sales along with elevated costs are not a good recipe for sustained internal cash-flow generation.

Conclusion

This is why, irrespective of how the airline’s second-quarter earnings turn out this week, shares at their present level are still not cheap enough for us to ponder a long-term bullish play. if indeed, as mentioned, we drop to the support area discussed earlier and there is no change in customer demand which is key, then the risk/reward play would obviously stack up in a more interesting way.

Therefore, to sum up, going solely off Southwest’s valuation, sales growth, and upward earnings revisions, investors may start buying here if Q2 numbers come in positive in any way. We look forward to continued coverage.

Be the first to comment