kmatija

SNDL Inc. (NASDAQ:SNDL), previously known as just another penny stock out of the Canadian cannabis sector, took full advantage of the meme-stock craze to transform its balance sheet and create real shareholder value. The company continues to put capital to work and still retains a large net cash position. While its origin story might be a bit unorthodox, SNDL is gradually becoming a worthy peer to the more well-known names. I expect that trend to only accelerate if and when the company IPOs its investment fund SunStream. At recent prices, the stock traded at valuations which give negative value to the cannabis operations.

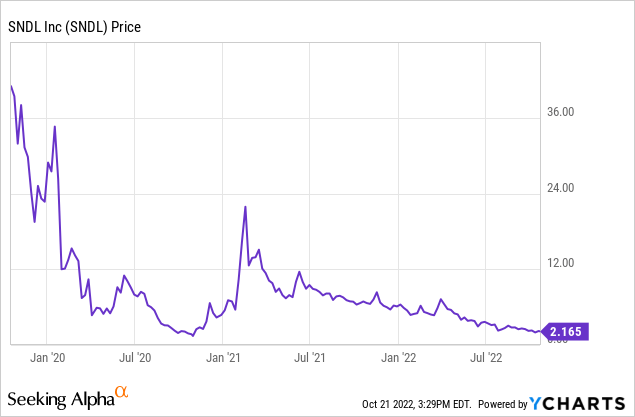

SNDL Stock Price

When I last covered SNDL, the stock had already fallen considerably from its meme-stock days. The stock has since fallen another 67%.

At the time, I concluded that it was best to sit on the sidelines until the implied value of the cannabis operations dipped even further. Due to a vicious crash in the cannabis sector, that result has taken place – offering investors a chance to diversify their cannabis holdings into what is quickly becoming “household material.”

SNDL Stock Key Metrics

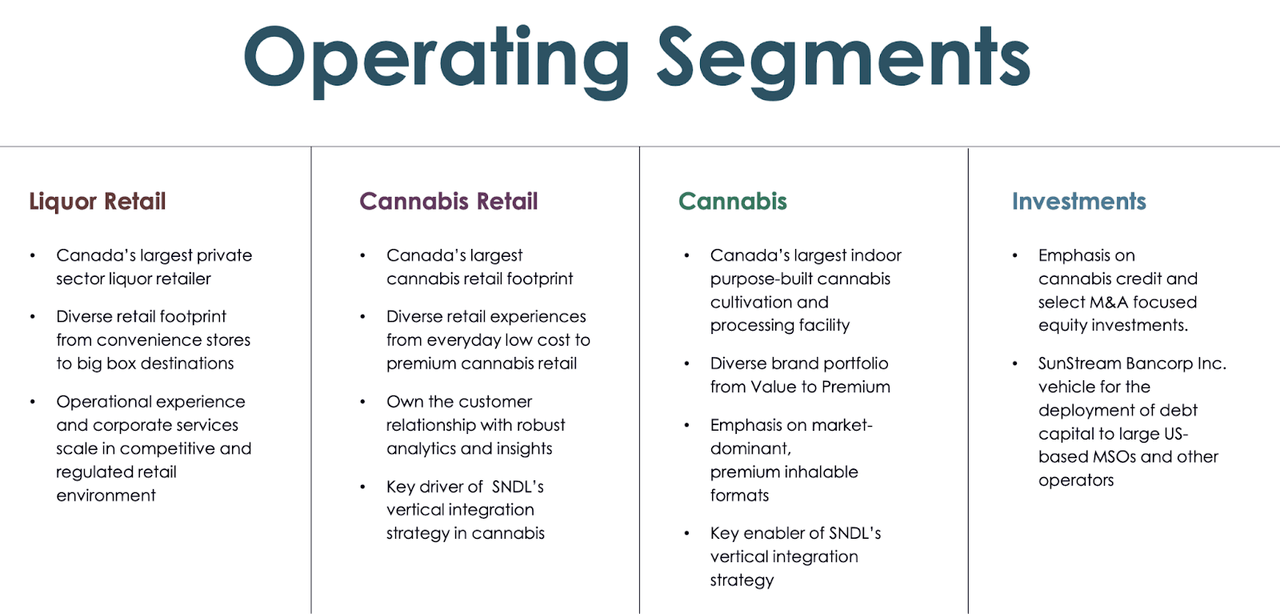

At this point, SNDL operates with 4 business segments, those being its liquor operations, cannabis retail and cultivation operations, and its investment portfolio.

2022 Q2 Presentation

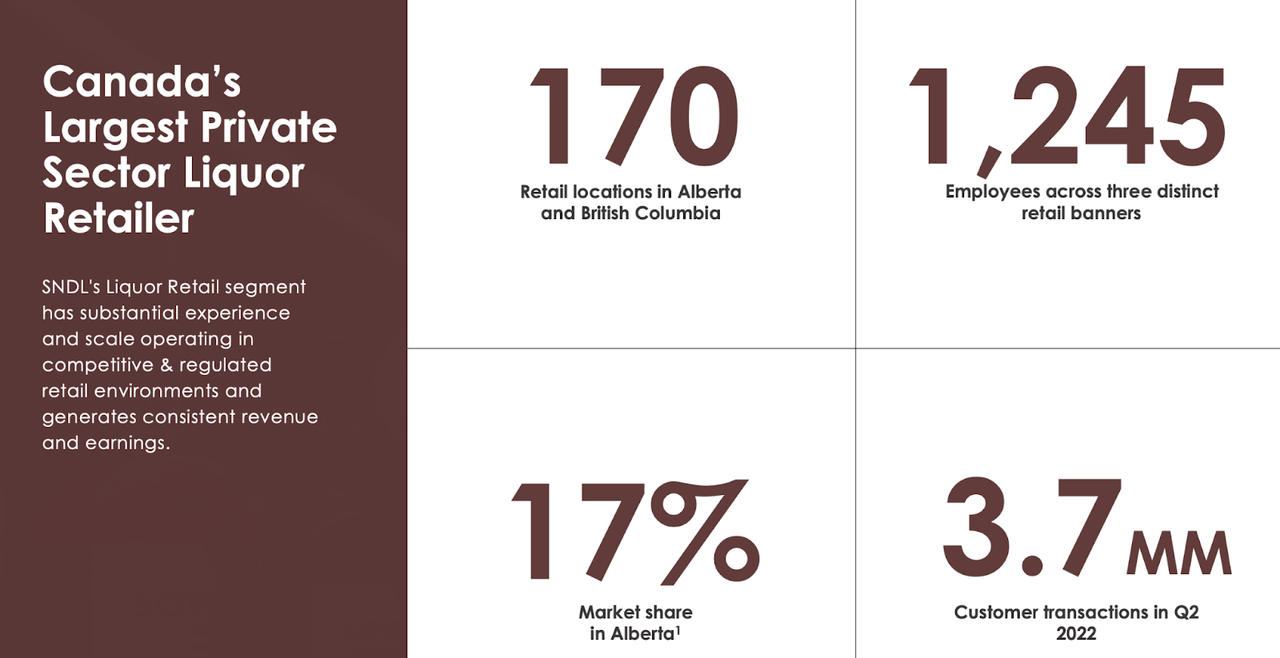

SNDL owns a sizable liquor retail presence, with a 17% market share in Alberta and 170 total retail locations.

2022 Q2 Presentation

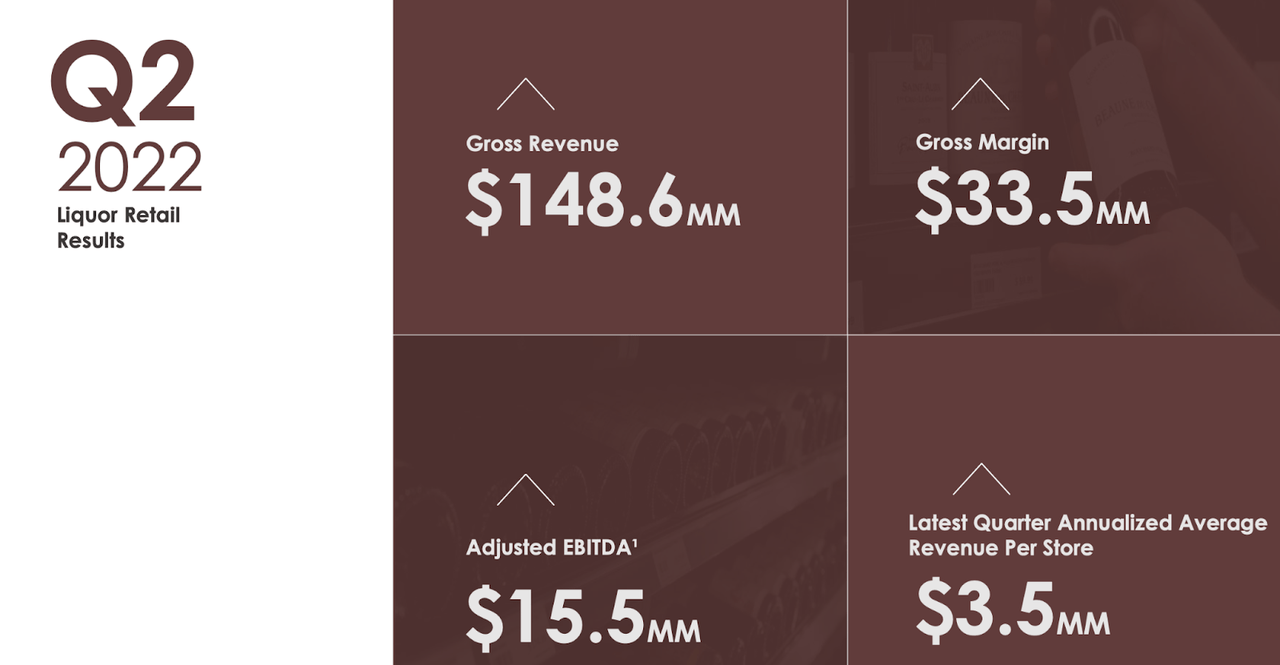

That might surprise some readers, as isn’t this supposed to be a cannabis company? It has become fairly common in the Canadian cannabis sector for these operators to operate non-cannabis business segments – mainly because the Canadian cannabis has proven to be very difficult. Liquor retail made up 66% of overall net revenues and is the main profit driver for the company.

2022 Q2 Presentation

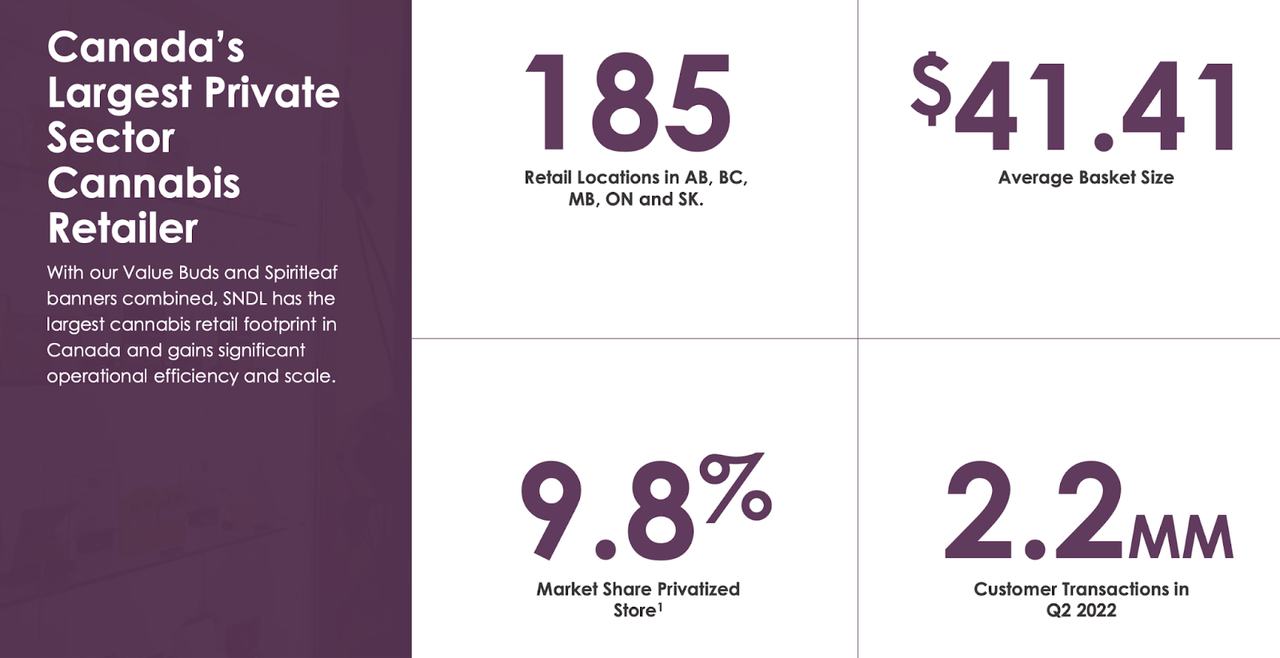

SNDL also operates 185 cannabis retail locations.

2022 Q2 Presentation

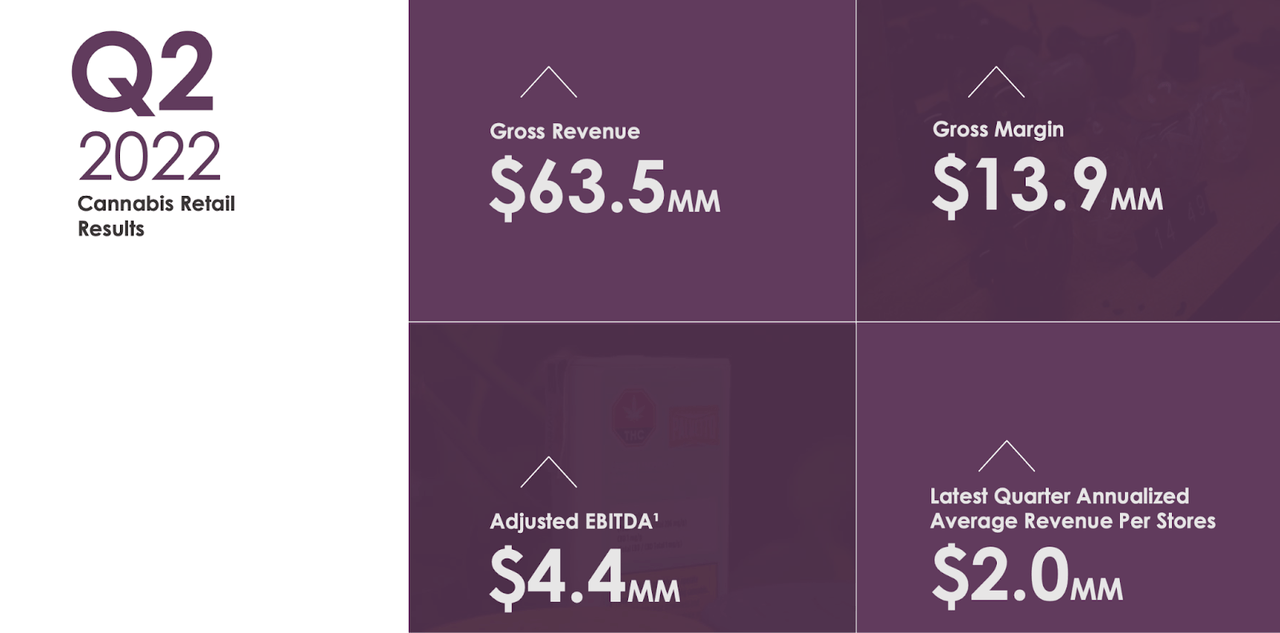

SNDL had previously bolstered its retail footprint through its acquisitions of Alcanna and Spiritleaf. This business segment is its second most profitable segment, with a 6.9% adjusted EBITDA margin, though I note that the margin calculations exclude corporate expenses.

2022 Q2 Presentation

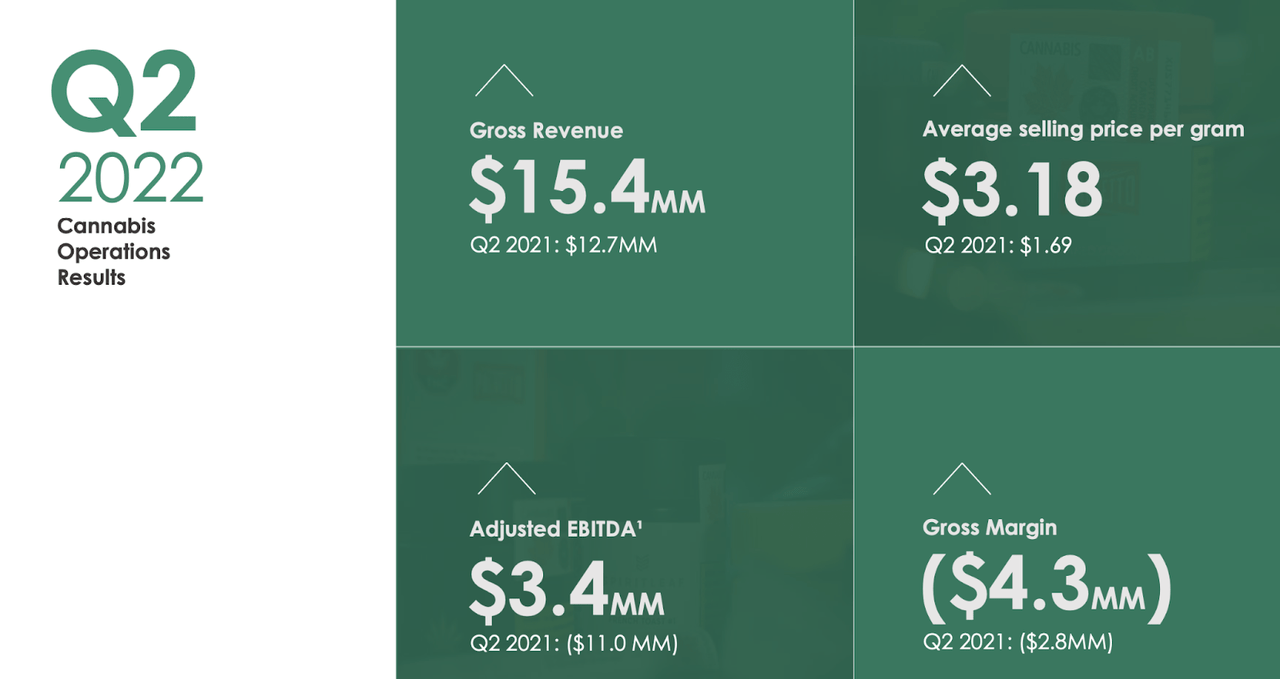

SNDL has also been scaling up its cultivation and production segment, though the gross margin was negative for another year.

2022 Q2 Presentation

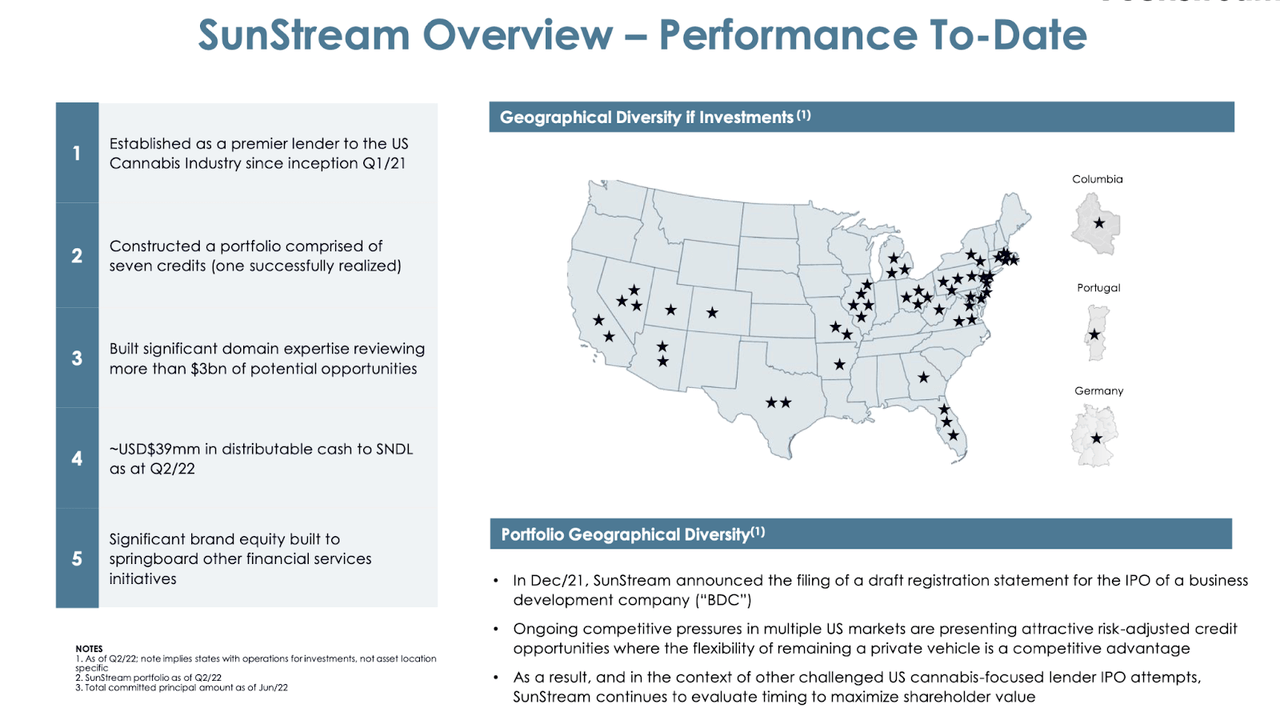

I have chosen to cover the company’s direct cannabis operations first because that may be what most investors care about, but in reality, it is their investment operations that matter most. SNDL operates a joint venture in SunStream. SunStream is a business development company which makes loans and equity investments primarily to U.S. cannabis operators.

2022 Q2 Presentation

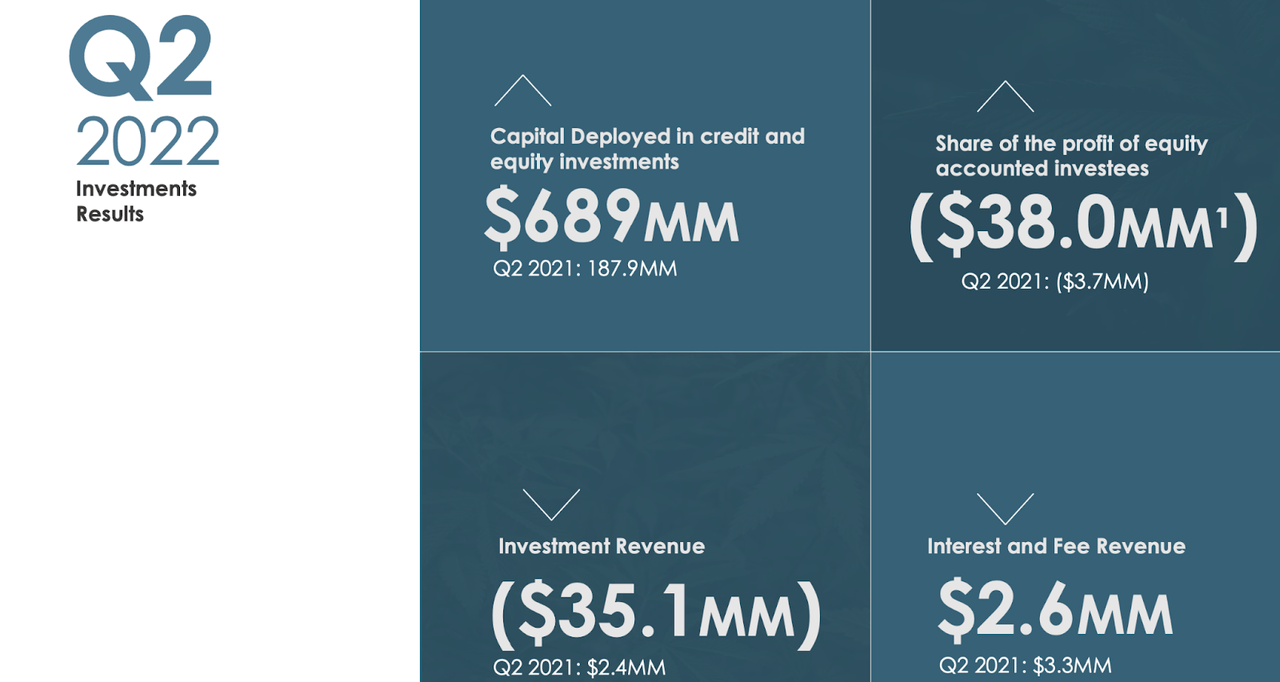

The investment opportunity exists because cannabis remains illegal in the United States at the federal level, limiting access to capital. As of the end of the quarter, SNDL had $689 million of capital deployed, with $2.6 million of interest and fee revenue. Operating income is likely to be messy quarter-to-quarter due to unrealized gains and losses on equity investments.

2022 Q2 Presentation

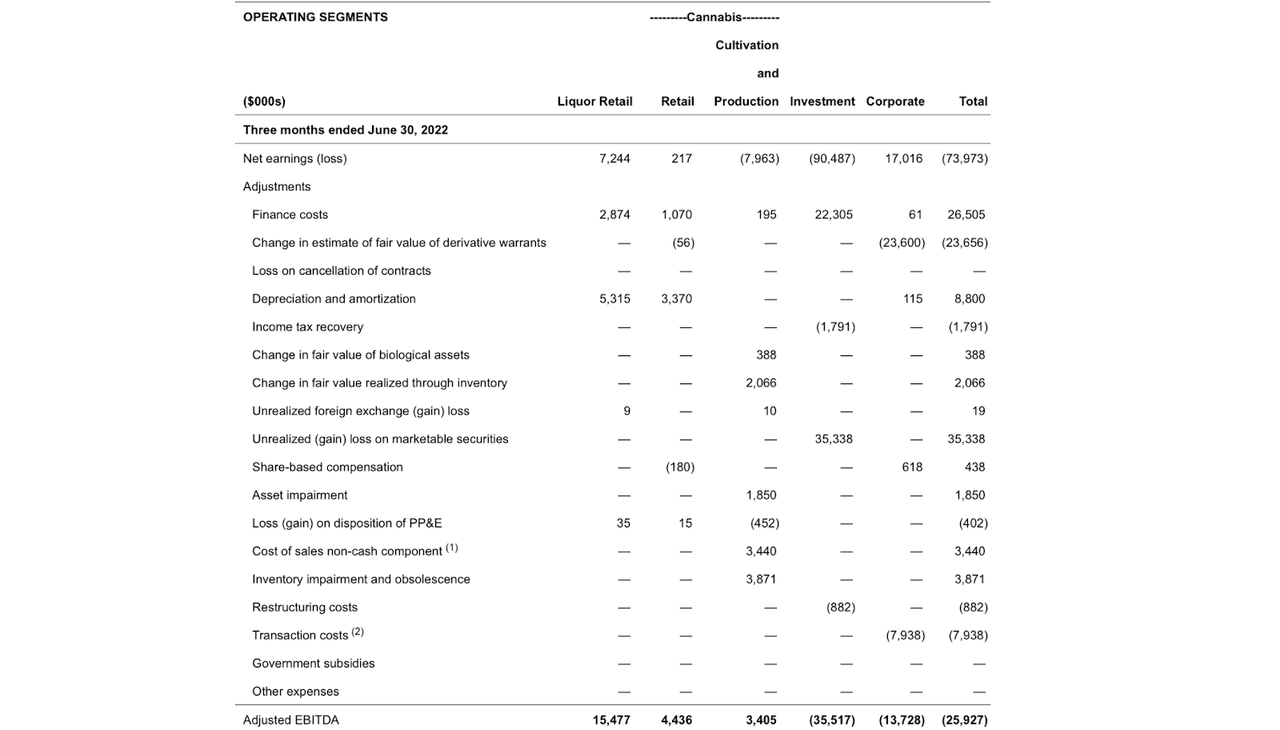

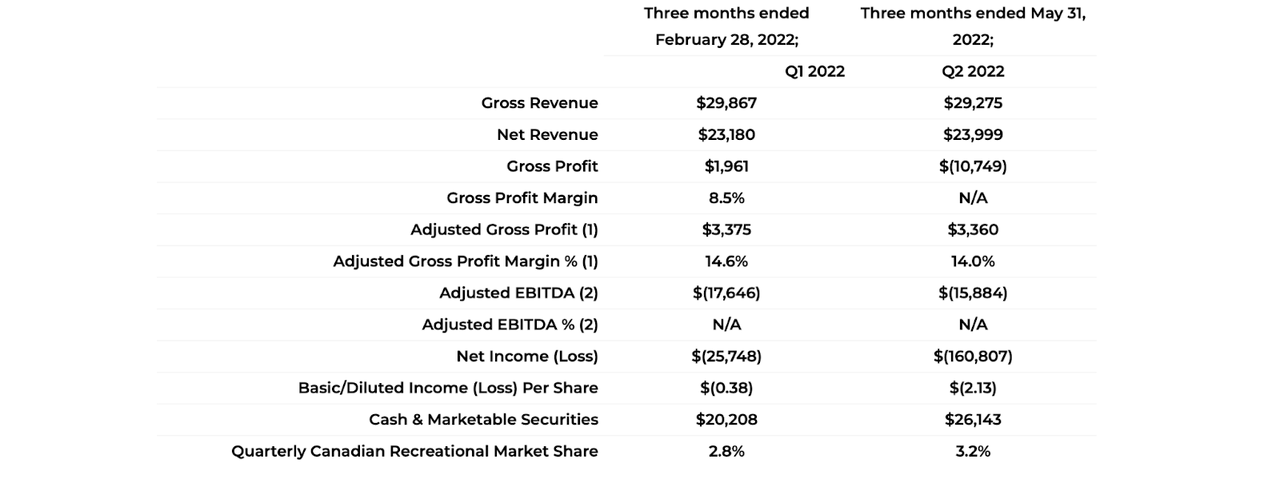

In the quarter, SNDL generated $25.9 million in adjusted EBITDA losses.

2022 Q2 Press Release

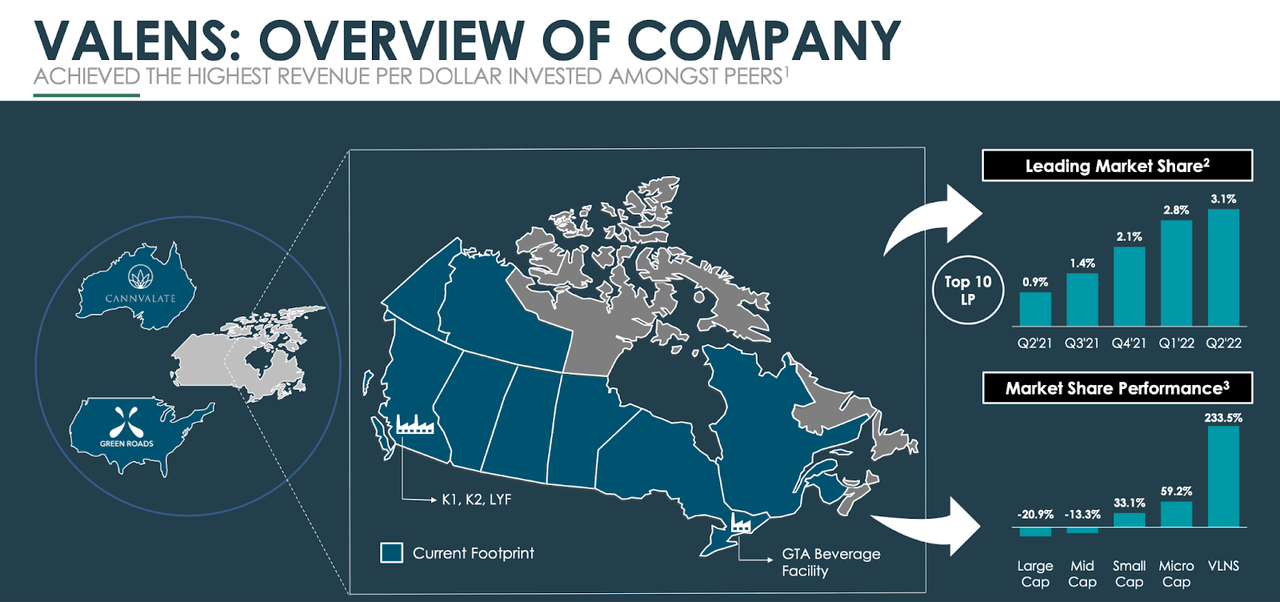

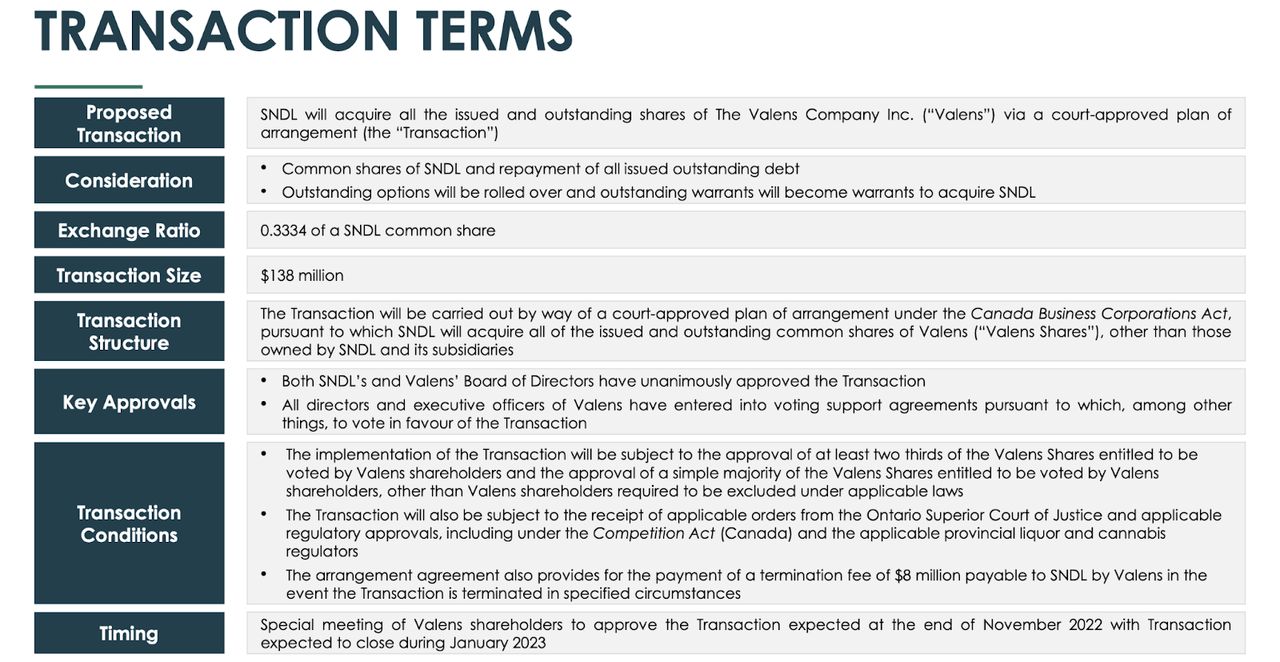

Subsequent to the end of the quarter, SNDL announced that it was acquiring Valens (VLNS), another cannabis operator in Canada.

SNDL Inc. – Valens Presentation

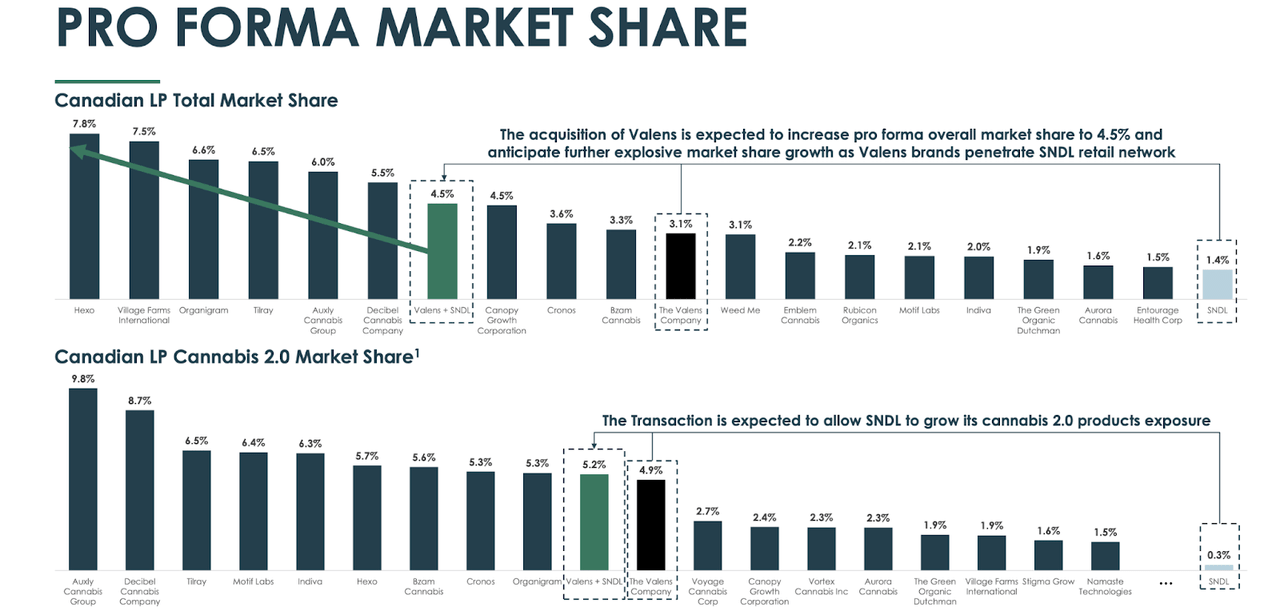

The combined company would have a projected 4.5% market share among Canadian licensed producers, bringing the company neck-and-neck with more well-known operators like Tilray (TLRY), Aurora Cannabis (ACB), and Canopy Growth (CGC).

SNDL Inc. – Valens Presentation

Under the terms of the agreement, each share of VLNS would receive 0.3334 shares of SNDL. SNDL expects the transaction to close in January of next year.

SNDL Inc. – Valens Presentation

As of recent prices, there remains a roughly 9% arbitrage spread, meaning that investors interested in owning SNDL could theoretically instead purchase VLNS stock and hold it through the transaction close to end up with 9% more shares. That, of course, is subject to the risk that the transaction falls through.

VLNS, for its own part, is not yet profitable on an adjusted EBITDA basis.

Valens Press Release

I view this transaction as a step in the wrong direction. The Canadian cannabis business has proven woefully difficult, with much promise and little execution to show for it over the past several years since the plant was legalized in 2018. I would have much greatly preferred the company to put more capital into its SunStream joint venture to invest in the equity and debt of U.S. cannabis operators, where cannabis operations are far more profitable.

Is SNDL Stock A Buy, Sell, Or Hold?

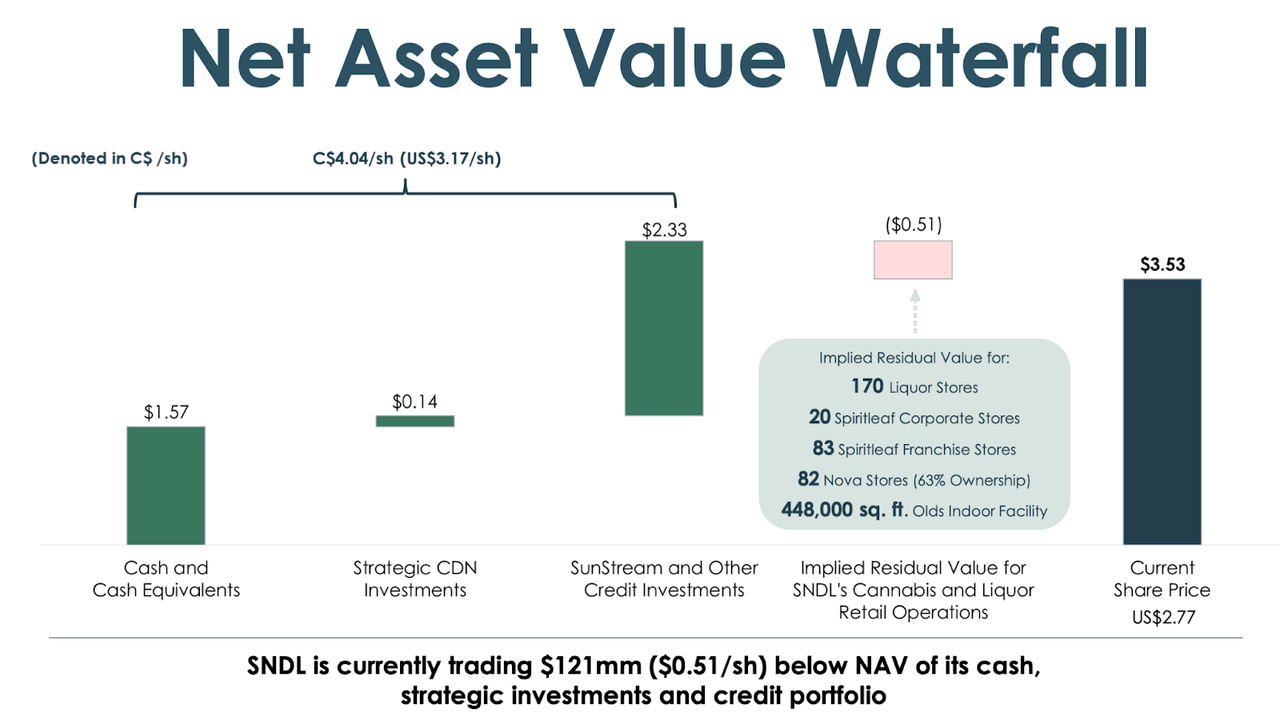

SNDL is no longer a meme stock, which means that it finally has real fundamental value. There is already $3.17 per share in value split between net cash, strategic Canadian investments, and its SunStream investment portfolio. But the stock is trading at around $2.20 per share, implying a negative value for the residual cannabis operations.

2022 Q2 Presentation

This means that in theory, SNDL could instantly create shareholder value by, for example, selling off its SunStream investment and using all the cash to repurchase the stock. Alternatively, SNDL could try to sell off its cannabis operations to repurchase the stock. Between the two, the latter may be the most direct for two reasons. First, exiting the cannabis operations may enable it to reduce its cash burn and second, the market will likely place greater value on the cash and investment portfolio – after all, the cannabis sector just underwent a severe crash.

But therein lies the problem. While SNDL is arguably better off just being an investment vehicle, there is no indication that management agrees. In fact, all evidence points to the contrary based on the recently announced acquisition of VLNS. That is typically the problem with these sum-of-the-parts value plays – the “hidden” value might remain hidden if management does not use it as a catalyst. In the meantime, SNDL may continue to burn cash – reducing the value of its net cash position – and that cash burn is likely to accelerate upon its acquisition of VLNS. I can see an eventual IPO or spinoff of SunStream as a potential catalyst leading to my buy rating – though I note that I continue to prefer investing instead in the stocks of U.S. operators.

Be the first to comment