dszc/iStock via Getty Images

Earnings of Southside Bancshares, Inc. (NASDAQ: NASDAQ:SBSI) are likely to be flattish in the coming quarters. The bottom line will receive support from moderate loan growth on the back of the Texan economy. Further, margin expansion will boost earnings. Overall, I’m expecting Southside Bancshares to report earnings of $3.31 per share for 2022 and $3.40 per share for 2023. Next year’s target price suggests a small upside from the current market price. Based on the total expected return, I’m adopting a hold rating on Southside Bancshares.

Large Securities Portfolio is Causing Problems

Southside Bancshares has a very large balance of securities, which make up around 38% of earning assets. This is a rather unfortunate balance sheet positioning in the current rate environment because of the following two factors.

- Most securities carry fixed rates. Therefore, they will hold back the average earning asset yield as deposit costs rise in the current up-rate cycle. The margin will suffer because of these securities.

- Mark-to-market losses on available-for-sale securities will erode the equity book value. As interest rates rise, the market value of securities will fall, leading to mark-to-market losses. Even after the shifting of substantial available-for-sale (“AFS”) securities into held-to-maturity (“HTM”) classification, more than half of all securities were classified as AFS at the end of September 2022. As per relevant accounting standards, the unrealized losses on AFS securities will bypass the income statement and flow into the equity book value account through other comprehensive income. The resultant attrition of the equity book value is problematic for investors because many market participants use the price-to-book value multiple to determine the fair value of banking stocks in the stock market.

The equity book value has already dropped by 22% in the first nine months of 2022. I’m expecting unrealized losses to further reduce the equity book value by 11% in the next two quarters. On the other hand, retained earnings (discussed below) will lift equity book value.

Substantial Loan Growth, Margin Expansion to Boost the Top Line

Loan growth slowed down in the third quarter from the second quarter’s level. The portfolio recorded a growth of 2.5% in the third quarter, which took the nine-month loan growth to 11.6%. This growth is unusually high in a historical context. High-interest rates will likely curb the growth momentum in the coming quarters. Therefore, I’m expecting loan growth to decline to a level closer to the historical average.

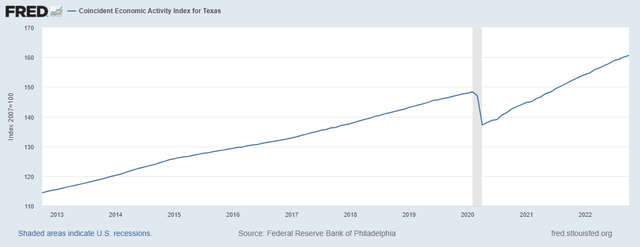

Southside Bancshares operates mainly in Texas, which currently has a satisfactory economy. Economic activity in the state is quite robust, as shown below.

The Federal Reserve Bank of Philadelphia

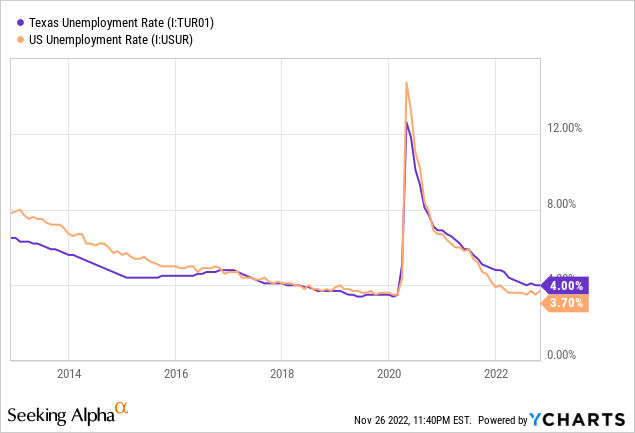

However, Texas is trailing most of the other states in terms of the health of the labor market. The state’s unemployment rate is currently higher than the national average, as shown below.

Considering these factors, I’m expecting the loan portfolio to grow by 1% in the last quarter of 2022, taking full-year loan growth to 12.7%. For 2023, I’m expecting the portfolio to grow by 4%. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 3,286 | 3,543 | 3,609 | 3,610 | 4,067 | 4,232 |

| Growth of Net Loans | 0.4% | 7.8% | 1.8% | 0.0% | 12.7% | 4.1% |

| Other Earning Assets | 2,164 | 2,588 | 2,733 | 2,994 | 2,698 | 2,752 |

| Deposits | 4,425 | 4,703 | 4,932 | 5,722 | 6,243 | 6,496 |

| Borrowings and Sub-Debt | 915 | 1,160 | 1,113 | 543 | 497 | 507 |

| Common equity | 731 | 805 | 875 | 912 | 685 | 707 |

| Book Value Per Share ($) | 20.8 | 23.7 | 26.3 | 27.9 | 21.2 | 21.9 |

| Tangible BVPS ($) | 14.6 | 17.4 | 20.0 | 21.5 | 14.8 | 15.5 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Apart from loan growth, the net interest income will also benefit from some margin expansion. Despite the large securities portfolio, the net interest margin is moderately rate sensitive. The results of the management’s interest rate sensitivity analysis given in the 10-Q filing show that a 200-basis points hike in interest rates can boost the net interest income by 7.19% over twelve months.

Considering these factors, I’m expecting the margin to grow by 10 basis points in the last quarter of 2022, following the six basis points hike in the third quarter. For 2023, I’m expecting the margin to grow by a further 10 basis points.

Earnings Likely to be Flattish

The anticipated loan growth and margin expansion will boost earnings through the end of 2023. On the other hand, a commensurate rise in operating expenses will restrict earnings growth. Meanwhile, I’m expecting the provisioning expense to remain at a normal level through the end of next year. I’m expecting the net provision expense to make up around 0.30% of total loans in 2023, which is close to the average for the last five years.

Overall, I’m expecting Southside Bancshares to report earnings of $3.31 per share for 2022, down 4.7% year-over-year. For 2023, I’m expecting earnings to grow by 3.0% to $3.40 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 172 | 170 | 187 | 190 | 212 | 238 |

| Provision for loan losses | 8 | 5 | 20 | (17) | 2 | 4 |

| Non-interest income | 41 | 42 | 50 | 49 | 40 | 42 |

| Non-interest expense | 120 | 119 | 123 | 125 | 129 | 146 |

| Net income – Common Sh. | 74 | 75 | 82 | 113 | 107 | 110 |

| EPS – Diluted ($) | 2.11 | 2.20 | 2.47 | 3.47 | 3.31 | 3.40 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Low Total Expected Return Justifies a Hold Rating

Southside Bancshares has a long-standing tradition of increasing its quarterly dividend every year. The company also pays a special dividend in the last quarter of the year. Given the earnings outlook, I’m expecting the company to increase its quarterly dividend by $0.02 per share to $0.36 per share in the first quarter of 2023 and maintain the special dividend at the current level of $0.04 per share. The earnings and dividend estimates suggest a payout ratio of 44% for 2023, which is close to the five-year average of 53%. Based on my dividend estimates, Southside Bancshares is offering a forward dividend yield of 4.1%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Southside Bancshares. The stock has traded at an average P/TB ratio of 1.89 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 14.6 | 17.4 | 20.0 | 21.5 | ||

| Average Market Price ($) | 34.3 | 34.1 | 29.5 | 38.6 | ||

| Historical P/TB | 2.35x | 1.96x | 1.48x | 1.79x | 1.89x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $15.5 gives a target price of $29.4 for the end of 2023. This price target implies a 19.4% downside from the November 25 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.69x | 1.79x | 1.89x | 1.99x | 2.09x |

| TBVPS – Dec 2023 ($) | 15.5 | 15.5 | 15.5 | 15.5 | 15.5 |

| Target Price ($) | 26.3 | 27.9 | 29.4 | 31.0 | 32.5 |

| Market Price ($) | 36.5 | 36.5 | 36.5 | 36.5 | 36.5 |

| Upside/(Downside) | (27.9)% | (23.6)% | (19.4)% | (15.1)% | (10.9)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 13.7x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.11 | 2.20 | 2.47 | 3.47 | ||

| Average Market Price ($) | 34.3 | 34.1 | 29.5 | 38.6 | ||

| Historical P/E | 16.2x | 15.5x | 11.9x | 11.1x | 13.7x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.40 gives a target price of $46.6 for the end of 2023. This price target implies a 27.9% upside from the November 25 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.7x | 12.7x | 13.7x | 14.7x | 15.7x |

| EPS 2023 ($) | 3.40 | 3.40 | 3.40 | 3.40 | 3.40 |

| Target Price ($) | 39.8 | 43.2 | 46.6 | 50.0 | 53.4 |

| Market Price ($) | 36.5 | 36.5 | 36.5 | 36.5 | 36.5 |

| Upside/(Downside) | 9.2% | 18.5% | 27.9% | 37.2% | 46.6% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $38.0, which implies a 4.3% upside from the current market price. Adding the forward dividend yield gives a total expected return of 8.3%. Hence, I’m adopting a hold rating on Southside Bancshares.

Be the first to comment