deberarr

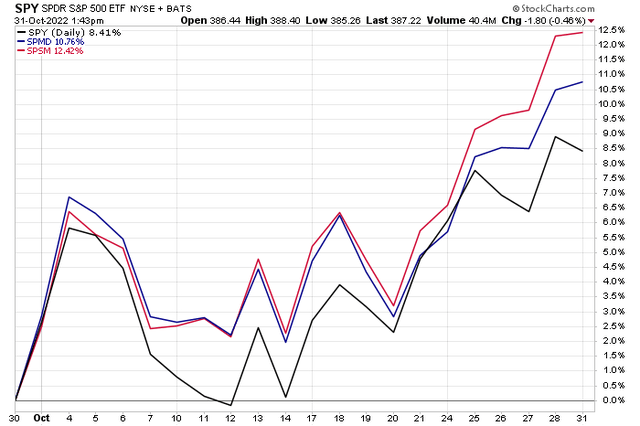

October proved to be a treat for small-cap and value equity investors. The S&P 500 ETF (SPY) rose 8% while mid-caps jumped 11%. Top of the heap was the smallest of the bunch, though. The SPDR Portfolio S&P 600 Small Cap ETF (NYSEARCA:SPSM) surged more than 12% for its best month since November 2020.

October Returns: The Smaller, The Better

SPSM: Small Caps Recover September’s Losses

I prefer to put on my intermarket analysis hat when reviewing monthly performances across financial markets. That means dissecting movements in bonds, stocks, commodities, and currencies.

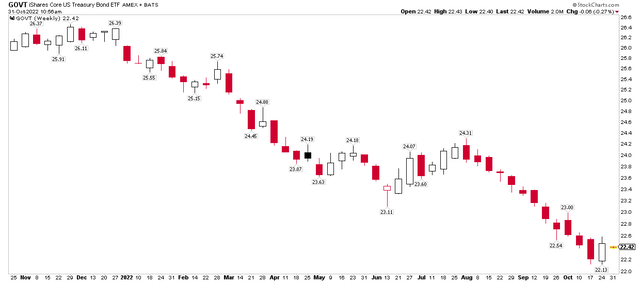

One of the biggest stories of October was the pronounced deterioration among government bonds. Down a staggering 12 straight weeks dating back to August, the iShares Core U.S. Treasury Bond ETF (GOVT) finally broke its downtrend during October’s final full week.

Tough Times For Treasuries

Rates rose on Halloween, though, as markets await the Nov. 2 Federal Reserve meeting. It’s widely expected that yet another 75-basis-point policy rate hike is in the cards. Traders have priced in a Fed terminal rate near 5% by May next year.

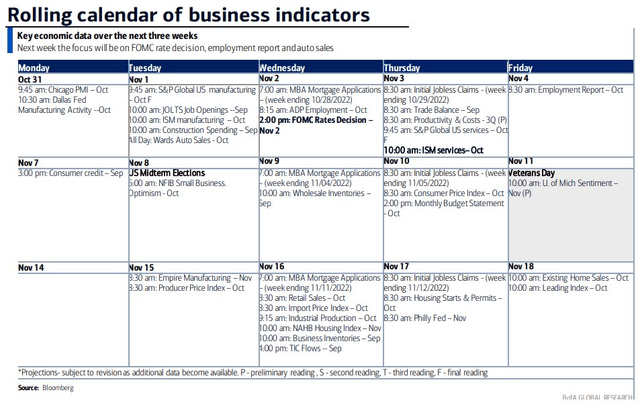

More market-moving news hits the tape this week, starting with the ISM Manufacturing report Tuesday morning and Friday’s jobs report. Volatility might also strike next week following the U.S. midterm elections (though I expect it to be a non-event) and with next Thursday’s CPI data release. And don’t forget about corporate earnings season, which continues through mid-November. Thus far, FactSet notes that the Q3 reporting period has featured the lowest EPS growth rate since Q3 of 2020.

Major Economic Data Points Upcoming

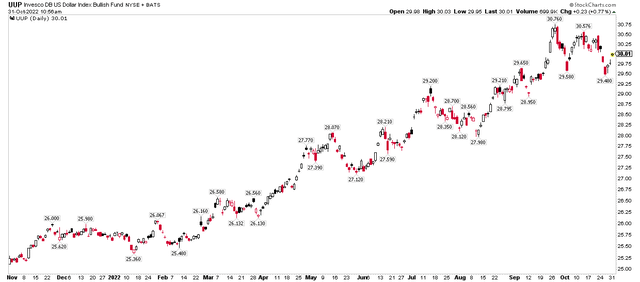

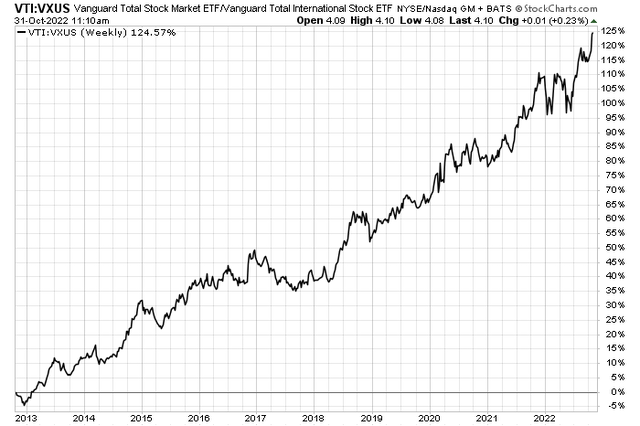

Stocks, of course, surged in October with the S&P 500 up more than 8%, but foreign equities suffered on a relative basis thanks to a much stronger U.S. dollar and turmoil in China. Domestic shares notched yet another all-time high against ex-U.S. names by late month. The major highlight was the sharp bearish reaction to President Xi’s re-election in China on Oct. 20.

U.S. Dollar ETF: Off The Highs

U.S. Stocks Marching Higher Vs Foreign Shares

Commodities have been rather quiet recently as inflation risks are balanced by a growth scare (boo!). Crude oil generally ranged from the low $80s to the mid-$90s in October as the Strategic Petroleum Reserve (SPR) continues to be tapped – now at its lowest reading in the last 40 years. RBOB gasoline futures, meanwhile, finished the month near 4-week lows after a move up from its year-to-date lows in September.

WTI Crude Oil In A Holding Pattern

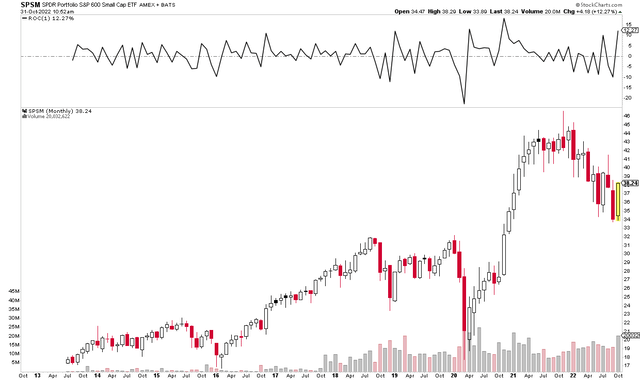

Honing in on small caps, SPSM tracks the total return performance of the S&P SmallCap 600 Index, with just a 0.05% gross annual expense ratio. SSGA Funds says SPSM is one of the low-cost core SPDR Portfolio ETFs, a suite of portfolio building blocks designed to provide broad, diversified exposure to core asset classes.

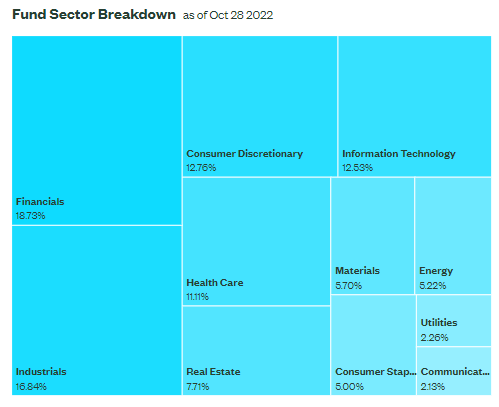

Small caps offer different exposure compared to large caps. SPSM’s biggest sector weight is Financials, a value area, at nearly 19% compared to the S&P 500’s massive 26% allocation to the growth-oriented Information Technology sector.

More broadly, SPSM is just 27.4% invested in the tech-media-telecom (TMT) sectors of I.T., Consumer Discretionary (dominated by Amazon and Tesla), and Communication Services sectors versus the S&P 500’s 44.6% combined weighting.

The bottom line is that if you seek exposure to the suddenly high-momentum ‘value’ style, now could be a great time to own SPSM. With still low valuations and relative strength perking up, I think an overweight to small caps can still work for the next several months.

SPSM: Value And Cyclical Tilts

SSGA Funds

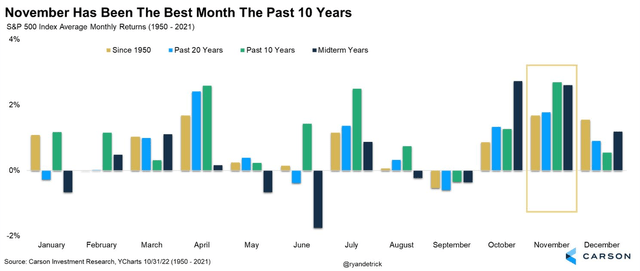

Looking ahead, seasonal trends favor the bulls (for a change). We just completed the most bearish stretch of the election cycle – Q2 and Q3 of a midterm year. Perhaps the bulls got ahead of the trend, given October’s strong rally. Nevertheless, Ryan Detrick at Carson Group finds that November has been the best month for the broad market in the last 10 years.

More Upside Risks? Bullish Season Trends Seen In November

The Bottom Line

This year’s steep stock market losses were just partially offset in October. Uncertainty is still high with the VIX in the mid to high 20s. Key economic data hits this week and next, along with a Fed meeting and the midterms making for some macro event risk. Corporate earnings reports keep rolling in, too. Equity investors hope the momentum continues for value and small-cap stocks following a stellar few weeks.

Be the first to comment