Dilok Klaisataporn

This ETF review series aims at evaluating products regarding the relative past performance of their strategies and metrics of their current portfolios. As holdings and weights change over time, updated reviews are posted when necessary.

Strategy and portfolio

The iShares S&P Small-Cap 600 Value ETF (NYSEARCA:IJS) has been tracking the S&P SmallCap 600 Value Index since July 2000. It is the second small cap value ETF regarding assets under management, after the Vanguard Small Cap Value ETF (VBR). It has 517 holdings, a 12-month trailing yield of 1.67%, a total expense ratio of 0.18%. It is a direct competitor of the SPDR S&P 600 SmallCap Value ETF (SLYV) and the Vanguard S&P Small-Cap 600 Value Index Fund (VIOV), which track the same underlying index and have a similar expense ratio (0.15%). If you have read my recent review of VIOV, you can save your time and skip this one: they are almost identical and my conclusion is the same. Some differences in the top 10 holdings and constituent weights are due to index tracking tactics. They are not worth a lot of attention. Since VIOV’s inception (09/07/2010), both funds have similar annualized returns (11.85% vs. 11.74%) and risk metrics.

As described by S&P Dow Jones Indices, S&P 600 constituents are ranked in Value and Growth styles using three valuation ratios and three growth metrics. The valuation ratios are book value to price, earnings to price and sales to price. By construction, 33% of the parent index constituents exclusively belongs to each style, and 34% belongs to both styles. The Value subset serves as S&P 600 Value Index and is rebalanced annually. It is capital-weighted, with an adjustment for constituents belonging to both styles. For example, a company with a Value rank better than its Growth rank is given a larger weight in the Value Index than in the Growth Index.

Aggregate valuation ratios of IJS are a bit disappointing: they are not much lower than for the parent index S&P SmallCap 600, represented in the next table by the iShares Core S&P Small-Cap ETF (IJR).

|

IJS |

IJR |

|

|

Price/Earnings TTM |

11.29 |

11.61 |

|

Price/Book |

1.39 |

1.69 |

|

Price/Sales |

0.66 |

0.86 |

|

Price/Cash Flow |

8.36 |

9.13 |

Source: Fidelity

IJS has over 500 holdings. The top 10 names represent 7.4% of asset value. The next table reports their weights and valuation ratios. The heaviest one weighs about 1%. As a consequence, risks related to individual stocks are very low.

|

Ticker |

Name |

Weight% |

P/E TTM |

P/E fwd |

P/Sales |

P/Book |

P/FCF |

Yield% |

|

Helmerich & Payne, Inc. |

1.06 |

877.51 |

11.32 |

2.61 |

1.95 |

N/A |

1.97 |

|

|

South Jersey Industries, Inc. |

0.83 |

25.90 |

20.02 |

1.62 |

2.04 |

N/A |

3.64 |

|

|

Sanmina Corp. |

0.77 |

16.50 |

11.52 |

0.51 |

2.17 |

20.98 |

0 |

|

|

Patterson-UTI Energy, Inc. |

0.76 |

N/A |

32.14 |

1.67 |

2.38 |

N/A |

1.82 |

|

|

CVB Financial Corp. |

0.72 |

18.55 |

17.07 |

7.63 |

2.12 |

25.88 |

2.79 |

|

|

Hostess Brands, Inc. |

0.71 |

21.56 |

26.95 |

2.73 |

2.00 |

28.31 |

0 |

|

|

First Hawaiian, Inc. |

0.66 |

13.80 |

12.86 |

4.29 |

1.52 |

11.44 |

3.97 |

|

|

Mr. Cooper Group, Inc. |

0.63 |

3.14 |

18.63 |

1.18 |

0.79 |

0.68 |

0 |

|

|

Agree Realty Corp. |

0.62 |

38.52 |

40.01 |

14.08 |

1.30 |

48.69 |

4.07 |

|

|

Insight Enterprises, Inc. |

0.62 |

14.18 |

11.75 |

0.35 |

2.29 |

N/A |

0 |

Ratios: Portfolio123

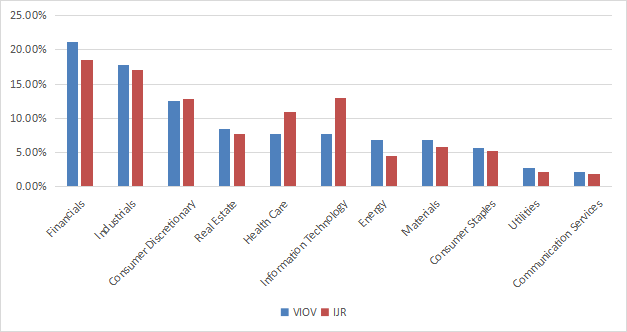

The top 3 sectors are financials (21.4%), industrials (18%) and consumer discretionary (12.6%). Other ones are below 9%. Compared to the small-cap benchmark, IJS underweights technology and healthcare.

IJS Sector breakdown (chart: author; data: iShares)

Since inception (07/24/2000), IJS is very close to the parent index in performance and risk metrics. Sharpe ratios (measuring risk-adjusted performance) are identical.

|

since July 2000 |

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

IJS |

693.97% |

9.72% |

-59.83% |

0.48 |

21.15% |

|

IJR |

681.65% |

9.64% |

-59.77% |

0.48 |

20.12% |

Data calculated with Portfolio123

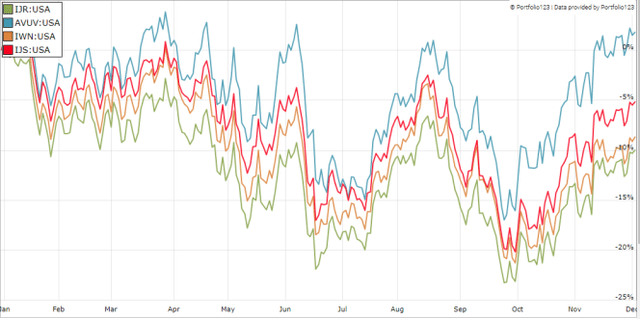

IJS beats IJR in 2022 (see next chart). Among its competitors in the small cap value category, it beats the iShares Russell 2000 Value ETF (IWN), but lags the Avantis U.S. Small Cap Value ETF (AVUV) by almost 7 percentage points.

IJS vs. IJR and competitors in 2022 (Portfolio123)

Comparison with my Dashboard List model

The Dashboard List is a list of 60 to 80 stocks in the S&P 1500 index, updated every month based on a simple quantitative methodology. All stocks in the Dashboard List are cheaper than their respective industry median in Price/Earnings, Price/Sales and Price/Free Cash Flow. An exception in utilities: the Price/Free Cash Flow is not taken into account to avoid some inconsistencies. Then, the 10 eligible companies with the highest Return on Equity in every sector are kept in the list. Some sectors are grouped together: energy with materials, communication with technology. Real estate is excluded because these valuation metrics don’t work well in this sector. I have been updating the Dashboard List every month on Seeking Alpha since December 2015, first in free-access articles, then in Quantitative Risk & Value.

The next table compares IJS since inception with the Dashboard List model, with a tweak: here, the list is reconstituted once a year to make it comparable with a passive index.

|

since July 2000 |

Total Return |

Annualized Return |

Drawdown |

Sharpe ratio |

Volatility |

|

IJS |

693.97% |

9.72% |

-59.83% |

0.48 |

21.15% |

|

Dashboard List (annual) |

1199.16% |

12.16% |

-57.52% |

0.68 |

17.13% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

The Dashboard List outperforms IJS by 2.5 percentage points in annualized return and has slightly better risk metrics (drawdown and volatility). A note of caution: IJS price history is real, whereas the model simulation is hypothetical.

Price to Book: a risky concept of value

I like the idea of mixing various ratios to rank value stocks. However, I think most value indexes doing so have two weaknesses, and IJS no exception. The first one is to classify all stocks on the same criteria. It means the valuation ratios are considered comparable across sectors. Obviously, they are not: you can read my monthly dashboard here for more details about this topic. A consequence is to overweight sectors where valuation ratios are naturally cheaper, especially financials. Some other sectors are disadvantaged: those with large intangible assets like technology. Companies with large intangible assets are those with a business model based on massive R&D, or a strong branding, or large user databases, or operating in a field where competition is limited by an expensive entry ticket. All these elements are not correctly reflected by valuation ratios.

The second weakness comes from the price/book ratio (P/B), which adds some risk in the strategy. Intuitively, a large group of companies with low P/B contains a higher percentage of value traps than a same-size group with low price/earnings, price/sales or price/free cash flow. Statistically, such a group has a higher volatility and deeper drawdowns in price. The next table shows the return and risk metrics of the cheapest quarter of the S&P 500 (i.e. 125 stocks) measured in price/book, price/earnings, price/sales and price/free cash flow. The sets are reconstituted annually between 1/1/1999 and 1/1/2022 with elements in equal weight.

|

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

Cheapest quarter in P/B |

9.95% |

-72.36% |

0.48 |

21.05% |

|

Cheapest quarter in P/E |

11.25% |

-65.09% |

0.57 |

18.91% |

|

Cheapest quarter in P/S |

12.62% |

-65.66% |

0.6 |

20.46% |

|

Cheapest quarter in P/FCF |

12.23% |

-63.55% |

0.61 |

19.05% |

Data calculated with Portfolio123

This also explains my choice of not using P/B in my Dashboard List model (more info at the end of this post).

Takeaway

IJS tracks the S&P SmallCap 600 Value Index, whose constituents are chosen and weighted based on various value and growth metrics. IJS, VIOV and SLYV have the same underlying index and they are equivalents for long-term investors. However, IJS is better for tactical asset allocation and trading, because it has a higher trading volume. Historical return and risk metrics are very close to those of the S&P SmallCap 600. IJS may be part of a tactical allocation strategy switching between value and growth styles. However, the S&P SmallCap 600 Value Index is not more attractive than its parent index regarding long-term performance. In my opinion, it has two weaknesses: ranking stocks regardless of their industries, and relying too much on the price/book ratio.

Be the first to comment