ampueroleonardo/iStock via Getty Images

Skyworks Solutions (NASDAQ:SWKS) reported in-line results for the recent quarter guiding upward for the September quarter. Unlike Qorvo (QRVO) which guided flat quarter over quarter, Skyworks’s significant exposure with Apple (AAPL) drives this seasonal response. Our last report on Skyworks forecasted cloudy skies. Since storm clouds come and go, we must ask, have the skies cleared?

June Quarter

We begin with the recent quarterly. Skyworks reported inline results:

- Record June Quarter revenue at $1.23 billion.

- Non-GAAP earnings of $2.44.

- Cash from operations of $214 million.

- Gross Margins of 51.2%.

- Purchased 1 million shares.

- Paid a dividend of $0.54.

Management guided September:

- Revenue between $1.375 billion and 1.425 billion.

- Gross margins between 51.0-51.5 inline with last quarter.

- Raised its dividend to $0.62 a share.

- Tax rates at 9%.

- Earnings at the mid-point of $2.90.

- Predicts sequential growth for the 2nd half of the year.

From the call, “Skyworks Technology leadership, innovation and scale has allowed us to continue to capture an outsize share of our mobile revenue from high performance 5G platforms. In Enterprise and IoT, we powered tri-band access points at Cisco, ramped Orange Livebox 6, Europe’s first carrier-grade 6E platform. We launched advanced solutions with Verizon for integrated WiFi and cellular gateways and supported Google’s newest Pixel Watch with our cellular GPS, WiFi and Bluetooth technologies.”

The automotive segment achieved record revenue. The company is leveraging its technology in market leading approaches for robo taxis and driverless vehicles and is working on a long laundry list of new products and technologies.

A Company’s Interesting Insight

Skyworks also offered investors a few bits of insight into its marketplace with a few statistics and facts.

- Global wireless data traffic is expected to grow at a 27% annual rate over the next five years (More than double).

- Machine to machine connections, the fastest growing IoT category will soon surpass 15 billion users.

- By 2030, we expect 650 million connected cars each consuming 25 times the data that we see in today’s smartphone.

Continuing, Skyworks now has two 10% plus customers, Apple with 55% of its total revenue and Samsung (OTCPK:SSNNF) at 10% plus. It also considers Google (GOOG) (GOOGL), a major customer.

Its broad market business, which grew almost 40% year over year, consists of more than 6000 customers. The infrastructure and networking business generates $2 billion in revenue on an annualized run rate. The broad business represents 38% of the business while mobile equals 62%. The mobile business was slightly down year over year driven from extreme China weakness. The broad base business is expected to remain strong year over year in the September quarter.

At this point, free cash flow is in the “mid-20s as a percent to revenue and based on further growth of the top line and further expansion of the profitability, we have line of sight to get to plus 30% free cash flow margin.” This view explains the steep dividend increase announced in June.

The China Problem

But all is not well. Raji Gill of Needham & Company asked, “Just a question on China. I know it’s about 10% to 15% of your revenue, but wondering kind of what you’re seeing in terms of the inventory situation there across the China handset OEMs?”

Liam Griffin, CEO, answered, “Yeah, it’s been certainly a challenging market in China and there’s several factors that played out here, right? Of course, you had lockdowns in some of the major provinces and across many of the factories that impeded demand even with the larger customers. And then you also had a group of folks that were just a little bit less prepared for the lockdowns as well. So if you look at the high-end market, China is still a market where you can get some very, very strong activity, tampered bit by lockdowns, which we think are going to abate rather quickly. But on the lower-end, the OBX brands really hadn’t performed too well at all.” It is about the lower phone market.

Vivek Arya of Bank of America asked, “I’m curious how much of a year-on-year headwind has China Android been for June and September, and does China Android bottom for you in December or March or when?” Griffin answered, “Even in the December quarter, almost a year ago, we started pushing the brakes. We actually pushed the brakes pretty hard in March and June. We did not want to end up with major inventory into the channel. We do expect relatively minor revenue in the September guide for the China customers, but we do expect beyond that, of course, that the demand will bounce back.” Unlike others, Skyworks expects China weakness to end in September, growing after that.

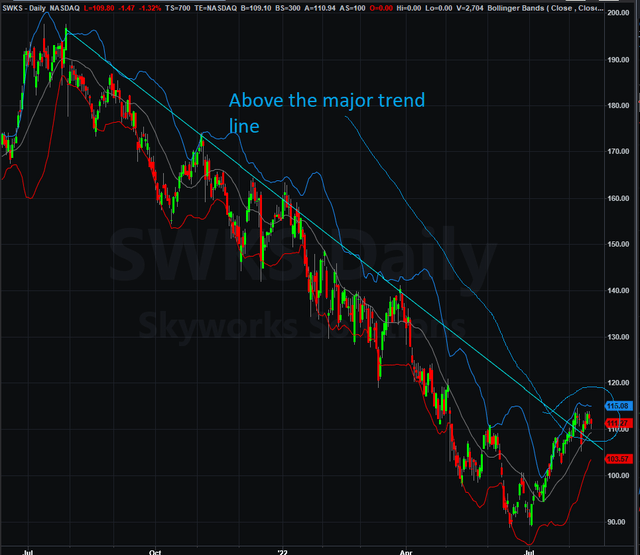

The Chart

We continue our evaluation by adding a day bar chart created using TradeStation Securities software of Skyworks.

The stock price broke above the major very bearish downtrend line (Cyan) and has been trading above that falling line. Sometimes prices, especially after major corrections, will fall back toward the line or slightly below from the upside. Good entry prices may be created when the price starts to gap higher from the line. Investors might watch for that change.

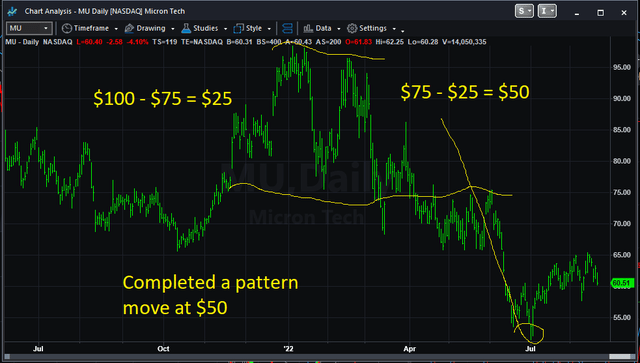

Continuing, from a news report containing several analysts comments, posted on Seeking Alpha, “Semiconductor stocks saw broad gains on Wednesday, led by companies tied to smartphones, while investment firm Citi said Micron Technology (NASDAQ:MU) was showing the “classic signs” of a bottom.” We included a chart of Micron above which illustrates some of Citi’s thoughts. Clearly, Micron completed its set up pattern move shown above. It is now trading near $60. Micron possesses a different market environment being heavily entrenched with the personal computer market, currently experiencing severe weakness. The chart is telling the story that the market has or is trying to find a bottom and investors taking new positions are not likely entering into the path of a falling knife.

Risks & Investments

The charts tell only a portion of the investment story. From the same Seeking Alpha news, “On Wednesday, Foxconn (OTCPK:FXCOF), which manufactures Apple’s iPhone, said “overall revenue would grow this year, though it cautioned that smartphone demand would slow. However, rising inflation would only have a limited impact on mid and high-end smartphones. Fundamentals that directly affect Skyworks might be improving both technically and fundamentally.

Risk still exists. Some influential economists strongly believe that a steep recession is on the horizon. If so, stock prices including Skyworks will falter forming new lower lows. But, for us, it seems like this is a good place to start a price watch waiting for the price to separate from the upper side of the down trend line. Storm clouds and rain, swept away, moved on. The clearer sky above seems like a sign for adding or starting an investment portion in Skyworks. Good buying opportunities might be eminent thus we have changed our opinion from a hold to a guarded buy at advantageous prices.

Be the first to comment