alvarez/E+ via Getty Images

Investment Thesis

Snap (NYSE:SNAP) put out Q1 2022 results with a lot of fanfare, as usual. Here, I cut back the noise and look through the facts.

The good news is that Q2 2022 guidance marks the low point for 2022. After Q2, the remainder of 2022 will be much easier.

But the question that looms large is whether or not Snap can, with ease, return to growth at approximately 35% CAGR? And I’m not convinced of that argument.

What’s more, I fail to see how paying 43x this year’s EBITDA makes for a compelling long, when there’s so much uncertainty right now.

With all in mind, I turn slightly bearish on this name.

Investor Sentiment: Stocks Don’t Trade in a Vacuum

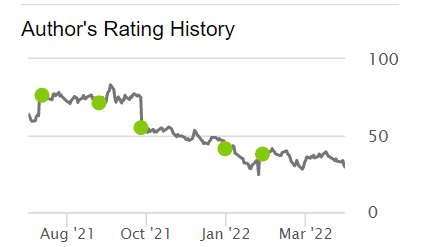

Author’s coverage of Snap

I’ve been a die-hard bull of Snap. Through all the ups and downs, well, mostly downs of late, I’ve been bullish on this name.

And the thing that frustrates people the most about my investment strategy is that when I’m wrong, I’m happy to admit that I was wrong.

I’m more than willing to put up my hand and admit that when the facts change, I have to change my mind.

So here’s why I’m now bearish on this name.

Revenue Growth Rates Outlook: Positive and Negative Considerations

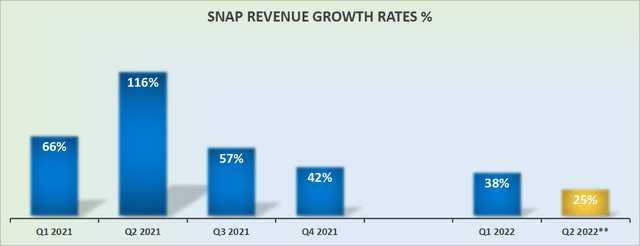

Snap revenue growth rates

There’s good news and bad news. The bad news is obvious, that Q2 last year was obviously the strongest revenue growth rate Snap had put out for a very long time, and that’s now in the rearview mirror.

Furthermore, the guidance for Q2 2022 points to ”just” 25% y/y revenue growth rates. Even though Snap states on the call,

We have shared that our business has grown at a rate of approximately 30% quarter-over-quarter to-date, but we’re concerned that the operating environment could be even more challenging going forward.

Accordingly, this is it. I believe that Snap’s guidance for approximately 25% y/y revenue growth rate in Q2 is a realistic forecast.

And before everyone starts clamoring that Snap is lowballing estimates to allow for an easy beat, remember, back in Q4 Snap’s guidance for Q1 2022 was for $1,030-$1,080 million in revenues this quarter.

And when Q1 actually came out, revenues were $1,063 million, thus below the high-end of its previous guidance.

Snap revenue surprises

For further evidence that Snap is not always lowballing estimates, consider that in the past twelve months, Snap has been 50/50 on whether it smashes through its revenue estimates or ends up missing estimates.

It’s very important when investing not to get distracted. Focus on the data.

The good news, however, is that once we get past Q2, the remainder of the year the comps get a lot easier. That’s something worthwhile to consider here.

Can Snap return to growing at approximately 35% CAGR or even higher in H2 2022? Presently, analysts continue to expect this to be the case.

And if Snap does return to growing at high 30s% to low 40s% CAGR, in that event, Snap would still be perceived to be in hypergrowth, and that would mean that the multiples that investors would be willing to consider would expand. And this investment, from this point, would work out.

But we’ll address its valuation soon. Before that, let’s talk about the elephant in the room.

Why I Turned Bearish on Tech?

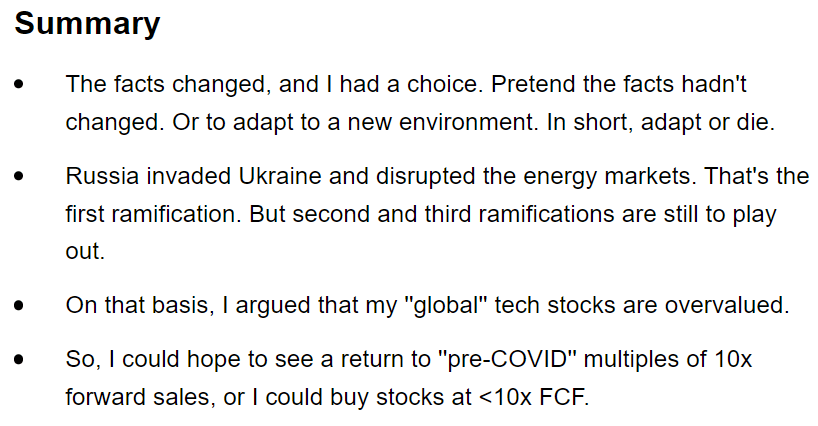

Recently, I wrote a two-part series on why I made a shift from tech to commodities where I discussed this. Here are the bullet points from part 1:

Why I Went From Tech To Commodities And You Should Too (Part 1)

To this effect, Snap’s call noted my concerns.

The slowdown in the rate of y/y growth observed post the invasion of Ukraine was broad-based, with the deceleration evident in both our direct response and brand advertising businesses, and to many industry verticals.

In the latter portion of Q1, advertisers in a wider variety of industry groups reported concerns related to the macro operating environment, including continued supply chain disruptions, rising input costs, economic concerns due to rising interest rates and concerns related to geopolitical risks stemming from the war in Ukraine.

Even though Snap’s share price bounced higher after hours, I don’t believe that this overhang is being sufficiently factored into Snap’s current valuation. Next, let’s cast our eyes on its profitability profile.

Will Snap ”Soon” Become Profitable?

If you have followed my past work, you would have read me make a lot of noise about the fact that with share prices falling, tech companies are going to have to dramatically increase their stock-based compensation, and that this would mean that all these tech companies are going to see their actual GAAP profitability decline going forward.

Along these lines, Snap commented,

While we have continued to grow our team and leverage stock-based compensation strategically to fostering ownership culture and drive long-term retention, we have remained focused on managing these programs responsibly.

[…] While we are pleased with the progress we have made on this metric, it is important to note that the dilution rate, in particular as it relates to SBC, tends to move inversely with our stock price. And thus can be subject to market forces over time.

Remember, the guidance that Snap puts out for Q2 2022 is an EBITDA guidance. This adds back stock-based compensation. So we are not getting any visibility into just how much stock-based compensation Snap is going to add in Q2.

But Snap is clearly signaling to investors that they are going to have to increase their compensation to have executive retention. Read the commentary again if you need further evidence.

SNAP Stock Valuation – Difficult to Estimate

Snap’s near-term revenue growth rates have a huge impact on the valuation premium that investors are willing to put on the stock.

If investors strongly believe that Snap is likely to grow at less than 30% CAGR, then they’ll put a lower multiple on the stock, compared with whether there’s a strong thesis that Snap could sustainably grow at more than 30% CAGR.

Having any visibility, clarity, conviction, and supportive arguments into Snap’s sustainable revenue growth rates would take this investment from a 50/50 chance of working out and tilt it in a positive direction.

Consider the following, Snap right now is priced at 8x sales. However, I don’t believe that investors are now, in 2022, valuing stocks on P/Sales ratios.

I know this strategy worked really well in 2020, but I believe that in 2022 investors are now mindful of bottom-line profitability.

On that basis, I estimate that Snap probably reaches around $1.1 billion of EBITDA this year. This puts the stock price at 43x this year’s EBITDA.

Is that cheap? I don’t think so. It really depends on whether or not Snap can grow its revenues sustainably at hyper-growth rates of 35% CAGR.

And at this stage, I do not believe this is a foregone conclusion.

The Bottom Line

There’s so much to like about Snap. Having at one point been a shareholder here, I have a very soft spot for it. I know that Snap’s management has triumphantly succeeded in pressing ahead and putting its privacy measuring hiccups in the rear-view mirror.

Indeed, given that this team has become so accustomed to overcoming one hurdle after another, this is clearly very bullish for shareholders.

But there again, I believe that Snap’s prowess has already been factored in here and then some.

Consequently, I’m not convinced that it’s worthwhile paying 43x EBITDA for Snap right now. Particularly when there are so many awesome bargains in the market right now priced at less than 10x free cash flow. Actual free cash flow, after stock-based comp is accounted for as a cash expense. Whatever you decide, good luck and happy investing.

Be the first to comment