niphon

Investment Thesis

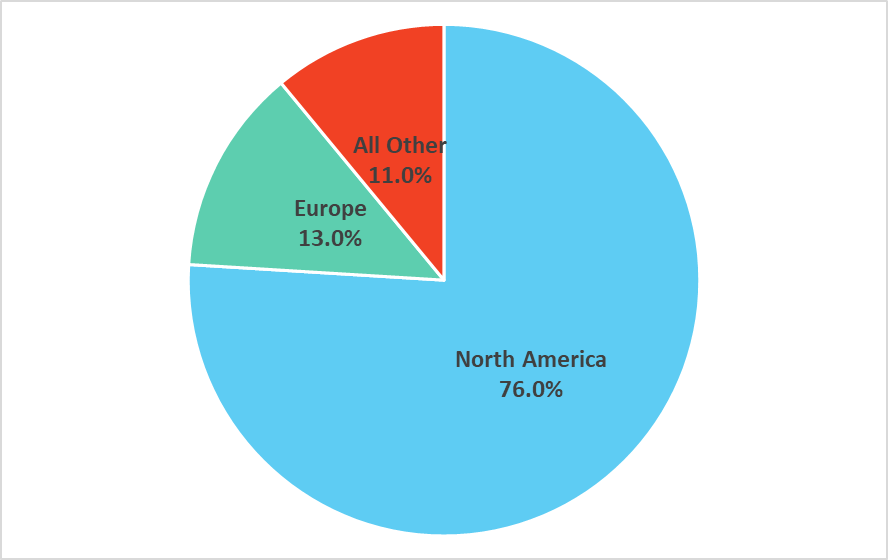

Snap-on (NYSE:SNA) is experiencing good demand for its products in North America and other emerging countries. While it is facing headwinds in Europe due to the rise in commodity costs, uncertain fuel supply, and the Russia-Ukraine War, I believe it should be more than offset by strengths in other geographies. The company should benefit from the initiatives in the Tools Group such as promotional activities through social media and expanding its franchisee’s selling capacity. Additionally, the trends in the auto repair markets such as increasing complexity in vehicles should act as a tailwind for the company as technicians will need better tools. The company’s margins should benefit from pricing actions, moderation in raw material costs, and RCI initiatives to improve productivity and efficiency.

Revenue Outlook

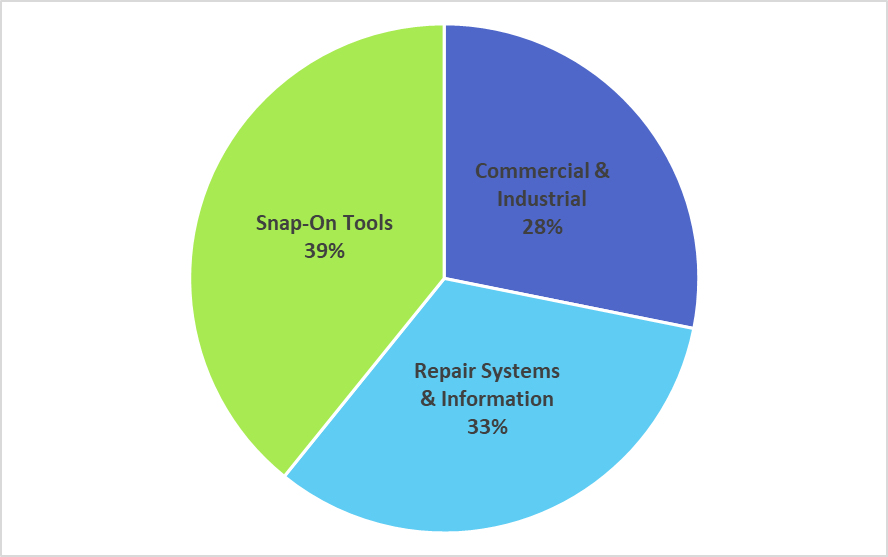

In Q3 FY22, the revenue of SNA increased 6.2% Y/Y helped by mid-single-digit sales growth in the Snap-on Tools Group segment, low single-digit growth in the Commercial Industrial Group (C&I) segment, and double-digit sales growth in the Repair Systems & Information Group (RS&I) segment. FX played a spoilsport negatively impacting the revenues by 4.2%. Geographically, the company experienced strong sales growth in the U.S. and other emerging markets, which more than offset the weaker demand in Europe.

The sales in the C&I segment grew 1.5% Y/Y due to the double-digit growth in the specialty tools business and a low single-digit increase in sales to customers in critical industries, partially offset by a 6.4% negative impact from FX translation. The sales in the Snap-on Tools Group segment increased 5.3% Y/Y due to a high single-digit gain in the U.S. business, partially offset by a low single-digit sales decrease in the international business and a 2.1% headwind from negative FX translation. The sales in the RS&I segment increased 13.6% Y/Y due to increased activity at the OEM dealerships, a double-digit percentage increase in sales of under-car equipment and collision repair, and a low single-digit percentage increase in sales of diagnosis and repair information products, partially offset by a 3.6% headwind from negative FX translation. The orders across the company increased by double-digit Y/Y with strong orders for tool storage, hand tools, and big-ticket items.

Looking forward, the auto repair market remains strong for the company. The spending on vehicle maintenance and repair is up as the vehicles are getting more complex and need more repairs. Big shop owners and managers are also experiencing good demand for vehicle repairs. SNA’s Repair Systems and Information Group segment is well-positioned to take advantage of opportunities in vehicle repairs. As the vehicles are getting more complex with a neural network of sensors, a dent on a bumper can lead to thousands of dollars in repairs as everything has to be recalibrated. New vehicles are released with different drivetrains, more driver assists, and increased vehicle automation, and Snap-on is well-positioned to help repair shops with products such as Fast-Track Intelligent Diagnostics, the Zeus, the TRITON, Mitchell 1 ProDemand repair information, etc.

The C&I segment is facing headwinds in Europe due to the rise in commodity costs, uncertain fuel supply, and currency fluctuation. However, the demand in North America and other emerging countries is demonstrating continued strength. The company is committed to extending in the critical industries and strengthening its position to capture opportunities as they arise by expanding its innovative product lineup. In the Snap-on Tools Group segment, the company is working on expanding its franchisee’s selling capacity, harnessing social media for promotional activities, and improving its products.

SNA’s geography-wise distribution (Company data, GS Analytics Research)

SNA’s segment-wise distribution (Company data, GS Analytics Research)

I believe that the company’s initiatives for the Tools Group, growth in all geographies except Europe, and positive trends in the auto repair market should benefit revenue growth in FY23.

Margin Outlook

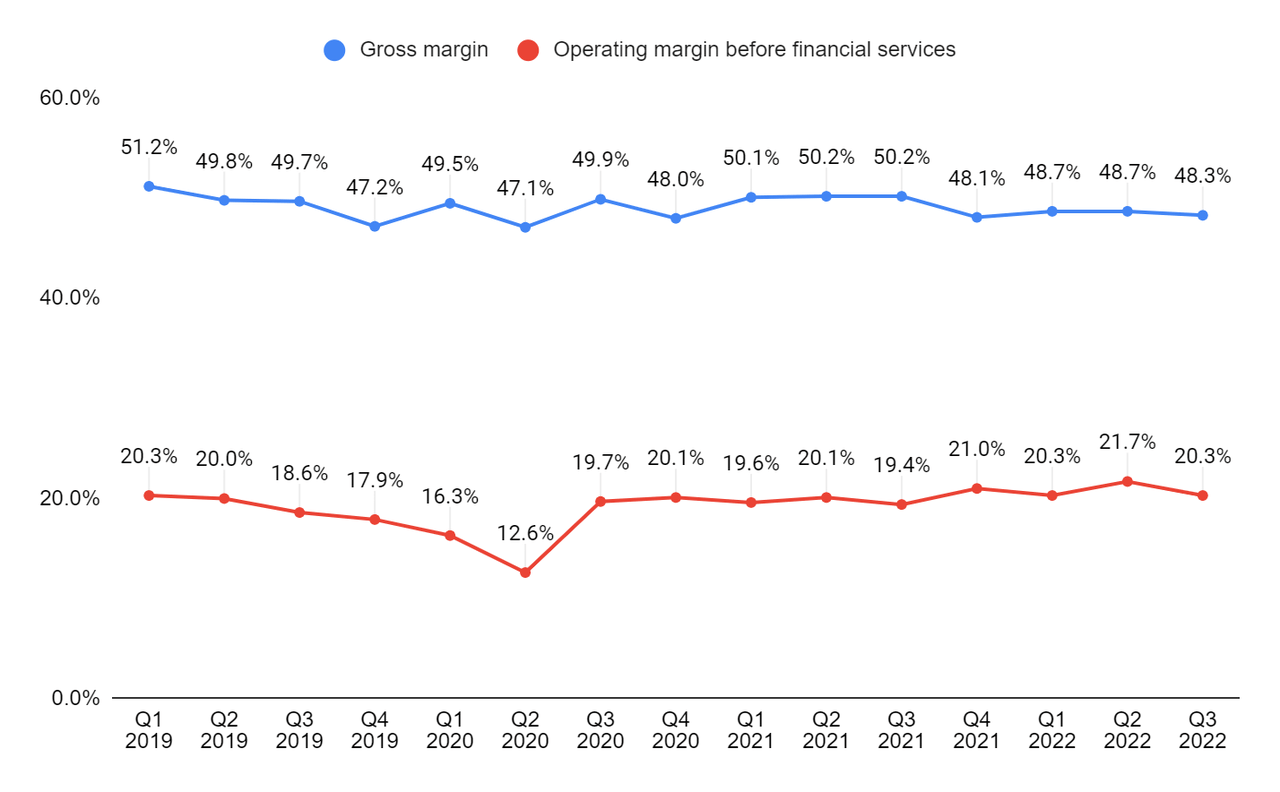

In Q3 FY22, the gross margin declined 190 bps Y/Y to 48.3% due to higher material costs, partially offset by increased sales volume, pricing actions, and the company’s Rapid Continuous Improvement (‘RCI’) initiatives. The operating margins (excluding financial services) improved by 90 bps Y/Y to 20.3% due to the 280 bps Y/Y improvement in operating expense as a percentage of revenue.

SNA’s gross margin and operating margin before financial services (Company data, GS Analytics Research)

Looking forward, the company’s margin should benefit from the moderation in raw material costs, such as steel prices. Additionally, the company’s margins should also benefit from the pricing actions taken to offset the inflation and SNA’s RCI initiatives which focus on improving the company’s productivity and efficiency.

Valuation & Conclusion

The stock is trading at 13.96x FY23 consensus EPS estimates of $16.69, which is slightly lower than its five-year average forward P/E of 14.30x. The company’s revenue should benefit from the initiatives in the Tools Group, growth in all geographies except Europe, and positive trends in the auto repair market. The margins should benefit from pricing actions, moderation in raw material costs, and RCI initiatives. Given the good growth prospects and a reasonable valuation, I have a buy rating on the stock.

Be the first to comment