Justin Sullivan

SoFi’s (NASDAQ:SOFI) dramatic ascent and collapse has left its bulls in disbelief, stunned maybe. We all made investment decisions which were retrospectively prudent but have been totally rocked back as positive sentiment collapsed and the market crumbled. Even more jarring is that the near future seems set to continue much of the pain that has defined the post-pandemic investment landscape.

Indeed, the macro backdrop is besieged by constantly rising inflation, the spectre of a recession, and an uncertain political orthodoxy as the largest land war in Europe in decades rages on. SoFi is now two and a half years into a student loan moratorium extension that looks set to be extended further and has recently filed for a $1 billion mixed shelf offering. The former will continue to put constraints on revenue growth potential while the latter will add dilution risk to an already battered stock price.

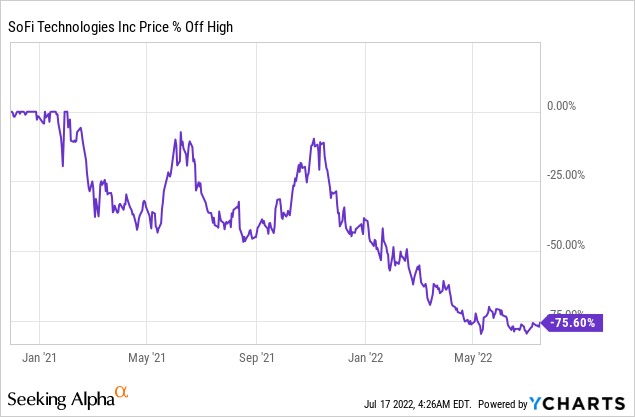

SoFi’s common shares now trade hands at $6.29 per share, down nearly 76% from their all-time highs to place the company’s market cap at $5.76 billion. Hence, with revenue for fiscal 2022 guided to be $1.51 billion, the company now trades on a historically low 3.8x price to revenue multiple. To put this multiple in context, SoFi’s revenue is set to grow by a further 40% to $2.1 billion in 2023. This would cut the multiple to 2.7x, despite SoFi being set to achieve an adjusted EBITDA of $484 million in the same year.

Profitability is set to become increasingly commonplace on the back of the company receiving its banking license earlier this year and synergies from the $1.1 billion acquisition of Technisys. The acquisition of Technisys presents a stalking horse for profitability as SoFi’s management expects synergies from the buyout which closed in March to help its Galileo division realize $75 million to $85 million in cumulative cost savings from 2023 to 2025 and approximately $60 million to $70 million annually thereafter.

A Historically Cheap Valuation

SoFi is executing on its financial plan to become a more robust and sound financial services company right before the market that has damned its stock price to a level below mediocrity. What does comparatively well in a period of economic growth? Financial services. What also does comparatively well in a recession? Financial services.

The short-term outlook has been clouded and has dragged SoFi to a valuation unbecoming for a fast-growing fintech company whose main revenue source, whilst crippled by the machinery of government and politics, will eventually be unleashed to once again realize its full potential. The current student loan moratorium, in place since March 2020, has an August 31, 2022 expiration date. However, I expect this to likely be extended again beyond the upcoming mid-term elections as it’s an easy vote winner with a seemingly faceless victim.

There might also be some student loan forgiveness which could predate the resumption of student loan repayments but the technicalities likely still have to be worked out. For example, will it see an equivalent discount of $10,000 applied to all new university enrolments? SoFi’s current valuation seemingly fully writes off the boost a resumption of student loan repayments will have on its financial standing. This helps create a scenario where the short-term aberration to the economy and stock markets as a result of inflation and war will eventually give way to more normal market conditions that should see sentiment return to historically normal levels. This should drive a recovery in SoFi’s stock price but has an uncertain timeline.

Brutal Markets

SoFi’s fall, along with the rest of fast-growing fintechs like MoneyLion (ML), Affirm (AFRM), and Upstart (UPST), has been protracted and material. When the internet was set alight at the beginning of 2020 with hopes of the new decade becoming a new roaring 20s, no one would have expected a once-in-a-century pandemic, record levels of inflation, and the largest land war in Europe since the end of the Second World War. With the VIX likely set to surge, the only thing that isn’t up is a stock market that now looks like the backside of a donkey.

The mute 20s could come to define our present malaise as investors solely nurse their portfolio losses whilst dealing with a historic cost of living crisis which shows no sign of abating. Winter is coming too, and the situation seems to be en route to worsening as an energy crisis in Europe will make inflation stickier, causing further stock market weakness and heightening negative investor sentiment. It’s hard to say just how bad things could get or whether we’ve reached the bottom. Hence, SoFi’s exceptional execution on its operational targets and guidance give reason for peace against the broader macro chaos. I continue to rate shares as a buy, with the new valuation opening up a good margin of safety. However, sentiment that’s already bad can become even worse, and SoFi’s collapsed multiple could collapse yet again.

Be the first to comment