We Are

Skyworks (NASDAQ:SWKS), our favorite investment idea to benefit from 5G, just reported another excellent quarter, delivering record third-quarter results with double-digit year-over-year growth in revenue and earnings per share.

Something that was great to hear during the earnings call is that the Infrastructure & Automotive business that Skyworks acquired from Silicon Labs, and which is focused on the automotive, industrial, communications, and data center markets, is performing above expectations and the integration is going very well.

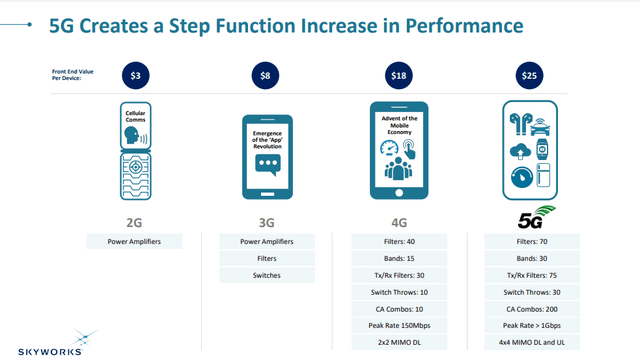

The results delivered also reflect the huge tailwind the company is getting from the migration to 5G. The technology migration from 4G to 5G means that the company is in a stronger competitive position thanks to its cutting-edge technology, know-how, and patents versus many of its competitors, and it also means more content on average per device given the increased complexity. While 4G represented an $18 opportunity on average for the company, 5G is closer to a $25 opportunity.

Skyworks Investor Presentation

Q3 2022 Results

For its third quarter 2022, Skyworks posted GAAP diluted EPS of $1.66, and Non-GAAP diluted EPS of $2.44, up 13% year over year. The company also delivered record Q3 revenue of $1.23 billion, above consensus and up 10% compared to last year. This was in part the result of content expansion in premium 5G enabled smartphones along with growth in automotive, data center and network infrastructure. Skyworks achieved gross margin of 51.2% in the quarter, up 60 basis points compared to Q3 of last year.

There were more great news for shareholders, with the announcement of an 11% increase to the quarterly dividend, marking the eighth consecutive year of increases.

Broad markets revenue was up an impressive 38% year over year, as Skyworks continued to drive design wins in fast-growing end-markets including automotive, industrial, data center and network infrastructure.

Financials

Skyworks has returned more than $1 billion to shareholders through dividends and share purchases, representing 129% of its free cash flow, during the first nine months of the fiscal year.

In terms of the different business segments, Broad market was 38% of total revenue, and up 38% year over year. Mobile was 62% of total revenue, slightly down on a year-over-year basis, in part due to softness in the China market.

June free cash flow was a little bit muted because of inventory built to support known design wins, and the revenue ramp that the company is expecting in the September and the December quarters.

Balance Sheet

The balance sheet remains strong ending the quarter with $662.2 million in cash, cash equivalents, and marketable securities. This was down from $1,027.2 in the prior year, part of the reasons is that the company-built inventories and invested in property, plant, and equipment. Total debt at the end of the quarter was $2,188.2 million, a small decrease from a year earlier.

Guidance

Skyworks is guiding to double-digit sequential revenue and earnings growth for Q4 2022. The company anticipates revenue between $1.375 billion and 1.425 billion. At the midpoint of $1.4 billion, revenue for the quarter is expected to increase 14% sequentially. Gross margin is projected to be in the range of 51% to 51.5%. And it expects Non-GAAP diluted earnings per share of $2.90, an increase of 19% sequentially.

The September quarter is a very strong mobile quarter, as there are important launches from customers. The company expects the Broad markets segment to be up double-digit year over year in the September quarter, but slightly down sequentially.

Valuation

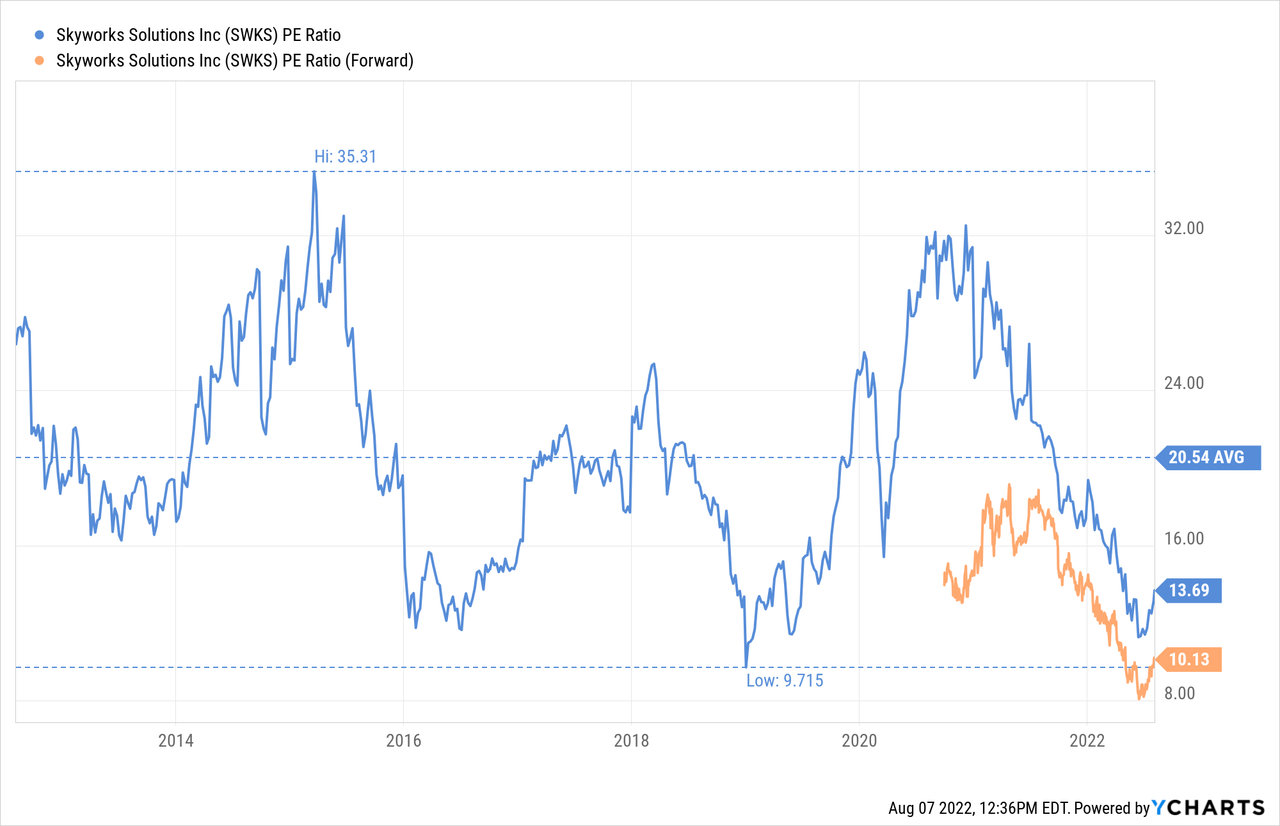

We will not go into as much detail on the valuation this time, as we recently did in a previous article. Suffice is to say that we continue to believe the shares are meaningfully undervalued, with a price/earnings ratio ~13x, which is much lower than the ten-year average of ~20.5x. We find the current valuation particularly attractive given the strong recent results, and guidance that the company is putting forward.

Risks

The two main risks we see with an investment in Skyworks are customer concentration risk, as well as the risk that one or more of its large customers could try to design themselves these RF devices. We think these risks are mitigated by the know-how that Skyworks has accumulated over the years, the large number of patents it has, and the fact that it manufactures many of the devices itself.

Conclusion

We were very pleased with the results that Skyworks delivered for its Q3 quarter, and the guidance that it presented for next quarter. Shares continue to look attractive to us at current prices, despite the small increase in share price since our last article. It was good to hear that the I&A business that Skyworks purchased last year is performing above expectations, and to see the impressive growth in the Broad markets segment. In summary, we continue to be impressed with the company’s performance and believe that shares are meaningfully undervalued at current prices.

Be the first to comment