Tashi-Delek/E+ via Getty Images

“A philosopher is a blind man in a dark room looking for a black cat that isn’t there. A theologian is the man who finds it.” – H.L. Mencken

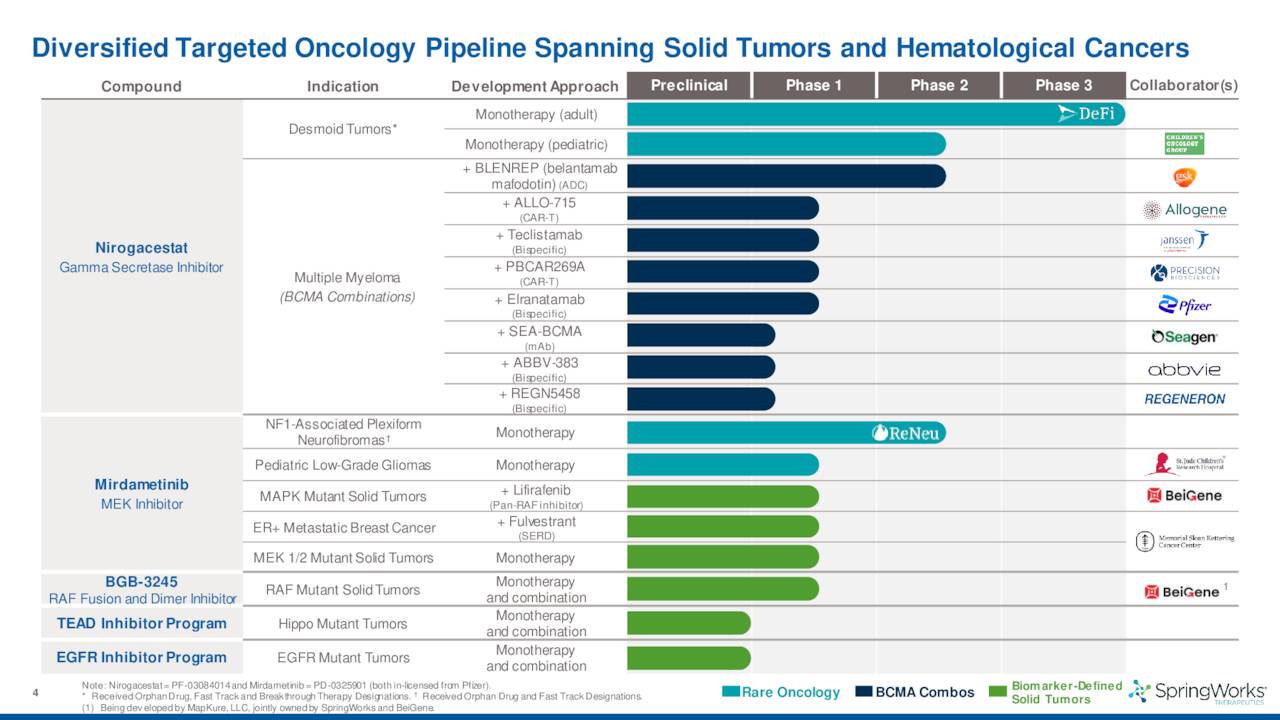

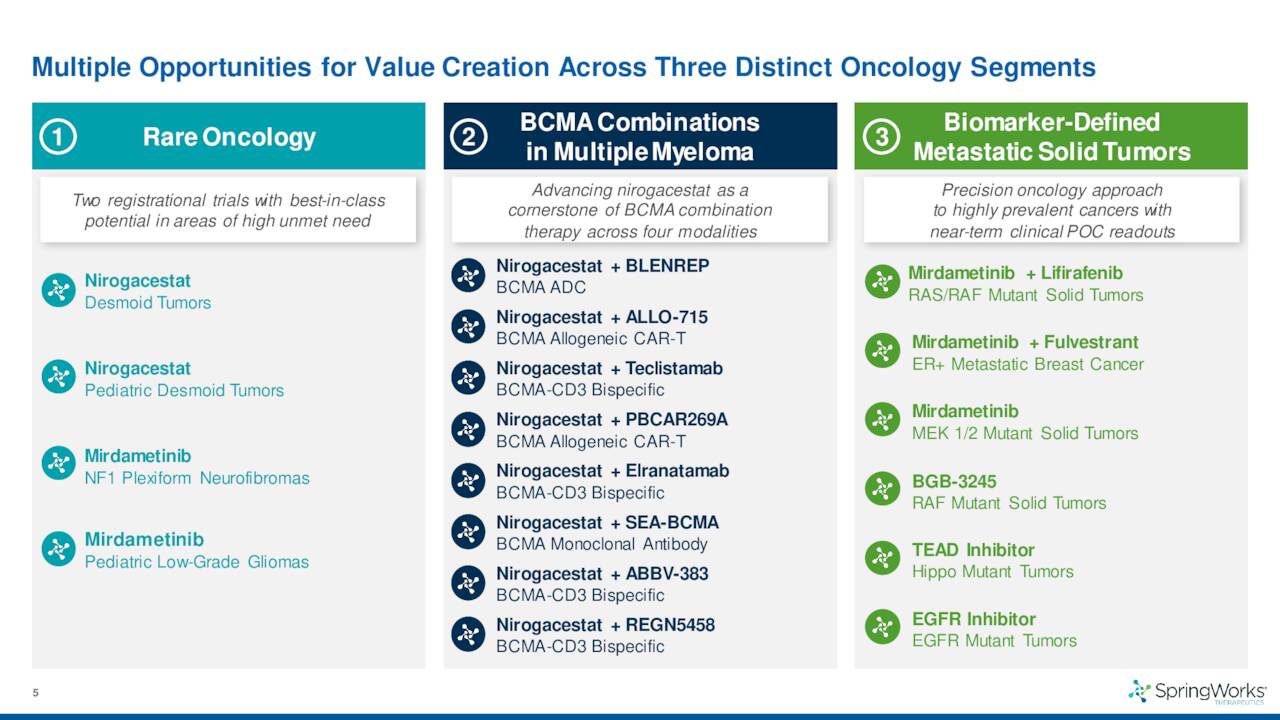

Today, we take our first look at SpringWorks Therapeutics, Inc. (NASDAQ:SWTX). The company has two main assets in development, one of which looks heading soon to its first NDA filing. The company also has numerous development partnerships with larger names like Pfizer (PFE). An analysis follows below.

Company Overview:

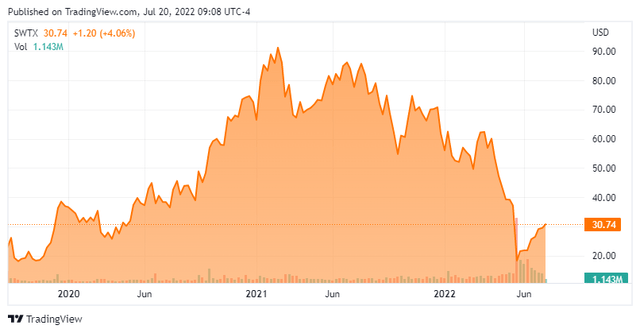

SpringWorks Therapeutics is headquartered in Stamford, CT. The company is focused on acquiring, developing, and commercializing medicines for underserved patient populations suffering from rare diseases and cancer. The stock currently trades just above $30.00 a share and sports an approximate market capitalization of $1.5 billion.

June Company Presentation

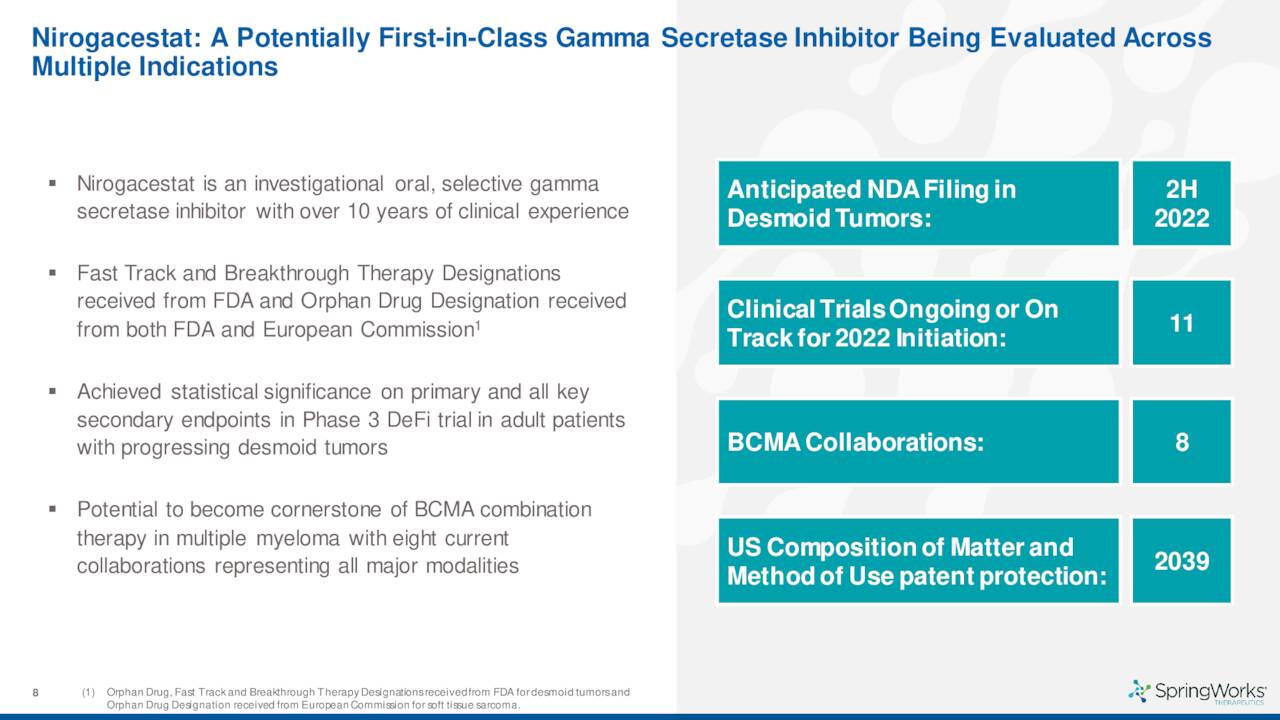

The company’s primary asset in its pipeline is nirogacestat. This compound is an oral small molecule gamma-secretase inhibitor.

June Company Presentation

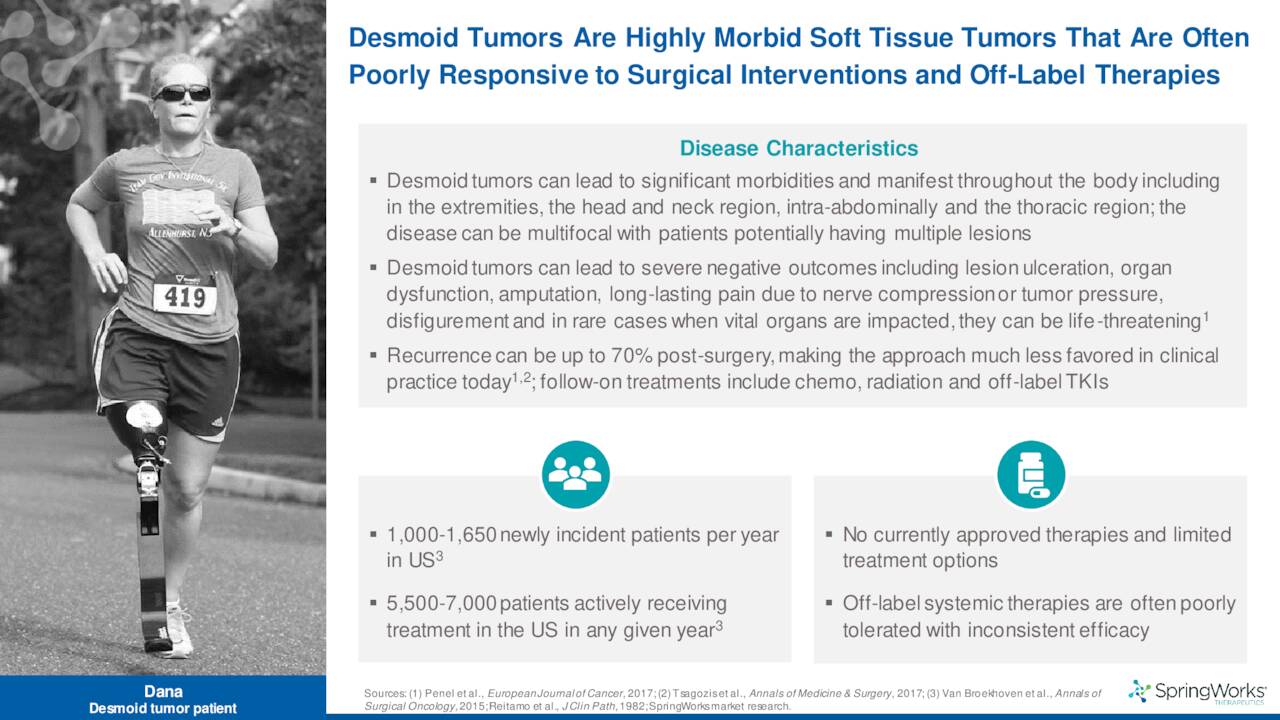

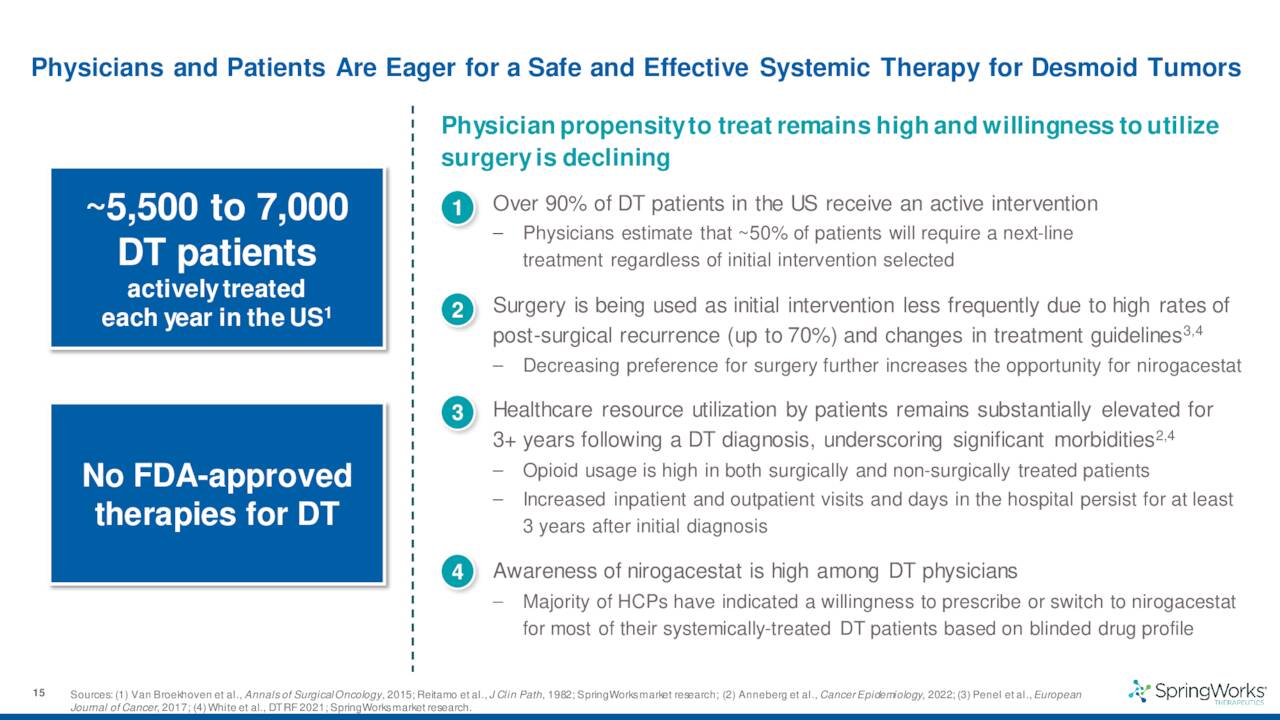

Nirogacestat is being developed as a monotherapy for the treatment of desmoid tumors.

June Company Presentation

June Company Presentation

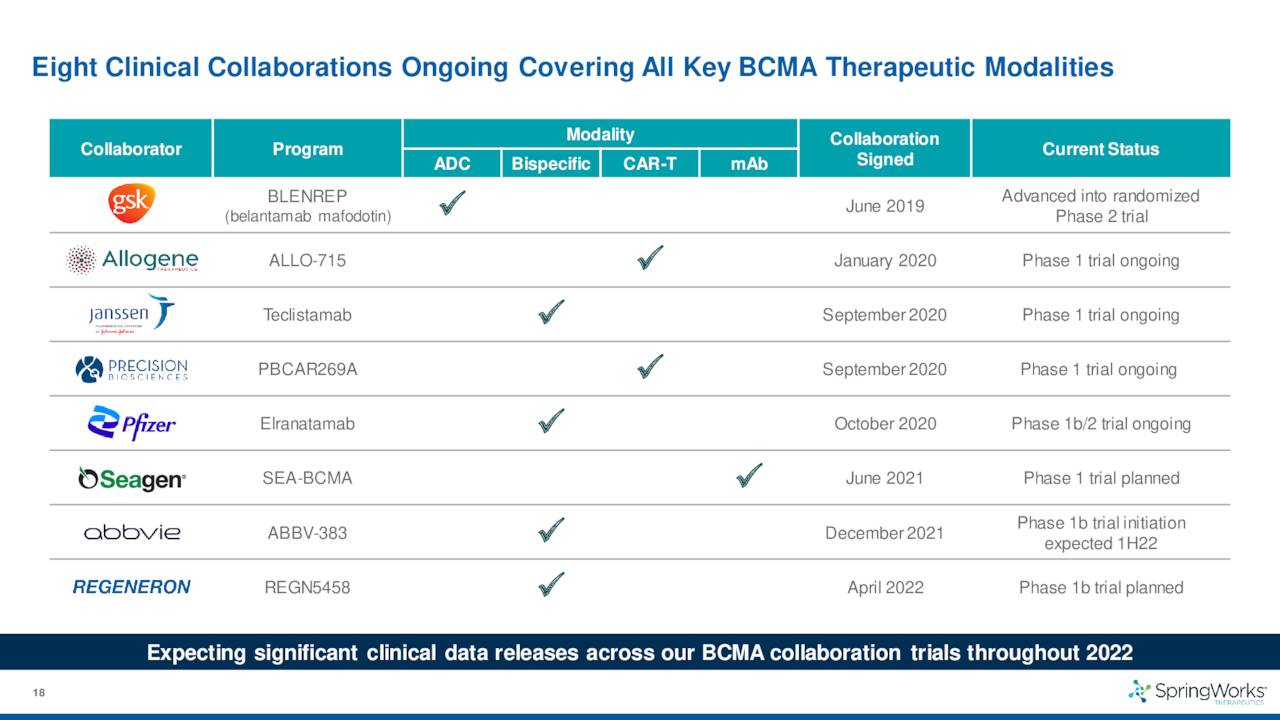

SpringWorks also has several partnerships with the likes of larger drug companies like Pfizer and GlaxoSmithKline (GSK) to combine nirogacestat with their anti-BCMA therapies to target various indications.

June Company Presentation

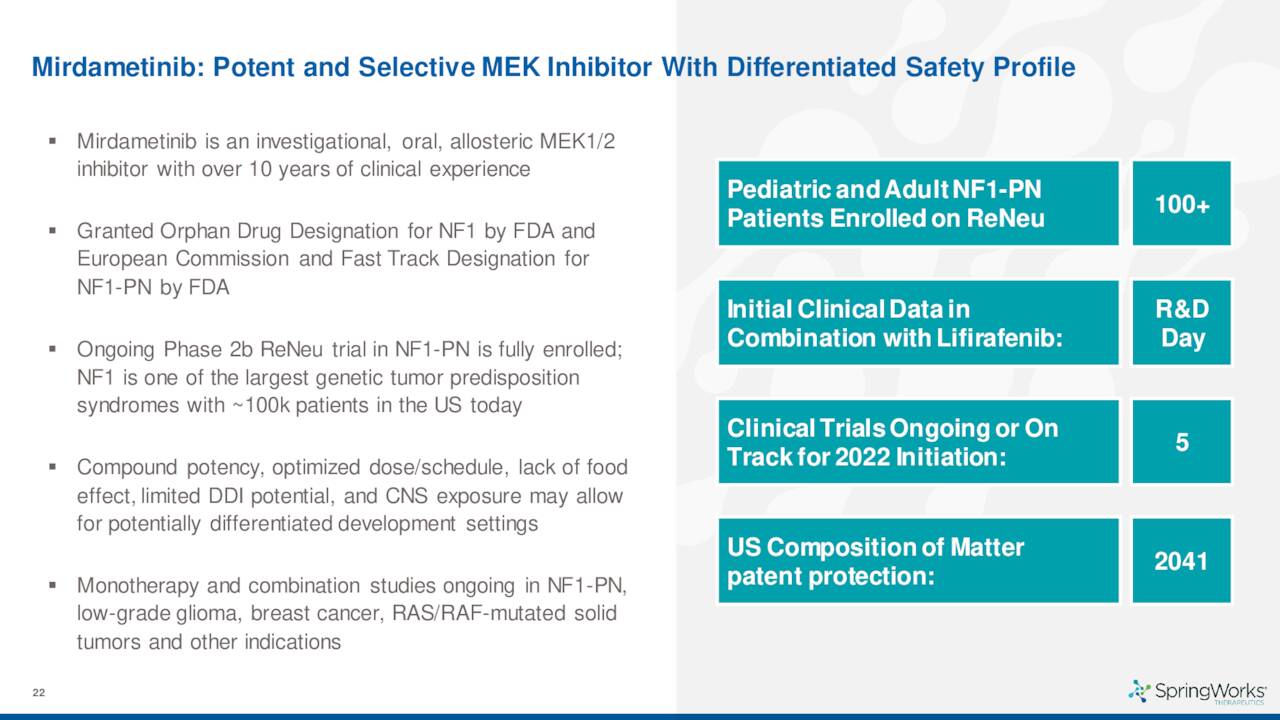

The company also has another pipeline asset called Mirdametinib in development. Given this is a much earlier staged compound, it will not be particularly germane to this analysis.

June Company Presentation

Recent Developments:

In late May, the company shared encouraging long-term follow-up data from a Phase 2 trial for nirogacestat in patients with progressing desmoid tumors.

June Company Presentation

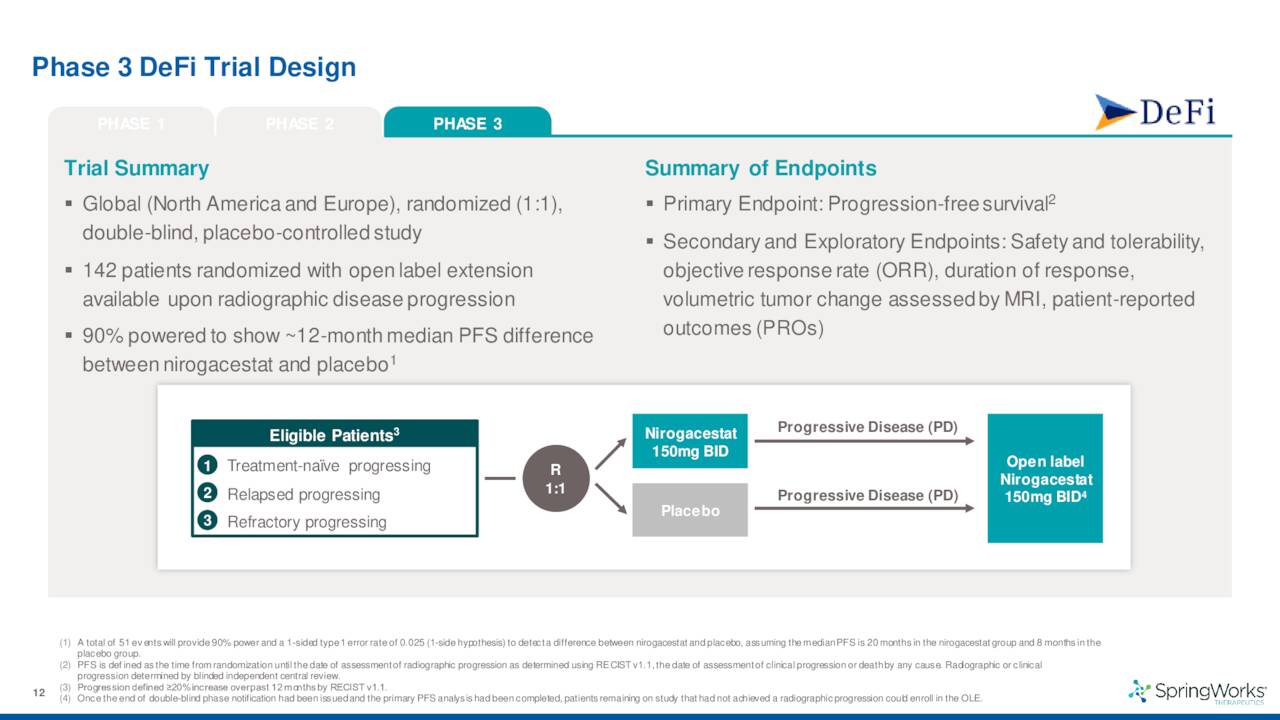

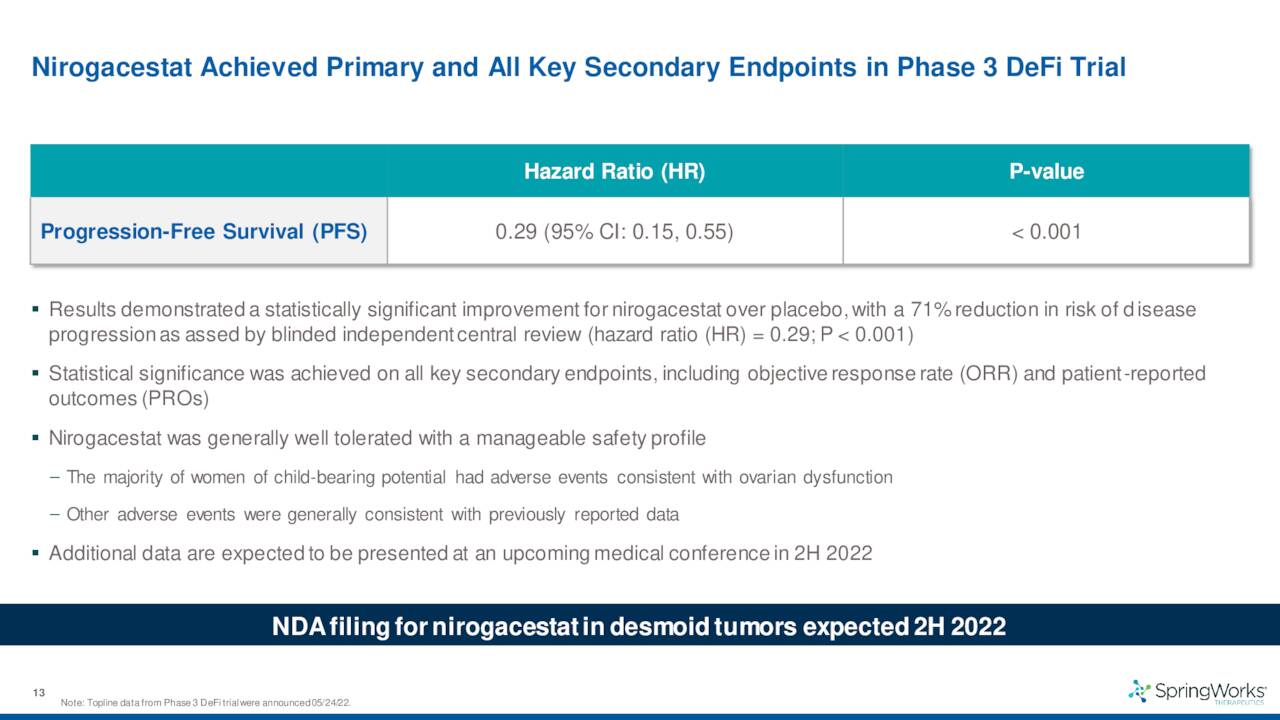

The company also disclosed data from a 142-person Phase 3 trial for this indication which met the criteria for both its primary endpoint as well as all of its secondary endpoints. The results from this study should lead to a marketing application for this indication sometime by the end of 2022. If all goes well, the company should garner its first FDA approval sometime in 2023 and begin commercialization.

June Company Presentation

June Company Presentation

It should be noted that the stock plunged that day as the company also posted initial data from a Phase 1/2 trial involving nirogacestat in patients with relapsed or refractory multiple myeloma or RRMM in combination with antibody drug conjugate BLENREP from Glaxo (who also sponsored the trial). The results were disappointing both in terms of efficacy and adverse effects.

Analyst Commentary & Balance Sheet:

On May 24th, Goldman Sachs maintained their Buy rating and raised their price target to $82 from $76 previously after SpringWorks reported topline results from the Phase 3 DeFi study of nirogacestat in desmoid tumors. The analyst stated the data is ‘sufficient to support approval of nirogacestat following a planned NDA filing in 2H22‘. Since then, Wedbush ($50 price target), J.P. Morgan ($92 price target) and H.C. Wainwright have all reiterated Buy or Outperform ratings on SWTX.

The stock has attracted a large amount of short interest as approximately 40% of its outstanding float is currently held short. There has been no insider activity in the equity so far in 2022. In the fourth quarter of 2021, insiders sold just over $4 million in aggregate, where the shares traded in the high $50s. After posting a net loss of $61.8 million in the first quarter, the company held approximately $380 million worth of cash and marketable securities on its balance sheet.

Verdict:

June Company Presentation

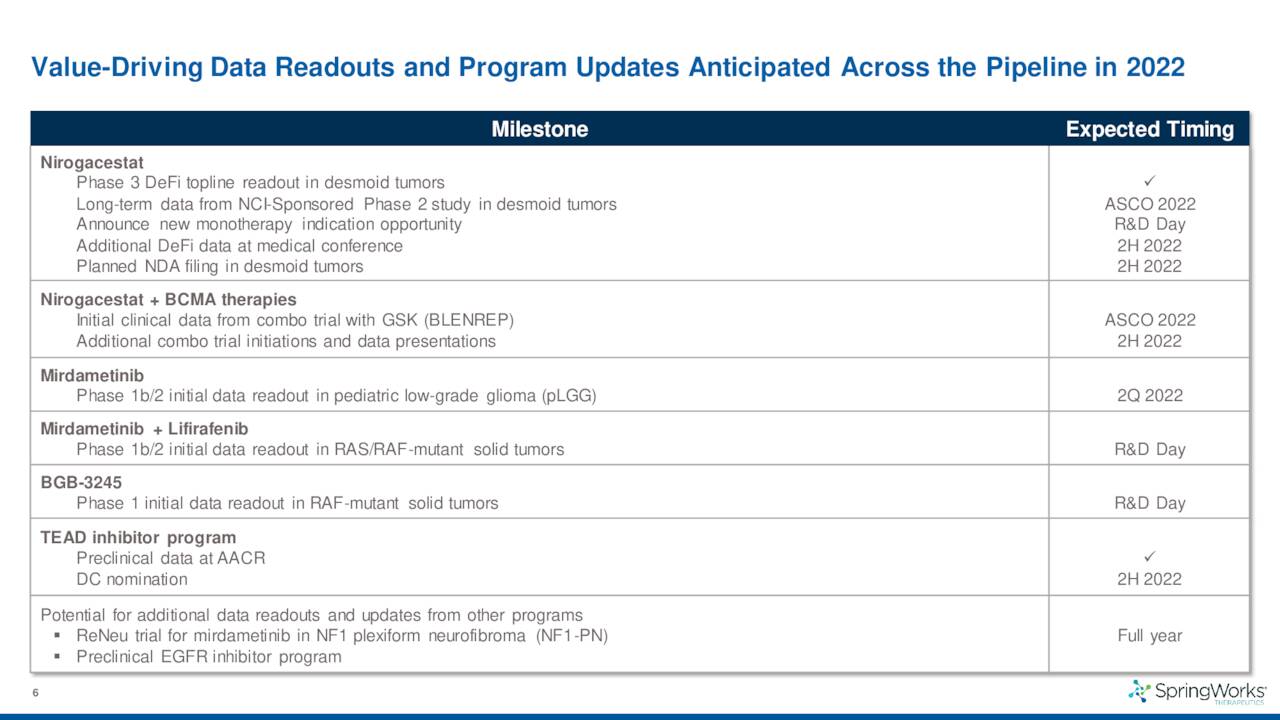

The company has several potential milestones throughout the rest of the year, the biggest being the NDA filing around nirogacestat to treat desmoid tumors.

June Company Presentation

While the recent data to treat refractory multiple myeloma was not encouraging at all, it is important to remember this is one of the multiple combination trials for nirogacestat that is partnered with multiple larger firms in a wide variety of indications.

I think SWTX merits a small ‘watch item’ position for now given its partnerships and upcoming NDA filing. A recent article put the peak sales potential for desmoid tumors in the U.S. at $825 million.

Several things give me pause for recommending it for a larger position at this time. One is the large short position in the stock. The overhang from the RRMM data could also linger for a bit as well. Finally, based on the current burn, the company is likely to raise additional capital over the next 12 months as well.

“Man always finds the omens he wants.” – Yukio Mishima

Be the first to comment