xijian/E+ via Getty Images

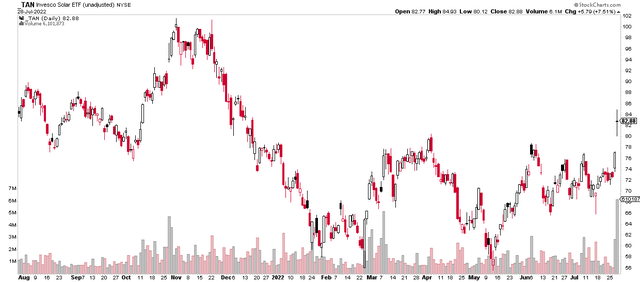

Solar stocks spiked on Thursday following news Wednesday night that Congress was working on an overhauled and light version of the dubious Build Back Better plan. The Inflation Reduction Act included many provisions that would benefit renewable energy providers through tax credits. The Invesco Solar ETF (TAN) rose more than 7% to a fresh year-to-date high on the news. Other alternative energy stocks rallied, too.

Solar Stocks Shine Following Renewable Energy Tax Credit Proposal

One solar company is at the heart of it all. SolarEdge Technologies (NASDAQ:SEDG), a 10% weight in TAN, nearly made a multi-year high on Thursday but settled for just a 4.9% advance. There remains uncertainty as to how much of the bill actually makes it through to law.

According to Bank of America Global Research, SolarEdge is a leading global power electronics company headquartered in Israel. SEDG designs and sells semiconductor-based DC optimized inverter and battery systems – comprising of DC optimizers to regulate output at the module level, a string inverter to convert DC electricity to AC, and a DC-coupled battery to store electricity. SEDG sells its products to solar installers, EPCs, and distributors globally with the largest focus on North America and Europe. The $19 billion market cap Information Technology semiconductor stock is also impacted by goings on in the Energy sector and the chip space.

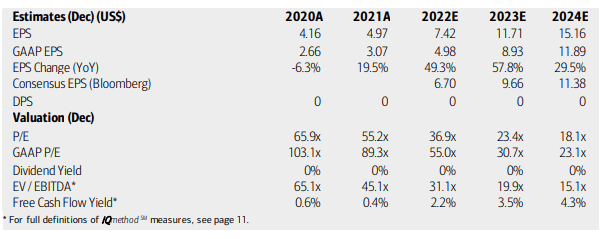

BofA analysts expect SEDG earnings to grow sharply through 2024, rising at a clip in the 30% to 60% range per annum. They are more bullish than the Bloomberg consensus estimate. Given the massive EPS growth rate, it is expected that SolarEdge’s P/E ratio is sky-high at 110 times last year’s earnings, according to The Wall Street Journal. The earnings multiple should come down if the stock price remains confounded in its recent range. The company does not pay a dividend, but it does have positive free cash flow.

SolarEdge: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

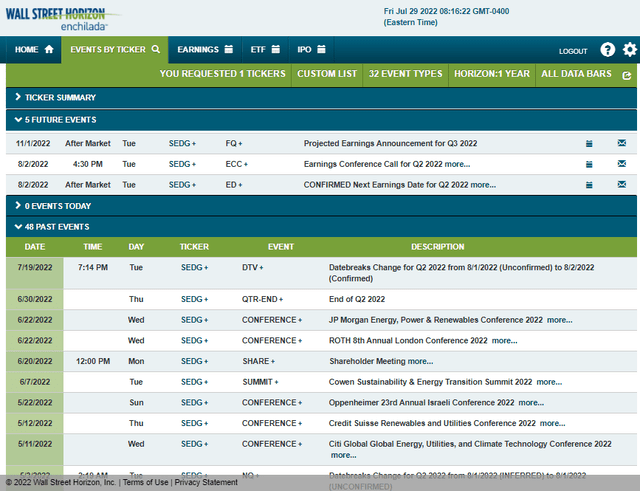

SEDG has a confirmed Q2 earnings date Tuesday, August 2, AMC, according to Wall Street Horizon, with a conference call to follow. The average of 19 analysts covering the stock expect EPS to come in at $1.39 per share.

Corporate Event Calendar: Earnings On Tap

The Technical Take

With so much news (noise) surrounding SolarEdge, what does the chart say? It’s about as basic as it gets considering there is no trend. There’s clear resistance in the $375 to $390 range while support is found in the $200 to $207 area. That range should be played until there is a definitive breakout. A bullish move above $380 (closing basis) would trigger a measured move price objective to near $460 while a bearish breakdown below $200 could send shares to $120.

SEDG: A Frustrating Trading Range For This Growth Stock

The Bottom Line

There is a lot to be bullish about on SEDG. Strong earnings growth and positive news from Washington are certainly tailwinds for this solar and chip stock. We will know more after Tuesday’s earnings announcement. Still, a defined trading range frustrates the bulls. Traders can play that range or wait for a bullish breakout or bearish breakdown.

Be the first to comment