Justin Sullivan/Getty Images News

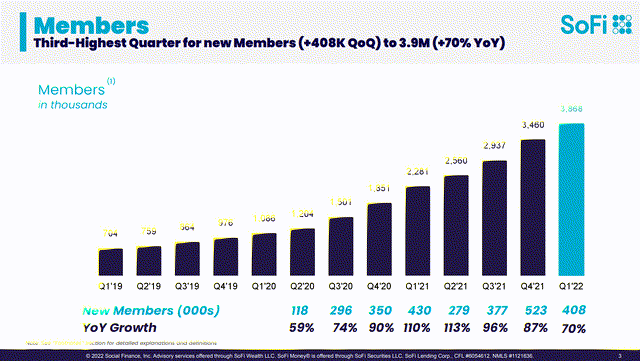

Every time SoFi Technologies (NASDAQ:SOFI) looks like it could rebound, shares are stopped dead in their tracks. This has been a painful investment for many as the growth trade has left many accounts decimated. Over the previous 6-months, shares of SOFI have been down -60.84%, and since SOFI went public 1-year prior, shares have collapsed by -74.20%. SOFI’s sell-off last summer was met with a sharp rally into insider buying and what the street touted as a great Q3 in 2021. This time when SOFI declined, the rally never came even though there was significant insider buying and strong earnings reports. Since the November $24.65 peak, shares have continued to make lower lows, and every sharp bounce has faded away.

Several have indicated that the rallies are nothing more than dead cat bounces and should be looked at as opportunities to exit the position. Anyone who has been bearish on SOFI has been correct, and as a bull, I have seen nothing but red in this investment. Just because my timing hasn’t been optimal doesn’t mean I am incorrect on SOFI as an investment. The key word is an investment, and I am not allocating capital to SOFI as a trade to make a quick buck. Yes, shares of SOFI could remain on the ropes, but a knockout blow is unlikely to occur. I can’t predict the future, but I am confident that SOFI will ultimately turn into a great investment. If you want to read about how SOFI is building the AWS of Fintech to deliver Banking as a Service (BaaS), you can read my article here. In this article, I will discuss the continuous buying spree from Anthony Noto (SOFI CEO), commentary at the Piper Sandler Global Exchange & Brokerage Conference by Chris Lapointe (SOFI CFO), and the possible reverse split which could occur. I have continued to add to my position of SOFI, I will continue to add shares at depressed prices, and I currently have cash-backed puts expiring on 6/17 at a strike price of $6.50, which at this rate could assign me additional shares.

SOFI

The insider buying train doesn’t seem to end with Anthony Noto

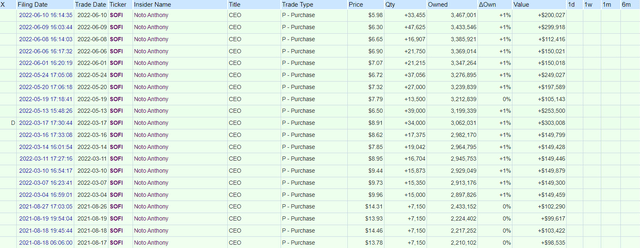

Like regular investors, insides may sell shares for a few reasons, including freeing up capital for a large purchase, paying taxes, sending a child to college, or having to divide assets due to a divorce. There is only 1 reason that anyone buys a stock, and that’s because they believe it is a good investment that will generate capital appreciation. Since May 27th, when my previous article on SOFI was published, Anthony Noto has made 5 additional purchases of SOFI stock. Mr. Noto continues to put his personal capital at risk, and his insider purchases are now becoming a never-ending shopping spree.

Mr. Noto was interviewed by Mihir Bhatia, a research analyst with Bank of America (BAC). He was very clear on why he was aggressively purchasing shares of SOFI. The interview can be watched here, and Mr. Noto discusses his purchases at the 20:01 time stamp. To paraphrase, Mr. Noto had indicated that his personal decisions to purchase shares of SOFI are based on his long-term view of SOFI’s business. He wants to help SOFI become one of the top 10 financial institutions in the United States and a top 15 technology company. When investors see SEC Form 4’s filed with his name on them, it’s because he believes in the long-term opportunity that shares of SOFI represent. The interview is excellent, and I encourage all current and possible shareholders to take the time to listen to it.

openinsider

Mr. Noto bought shares 4/5 days this week, adding another 119,737 shares bringing his total share count to 3,467,001. Since SOFI went public last June, Mr. Noto has made 19 insider purchases, adding 385,452 shares at the cost of $3,018,834. Most of his purchases came in 2022 as Mr. Noto has added 356,852 shares at $2,614,910. June isn’t even halfway through, and he has made 5 insider purchases. When you look at the filings above, I am excluding the purchase on 3/17, which is marked with a D as this was from an option exercise. Bears can come to any conclusions they like, but no matter how you look at this, Mr. Noto obviously believes shares of SOFI are undervalued and that they represent a great opportunity at their current levels. My personal belief is that Mr. Noto’s purchases are bullish, and this is what I want to see from a CEO. Only time will tell if Mr. Noto is correct, but his conviction is clear as day.

I want to add something from one of my previous articles about Mr. Noto. If you are not familiar with his background, you may see his purchases more bullishly after reading this:

Anthony Noto has had a distinguished career that many may be unfamiliar with. Mr. Noto graduated from West Point Military Academy and went on to become an Army Ranger. After his military career, Mr. Noto graduated from Wharton with an MBA and joined Goldman Sachs (GS). Mr. Noto was voted the top analyst by Institutional Investor magazine and led GS’s communications, media, and entertainment research team. He then became a Managing Director and later a Partner at GS. After almost a decade with GS, Mr. Noto took the CFO position at the National Football League (NFL) and then returned to GS several years later as Co-Head of their global media group. Mr. Noto left GS once again and became the CFO of Twitter (TWTR) and then the COO of TWTR before being tapped as SOFI’s CEO in early 2018.

Chris Lapointe’s (SOFI CFO) commentary at the Piper Sandler Global Exchange & Brokerage Conference was very bullish

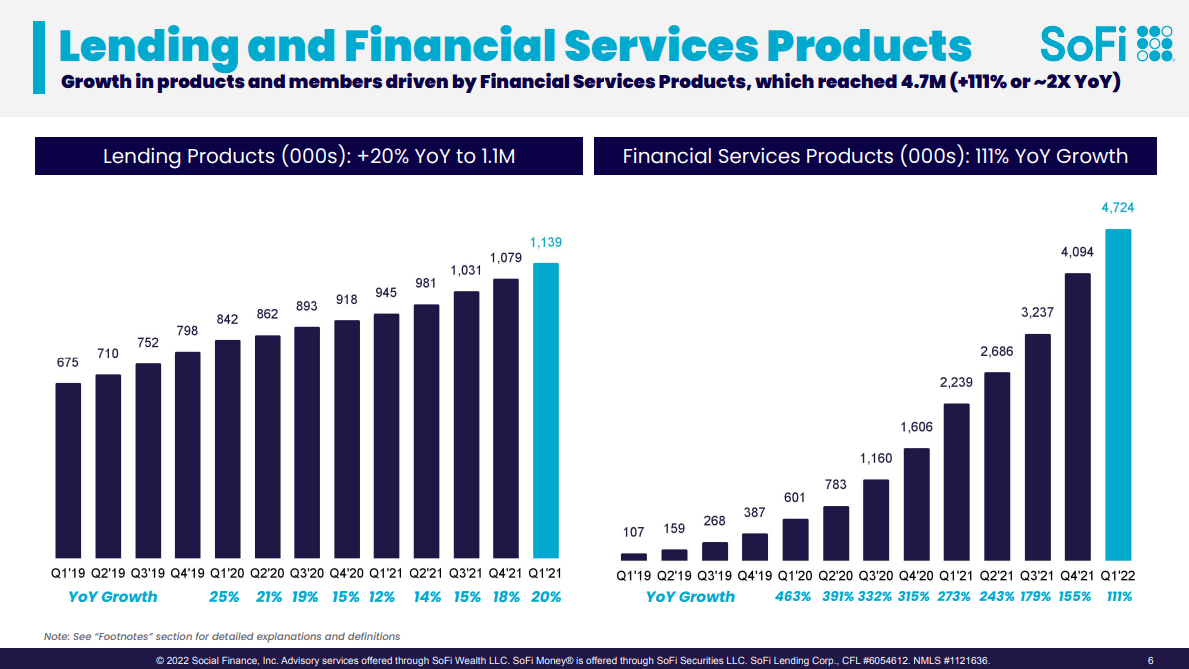

Mr. Lapointe touched on several points during the Piper Sandler conference that can be viewed as bullish for SOFI’s future. Management expects to see continued growth in the high-margin personal loans business where people are looking to refi at a variable rate debt into fixed-rate loans. Prior to having the bank charter, SOFI had access to roughly $7 billion of warehouse capacity. SOFI would pay between 150 to 400 basis points depending on the facility to access capital. The facilities that made up the $7 billion aggregate were variable and tied to the Fed, as Fed funds increase, so does the cost of capital from these facilities. Due to the bank charter that SOFI was granted, they can offer an APY of 1.25% for anyone enrolled in direct deposits. As a bank, SOFI’s cost of capital savings between their deposits and the warehouse facilities is in excess of 150 basis points.

When SOFI reported Q1 earnings, they were at roughly $1.5 billion in deposits and adding around $100 million per week. As of June 9th, SOFI was at $2.2 billion of deposits at SoFi Bank and growing at a rate that exceeds $100 million per week. SOFI has seen an increase in its conversion rate for direct deposit members as they have increased by 60% in Q1 QoQ compared to Q4 2021. There are 29 weeks left in 2022, and at this rate, SOFI will add another $2.9 billion+ in deposits by 2023.

SOFI

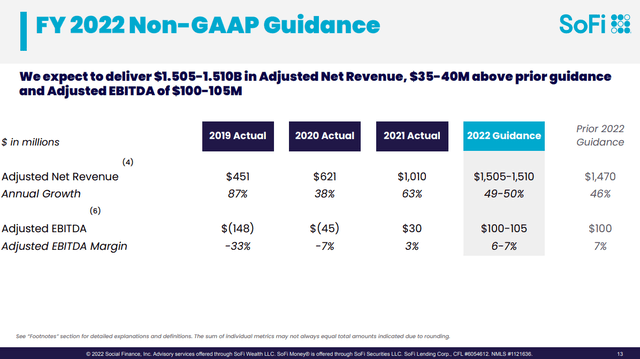

One of the large issues investors have had with SOFI is GAAP profitability, as the market has shifted to a focus on net income and free cash flow rather than revenue growth. Mr. Lapointe addressed this head-on. SOFI’s first step was to become EBITDA profitable for a full year which occurred in 2021. SOFI is delivering 50% margins in its lending business each quarter, and its tech platform consisting of Galileo is delivering 30% margins. The Financial Service segment had a contribution loss of roughly $50 million in Q1. Mr. Lapointe explained that if you look at variable profits and exclude the marketing spend, SOFI has been profitable for the previous 3 quarters. SOFI is predicting that they will be profitable on a variable profit basis, including marketing in this fiscal year.

Some bears may say these are fancy talking points to justify losing money on a GAAP basis. SOFI is a young company and is still in its hyper-growth phase. It’s important to understand the concept of hyper-scaling and that the most important thing today is to acquire more members delivering positive variable profit to cover SOFI’s fixed costs. Mr. Lapointe believes SOFI will cover its fixed costs and end 2023 on a contribution profit basis. He believes there is certainly a path to GAAP profitability, and from how I read his remarks, 2024 could be the year. Mr. Lapointe also reiterated that SOFI is driving toward operating at a 30% incremental EBITDA margin in 2023 and future years. There have been many critical points, but one of the most important is that SOFI believes that operating at an incremental EBITDA margin of 30% will allow them to drive topline revenue growth for decades. SOFI isn’t looking at several years of growth when they say decades to come, decades are plural, and leadership is expecting a minimum of 20 years of topline revenue growth.

SOFI

The possible reverse split and my thoughts

On 5/23, SOFI released a proxy statement, and proposal 5 was to approve an amendment of the company’s certificate of incorporation to give the board of directors discretionary authority to affect a reverse stock split. On 6/3, SOFI released additional proxy materials, which clearly outlined why SOFI is considering a reverse stock split. Below is exactly, what the additional proxy material says:

Why is SoFi considering a reverse stock split?

The primary objectives for effecting a reverse stock split, should the Board choose to effect one, would be to increase the per share price of SoFi’s common stock. The Board believes that, should the appropriate circumstances arise, effecting a reverse stock split would, among other things, help us appeal to a broader range of investors, partners and potential new hires, to generate greater investor interest in SoFi and improve the perception of SoFi’s common stock as an investment security.

Appeal to a Broader Range of Investors to Generate Greater Investor Interest in SoFi. An increase in SoFi’s stock price may make it more attractive to investors, including brokerage firms that are reluctant to recommend lower-priced securities to their clients, or institutional investors with internal practices or policies prohibiting them from holding lower-priced stocks in their portfolios, which reduces the number of potential purchasers of SoFi common stock. In addition, analysts at many brokerage firms typically do not monitor the trading activity or otherwise provide coverage of lower-priced stocks. Our Board believes that the anticipated higher market price resulting from a reverse stock split may enable investors and brokerage firms with policies and practices such as those described above to invest in SoFi common stock.

Improve the Perception of SoFi Common Stock as an Investment Security. We believe that the overall economic environment in which we and other financial services companies are currently operating has been a significant contributing factor to the decline in the trading price of SoFi’s common stock. The Board views its discretionary ability to effect a reverse stock split as one potential means of increasing the per share price of SoFi common stock, which could improve the perception of SoFi common stock as a viable investment security. Lower-priced stocks have a perception in the investment community as being risky and speculative, which may negatively impact not only the price of SoFi’s common stock, but also our market liquidity. As a financial services company, we believe that we may be particularly sensitive to this type of negative public perception.

Attract New Talent and Partnerships by Appropriately Reflecting the Financial Health of the Company. A company’s share price acts as a signal to potential partners and new talent of the company’s financial standing. The health and outlook for SoFi remains strong following our first quarter 2022 results (see our Form 10-Q here), and the ability to effect a reverse stock split could allow for stock price alignment with this performance, if the Board deems it to be in the best interests of SoFi and its stockholders. Note that a reverse stock split may not achieve all of the desired results that have been outlined above-it may not increase the price of SoFi’s common stock over the long-term, and it may lead to a decrease in overall market capitalization, among other things. However, the Board considered all of the foregoing factors, and unanimously agreed to put forward a proposal that would give the Board the flexibility to manage through current adverse market conditions. As noted above, even if stockholders approve the proposal, the Board reserves the right not to effect a reverse stock split if it deems it to be in the best interests of SoFi and its stockholders at the time.

Nothing has been solidified, the vote hasn’t happened, and SOFI may not go through with a reverse split. Here are my feelings on the matter. My preference is that SOFI does not conduct a reverse split. I would rather the shares trade at depressed levels for an extended period of time, even if it means years in the single digits. I don’t believe the Office of the Comptroller of the Currency (OCC) would award a national bank charter to a company that is on the verge of going under. SOFI’s chart is ugly, and that is one conclusion someone could arrive at looking at its current price trajectory.

In the long run, I believe shares of SOFI will generate capital appreciation regardless of whether a reverse split occurs or not. I would rather see management grow the business as they are and, when they become GAAP profitable, allocate a percentage of their Free Cash Flow (FCF) to buybacks and dividends. Since I believe in SOFI long-term, the negative perception is an added benefit as I can add shares at depressed prices. I understand why leadership would consider a reverse split, and all their reasons are valid. SOFI is still in its hyper-growth phase, and this isn’t a situation where their back is against the wall, with the only option of staying listed on a major exchange is to conduct a reverse split. In the end, everything will work itself out, and if I am correct, the longs will win, and individuals with short positions will experience the same pain as the bulls have during the sell-off.

There are still risks to performing a reverse split which leadership has outlined. There is no guarantee that a reverse split will keep shares at elevated prices. While the market cap will not change, the share price will, and it could provide short sellers with additional runway to continue betting against SOFI. I would rather take our chances with the current structure and reduce the share count in the future through a buyback program when SOFI is in a position to implement one than conduct a reverse split.

I can hold SOFI for decades and continue to add capital to the investment, which makes me believe I can outlast the short sellers and the negative market sentiment toward SOFI. While I have the ability to look at SOFI’s situation through a different lens, my situation isn’t the same as everyone else’s, and it may not align with leadership’s future plans. Be that as it may, I will vote my shares as yes at the annual meeting and back Mr. Noto and his team. If I don’t have faith in the management team, then I have no business being a shareholder in SOFI.

Possible future projections

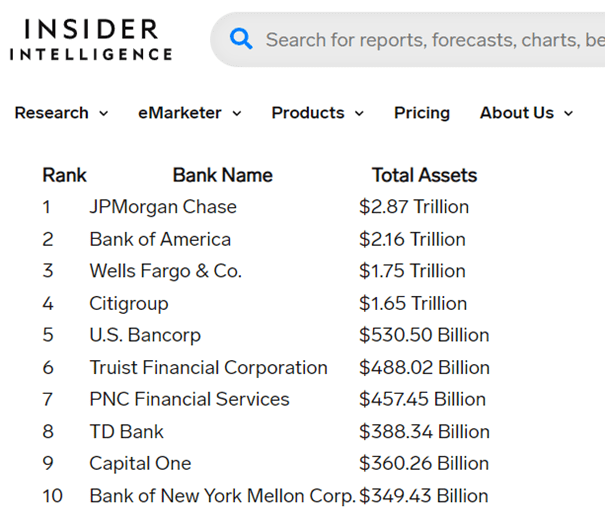

Both Mr. Noto and Mr. Lapointe have stated that they believe SOFI will become a top-10 financial institution in the United States. As of January 1st, the largest banks in the United States ranged from $2.87 trillion to $349.43 billion in total assets. SOFI ended Q1 2022 with $12.25 billion in total assets. Based on this list, SOFI would need to grow its total assets by 28x to break into the 10th spot. This list is almost half a year old, and these banks have all grown their total assets since Insider Intelligence collected the data. At the end of Q1, The Bank of New York Mellon (BK) had $473.81 billion in total assets. Assuming that BK is still the 10th largest financial institution, SOFI would need to grow its total assets by 38x to take the 10th spot, and that’s assuming BK didn’t grow.

Insider Intelligence

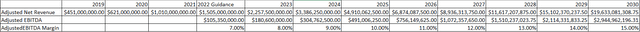

I can’t predict the future so only time will tell if SOFI reaches this goal. SOFI currently has a market cap of $5.6 billion and trades at a 5.1 P/S. BAC is trading at a P/S of 3.01, and JPMorgan Chase (JPM) trades at a P/S of 2.97. This is only a projection, and I could be ultra-conservative or overly bullish, so please keep that in mind. I believe that SOFI could reach $19.63 billion in organic revenue in 2030. 2022 is projected to have a 49-50% YoY growth rate, and that is excluding revenue from refinancing student loans. Assuming student loans are back in effect starting 1/1/23, I could see SOFI growing revenue at a rate of 50% in 2023 & 2024 as the backlog from the forbearance refinances their loans. Then I would assume SOFI would grow at a 45% rate in 2025, 40% in 2026, and 30% from 2027 to 2030. Maybe this is too bullish, and maybe it’s too conservative; only time will tell. I want to see what a full year looks like with the combination of the bank charter and student loan refinancing operating at 100% looks like for SOFI.

Assuming that SOFI generates $19.63 billion of revenue in 2030, I would speculate that its P/S ratio would decrease as the company grows. I will place a P/S of 3 since that’s right between JPM and BAC to be conservative. If SOFI generated $19.63 billion of revenue in 2030 with a P/S of 3 it places its market cap at $58.9 billion. This would be 10.52x larger than today’s market cap of $5.6 billion, which would place a $62.49 price on shares of SOFI. Yes, I am making assumptions, but that’s what you need to do with investing. Looking out 8.5 years to the end of 2030, I believe SOFI could become a $58.9 billion company with a share price of $62.49 or grow to a market cap of $100 billion, placing its shares at $106.09 based on a P/S of 3. Could shares of SOFI generate a 10.5 – 17.86x return over the next 8.5 years, yes, they could, but I could also be wrong and overly bullish. If SOFI was to grow its revenue to $7.5 billion in 2030, using a P/S of 3 it would put its market cap at $22.5 billion, which is a 4.02x return over the next 8.5 years. Regardless of which scenario unfolds, I believe SOFI is undervalued and will generate significant capital appreciation over this decade.

Steven Fiorillo

Conclusion

Shareholder value has been decimated, but I am still adding to my position in SOFI. I believe SOFI will become one of the largest financial institutions in the United States as its geared toward the next generation of Americans. SOFI is pioneering a truly digital-first personal finance solution, and it’s still the early chapters in its story. SOFI’s CEO is continuously purchasing shares of SOFI on the open market and has added to his position 15 times in 2022. After listening to all the interviews, I could find with Mr. Noto and Mr. Lapointe, I am more bullish on buying in the single digits than I was in the double digits. I am not worried about a reverse split, and while I think there is another way to achieve their goals, I will vote yes on my shares and support the management’s decision to implement a reverse split if they believe it is in the best interest of the shareholders. Regardless of a reverse split, I believe SOFI could be a 10.5 – 17.86x return by the close of the fiscal year 2030, and while this is a long-time horizon, I have never invested in SOFI trying to make a quick buck. I am looking at the current weakness as an opportunity because I am able to add shares at depressed prices to a company that I believe is undervalued and misunderstood.

Be the first to comment