DaveAlan/iStock Unreleased via Getty Images

Southwest Airlines Co. (NYSE:LUV) is a leader in the airline industry that had achieved 47 consecutive years of annual profitability through 2019. Their market leadership continues to be supported by low fares and the utilization of point-to-point service, which reduces operating costs for the company. Their earnings potential is anchored by their superior balance sheet that boasts of +$16.5B in total liquidity and an investment-grade credit rating from all three ratings agencies.

The company’s focus on domestic and leisure travel is a current competitive advantage against competitors that are more exposed to the uncertainties relating to the return of business and international travel. A favorable outlook for leisure travel is supported by air travel demand that is already seeing strong bookings with TSA checkpoint figures that are higher than 2021 and 90% of 2019 levels.

Labor issues and rising fuel costs will continue to impact LUV in the near-term, but these headwinds are expected to subside over time. Cost mitigation efforts taken during the pandemic have made the company stronger and more agile. The improved liquidity and net cash position provides significant flexibility in ramping up CAPEX in the years ahead and enables the company to quickly restore shareholder payouts once they are permitted to do so per the terms of their Payroll Support Program.

For long-term focused investors interested in adding a quality airline to their diversified portfolios, shares in LUV are attractive at current levels ahead of their earnings release at the end of the month. At current pricing, shares are nearly 30% undervalued.

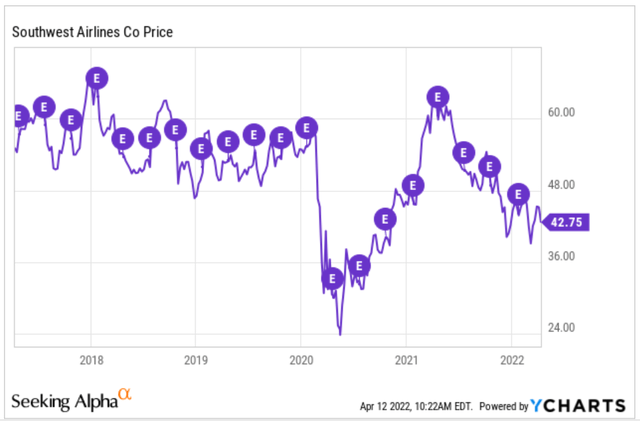

The Charts

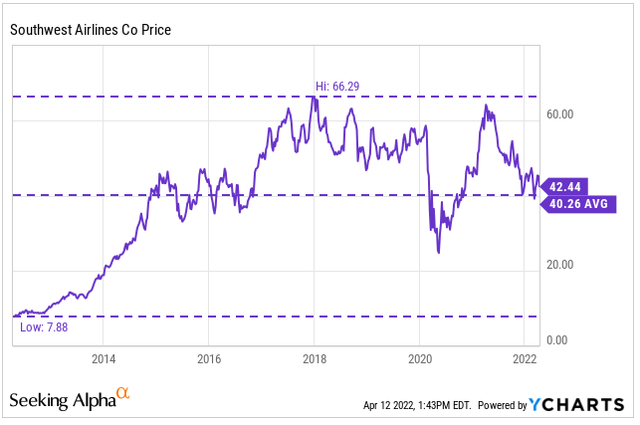

LUV is currently trading between $42-$43. This is down from their high of $66 in 2018, and it is also on the back end of their current 52-week range. Shares are, however, well above their lows from 2020 and slightly above their historical average. From a P/E standpoint, they are currently at 37x forward earnings versus a historical average of 26x.

While this seems high, earnings expectations are skewed due to the significant uncertainties of the current operating environment. On a price/book standpoint, the company is currently trading at 2.4x versus a historical average of 3x. Additionally, shares are at 11x cash flow versus a historical average of 13.9x. Some value, therefore, does exist at present levels.

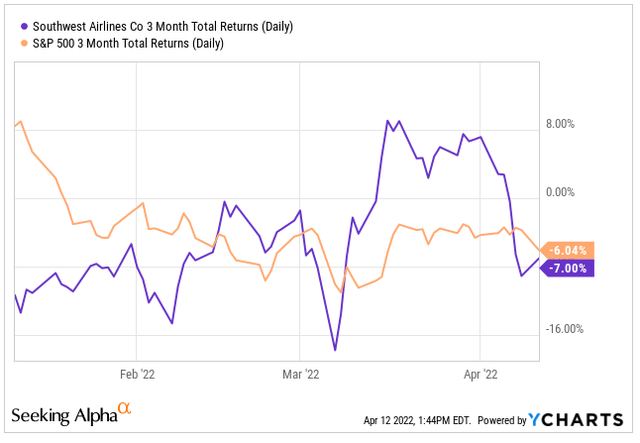

Over the past three months, LUV is down 7%. This is slightly worse than the broader S&P, which is down 6%. In recent days, the price of LUV has trended upwards in anticipation of the early release of Delta Airlines (DAL), which is due out tomorrow, April 13.

YCharts – LUV 3-MTH Returns Compared to S&P 500

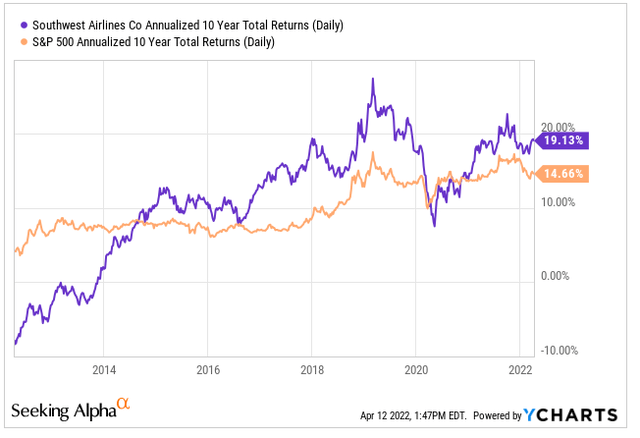

The underperformance of LUV is at odd with their historical performance against the S&P. Over a timespan of ten years, LUV has returned 19% versus returns of about 15% for the S&P. There was a period of underperformance in the years prior to 2015, but that was followed by significant outperformance from 2017 through the beginning of 2020.

YCharts – LUV 10-YR Returns Compared to S&P 500

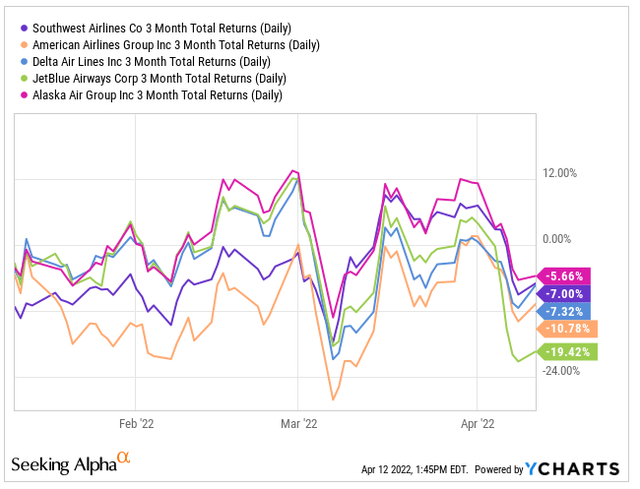

Against their competitors, LUV has been performing on par over the past three months, though they are outperforming American Airlines (AAL) by a wider gap than DAL.

YCharts – LUV 3-MTH Returns Compared to Peers

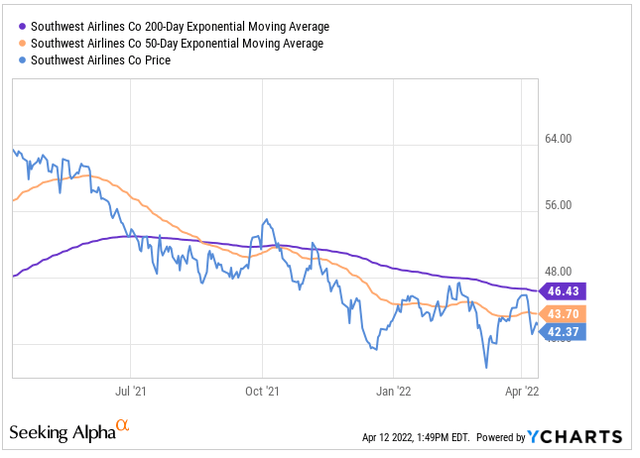

In the summer months of 2021, LUV was trading comfortably above their 200-day moving average. Towards the end of summer, however, they crossed below and have yet to maintain levels above it. Also at that point, the 200-day moving average crossed over the 50-day average. This was confirmation of bearish sentiment, which signaled further losses ahead. Currently, the stock is fighting against the 50-day threshold and is seeing some bullish sentiment ahead of earnings. Whether the company can cross the threshold and maintain levels above it will be important to monitor moving forward.

YCharts – LUV 200/50 – Day Moving Averages

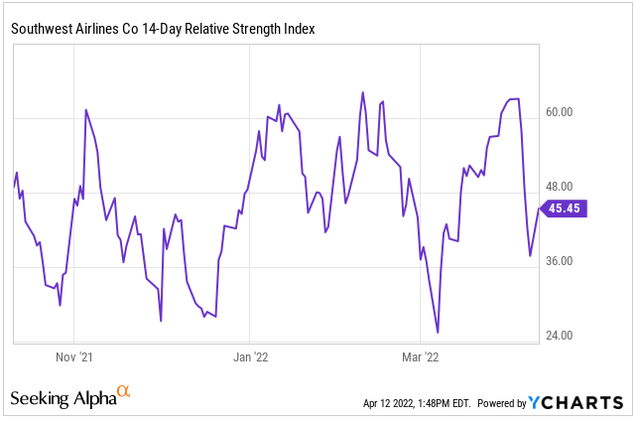

Bullish sentiment can be further supported by the RSI, which has been increasing in recent days. At one point, sentiment appeared as if it would approach overbought territory, but then it dropped quite significantly from the 60 range to the 40 range. After DAL reports tomorrow, RSI will likely settle in at a more rangebound state until LUV itself is due to report.

LUV is currently trading on the lower-end of their 52-week range and is currently underperforming against the broader S&P. Sentiment has improvement in recent days ahead of the first big earnings release from DAL. The results of DAL will provide a solid indicator of what to expect from LUV when they report later this month. Regardless of the charts or the results of earnings of a peer within the industry, an analysis of the company’s fundamentals is necessary to obtain more complete insight into the company’s prospects.

The Fundamentals

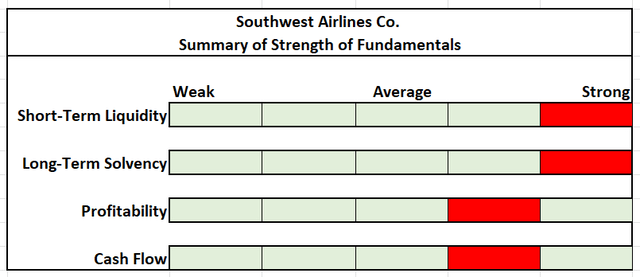

Author’s Assessment of Strength of Fundamentals

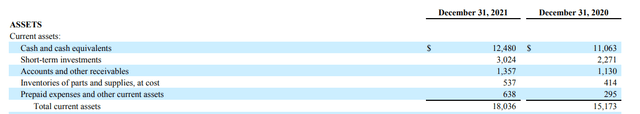

At the end of December 31, 2021, LUV had total current assets of +$18B and total current liabilities of +$9.2B. At nearly 2x total liabilities, the company’s current assets are more than enough to cover their total current liabilities. Additionally, their cash balance of +$12.5B, alone, can cover 100% of their short-term obligations. In addition to cash and cash equivalents of +$15.5B, LUV also has access to +$1B under their credit facility.

Furthermore, their A/R and inventory balances do not appear to be building up to concerning levels. In the current year, the little inventory they did carry was being sold within 15 days and A/R collections were also completed within 15 days. Thus, asset turnover is a non-issue for the company.

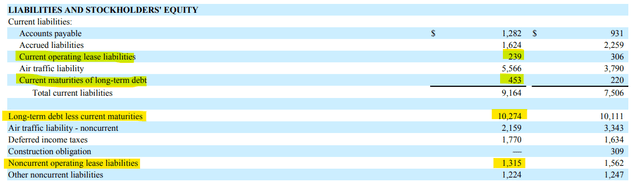

Partial Balance Sheet – Form 10-K Partial Balance Sheet – Form 10-K

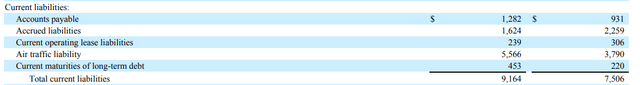

From a longer-term perspective, LUV had +$10.3B in term debt. As of December 31, 2021, aggregate annual principal maturities of debt and finance leases was +$5.2B due prior to 2027 and +$5.1B due thereafter. Repayment is not a concern since the company is in a net cash position of +$3.2B. This is represented as total debt and operating lease liabilities, less the company’s cash & cash equivalents.

Partial Balance Sheet – Cash – Form 10-K Partial Balance Sheet – Total Liabilities

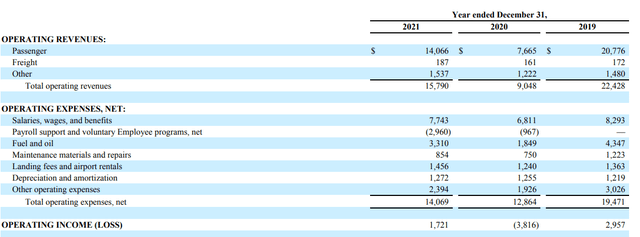

LUV’s strong balance sheet enabled the company to effectively weather the COVID-related disruptions, which resulted in total 2021 revenues that were up over 70% from 2020 but still 30% down from their levels in 2019.

In addition, operating margins were negatively affected by higher wages and fuel expenses. Margins in 2021 were 10.9% versus 13.2% in 2019. While the company is less exposed to rising fuel prices due to their fuel hedging program, higher fuel costs are expected to be continued headwinds through 2022. As such, recovery in profitability likely won’t occur until 2023 or 2024.

Partial Income Statement – Form 10-K

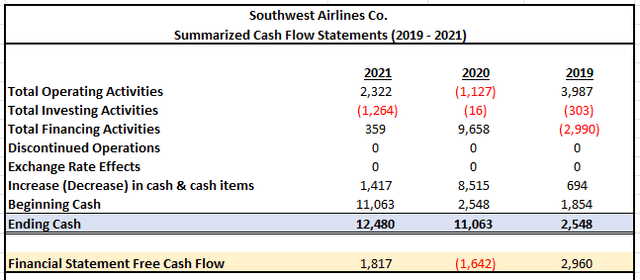

Despite the elevated costs, LUV still generated +$2.3B in operating cash flows and +$1.8B in free cash flows in 2021. In 2020, the company had net borrowings of +$9.7B, but unlike their competitors, they did not raise debt against the value of their loyalty programs.

CAPEX spending was still down in the current year, but it is expected to increase beginning this fiscal year. This year, the company expects to spend +$5B in 2021 and average +$3.5B per year thereafter. Additional debt issuance likely won’t be necessary due to their existing liquidity but that could change if cash flows are negatively impacted by rising input costs.

Author’s Summary of Cash Flow Statement

The overall fundamentals of LUV are strong and are anchored by a superior balance sheet, which holds title to an investment-grade credit rating from all three rating agencies, the only airline to have this designation. The superb rating is evidenced by the +$16.5B in available liquidity and the net cash position of +$3.2B.

Revenues have yet to recover to pre-pandemic levels, but the outlook for air travel is positive. Rising wages and fuel costs will continue to impair profitability, but over time, these costs will moderate and likely be recovered through a combination of efficiencies and higher-fares. This should support a return to pre-pandemic profitability levels in 2023 or 2024. For these reasons, it is appropriate to assess the company’s fundamentals as strong.

Upcoming Earnings

LUV is set to report earnings on April 28, 2022. On their last earnings release, they beat on both revenues and EPS. The consensus revenue estimate for the current quarter is +$4.66B, and the current estimate for EPS is -$0.35. This compares to prior year actuals of +$2.05B and -$1.71, respectively.

LUV has a history of beating on estimates for EPS but has a poor record of meeting revenue expectations. Over the past five years, shares have been relatively stable after earnings, but the swings have been more amplified over the COVID era and that is expected. DAL will be reporting tomorrow, and their results will be a good barometer for LUV. If DAL posts a strong beat paired with strong guidance, that will likely catapult LUV higher ahead of their own earnings.

YCharts – LUV Price Movements After Earnings

Primary Risks

The effects of COVID have adversely affected passenger demand and bookings for both business and leisure travel. This, in turn, has affected the company’s operating income and cash flows. Furthermore, the ability to attract and retain passengers is dependent upon the perception and reputation of the company’s commitment to the health and safety of their flights. Heightened perceptions to the risk of infection on one of LUV’s flights could result in reduced passenger demand and harm to the company’s reputation. Additionally, even once the pandemic subsides, demand for air travel may remain weak due to permanent changes in behavior, such as reduced business travel or a preference for road trips for leisure travel.

In addition to the effects of COVID, the airline industry is highly sensitive to changes in overall economic conditions. As a consumer leisure service, in times of economic turmoil with periods of significant stress to household budgets, demand for discretionary travel would be among the first to be cut as consumers reorient a larger share of their budget to more essential items. In addition, the rising cost of food and energy is a further strain on household incomes. As these costs continue to rise, consumers will increasingly cut back on discretionary spending. Since the airline industry operates on high fixed costs with flight expenses that that do not vary significantly with the number of passengers carried, small declines in the number of passengers carried could have a negative impact on the company’s results of operations.

Jet fuel and oil represented nearly 25% of the company’s operating expenses in 2021. Continued increases in the cost of fuel could significantly impact profitability if the company is not properly hedged or if they are unable to recover the costs through higher ticket fares. The ability to recover their costs is limited by the company’s reputation for historically low-fares and the highly competitive nature of the industry. In addition, the company is also reliant upon the readily available supply and timely delivery of jet fuel to the airports that it serves. A disruption in supply at any of these airports has the potential to result in flight cancellations, which would affect operations and harm the company’s brand and reputation.

In the past, the company’s lost-cost structure has been one of its primary competitive advantages. The growth of “Ultra-Low-Cost Carriers” (ULCCs), however, has challenged the company’s strengths. In some instances, ULCCs have surpassed the company’s cost advantage with larger aircraft, increased seat density, and lower wages. ULCCs have further introduced “unbundled” service offerings which appeal to price-sensitive travelers through promotion to consumers of an extremely low relative base fare for a seat, while separately charging for related services and products. Continuing competition with these carriers will force the company to respond in ways that may cut into margins and negatively impact profitability.

At the end of 2021, approximately 82% of LUV’s employees were represented for collective bargaining purposes by labor unions, making the company particularly exposed in the event of labor-related job actions. Recently, the labor union spoke out against pilot fatigue and rigorous working conditions. If the company’s response is inadequate for the union, there exists a heightened risk of work stoppage, which, should one occur, would happen at the height of the travel season. This would negatively impact the company’s results of operations and reputation among its customers.

Conclusion

LUV is a quality airline with significant earnings potential. Their focus on domestic leisure travel is a current strength that insulates the company from the uncertain fate of business and international travel. Strong bookings for the upcoming travel season and favorable long-term fundamentals in the industry further support the recovery thesis.

Anchoring the strong earnings potential of the company is a fortress balance sheet, which includes a net cash position of +$3.2B and an investment-grade credit rating from all three ratings agencies. The sizeable cash balance will be put to work on CAPEX in 2022 and beyond. After restrictions on shareholder payouts are lifted, excess cash will likely be returned via buybacks and dividends.

At present, the company’s shares are trading at 11x cash flow versus a historical average of 13.9x. At normalized multiples, shares would be worth about $55, which would be a premium of nearly 30% to current pricing. For investors who seek a comfortable flight, LUV is a quality airline for any diversified long-term portfolio.

Be the first to comment