Rich Fury/Getty Images Entertainment

SoFi Technologies (NASDAQ:SOFI) has been one of my bullish convictions on the growth side of my portfolio. Speculation around the extended student loan moratorium has been a dark cloud hanging over SOFI. When SOFI provided 2022 guidance last month, they explicitly stated that their projection was predicated on the Student Loan Moratorium ending May 1st. That business segment contributed to top and bottom lines throughout the 2nd half of the year. This has been a risk that Anthony Noto has been clear about and never shied away from the reality that another extension could occur.

Well, on April 6th, 2022, President Biden extended the pause on student loan payments another 4 months until August 31st. The news caused a flurry of analyst activity and a devastating trading session on April 7th as shares of SOFI opened at $8.27, down $0.48 cents from the previous close, and dropped to a session low of $7.64. Shares finished off the session lows above $8, which is a far cry from inching past the $10 mark just days prior and the rally back into the $20s going into the end of 2021. If an extension on student loans is the breaking point, then SOFI isn’t the stock for you. Nobody likes to see their investments in the red, especially when they become deep into the double digits, but SOFI has always been an investment based on the future. Nobody can predict what will happen along the way, but if you’re still bullish on SOFI’s future, the current price action should be looked at as a gift, not a curse. Personally, I purchased more shares in the $8s and some more when it dipped into the high $7s. I will continue to purchase shares to bring my price per share as close to $10 as possible. My stance on SOFI isn’t changing, this is a minor deterrent in the grand scheme of things, and as I plan to be a long-term shareholder, I will keep banging the ask in the single digits.

The Statement by President Biden

In a statement issued by President Biden on April 6th he indicated that millions of student loan borrowers would face significant economic hardship if student loan repayments were to resume on May 1st. President Biden made it official that his Administration would extend the pause on federal student loan repayments through August 31st. What’s interesting is that at the end of the statement, it specifically says:

“I’m asking all student loan borrowers to work with the Department of Education to prepare for a return to repayment, look into Public Service Loan Forgiveness, and explore other options to lower their payments.”

I am not going to get political and will not engage in a political debate about this subject in the comment section. Everyone knew this was a possibility, and it occurred. The last paragraph does seem as if President Biden will end the moratorium at some point; unfortunately for SOFI, that day isn’t on May 1st.

SOFI responds to the Statement from The White House

In response to the news out of The White House, SOFI issued a statement and issued updated guidance to reflect the extension of the student loan moratorium. SOFI didn’t pull any punches and stated that due to a number of factors, including the impending fall midterm elections, it’s their position that a 7th extension may be on the horizon. SOFI updated its 2022 guidance for a worst-case scenario of the moratorium being pushed out until 2023.

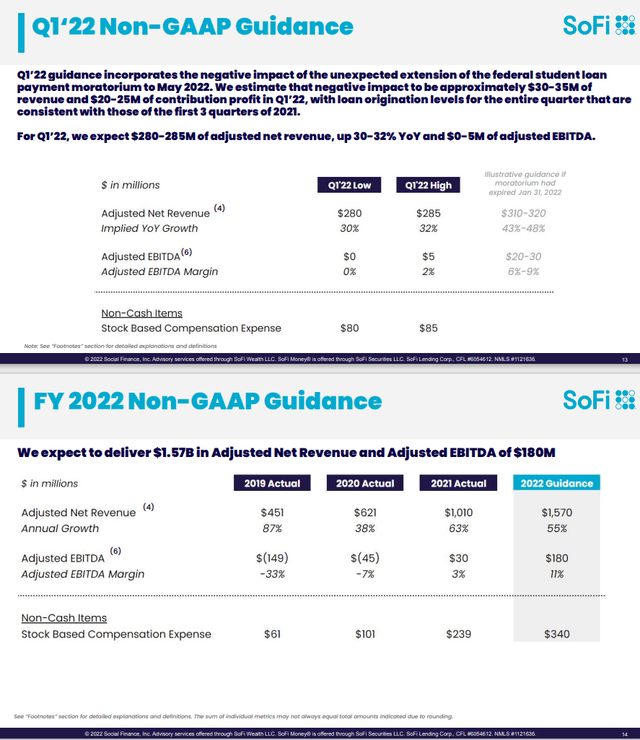

SOFI had originally guided for 2022’s annual revenue to come in at $1.57 billion and their EBITDA to be $180 million for 2022 based on the moratorium being lifted and repayments starting back up at the end of Q2. SOFI’s new guidance is $1.47 billion for revenue and $100 million in EBITDA for 2022. Q1 wasn’t impacted because the moratorium was always going to impact Q1 of 2022.

What the analyst community is saying

Wall Street analysts are trimming their price targets as well as revenue and EBITDA estimates.

- Oppenheimer’s Dominick Gabriele reduced his price target to $13 from $18 and stated that “We don’t think this moratorium will be extended indefinitely; this thesis could be largely played out”

- Wedbush analyst David Chiaverini cut his target to $15 from $20 and maintained an Outperform rating

- Morgan Stanley’s Betsy Graseck trimmed her EBITDA estimate for SoFi by $42M to $100M.

On April 5th prior to the announcement Moffett Nathanson assigned a buy rating with a price target of $13 to SOFI and indicated that they expect 50% adjusted revenue growth in 2022 and ~40% revenue growth over the next four years.

Among Seeking Alpha Contributors, there were 2 sell articles and 1 hold article. If no other articles are written, this one will be the first buy article since the lowered guidance.

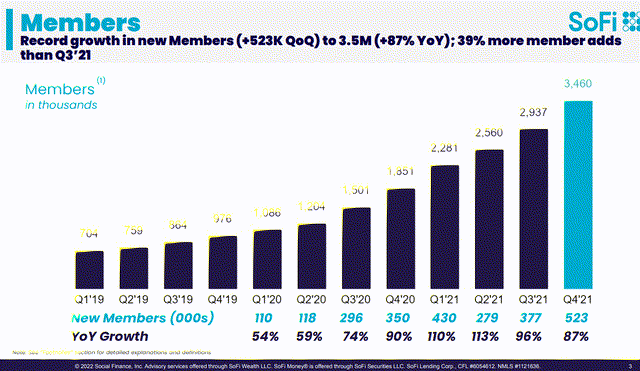

Only 6 months ago, Morgan Stanley (MS) upgraded SOFI to an overweight weighting and a $25 price target. MS projected that SOFI would double is customer base to 5.3 million over the next 2 years and that the expiration of the student loan moratorium would drive a 70% increase in student loan originations and return to pre-pandemic levels. In MS’s bull case, they placed a $34 price target on SOFI, predicated on SOFI obtaining its bank charter by early 2022. MS indicated that the bank charter could provide more than $200 million of revenue upside from holding loans longer before the sale and lower cost of funds. In March, MS downgraded SOFI to equal weight and trimmed its price target to $10 based on the federal student loan moratorium possibly extending past May 2022. Putting the student loans aside for a moment, SOFI has its bank charter, and MS hasn’t retracted its 5.3 million membership base over the next two years. While the short-term headwinds are prevailing, the long-term story is still intact.

My thoughts on the Moratorium and SOFI moving forward

Obviously, I am disappointed that shares of SOFI have declined as much as they have, but that doesn’t change my conviction in the name. I think the main difference is I have all the time in the world to wait out the storm and accumulate more shares. SOFI has never been a trade for me, and I wasn’t going to sell in 2022 even if shares hit $30. There is a big difference between a trade and an investment. I cannot stress this enough, SOFI is a long-term investment for me, and I plan on being a shareholder of SOFI a decade into the future. I couldn’t tell you if student loans will be forgiven, if the moratorium ends on August 31st, or be pushed out further into the future. SOFI has diversified its business and continues to build the personal banking platform for the future. If I was worried about tomorrow, next week, or next month, I would only invest in Index Funds or companies such as The Coca-Cola Company (KO). No disrespect to Index Funds, as I have several or KO, as I am a shareholder, but if I didn’t have an appetite for risk, then SOFI wouldn’t be in my holdings.

SOFI guided down and has anticipated the moratorium impacting the entire 2022 fiscal year. Total revenue is now projected at $1.47 billion, $100 million less than their prior guidance of -6.4%. Adjusted EBITDA took a larger hit as SOFI just became profitable from an EBITDA metric. SOFI reduced its Adjusted EBITDA guidance by $80 million from $180 million to $100 million. This is a reduction of -44.44%. Some may look at these numbers and run for the hills, but I am just shrugging my shoulders and hitting the ask with orders when I can. The new guidance for 2022, which doesn’t account for student loans, is conservative in my view because student loans may start back up, or they may not. SOFI is getting ahead of any future bad news now. At the end of the day, the new 2022 guidance is an increase of $460 million in revenue (45.55%) and $70 million in Adjusted EBITDA (233.33%). SOFI could grow its membership faster than projected, leading to more financial products utilized. SOFI is still in its early innings, and this is an investment that needs time to mature.

I invested in SOFI because I believe they have a strong leadership team, a great vision, and the personal finance sector is ripe for disruption. SOFI is absolutely disrupting the traditional banking industry and delivering personal finance products its competitors aren’t:

- SOFI launched a no-fee cryptocurrency purchase for direct deposit members. SOFI members now have the ability to allocate a percentage of their paycheck to crypto with every direct deposit at no cost. SOFI offers 30 crypto-currency coins that members can select for automatic purchases directly from their paycheck without a transaction fee. Is any other financial institution offering no-fee crypto purchasing where you can have part of your paycheck deposited into Bitcoin (BTC-USD), Ethereum (ETH-USD), or Solana (SOL-USD)?

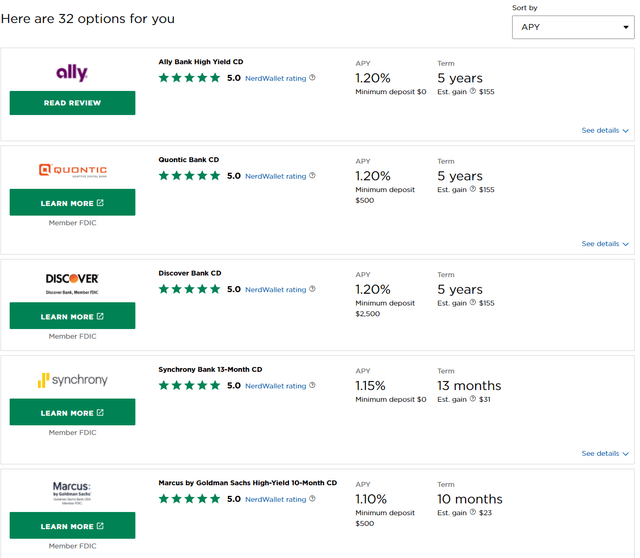

- SOFI is now offering a 1.25% APY checking and savings account for all members who have direct deposit. SOFI will also now offer 0.70% APY for those looking for a high yield opportunity without direct deposit. SOFI Checking and Savings also allows members to earn these increased rates on all their money with SOFI Checking & Savings, with no limits or balance caps to earn interest. I just went on Nerdwallet and searched for CDs up to 5 years from National Banks, Online Banks, and non-bank financial institutions. You would need to lock your cash up for 5-years with Ally, Quontic, or Discover to get a 1.20% APY.

Conclusion

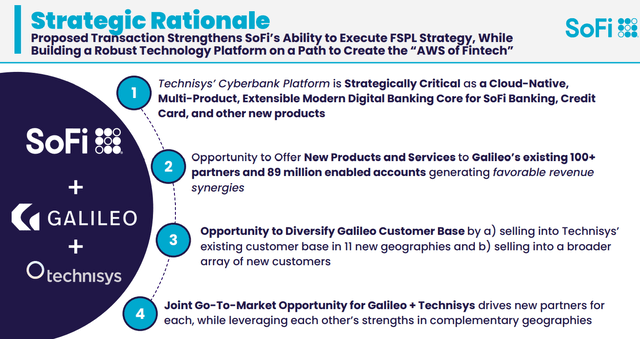

Nothing has changed for me in SOFI’s long-term story, except I was able to buy more shares at a lower price yesterday and today to lower my average price per share. Rome wasn’t built in a day, and traditional banking & financial services won’t change overnight. SOFI is gearing up to be the personal finance choice of Gen Z, not millennials or baby boomers. SOFI also owns the entire backend of the digital banking process, has its bank charter, and is developing banking as a service which you can read about here. People sold shares of Meta Platforms (FB) upon a Q4 report that was great, yet the stock plunged from $323 on 2/2/22 to $237.76 overnight, then down to $186.63 on 3/14/22. Unlike others, I didn’t sell a single share, and I added to my position. I have owned shares since they went public, and adding around $200 increased my cost basis. So far, I have been incorrect but investing isn’t a sprint, and I am convinced that SOFI will come out on top in the future. As long as shares are under pressure, I will continue to buy more shares because the long-term story is still intact, and the short-term headwinds will disappear eventually. If there is one thing I am sure of, I can outlast the short sellers and the negativity surrounding shares of SOFI.

Be the first to comment