Passakorn Prothien/iStock via Getty Images

Smartsheet Q4 Earnings – Good Results in a Crowded Market

“The global work management market is thriving, and customers are choosing Smartsheet (NYSE:SMAR) in record numbers” claimed company CEO Mark Mader as part of the firm’s recent Q4 FY ’22 earnings release. With regard to his market claim, is he right? In the context of SMAR itself, I think the question is a bit hard to answer; but this is actually to the credit of the now 15+ year-old company. SMAR’s relatively broad product suite can support a variety of use cases and needs, such as workflow automation, project management, and no-code application development. Accordingly, there is no single market that necessarily encompasses everything that SMAR can do and thus it is quite challenging to evaluate the dynamics of their overall market – which, incidentally, the company described differently as the “work execution market” in its Annual Report FY ’21. Personally, I tend to “lump” SMAR into the workflow automation market as I think it is a reasonable generalization for the company’s capabilities. On that point, we might note that Precision Reports, obviously representative of only a single analyst, forecasts the global workflow automation market to grow from roughly ~$8B today to $17.3B by 2027 at a 13.4% CAGR.

I think the prior, albeit brief, market analysis is helpful when evaluating the firm’s recent quarterly and full-year performance, whose results included:

- Q4 and FY ‘22 revenue total both grew ~43% on a QoQ and YoY basis respectively. Total revenue in the quarter was $157.4M versus $109.9M in the prior period; and total revenue for FY ’22 was $550.8M versus $385.5M in the prior year.

- As the firm’s strongest quarter (historically speaking), Q4 billings grew 48% QoQ. Q4 FY ’22 billings stood at $224.3M versus $151.2M in the prior period. Notably, full-year billings increased at nearly the same rate, growing 47% to $661.5M in FY ’22 versus $450.7M in FY ’21.

- Strong customer growth with each of the firm’s “buckets” of annualized contract value (“ACV”). Management reported that the number of customers with ACV of $100,000 or more grew 74% QoQ to 1,026; the number of customers with ACV of $50,000 or more grew 28% QoQ to 2,354; and the number of customers with ACV of $5,000 or more grew 37% QoQ to 15,150.

- GAAP operating margin held steady at negative (31%) for the full-year versus FY ‘21. GAAP operating margin for the quarter saw a (700bps) drop to (33%) versus the prior period, again, largely due to increased share-based compensation.

- Full-year GAAP operating loss increased to ($170.0M) from ($120.5M) in the prior year. The increase in operating loss is largely attributable to an increase in share-based compensation expense from $72M to ~$116M.

When we consider SMAR’s performance in the context of the prior market analysis, we might surmise they:

- Have a good amount of runway ahead; and

- Are outpacing the market growth rate (if we assume the CAGR of 13.4% mentioned above reasonably reflects the CAGR of their overall market).

However, with respect to the first point, we must consider this assumption with the understanding that the firm plays in a fairly crowded space. Management notes that:

Our primary competition remains a combination of manual, email- and spreadsheet-based processes from providers such as Microsoft and Google that users have historically relied on to manage work. Certain of our features compete with current products and services offered by Airtable, Asana, Atlassian, Monday.com, Planview, Workfront, Wrike, and others.

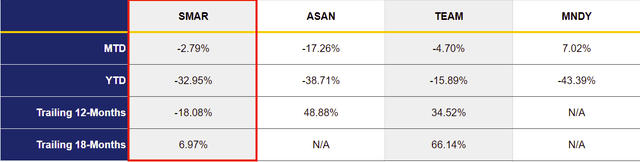

Of the firms listed in the quote, Asana (ASAN) and monday.com (MNDY) are arguably two “closer” competitors to SMAR in terms of product offerings, firm size, and operating characteristics. On that point, this particular group of companies has seen a rough start to the year.

Figure 1: SMAR and Selected Competitor Performance Comparison

Notes:

- Data as of market close March 17, 2022.

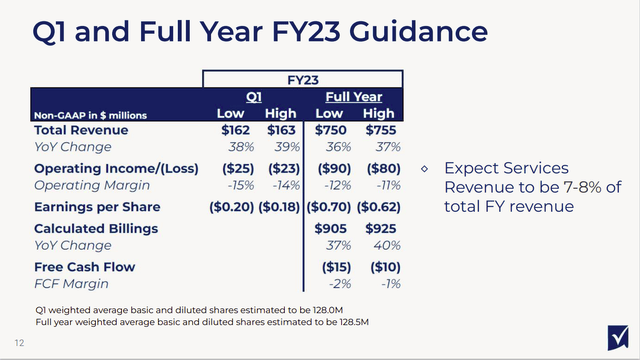

With market dynamics in mind, what can investors expect from SMAR in FY ’23 and beyond? And, more importantly, can the company ever become profitable?

SMAR is On Track to Reach $1B in Sales but a Tough Path to Profitability

Management’s forecast for FY ’23 includes continued outperformance on the top line, albeit at a slowing rate, as well as FCF margin improvement which stood at (-4%) for FY ‘22.

Figure 2: SMAR FY ’23 Forecast

SMAR Q4 FY ’22 Earnings Presentation

Source: SMAR Q4 FY ’22 Earnings Presentation

If we extrapolate from the high-side revenue forecast using the anticipated rate of growth of 36%-37%, SMAR should be generating $1B+ in sales by the end of FY ’24 – a significant milestone, although perhaps one some investors think should have been achieved sooner given the firm’s age. Naturally, should the company fail to meet its targets, investors may be waiting until FY ’25 or beyond for management to reach that goalpost.

While SMAR may indeed continue to perform reasonably well in terms of sales growth, we should also note that non-GAAP operating margin is expected to worsen to (11%) – (12%) versus (6%) in FY ’22. Investors are therefore led to wonder if SMAR will merely keep generating losses, or if the firm has a route to profitability. I tend to lean in the direction that SMAR will never become profitable for 3 reasons:

- Ongoing sales and R&D compensation expenses will probably keep SMAR in the red. SMAR has done a great job seeding a large number of accounts with small environments. For example, as noted in the introductory section, the firm recorded more than 15,000 customers with an ACV of at least $5,000 but less than $50,000. Accordingly, this large pool of small customers holds the promise of expansion into larger ACV “buckets”. However, this will, of course, come at a cost as SMAR needs to invest in its sales and marketing organization to drive those opportunities. Like so many other software vendors, SMAR has a fairly large share-based compensation expense attributable to its sales team, and this will continue to grow with management’s planned investments in its field organization for FY ’23; although Pete Godbole, SMAR’s CFO, noted during the Q4 FY ’22 earnings call that the company hopes to eventually realize efficiencies of scale from those investments, thus helping bolster margins. Having sold enterprise software for so many years, I am reasonably certain that SMAR’s average deal size is simply too low relative to the costs of its sales organization; and, more importantly, that its average deal size will probably never grow to a sufficient size to offset those costs. Therefore, I am suggesting SMAR might never achieve an economy of scale with its field operations and that particular functional area is, more than any other area, likely to keep the firm in the red. SMAR similarly has a large share-based compensation expense associated with its R&D organization; in fact, share-based compensation expenses for R&D were slightly higher than the analogous expense for sales operations in FY ’22. Given the market dynamics discussed earlier, R&D compensation expense is also going to have to increase so that SMAR can keep pace with its main competitors. Unlike sales, I do tend to think management may be able to achieve a certain economy of scale with its R&D team over time; and therefore R&D share-based compensation expense may level off at some point. But, overall sales and R&D compensation expenses will probably continue to increase at a rate that is not offset by resulting revenue growth.

- Competitive displacements have been a driver of new deals, but SMAR’s moat may not be all that wide. Mr. Mader explained during the Q4 FY ’22 earnings call that “…it was notable in the sense that [SMAR] had a few really nice-sized wins and growth opportunities that either happened to displace a competitor or [SMAR is] growing very tremendously around the competitor who was in an account.” This, naturally, is an ideal dynamic where SMAR is knocking competitors out of an account, or “landing” next to one or more competitive solutions such that they can co-exist or replace those solutions over time. This success is evidenced by its net retention rate, which is expected to be above 130% in FY ’23, and by its low rate of churn. While SMAR may enjoy a certain “stickiness” among their larger customers who are probably reluctant to move broad deployments to an alternative platform, the same may not be true among their smaller customers. Smaller customers who operate a set of work management software products may ultimately rationalize to a single platform given that it may be easier for them to do so; and it’s not clear to me that SMAR has such an edge over its competitors like ASAN and MDAY whereby it would be a given they would emerge as the platform-of-choice under such a scenario. Of course, this is where selling comes into play. But, this implies then SMAR must operate a (likely) very expensive field team to maintain its position in smaller accounts. Those economics are probably not going to work. Further, while SMAR has a very low churn rate, they are not immune from churn itself. Smaller customers, in particular, may be inclined to hunt for increasingly cheaper solutions over time because their cost of migration may be relatively low; and with such a large percentage of SMAR’s customers with ACVs less than $100,000, investors may see the company’s churn rate increase significantly over time.

- Services revenues suggest SMAR may be destined to be more of a departmental solution rather than a strategic solution. Per Figure 2, SMAR expects 7% – 8% of total sales in FY ’23 as services revenues. Thus, assuming the company achieves its high-side sales forecast, SMAR will recognize ~$60M in services revenues in the current fiscal period. While that is certainly not trivial, I sense that a large segment of customers is using SMAR’s out-of-box functionality for isolated, departmental use cases, but not exploiting the platform strategically. This idea seems to be aligned with management comments made during the Q4 FY ’22 earnings call; and would certainly be an impetus for the company to expand its salesforce such that they can drive more accounts to use the SMAR ecosystem more strategically. However, we must recognize that SMAR is more than 15 years old at this point; and one might be forgiven to expect a much larger contribution of sales from services both in an absolute sense and on a percentage basis. While it is just my supposition, SMAR’s relatively small services business could be suggestive that a handful of customers are using the SMAR platform strategically and driving a majority of services revenues, while the overwhelming majority of customers are perfectly content with easily maintained, more out-of-the-box-type functionality. That, in turn, could suggest top line growth could stall as expected opportunities to grow smaller customers into larger ones do not materialize.

Closing Thoughts

Answering my earlier question, I personally suspect SMAR will never become profitable. That being said, it would seem that the company has the right ingredients to cook up a strong FY ’23, and thus I wouldn’t be surprised if share prices react accordingly. At the same time, I think the stock, which appreciated nicely after Q4 FY ’22 results were released, offers little margin-of-safety relative to the long-term risks inherent to the business. As such, and in spite of their excellent software products, I think there are better opportunities than SMAR for investors looking to deploy capital into a tech play.

Be the first to comment